Massachusetts R-408 is a form issued by the Massachusetts Department of Revenue for the purpose of claiming a refund or credit of Massachusetts income tax. The form is required for individuals, corporations, partnerships, trusts, and estates who have paid more Massachusetts income tax than they owe. There are three types of Massachusetts R-408 forms: the R-408A, R-408B, and R-408C. The R-408A is used by individuals to claim a refund or credit of Massachusetts income taxes. The R-408B is used by corporations, partnerships, trusts, and estates to claim a refund or credit of Massachusetts income taxes. The R-408C is used by individuals to claim a refund or credit of Massachusetts income taxes for the prior tax year.

Massachusetts R-408

Description

How to fill out Massachusetts R-408?

How much time and resources do you normally spend on composing formal paperwork? There’s a greater opportunity to get such forms than hiring legal experts or wasting hours browsing the web for an appropriate blank. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Massachusetts R-408.

To obtain and complete an appropriate Massachusetts R-408 blank, follow these easy steps:

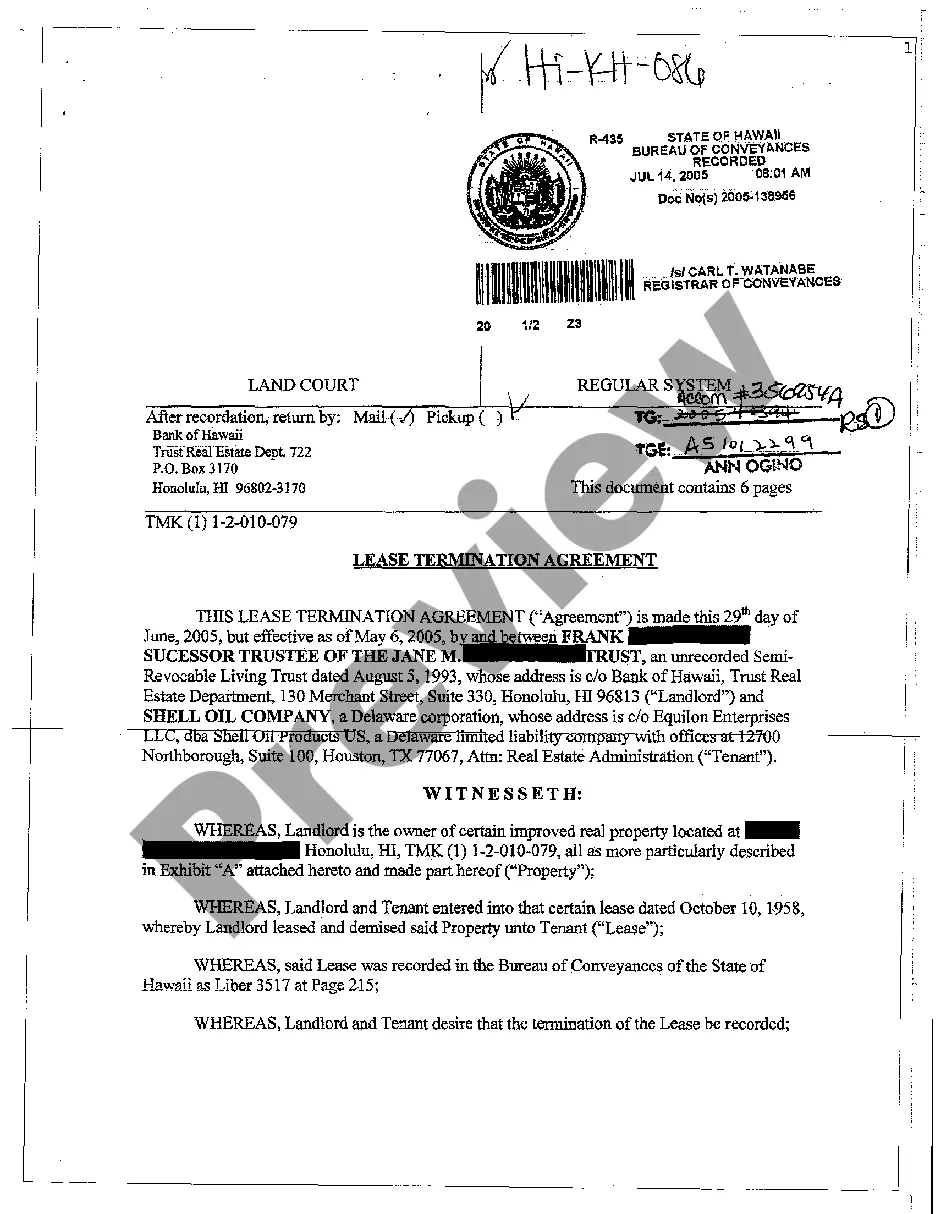

- Examine the form content to ensure it complies with your state requirements. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, locate another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Massachusetts R-408. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Select the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally safe for that.

- Download your Massachusetts R-408 on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously downloaded documents that you safely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trustworthy web services. Sign up for us today!

Form popularity

FAQ

In Massachusetts, a divorce can be filed as ?no-fault? or ?fault,? and either of these can be contested or uncontested. Before you file, you'll need to choose the type that's right for you.

A common question we get is "Is MA a 50/50 divorce state?"No. The state of Massachusetts is not a 50/50 state or a community property state. This means that, if the court must decide, all the property, assets, and liabilities are not necessarily divided equally between the two parties, as is the case in some states.

Filing first for divorce does not matter in Massachusetts. The first person to file will choose the grounds for divorce or whether to file a no fault divorce.

Abandonment or desertion provides grounds for a fault-based divorce if a spouse left voluntarily, without good reason or an intent to return, and without the other spouse's consent. A spouse must be out of the home for a year or more before the other spouse can file for divorce on grounds of desertion.

The divorce is finalized 120 days after the judgment date. The court will set a hearing date after all paperwork has been filed and send you notice in the mail. Both spouses must attend the hearing unless the court has accepted an attendance waiver for one spouse.

You can file for a fault divorce in person or by mail. If you or your spouse lives in the county where you lived together, file the required forms and fees with the Probate and Family Court in that county.

Evidence of a compromise or offer to compromise may be admitted (with limiting instructions) for a purpose other than to prove liability or the invalidity of the claim, such as to impeach the credibility of a witness.