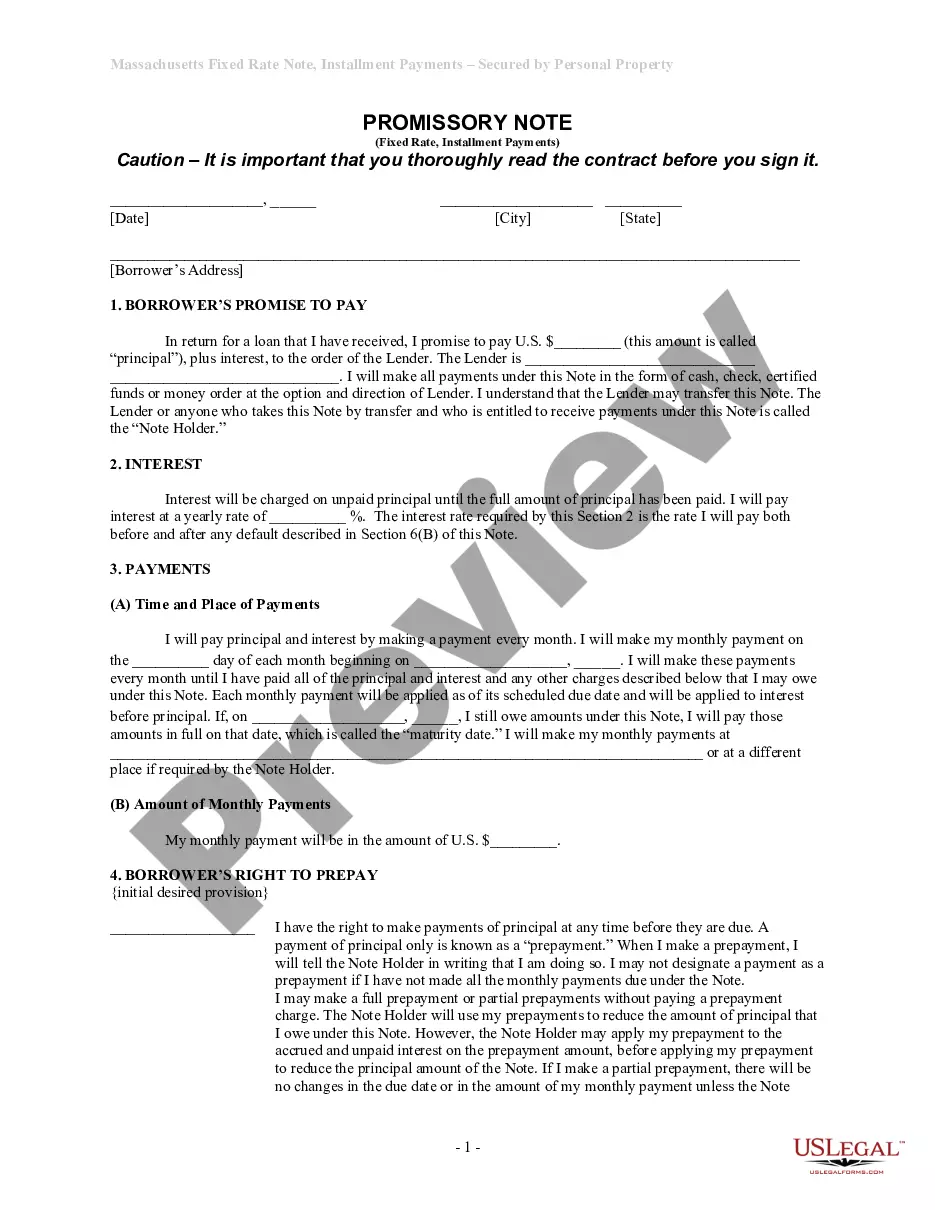

Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Massachusetts Installments Fixed Rate Promissory Note Secured By Personal Property?

Welcome to the biggest legal files library, US Legal Forms. Right here you can find any sample including Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property templates and save them (as many of them as you want/need to have). Prepare official files in a few hours, instead of days or weeks, without spending an arm and a leg with an lawyer or attorney. Get the state-specific form in a couple of clicks and be confident with the knowledge that it was drafted by our accredited legal professionals.

If you’re already a subscribed consumer, just log in to your account and then click Download next to the Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property you want. Due to the fact US Legal Forms is web-based, you’ll generally get access to your downloaded forms, no matter the device you’re using. Find them in the My Forms tab.

If you don't have an account yet, what exactly are you waiting for? Check out our guidelines listed below to get started:

- If this is a state-specific document, check out its applicability in your state.

- Look at the description (if offered) to understand if it’s the proper template.

- See more content with the Preview feature.

- If the document meets all of your needs, click Buy Now.

- To create an account, pick a pricing plan.

- Use a card or PayPal account to register.

- Save the template in the format you want (Word or PDF).

- Print out the file and fill it with your/your business’s information.

After you’ve completed the Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property, send out it to your attorney for verification. It’s an extra step but an essential one for being certain you’re fully covered. Join US Legal Forms now and get thousands of reusable samples.

Form popularity

FAQ

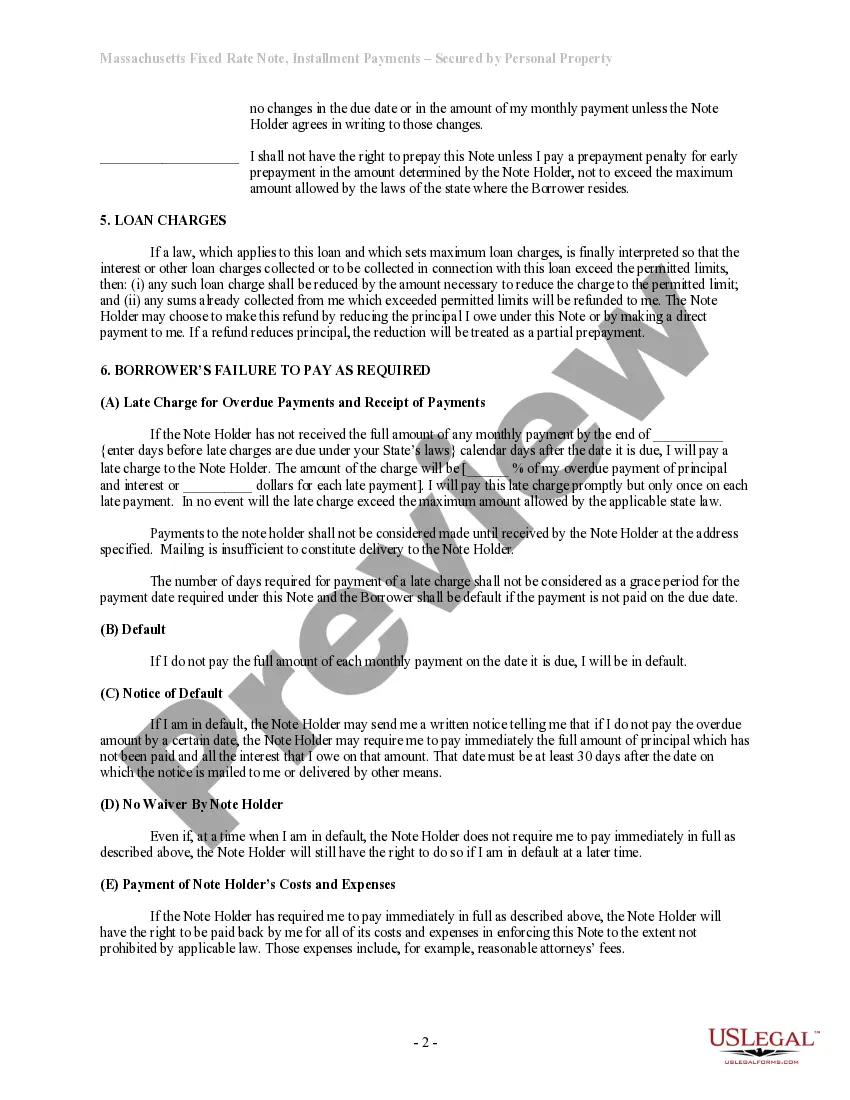

A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

What Is a Promissory Note? A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

When a loan changes hands, the promissory note is endorsed (signed over) to the new owner of the loan. In some cases, the note is endorsed in blank which makes it a bearer instrument under Article 3 of the Uniform Commercial Code. So, any party that possesses the note has the legal authority to enforce it.

The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

There is no legal requirement to have a Massachusetts promissory note notarized or witnessed. It should be signed and dated by the borrower and any co-signer.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.