Massachusetts Assignment to Living Trust

Description

How to fill out Massachusetts Assignment To Living Trust?

Welcome to the biggest legal documents library, US Legal Forms. Right here you will find any template including Massachusetts Assignment to Living Trust forms and download them (as many of them as you wish/require). Prepare official documents within a couple of hours, rather than days or weeks, without having to spend an arm and a leg with an legal professional. Get your state-specific form in a couple of clicks and be confident knowing that it was drafted by our qualified legal professionals.

If you’re already a subscribed consumer, just log in to your account and then click Download near the Massachusetts Assignment to Living Trust you require. Because US Legal Forms is online solution, you’ll generally get access to your saved templates, no matter what device you’re utilizing. Find them in the My Forms tab.

If you don't have an account yet, what exactly are you awaiting? Check out our instructions listed below to begin:

- If this is a state-specific sample, check its validity in your state.

- Look at the description (if readily available) to understand if it’s the right template.

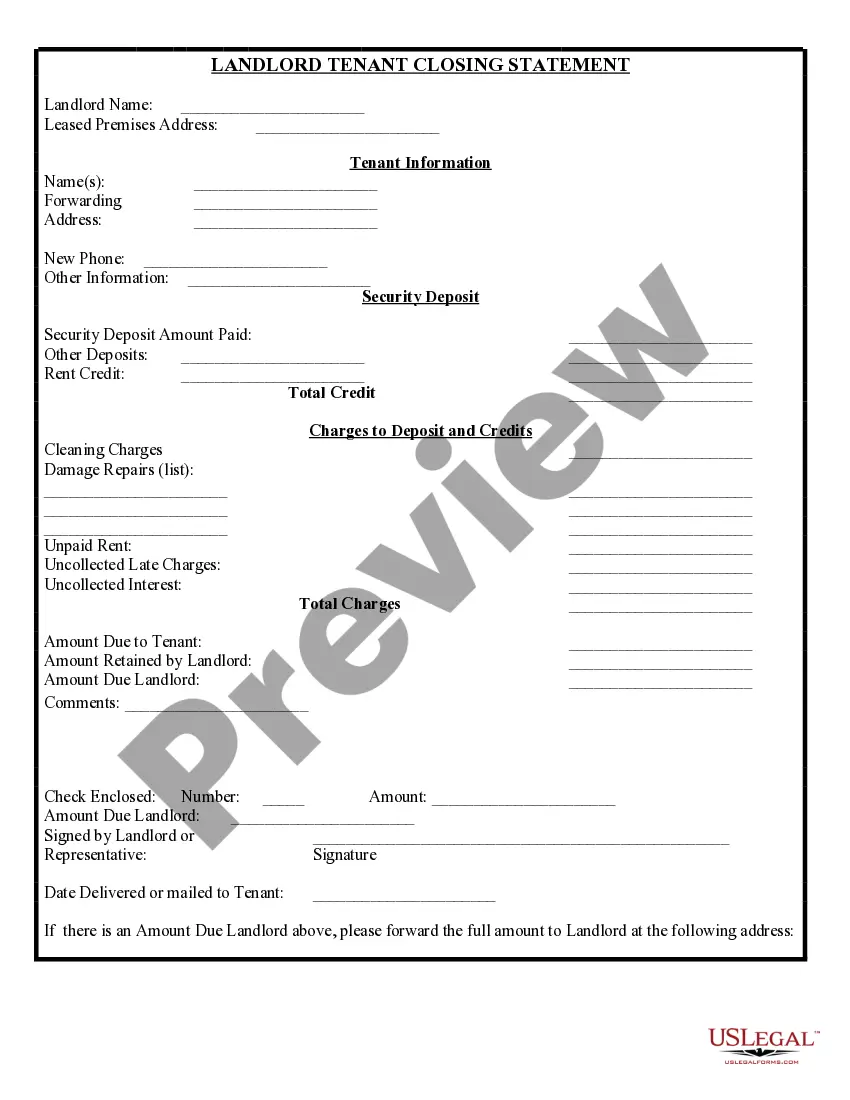

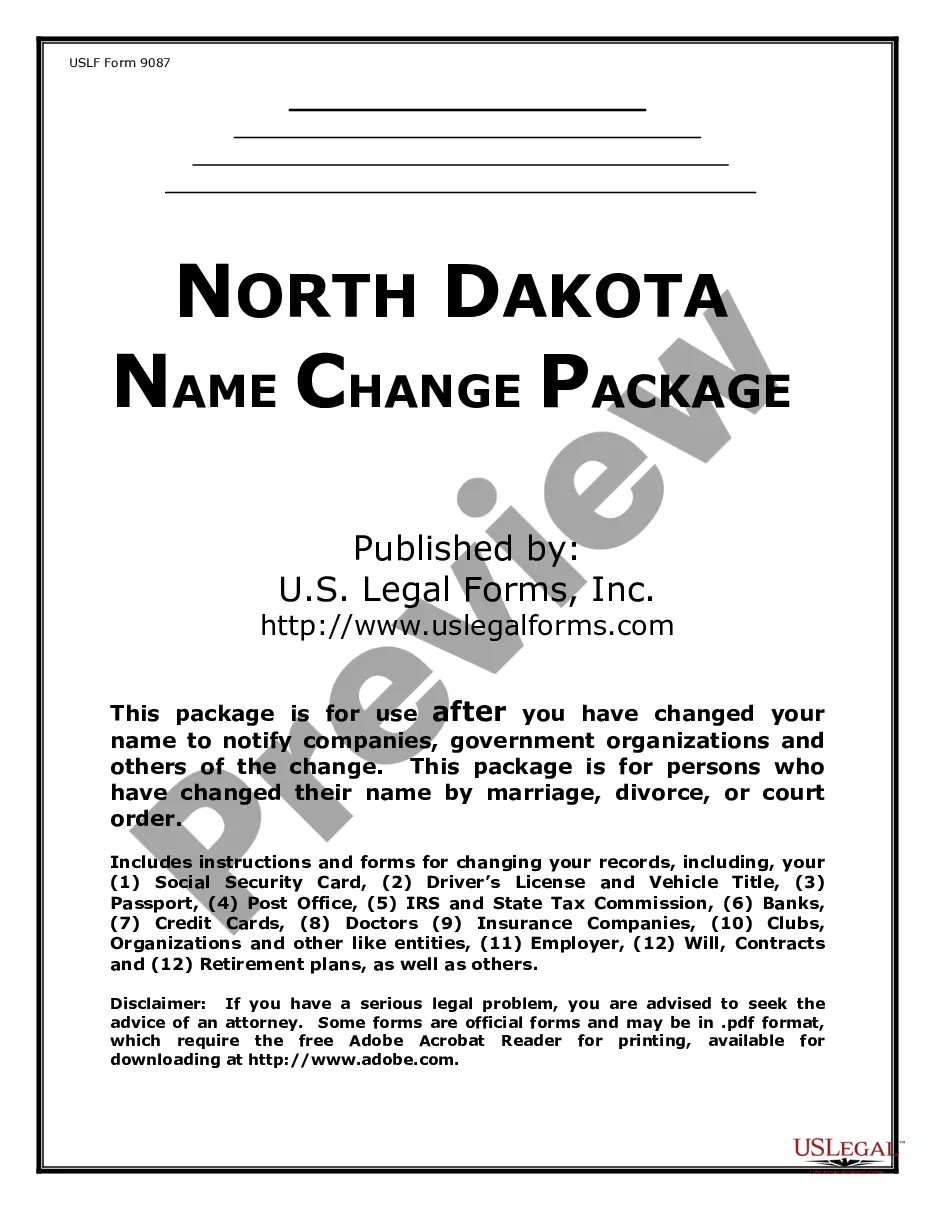

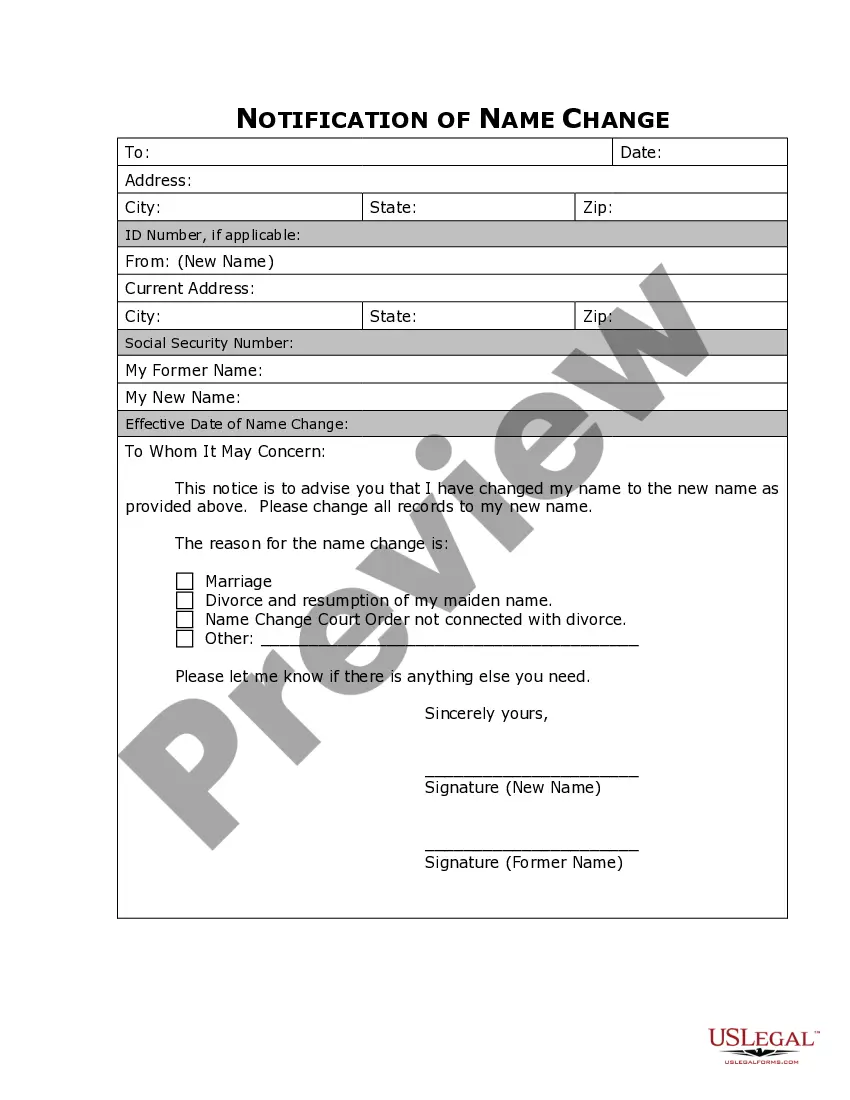

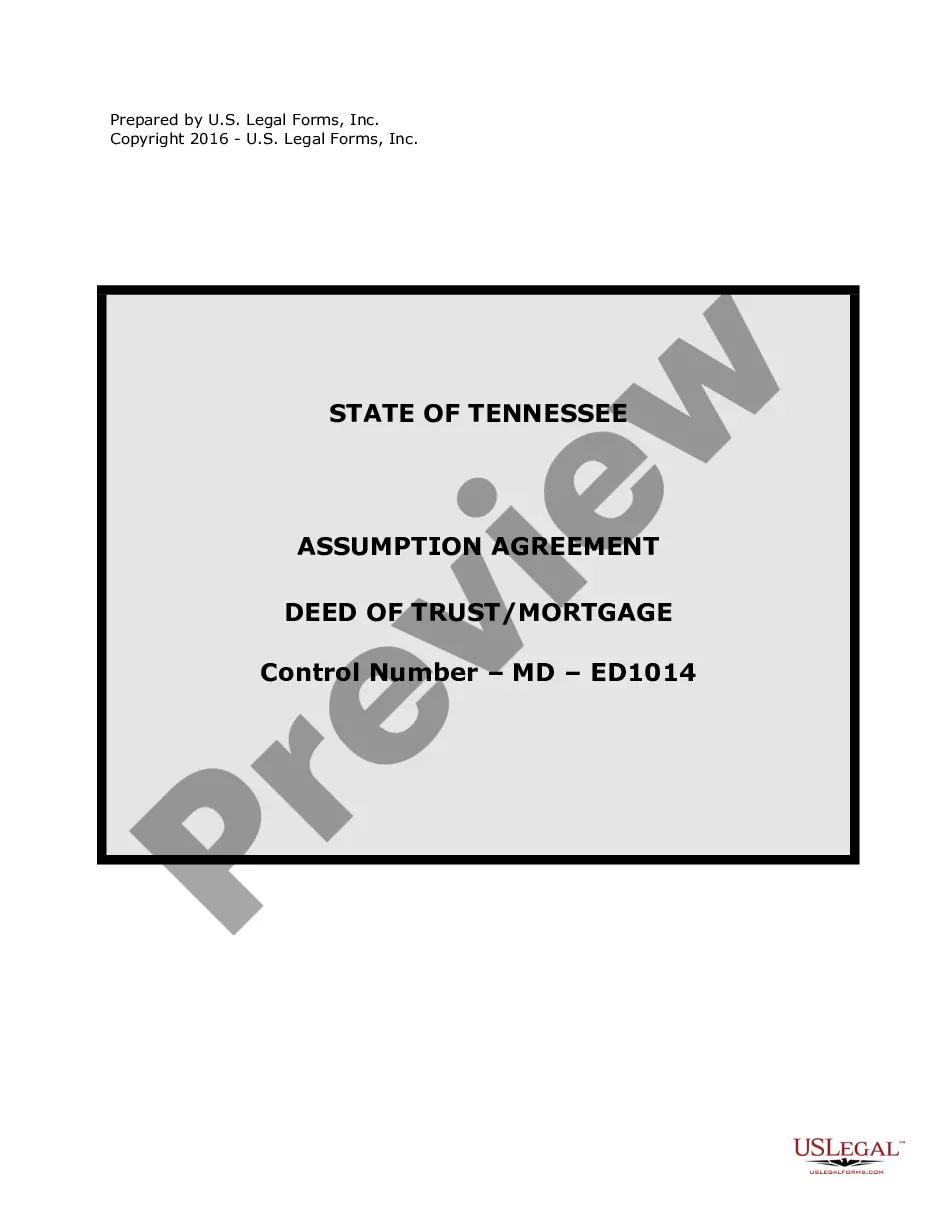

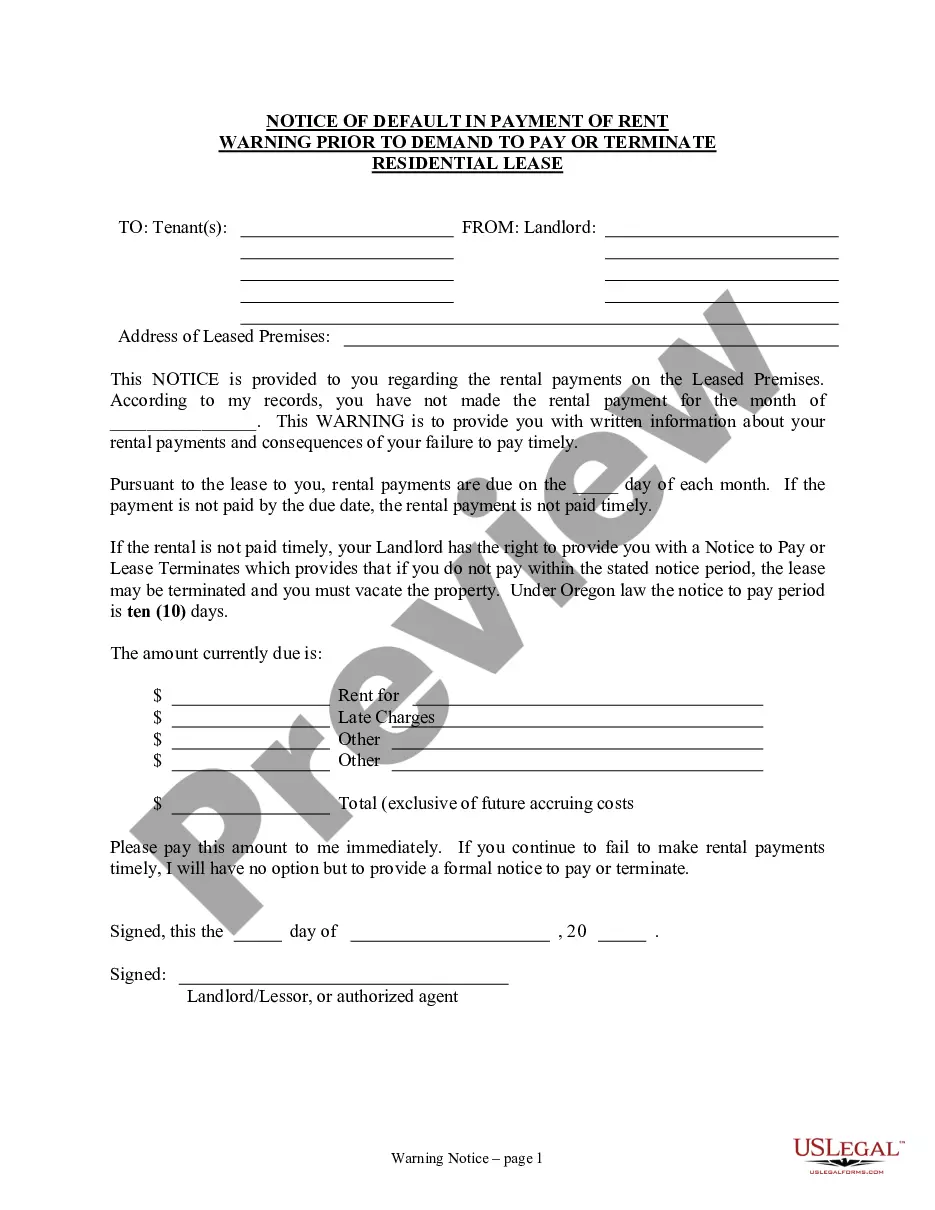

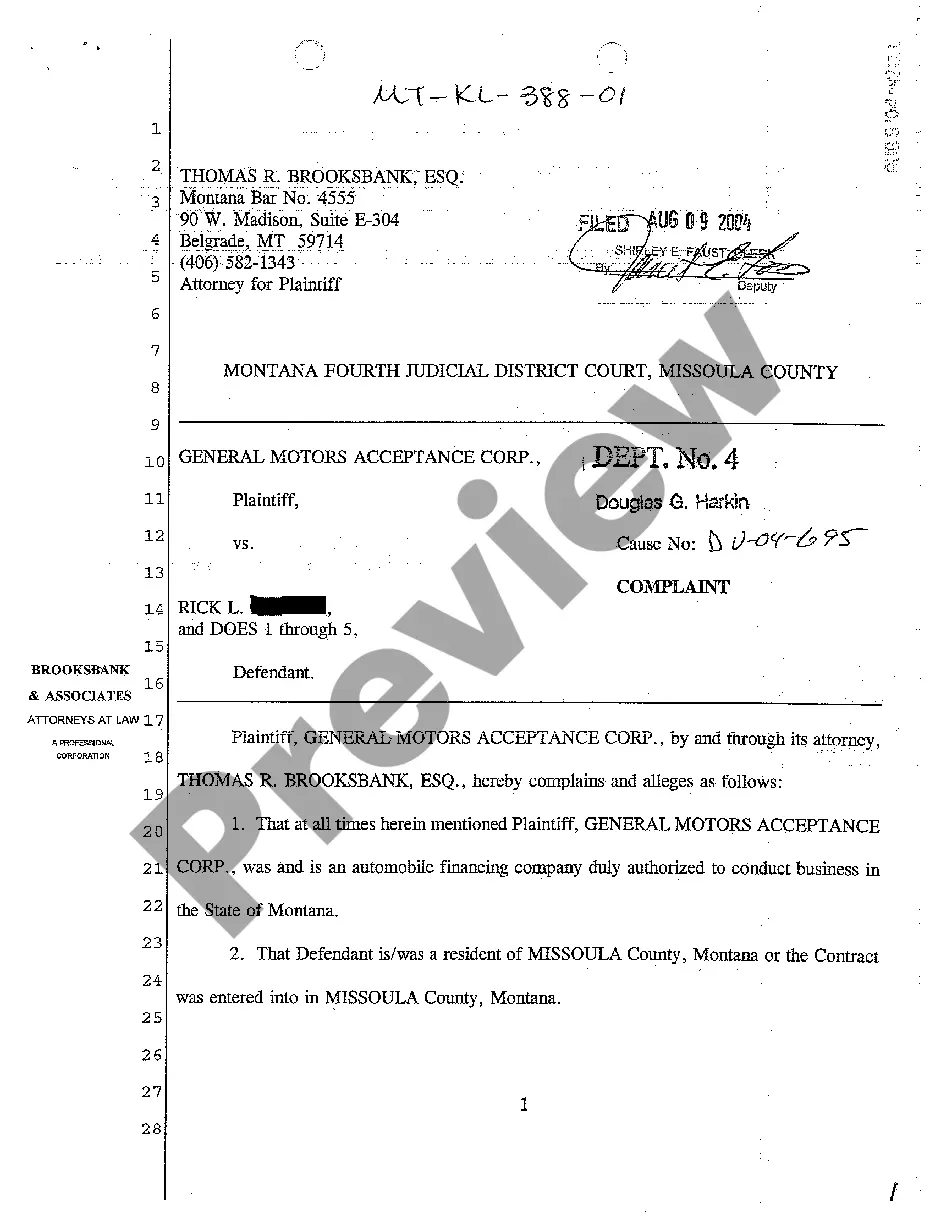

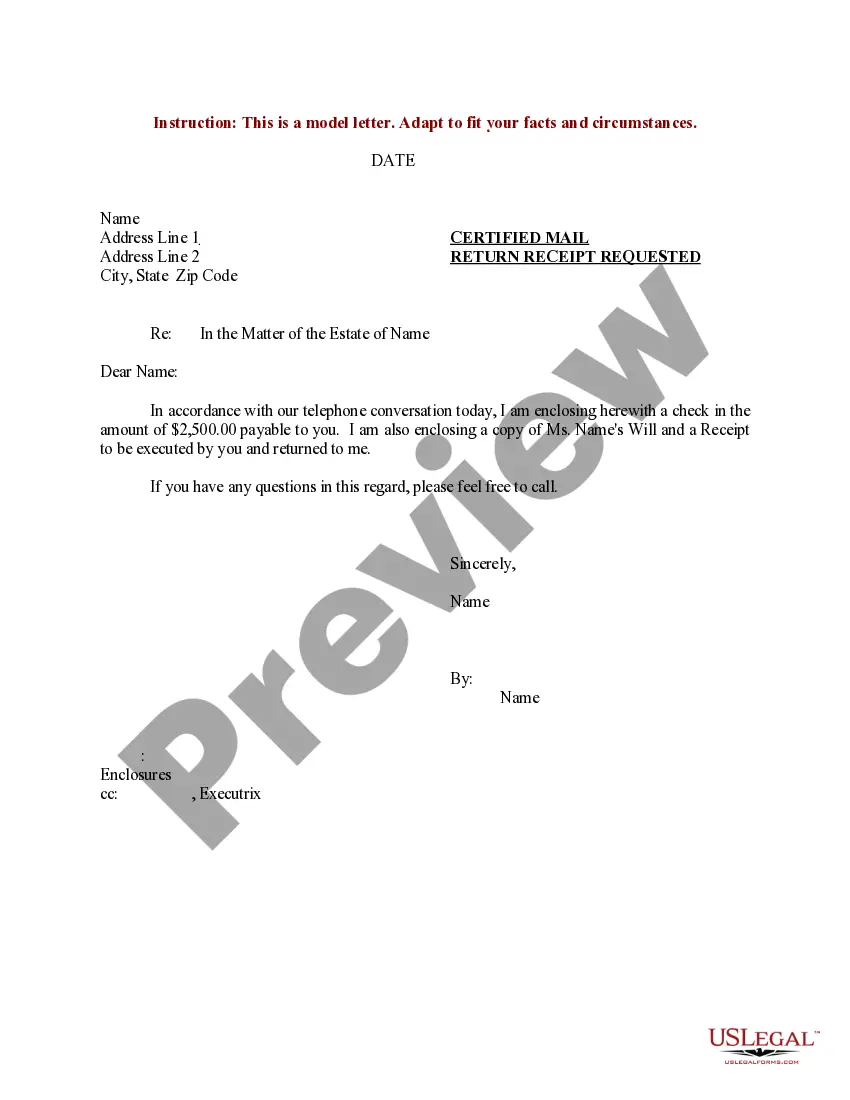

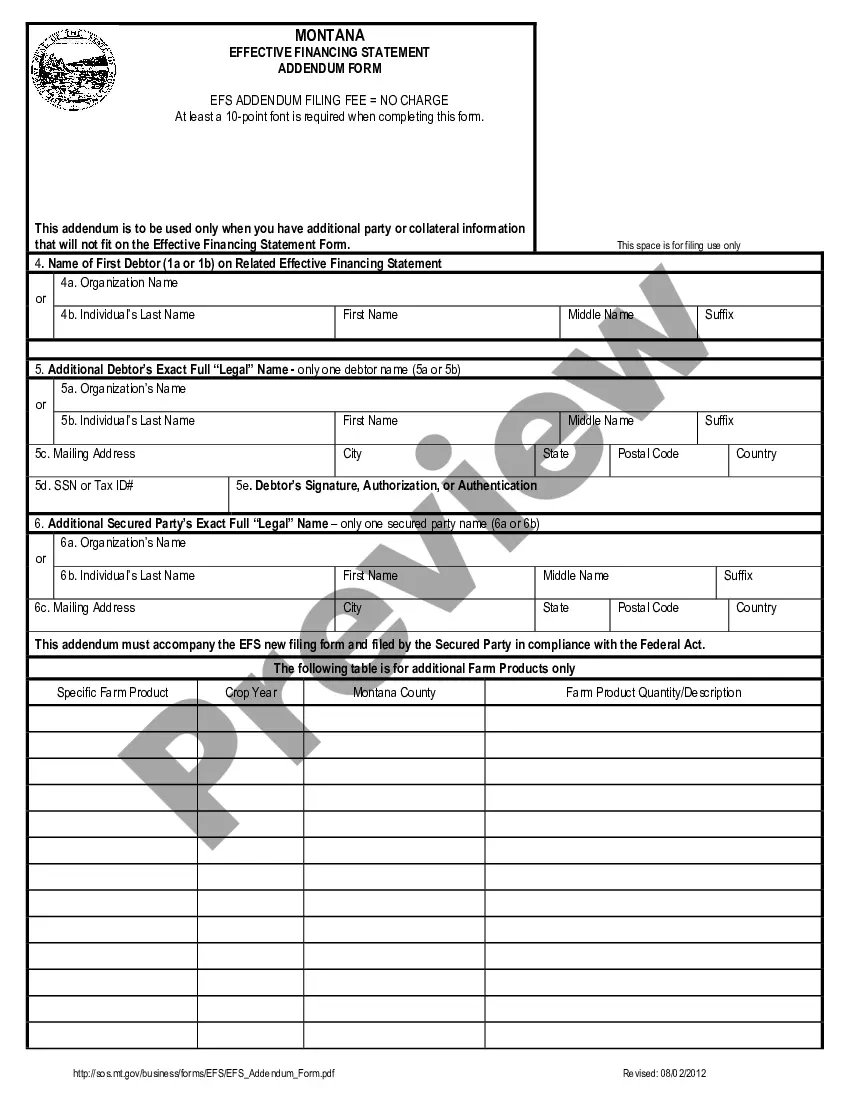

- See more content with the Preview feature.

- If the example fulfills all your needs, just click Buy Now.

- To create an account, choose a pricing plan.

- Use a credit card or PayPal account to sign up.

- Save the template in the format you require (Word or PDF).

- Print the file and fill it out with your/your business’s information.

Once you’ve completed the Massachusetts Assignment to Living Trust, give it to your attorney for verification. It’s an additional step but an essential one for being confident you’re completely covered. Join US Legal Forms now and get thousands of reusable samples.

Form popularity

FAQ

In order to create a general petition for the creation of a trust, the filing fee is $375 with a surcharge of $15. Once the trust has been created, there will be a great deal of paperwork involved, since every asset that is added to the trust will need to be signed for.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

A living trust in Massachusetts is created by the grantor, the person putting things into trust. As the grantor you must choose a trustee who is charged with managing the trust for your benefit while you are alive and distributing your assets to your beneficiaries after your death.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Prior to enacting G.L.c. 184, §35, Massachusetts was among the few states requiring the full trust document for trusts containing real property to be recorded.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Decide between a single or joint trust. A single is obviously a good match for those that are unmarried. Review your property. Pick a trustee. Get your trust documents together. Sign your living trust. Fund your trust with your assets and property.