Small Estate Affidavit for Estates under $25,000

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

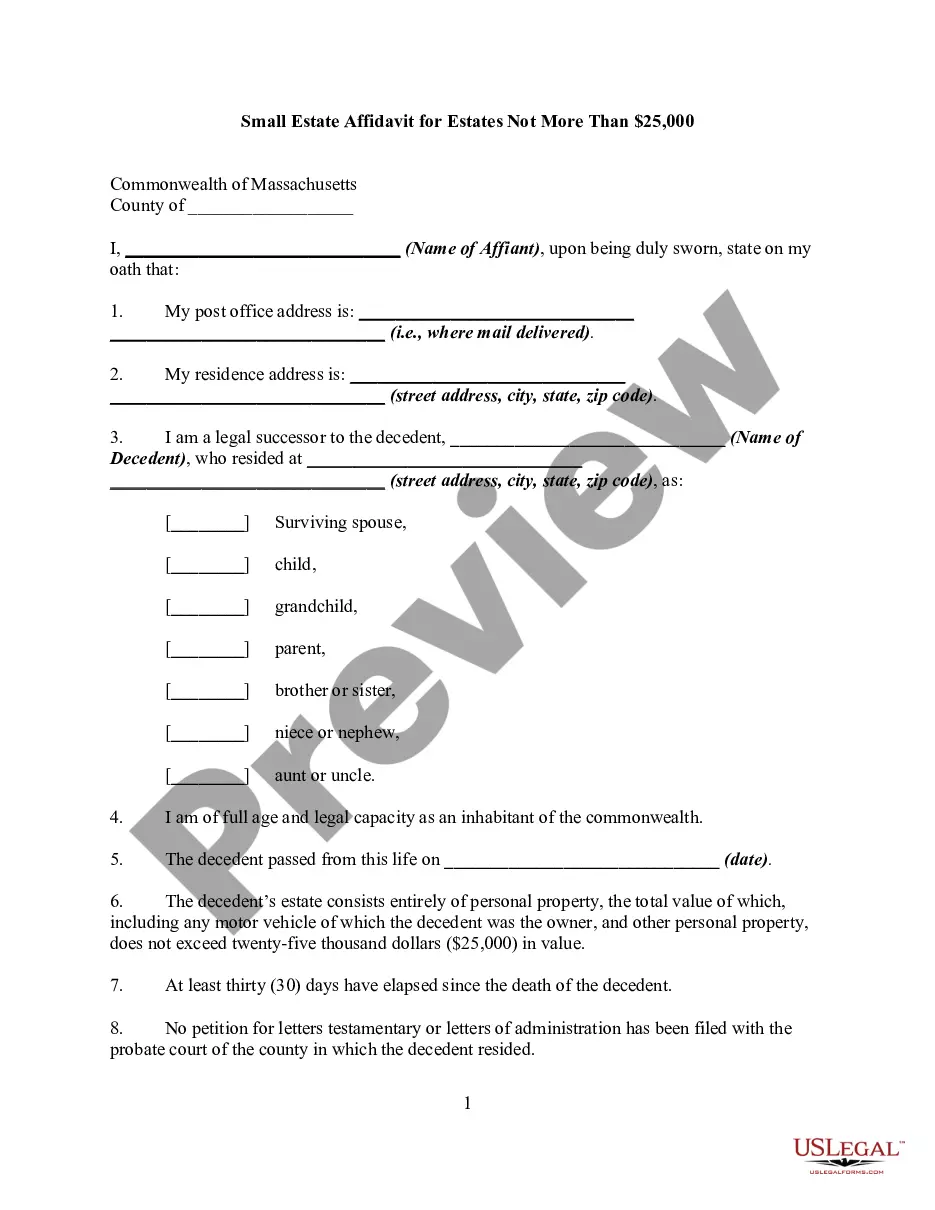

1. Small Estate Affidavit -Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2. Summary Administration -Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

Massachusetts Summary:

Under Massachusetts statute, where as estate is valued at less than $25,000, an interested party may, thirty (30) days after the death of the decedent, file a small estate sworn statement. In response to a properly filed statement, the register of probate may issue an attested copy of the statement, permitting the interested party to recover debts due to the deceased as well as cover funeral expenses.

Massachusetts Requirements:

Massachusetts requirements are set forth in the statutes below.

Chapter 195: Section 16. Voluntary informal administration of small estates.

Section 16. If an inhabitant of the commonwealth dies leaving an estate consisting entirely of personal property the total value of which may include a motor vehicle of which the decedent was the owner, and other personal property not exceeding fifteen thousand dollars in value, his surviving spouse, child, grandchild, parent, brother, sister, niece, nephew, aunt or uncle, if of full age and legal capacity and an inhabitant of the commonwealth, or, in the case of a person who at his death, was an inpatient or resident of any facility of the department of mental health, the department of mental retardation or was receiving relief or support under chapter one hundred and seventeen or assistance under chapter one hundred and eighteen, one hundred and eighteen A or one hundred and eighteen E, any person designated to act as a voluntary administrator of the estate of such person by the department of mental health, the department of mental retardation or the division of medical assistance, may, after the expiration of thirty days from the death of the decedent, provided no petition for letters testamentary or letters of administration have been filed with the probate court of the county in which the decedent resided, file with said probate court upon a form prescribed by the court a statement, verified by oath, or affirmation containing:

(a) the name and residential address of the affiant,

(b) the name, residence and date of death of the deceased,

(c) the relationship of the affiant to the deceased,

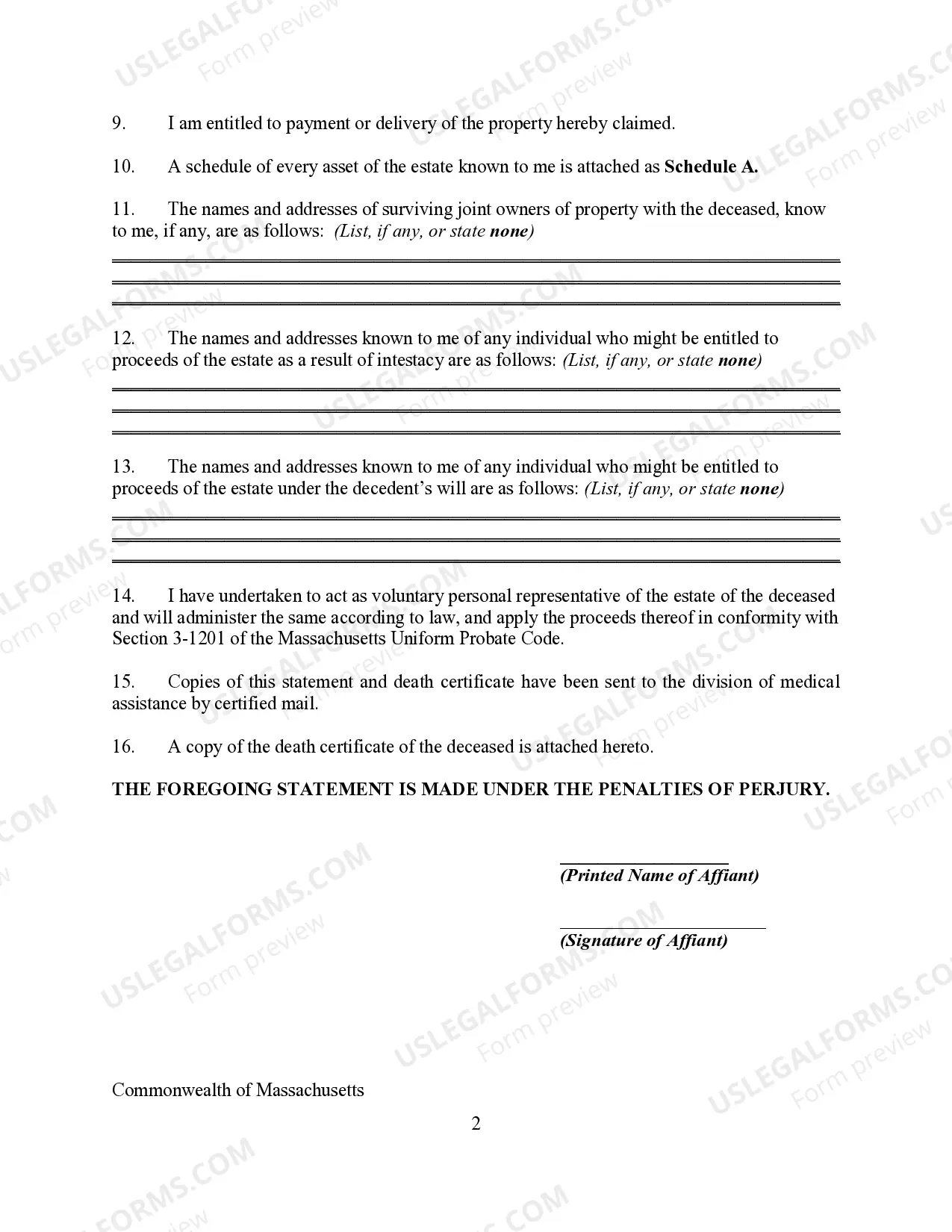

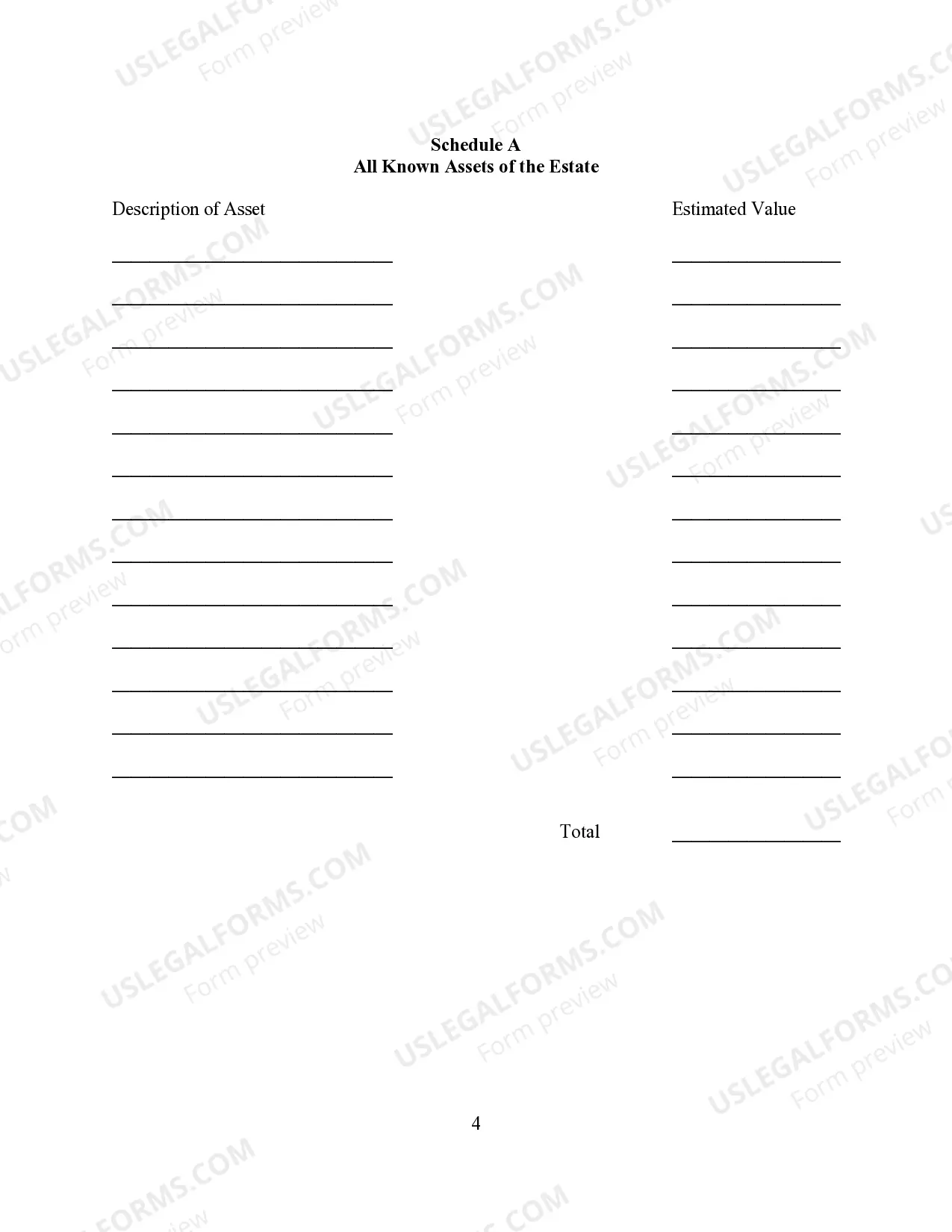

(d) a schedule showing every asset of the estate known to the affiant and the estimated value of each such asset,

(e) a statement that the affiant has undertaken to act as voluntary administrator of the estate of the deceased and will administer the same according to law, and apply the proceeds thereof in conformity with this section,

(f) the names and addresses of surviving joint owners of property with the deceased, known to the affiant, and

(g) the names and addresses known to the affiant of the persons who would take under the provisions of section three of chapter one hundred and ninety in the case of intestacy. The oath required by this section shall not be governed by section one A of chapter two hundred and sixty-eight.

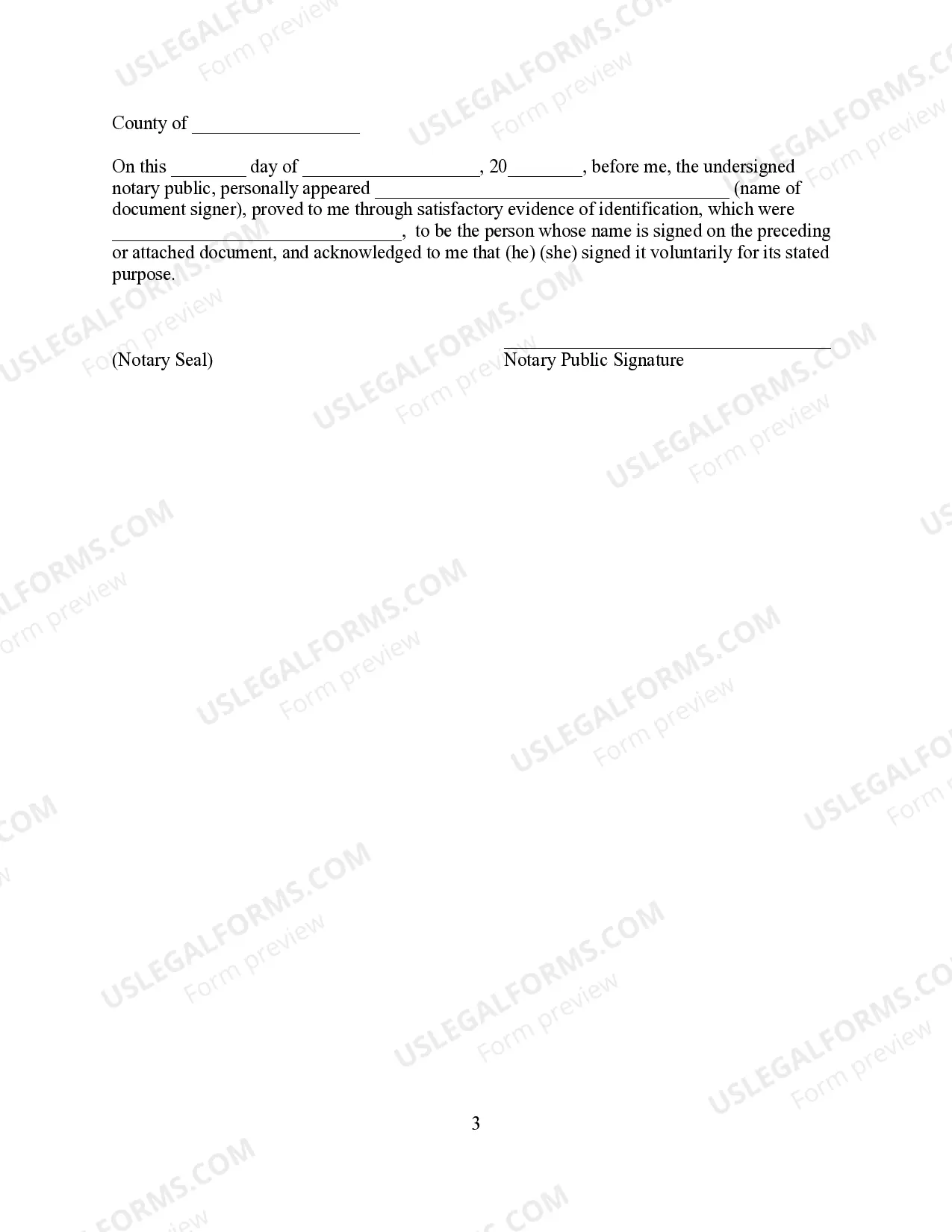

Upon presentation of such statement, accompanied by a certificate of the death of the deceased by a public officer and payment of a fee of three dollars or such amount as may be specified in section forty of chapter two hundred and sixty-two, the register of probate shall docket these documents as a part of the permanent records of the court. Upon payment of a fee as prescribed in section forty of chapter two hundred and sixty-two, the register shall, if no other probate proceeding for administration of such estate is pending in said court, issue an attested copy of a statement duly filed under this section.

Notwithstanding any provision of law to the contrary, a voluntary administrator shall certify on the statement that copies of said statement and death certificate have been sent to the division of medical assistance by certified mail. If the decedent received medical assistance under chapter one hundred eighteen

(1) when age sixty-five or older or

(2) at any time on or after March twenty-second, nineteen hundred ninety-one, regardless of age, while an inpatient in a nursing facility or other medical institution, the provisions of section thirty-two of chapter one hundred eighteen E shall apply except

(1) the period for the department to present a claim under subsection (b)(1) of said section thirty-two shall be within four months of the date the register of probate dockets the statement and

(2) interest on allowed claims under subsection (c) of said section thirty-two shall commence four months plus sixty days after said date. This paragraph shall apply to estates of decedents dying on or after September first, nineteen hundred and ninety-two.

Upon the presentation of a copy of such a statement duly attested by the register of probate, the tender of a proper receipt in writing and the surrender of any policy, passbook, note, certificate or other evidentiary instrument, a voluntary administrator may, as the legal representative of the deceased and his estate, receive payment of any debt or obligation in the nature of a debt, or delivery of any chattel or asset, scheduled in such statement. Payments and deliveries made under this section shall discharge the liability of the debtor, obligor or deliverer to all persons with respect to such debt, chattel, obligation or other asset unless, at the time of such payment or delivery, a written demand has been made upon said debtor, obligor or deliverer by a duly appointed executor or administrator.

A voluntary administrator may sell any chattel so received and negotiate or assign any chose in action to convert the same to cash in a reasonable amount.

A voluntary administrator shall, as far as possible out of the assets which come into his hands, first discharge the necessary expenses of the funeral and last sickness of the deceased and the necessary expenses of administration without fee for his services, and then pay the debts of the deceased in the order specified in section one of chapter one hundred and ninety-eight and any other debts of the estate, and then distribute the balance, if any, to the surviving spouse, or, if there is no surviving spouse, to the persons and in the proportions prescribed by clauses (1), (2), (3), (4) and (5) of section three of chapter one hundred and ninety.

A voluntary administrator shall be liable as an executor in his own wrong to all persons aggrieved by his administration of the estate, and, if letters testamentary or letters of administration are at any time granted, shall be liable as such an executor to the rightful executor or administrator.

For the purpose of paragraph (6) of section one hundred and thirteen A of chapter one hundred and seventy-five and section two of chapter ninety, a voluntary administrator shall be deemed to be the legal representative of the estate of the decedent until an executor or administrator is appointed.

Upon payment of the proper fee, the register of probate may issue a certificate of appointment to said administrator, with a copy of the statement annexed thereto.

Section 3-1201. If an inhabitant of the commonwealth dies leaving an estate consisting entirely of personal property the total value of which may include a motor vehicle of which the decedent was the owner, and other personal property not exceeding $25,000 in value, any interested person may, after the expiration of 30 days from the death of the decedent, provided no petition for appointment of a personal representative has been filed with the court of the county in which the decedent resided, file with said court upon a form prescribed by the court a statement, verified by oath, or affirmation containing: (a) the name and residential address of the petitioner, (b) the name, residence and date of death of the deceased, (c) the relationship of the petitioner to the deceased, (d) a schedule showing every asset of the estate known to the petitioner and the estimated value of each such asset, (e) a statement that the petitioner has undertaken to act as voluntary personal representative of the estate of the deceased and will administer the same according to law, and apply the proceeds thereof in conformity with this section, (f) the names and addresses of surviving joint owners of property with the deceased, known to the petitioner, (g) the names and addresses known to the petitioner of the persons who would take under the provisions of part 1 of article II of this chapter in the case of intestacy, and (h) the names and addresses known to the petitioner of the persons who would take under the provisions of the will, if any. The original of any will shall be filed with the above statement.

Upon presentation of such statement, accompanied by a certificate of the death of the deceased by a public officer and payment of a fee as may be specified in section 40 of chapter 262, the register shall docket these documents as a part of the permanent records of the court. Upon payment of a fee as prescribed in said section 40 of chapter 262, the register shall, if no other probate proceeding for administration of such estate is pending in said court, issue an attested copy of a statement duly filed under this section.

Notwithstanding any general or special or law to the contrary, a voluntary personal representative shall certify on the statement that copies of such statement and death certificate have been sent to the division of medical assistance by certified mail. If the decedent received medical assistance under chapter 118E (1) when age 65 or older or (2) at any time on or after March 22, 1991, regardless of age, while an inpatient in a nursing facility or other medical institution, the provisions of section 32 of said chapter 118E shall apply except (1) the period for said department to present a claim under subsection (b)(1) of said section 32 of said chapter 118E shall be within 4 months of the date the register dockets the statement and (2) interest on allowed claims under subsection (c) of said section 32 of said chapter 118E shall commence 4 months plus 60 days after said date. This paragraph shall apply to estates of decedents dying on or after September 1, 1992.

Upon the presentation of a copy of such a statement duly attested by the register, the tender of a proper receipt in writing and the surrender of any policy, passbook, note, certificate or other evidentiary instrument, a voluntary personal representative may, as the legal representative of the deceased and his estate, receive payment of any debt or obligation in the nature of a debt, or delivery of any chattel or asset, scheduled in such statement. Payments and deliveries made under this section shall discharge liability of the debtor, obligor or deliverer to all persons with respect to such debt, chattel, obligation or other asset unless, at the time of such payment or delivery, a written demand has been made upon said debtor, obligor or deliverer by a duly appointed personal representative.

A voluntary personal representative may sell any chattel so received and negotiate or assign any chose in action to convert the same to cash in a reasonable amount.

A voluntary personal representative shall, as far as possible out of the assets which come into his hands, first discharge the necessary expenses of the funeral and last sickness of the deceased and the necessary expenses of administration without fee for his services, and then pay the debts of the deceased in the order specified in section 3-805 and any other debts of the estate, and then distribute the balance, if any, in accordance with part 1 of article II of this chapter.

A voluntary personal representative shall be liable as a personal representative in his own wrong to all persons aggrieved by his administration of the estate, and, if letters testamentary or letters of administration are at any time granted, shall be liable as such a personal representative to the rightful personal representative.

For the purpose of paragraph (6) of section 113A of chapter 175 and section 2 of chapter 90, a voluntary personal representative shall be deemed to be the personal representative of the estate of the decedent until a personal representative is appointed.

Upon payment of the proper fee, the register may issue a certificate of appointment to such voluntary personal representative, with a copy of the statement annexed thereto.