Annual Minutes for a Massachusetts Professional Corporation

Description File Massachusetts Annual Report

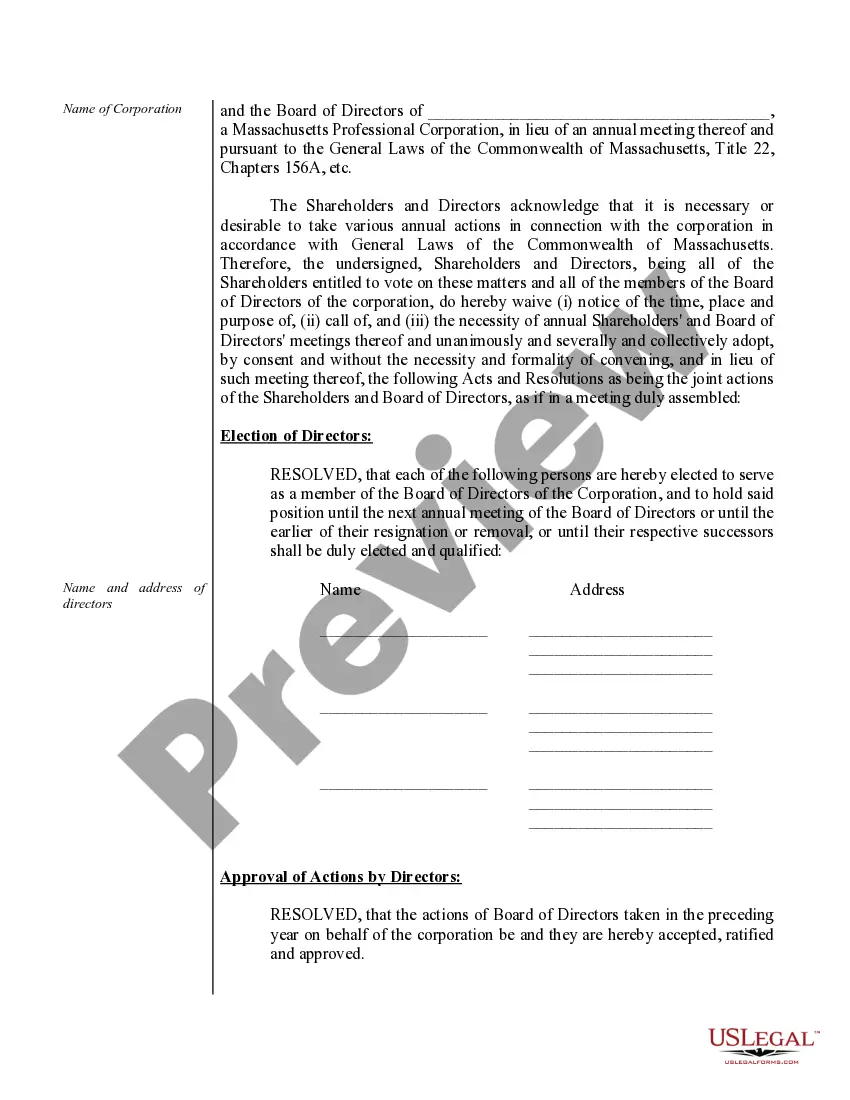

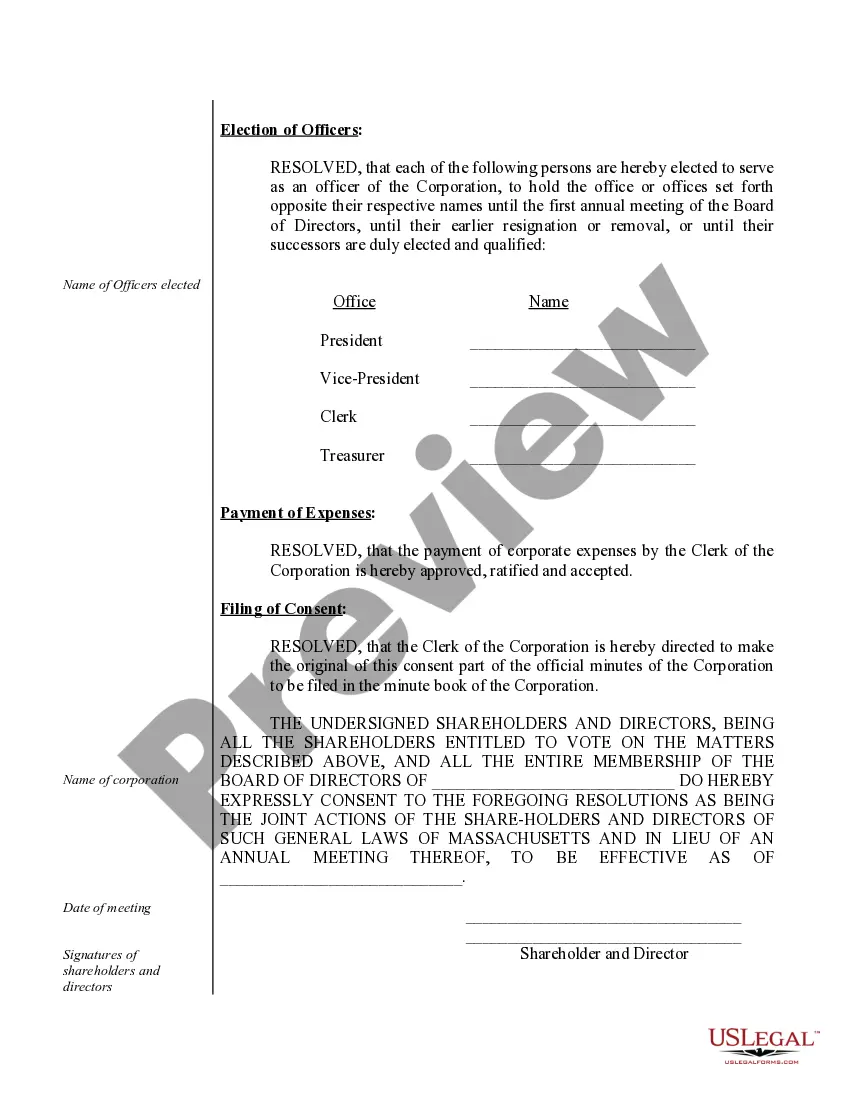

How to fill out Annual Minutes Corporation?

Welcome to the most significant legal files library, US Legal Forms. Right here you can get any template such as Annual Minutes for a Massachusetts Professional Corporation forms and save them (as many of them as you want/require). Prepare official files within a few hours, instead of days or weeks, without spending an arm and a leg with an lawyer or attorney. Get the state-specific example in a couple of clicks and be confident with the knowledge that it was drafted by our state-certified attorneys.

If you’re already a subscribed customer, just log in to your account and click Download near the Annual Minutes for a Massachusetts Professional Corporation you require. Due to the fact US Legal Forms is web-based, you’ll generally get access to your downloaded templates, regardless of the device you’re utilizing. Locate them within the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check our instructions below to begin:

- If this is a state-specific form, check out its validity in your state.

- See the description (if accessible) to learn if it’s the correct template.

- See much more content with the Preview function.

- If the sample matches your needs, click Buy Now.

- To make an account, pick a pricing plan.

- Use a card or PayPal account to subscribe.

- Download the file in the format you want (Word or PDF).

- Print out the file and fill it out with your/your business’s details.

Once you’ve filled out the Annual Minutes for a Massachusetts Professional Corporation, send away it to your lawyer for verification. It’s an additional step but a necessary one for making certain you’re totally covered. Sign up for US Legal Forms now and get a large number of reusable samples.

Ma Annual Fill Form popularity

Ma Annual Document Other Form Names

Massachusetts Annual A FAQ

How much does it cost to form a corporation in Massachusetts? You can register your business name with the Massachusetts Secretary of the Commonwealth Corporations Division for $30. To file your Articles of Incorporation, the Massachusetts Secretary of the Commonwealth Corporations Division charges a $275 filing fee.

Top 5 Tips on Registering a Business in Massachusetts LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year. Massachusetts registered agent and resident agent are synonymous.

Step 1: Get Your Certificate of Organization Forms. You can download and mail in your Massachusetts Certificate of Organization, OR you can file online. Step 2: Fill Out the Certificate of Organization. Step 3: File the Certificate of Organization.

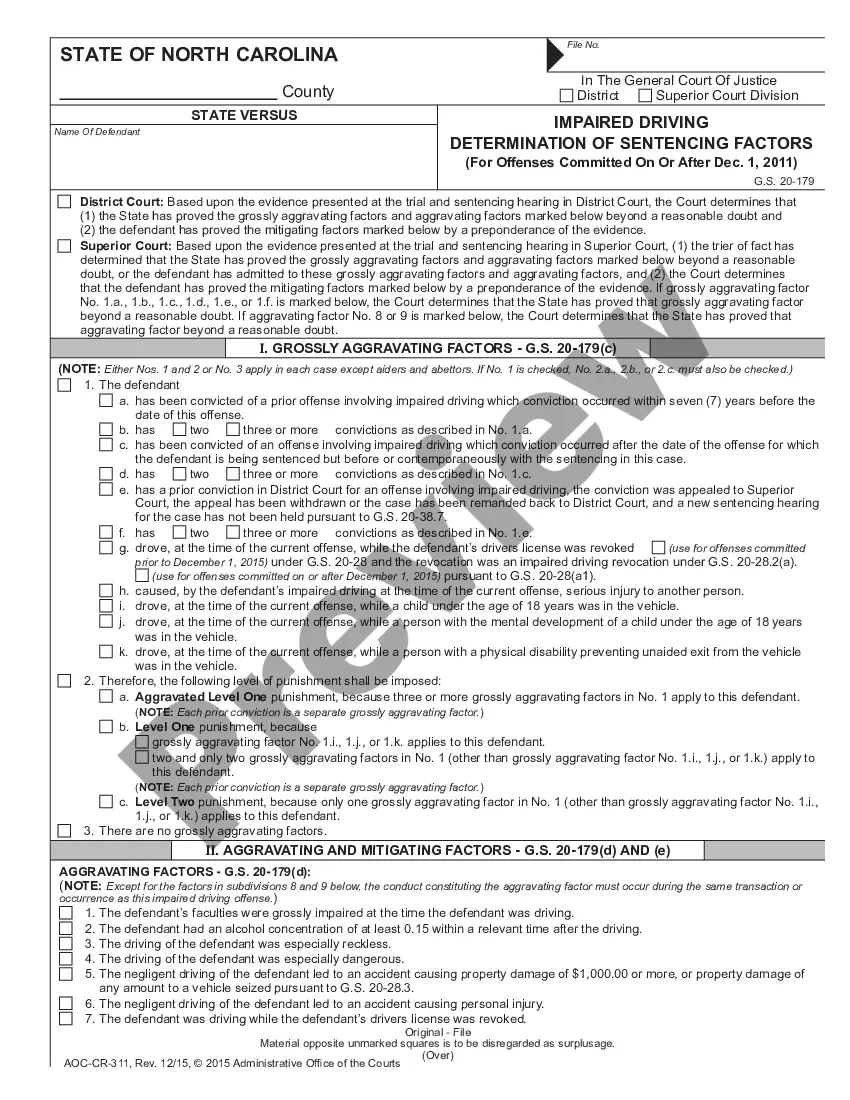

Determine If You Need To File an Annual Report. Every state has its own annual report requirements. Find Out When the Annual Report is Due. Complete the Annual Report Form. File Annual Report. Repeat the Process for Other States Where You're Registered to Do Business. Set Up Reminders for Your Next Annual Report Deadline.

Choose a Business Name. Check Availability of Name. Register a DBA Name. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholders' Agreement. Hold Initial Board of Directors Meeting.

Annual reports typically include financial statements, such as balance sheets, income statements, and cash flow statements. It contains 3 sections: cash from operations, cash from investing and cash from financing..

The State of Massachusetts requires you to file an annual report for your LLC. You can mail in the report or complete it online at the Corporations Division website. You'll need a customer ID number and PIN to access the online form.

Corporations are required to pay between $50 and $200 in government filing fees. This is in addition to the filing fees paid to the Secretary of State. Government filings are based on the type of business being incorporated and the state in which the business is incorporating.

Chairman's Letter. Business Profile. Management Discussion and Analysis. Financial Statements. Determine the Key Message. Finalize Structure and Content.