The Massachusetts Formal Checklist is a document issued by the Massachusetts Department of Revenue which provides businesses with a summary of all applicable state taxes and associated filing requirements. It is intended to help businesses understand the state tax laws and regulations, and to ensure that all required taxes are paid and filed in a timely manner. The checklist is divided into two parts: the Federal Tax Schedule and the Massachusetts Tax Schedule. The Federal Tax Schedule outlines the taxes, filing requirements, and due dates associated with federal taxes, such as income tax and payroll taxes. The Massachusetts Tax Schedule outlines the taxes, filing requirements, and due dates associated with state taxes, such as sales and use tax, meals tax, room occupancy excise, and corporate excise. Both schedules also indicate the type of return or form that must be filed and when it is due. There are three types of Massachusetts Formal Checklist: the Annual Checklist, the Quarterly Checklist, and the Monthly Checklist. The Annual Checklist is issued once a year and summarizes all applicable state taxes and associated filing requirements. The Quarterly Checklist is issued four times a year and summarizes taxes and filing requirements for the current quarter and the three succeeding quarters. The Monthly Checklist is issued each month and summarizes taxes and filing requirements for the current month and the two preceding months.

Massachusetts Formal Checklist

Description

How to fill out Massachusetts Formal Checklist?

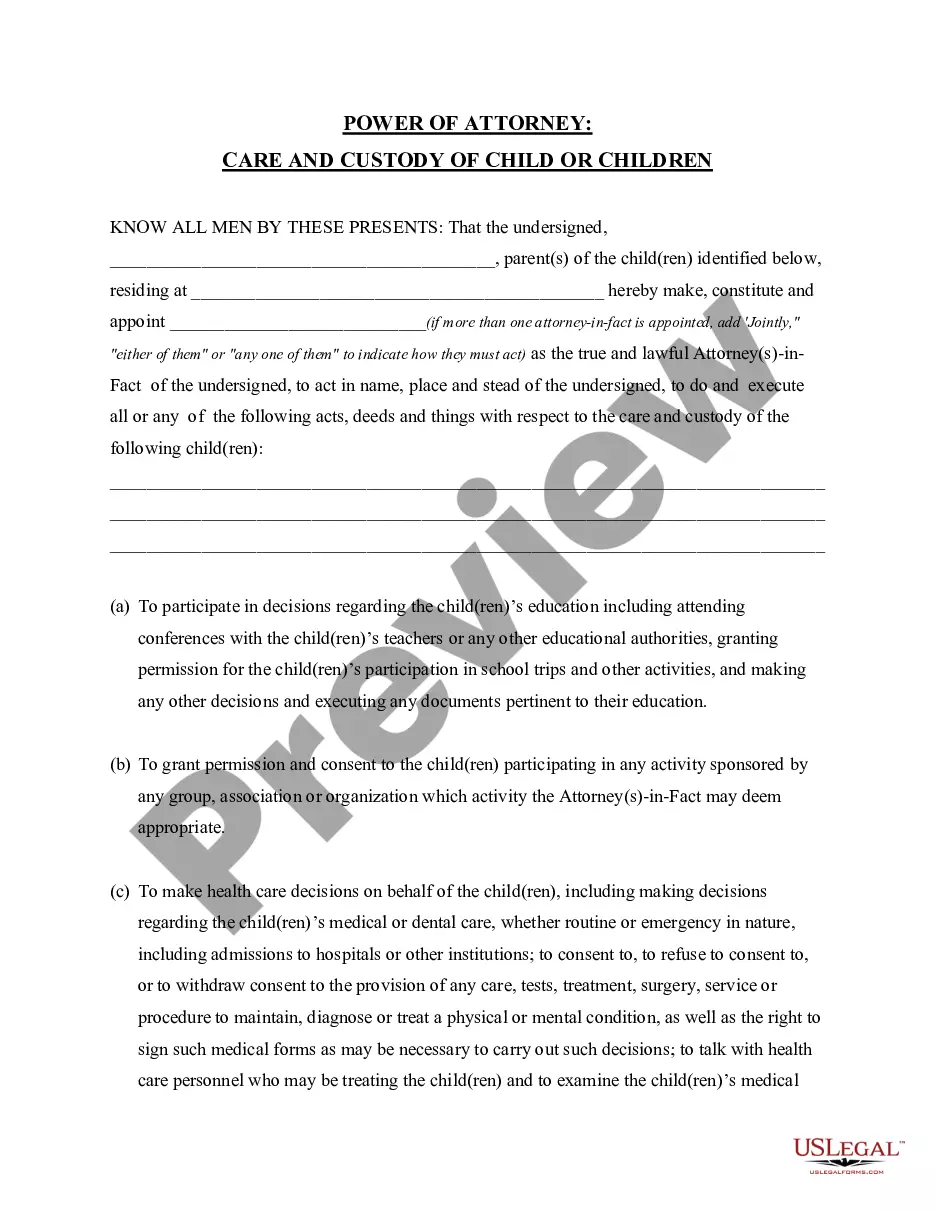

Handling legal paperwork requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Massachusetts Formal Checklist template from our service, you can be sure it complies with federal and state regulations.

Working with our service is straightforward and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to get your Massachusetts Formal Checklist within minutes:

- Remember to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Massachusetts Formal Checklist in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the Massachusetts Formal Checklist you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in full legal compliance!