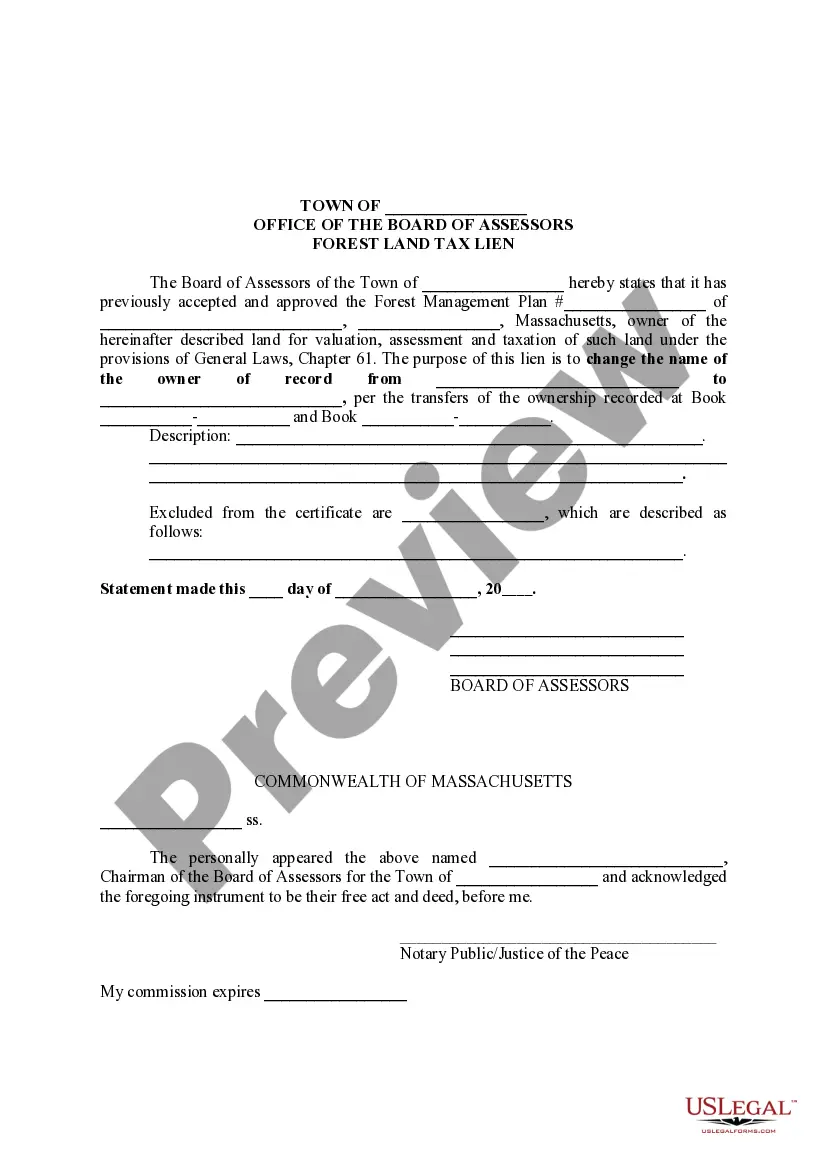

Massachusetts Forest Land Tax Lien

Description

How to fill out Massachusetts Forest Land Tax Lien?

Welcome to the most significant legal documents library, US Legal Forms. Here you can get any template including Massachusetts Forest Land Tax Lien templates and download them (as many of them as you want/need). Get ready official papers within a few hours, rather than days or even weeks, without spending an arm and a leg on an attorney. Get your state-specific example in a couple of clicks and feel confident with the knowledge that it was drafted by our qualified attorneys.

If you’re already a subscribed customer, just log in to your account and click Download next to the Massachusetts Forest Land Tax Lien you require. Because US Legal Forms is online solution, you’ll always have access to your saved templates, no matter what device you’re using. Locate them inside the My Forms tab.

If you don't come with an account yet, what are you waiting for? Check out our instructions listed below to start:

- If this is a state-specific document, check out its applicability in your state.

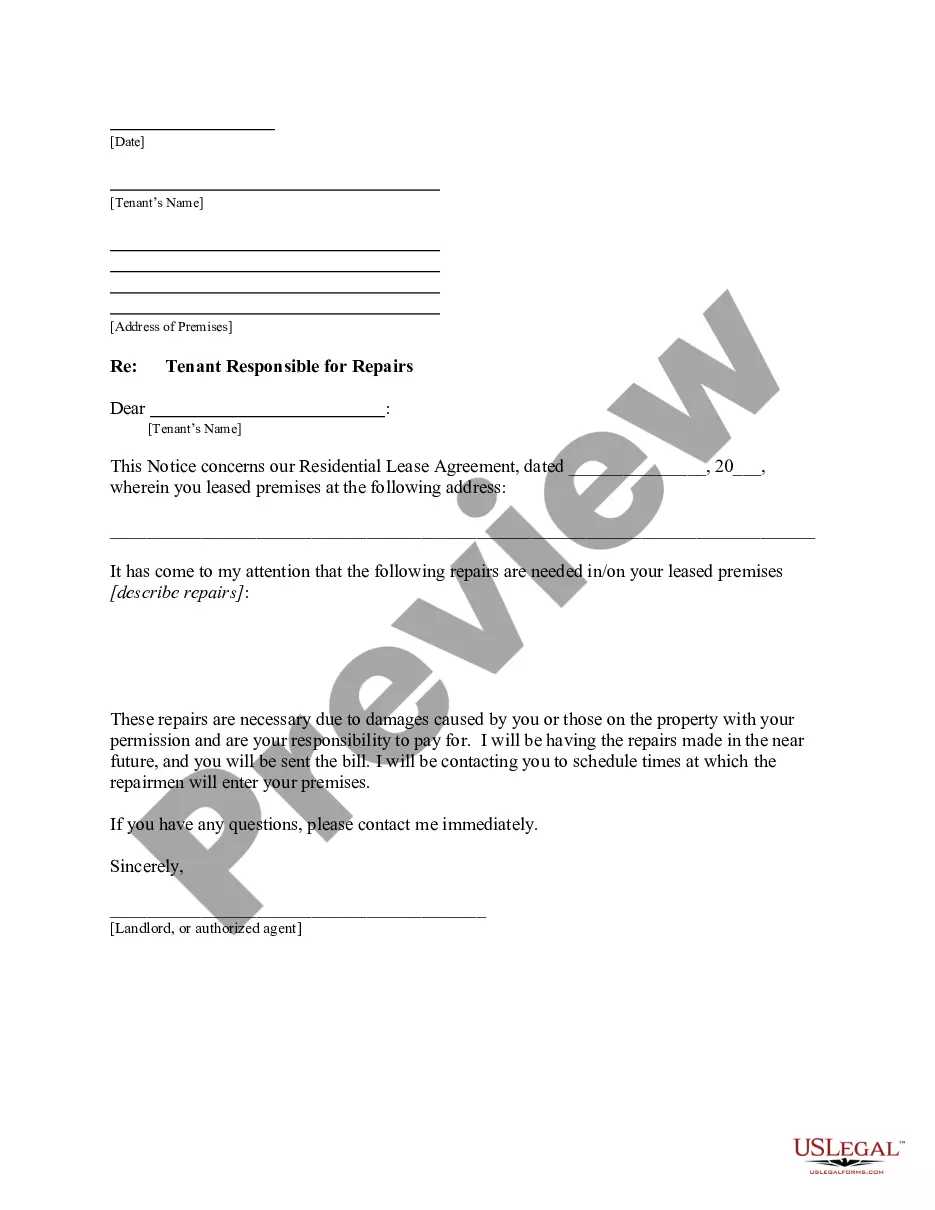

- Look at the description (if readily available) to learn if it’s the correct example.

- See a lot more content with the Preview feature.

- If the sample meets all of your needs, just click Buy Now.

- To make an account, pick a pricing plan.

- Use a credit card or PayPal account to sign up.

- Download the template in the format you want (Word or PDF).

- Print the document and complete it with your/your business’s details.

Once you’ve filled out the Massachusetts Forest Land Tax Lien, send out it to your lawyer for verification. It’s an additional step but an essential one for making confident you’re completely covered. Sign up for US Legal Forms now and get access to a large number of reusable examples.

Form popularity

FAQ

The agricultural and horticultural land classification program under Massachusetts General Laws Chapter 61A is designed to encourage the preservation of the Commonwealth's valuable farmland and promote active agricultural and horticultural land use.

The term farm includes stock, dairy, poultry, fruit, furbearing animal, and truck farms, plantations, ranches, nurseries, ranges, greenhouses or other similar structures used primarily for the raising of agricultural or horticultural commodities, and orchards and woodlands.A vineyard selling grapes is a farm.

A farm is defined as any place from which $1,000 or more of agricultural products were produced and sold, or normally would have been sold, during the year.

There is no hard-and-fast land requirement. However, the farmers I spoke with said that someone would need at least 500 owned acres and 1,000 leased acres to make a living. The quality of the land certainly affects those numbers.

Ch. 61B is the recreational land tax law. The purpose of Ch. 61B is to reduce the assessed value of land based on its use for open space or recreation. Assessed values under this law are reduced by 75%.

"'Farming' or 'agriculture' shall include farming in all of its branches and the cultivation and tillage of the soil, dairying, the production, cultivation, growing and harvesting of any agricultural, aquacultural, floricultural or horticultural commodities, the growing and harvesting of forest products upon forest

USDA defines a small farm as an operation with gross cash farm income under $250,000.While most U.S. farms are small 91 percent according to the Census of Agriculture large farms ($250,000 and above) account for 85 percent of the market value of agricultural production.