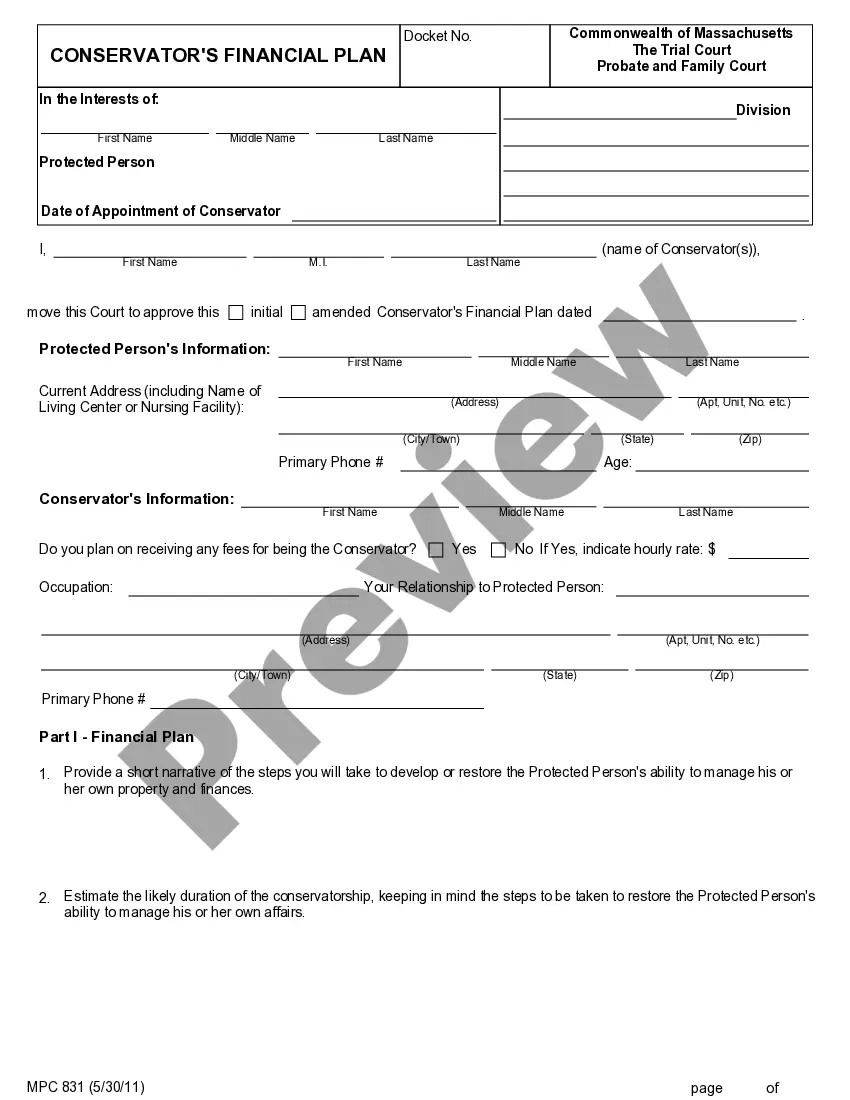

The Massachusetts Conservators Financial Plan is a legal document that is used to guide the management of an individual’s financial resources when they are unable to do so themselves. It is generally used for elderly individuals who have been deemed unable to make legal decisions about their finances due to physical or cognitive impairment. The plan outlines the powers and duties of the conservator, who is a legally appointed guardian of the individual’s estate. There are two main types of Massachusetts Conservators Financial Plans: the basic plan and the comprehensive plan. The basic plan outlines the conservator’s role in care management, budgeting, investments, taxes, and estate planning. The comprehensive plan includes more detailed information about the individual’s financial situation, including detailed financial statements, investments, and insurance policies. Both plans are designed to ensure that the conservator is acting in the best interests of the individual’s estate and that their financial decisions are made with careful consideration. The plan also serves as a record of the financial decisions made by the conservator, which can be used to review the conservator’s performance in the future.

Massachusetts Conservators Financial Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Conservators Financial Plan?

Drafting legal documents can be a significant hassle if you lack immediate access to fillable templates. With the US Legal Forms online repository of formal papers, you can trust that the templates you receive conform with federal and state standards and have been verified by our experts.

Acquiring your Massachusetts Conservators Financial Plan from our service is as simple as pie. Existing users with an active subscription just need to Log In and click the Download button once they locate the appropriate template. Later, if needed, users can find the same document under the My documents section of their account. However, even if you are a newcomer to our service, registering with a valid subscription will only take a few minutes. Here’s a brief guide for you.

Haven’t you experienced US Legal Forms yet? Register for our service now to obtain any official document swiftly and efficiently whenever you need it, and maintain your documentation in order!

- Document compliance verification. You should thoroughly examine the contents of the form you wish to ensure that it meets your needs and adheres to your state regulations. Examining your document and reviewing its general overview will assist you in doing just that.

- Alternative searching (optional). If you encounter any discrepancies, navigate the library using the Search tab above until you find a suitable blank, and click Buy Now once you identify the one you need.

- Account creation and document acquisition. Establish an account with US Legal Forms. After confirming your account, Log In and choose your desired subscription plan. Make a payment to continue (PayPal and credit card options are offered).

- Template retrieval and subsequent use. Select the file format for your Massachusetts Conservators Financial Plan and click Download to store it on your device. Print it out to manually complete your forms, or utilize a feature-rich online editor to create an electronic version more quickly and efficiently.

Form popularity

FAQ

GUARDIANSHIP AND CONSERVATORSHIP Guardians may be appointed for protection of the person only. A conservator must be appointed to protect property and business affairs of a person in need of protection.

GUARDIANSHIP AND CONSERVATORSHIP Guardians may be appointed for protection of the person only. A conservator must be appointed to protect property and business affairs of a person in need of protection.

The court will likely remove you as conservator and appoint a successor. There are other situations that may end your conservatorship, such as the death of your ward or if a court finds there is good cause to terminate your duties.

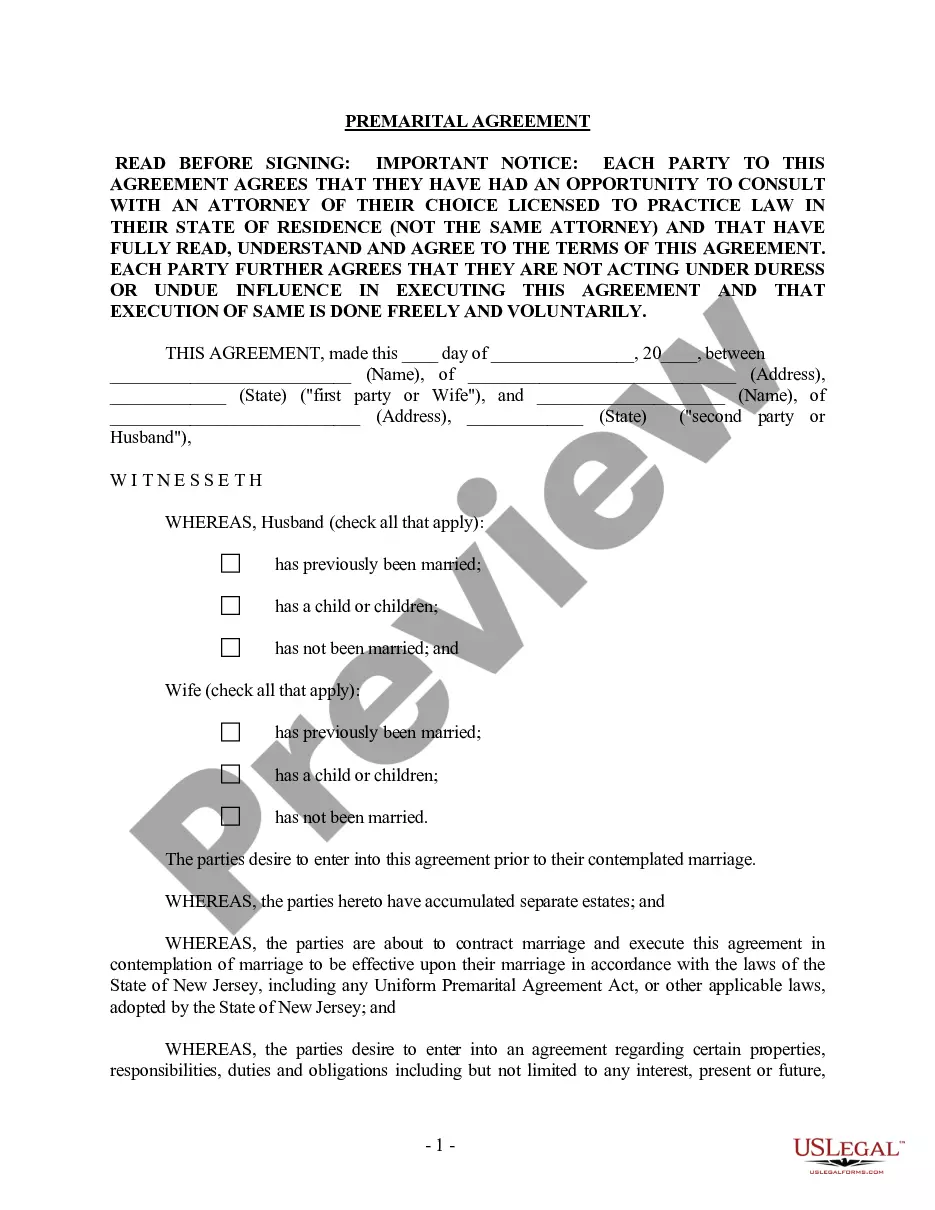

The court may appoint a Conservator to make financial decisions on the individual's behalf. With a Power of Attorney in place, the Attorney-in-Fact has the legal authority to make financial decisions without the burdens of the court process of appointing a conservator.

A conservator of the estate is appointed to supervise the financial affairs of an adult who is found by the court to be incapable of doing so themselves. Financial conservatorships may require the conservator to manage the conservatee's assets, income and public assistance benefits.

A conservatorship is when a court appoints someone to manage a minor or incapacitated person's financial and personal affairs. The conservator becomes responsible for the minor's finances and can limit spending decisions.

In most instances, the powers of a limited conservatorship of the person allow the conservator to arrange for the housing, health care, meals, personal care, housekeeping, transportation, recreation, and education of the conservatee.

A conservator's duties and responsibilities to the adult or minor include the following: Collect and manage the assets of the protected person's estate. Pay bills and taxes. Enter into contracts. Oversee the maintenance of real property. Maintain business operations. Pay for living and medical expenses.