Massachusetts Fiduciary Deed - Trustee to Individual

Description Fiduciary Deed Form

How to fill out Massachusetts Deed Template?

Welcome to the greatest legal documents library, US Legal Forms. Here you can find any template including Massachusetts Fiduciary Deed - Trustee to Individual templates and save them (as many of them as you wish/need). Prepare official documents in a few hours, instead of days or even weeks, without spending an arm and a leg with an attorney. Get your state-specific sample in a couple of clicks and be confident with the knowledge that it was drafted by our qualified legal professionals.

If you’re already a subscribed consumer, just log in to your account and then click Download next to the Massachusetts Fiduciary Deed - Trustee to Individual you require. Due to the fact US Legal Forms is web-based, you’ll generally have access to your saved files, no matter the device you’re using. See them inside the My Forms tab.

If you don't have an account yet, what are you waiting for? Check our guidelines listed below to start:

- If this is a state-specific sample, check its validity in the state where you live.

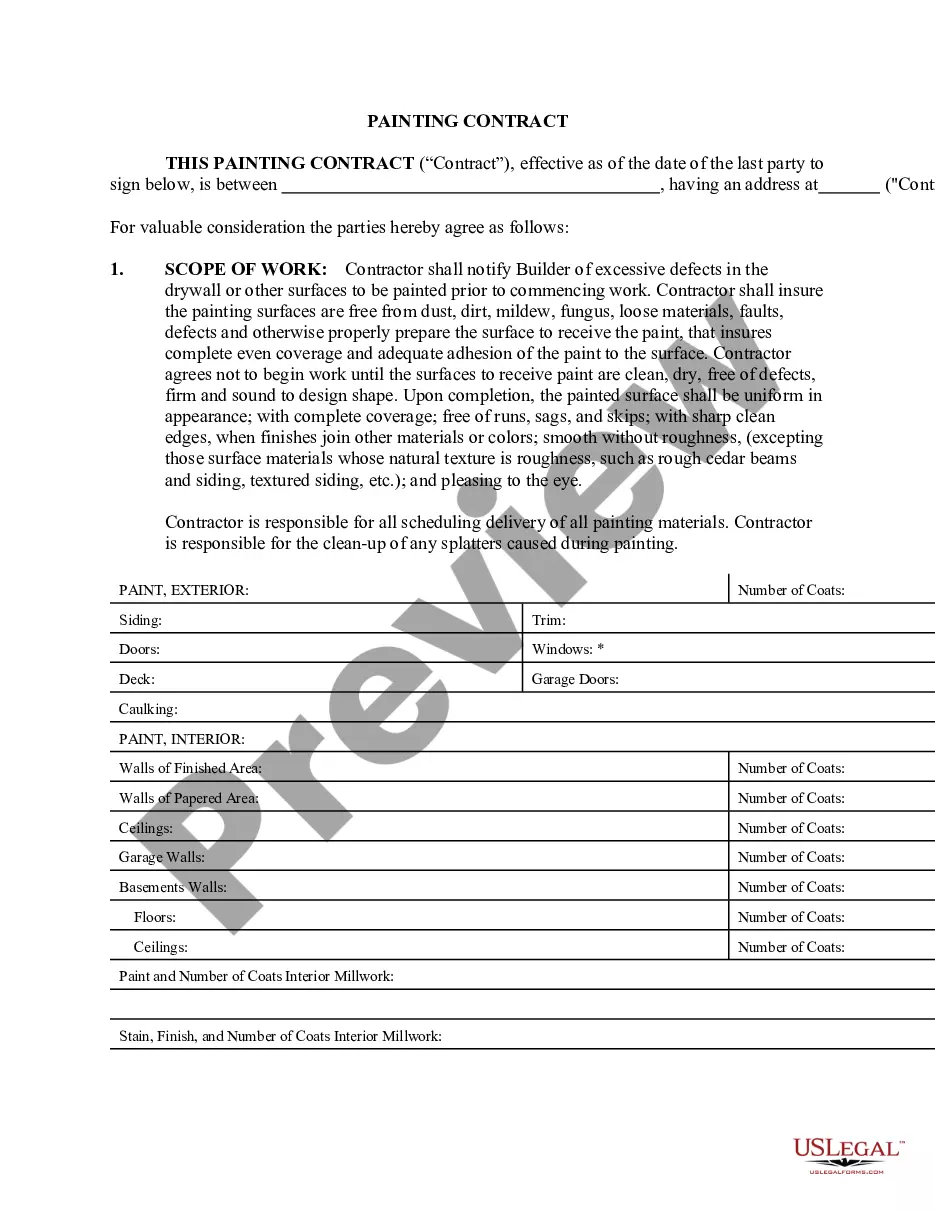

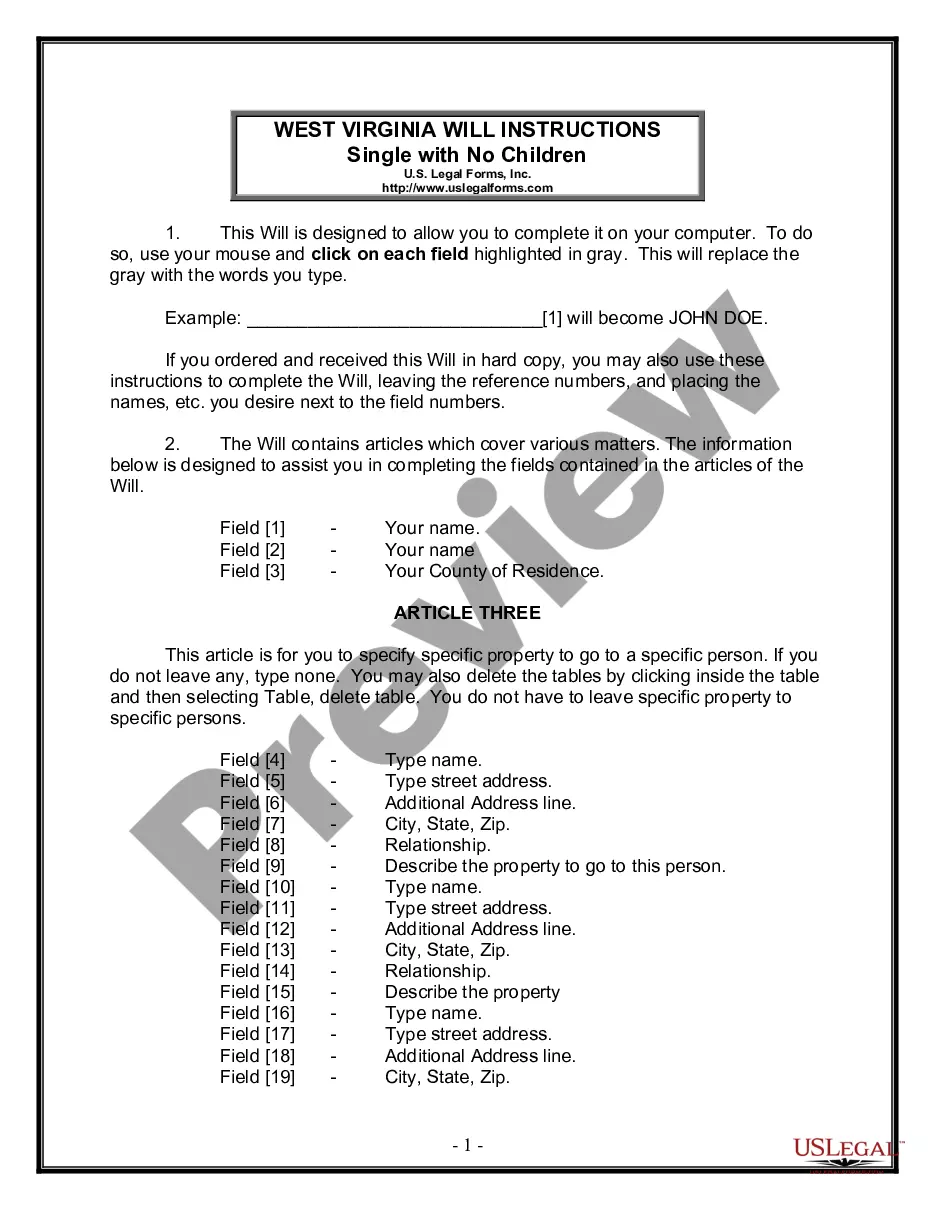

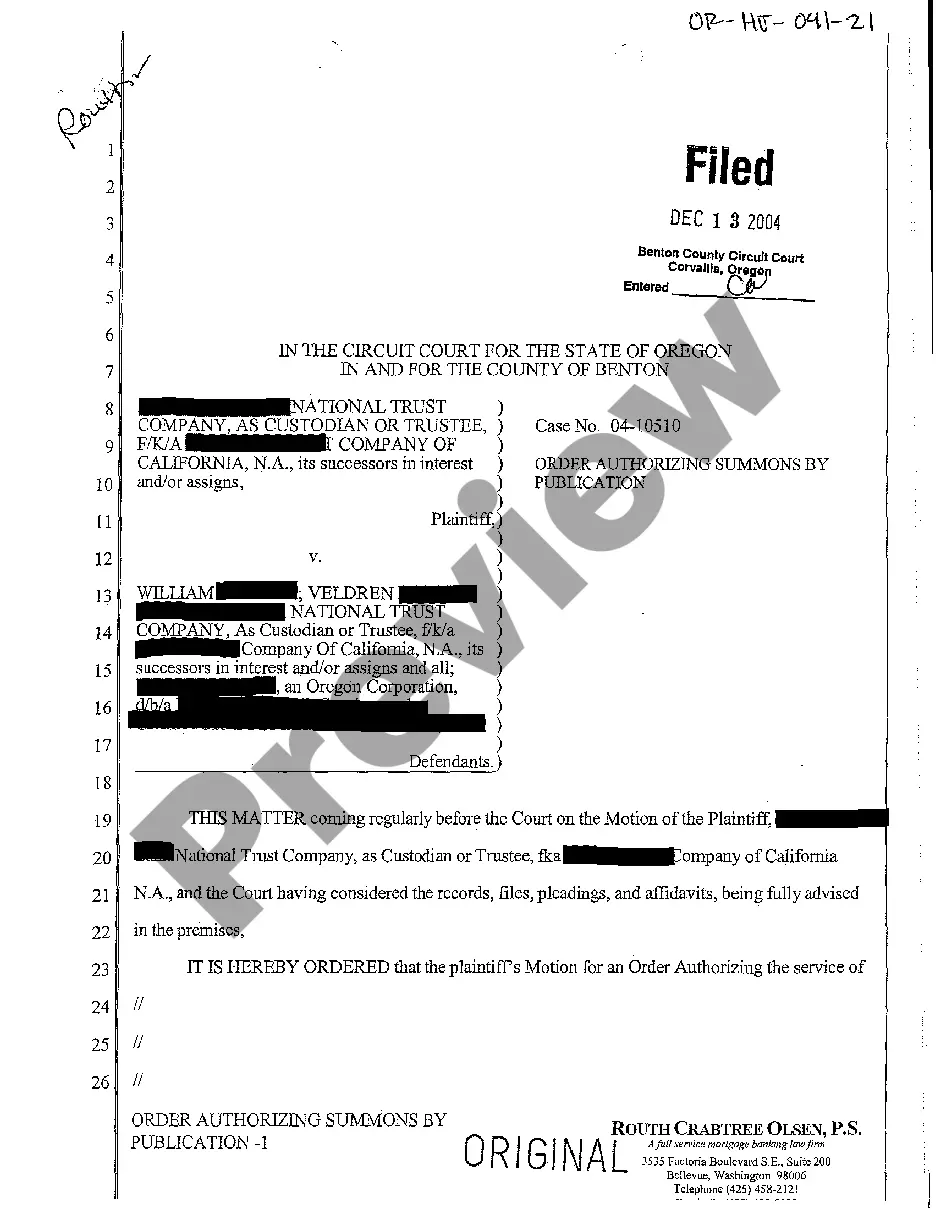

- Look at the description (if accessible) to understand if it’s the proper template.

- See more content with the Preview option.

- If the example meets your needs, just click Buy Now.

- To create your account, select a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Save the document in the format you need (Word or PDF).

- Print the document and fill it out with your/your business’s details.

After you’ve completed the Massachusetts Fiduciary Deed - Trustee to Individual, give it to your legal professional for confirmation. It’s an additional step but a necessary one for making certain you’re fully covered. Join US Legal Forms now and get a mass amount of reusable samples.

Deed Trustee Document Form popularity

Fiduciary Deed Statement Other Form Names

Deed Trustee Online FAQ

Trustees aren't allowed to sell trust property to themselves unless the trust agreement has explicitly allowed them to do so. They also shouldn't sell the trust property to another trust that they manage, or borrow trust funds for personal use.

The trustee cannot grant legitimate and reasonable requests from one beneficiary in a timely manner and deny or delay granting legitimate and reasonable requests from another beneficiary simply because the trustee does not particularly care for that beneficiary. Invest trust assets in a conservative manner.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

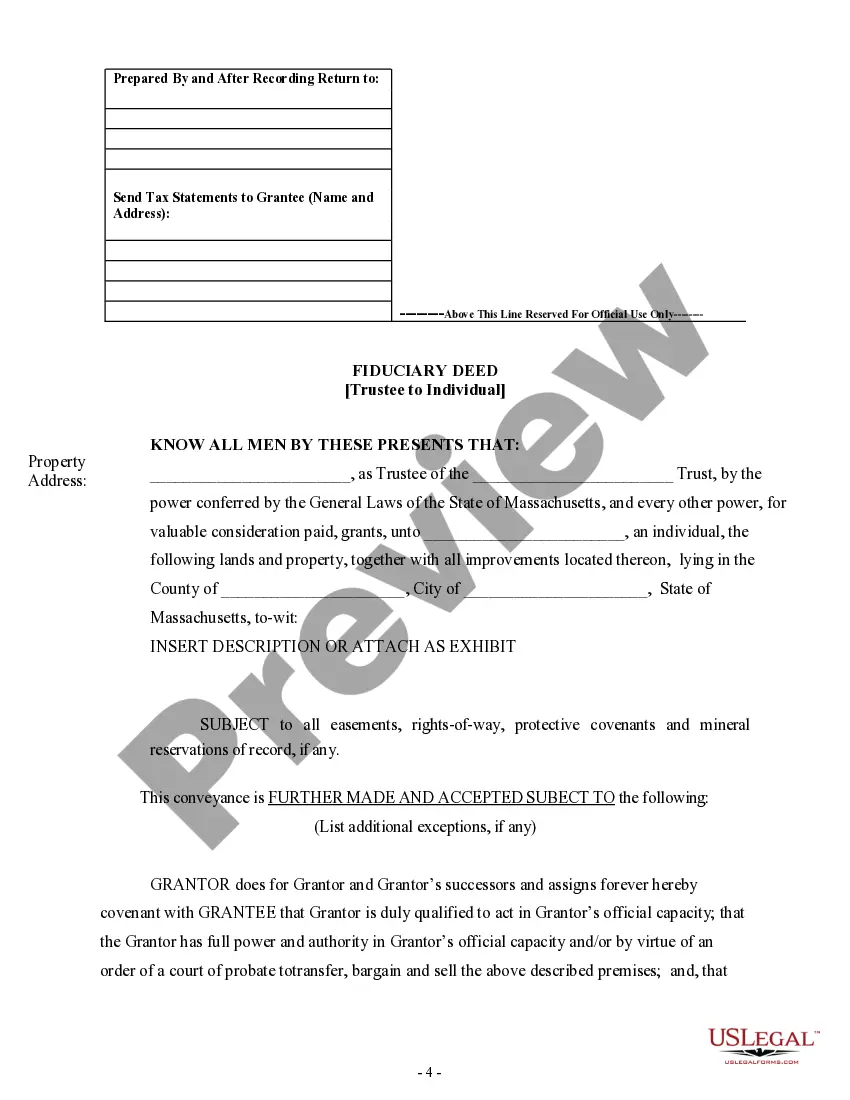

Prior to enacting G.L.c. 184, §35, Massachusetts was among the few states requiring the full trust document for trusts containing real property to be recorded.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.

Since the Schedule of Beneficiaries to a trust is not recorded with the Declaration of Trust at the Registry of Deeds, the identity of the Beneficiaries is not a matter of public record.There are two types of Trusts in Massachusetts.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

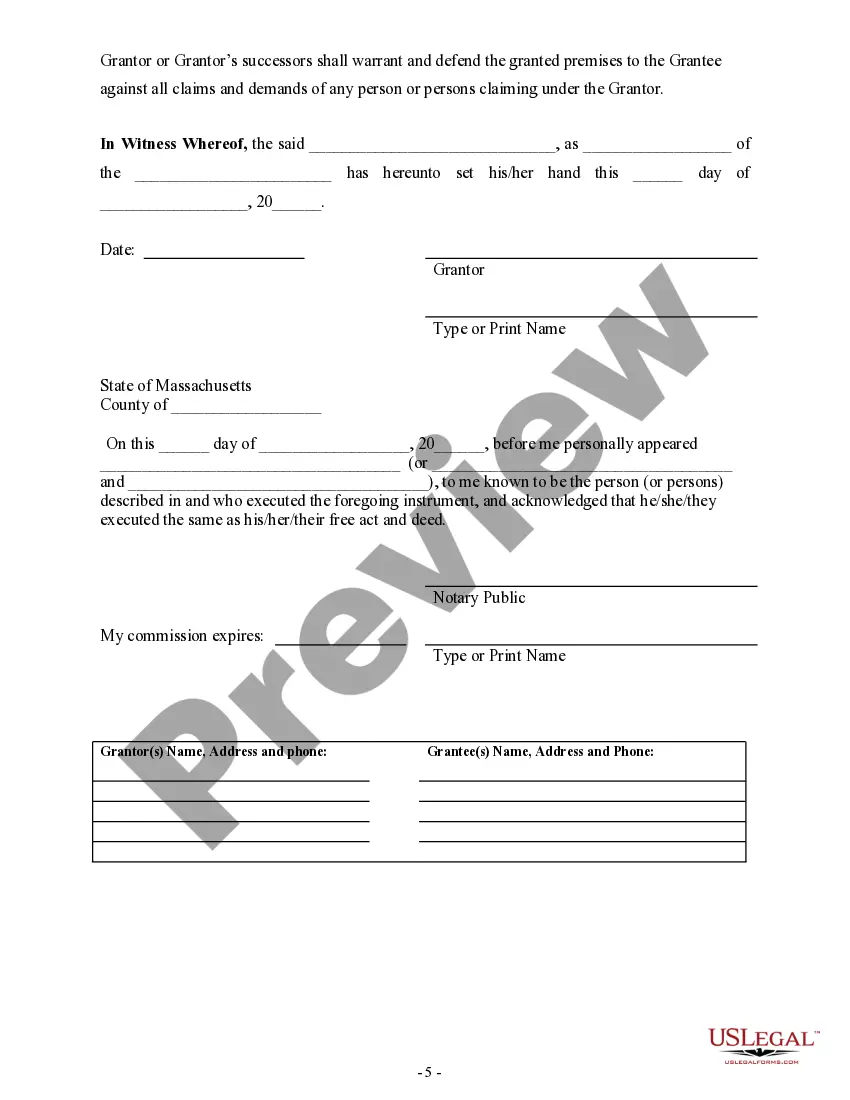

How to sign as a Trustee. When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.