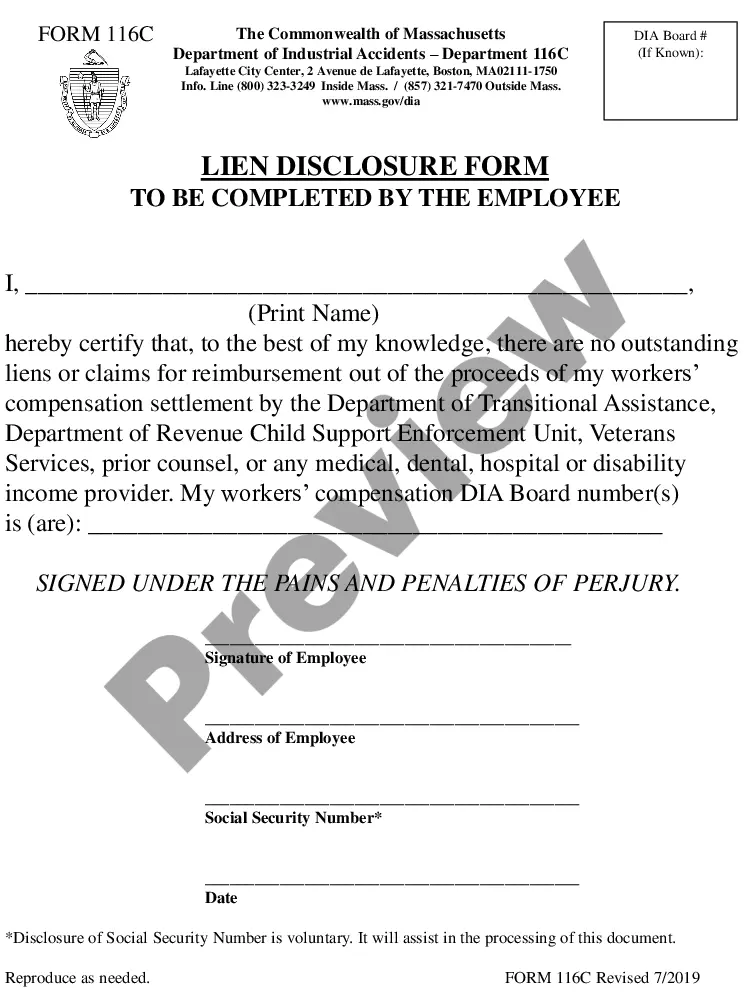

The Massachusetts Lien Disclosure Form is a legal document that is used to disclose any liens that exist on the property, such as liens for unpaid taxes, mechanic's liens, and mortgages. This form must be completed and signed by the seller and the buyer prior to the closing of the sale. The purpose of the form is to protect both parties from any future issues that could arise as a result of an undisclosed lien. There are three types of Massachusetts Lien Disclosure Forms: 1. Massachusetts Tax Lien Disclosure Form: This form must be completed and signed by the seller and the buyer prior to the closing of the sale. It is used to disclose any tax liens that exist on the property. 2. Massachusetts Mechanic's Lien Disclosure Form: This form must be completed and signed by the seller and the buyer prior to the closing of the sale. It is used to disclose any mechanic's liens that exist on the property. 3. Massachusetts Mortgage Lien Disclosure Form: This form must be completed and signed by the seller and the buyer prior to the closing of the sale. It is used to disclose any mortgage liens that exist on the property.

Massachusetts Lien Disclosure Form

Description

How to fill out Massachusetts Lien Disclosure Form?

Completing official documentation can be quite a challenge if you lack accessible fillable templates. With the US Legal Forms online repository of formal documents, you can have confidence in the blanks you acquire, as all are compliant with federal and state regulations and are validated by our experts.

Retrieving your Massachusetts Lien Disclosure Form from our service is as simple as ABC. Previously registered users with an active subscription need only sign in and click the Download button once they find the appropriate template. Subsequently, if necessary, users can utilize the same blank from the My documents section of their account. However, even if you are a newcomer to our service, registering with a valid subscription will take just a few moments. Here’s a brief guide for you.

Haven’t you experienced US Legal Forms yet? Register for our service today to acquire any formal document swiftly and effortlessly whenever you require, and keep your paperwork organized!

- Document compliance verification. You should meticulously review the contents of the form you wish to ensure that it meets your requirements and satisfies your state law stipulations. Previewing your document and reviewing its general summary will assist you in this.

- Alternative search (optional). If you encounter any discrepancies, explore the library using the Search tab above until you find a suitable template, and click Buy Now when you identify the one you require.

- Account creation and form purchase. Establish an account with US Legal Forms. Once your account is verified, Log In and choose the most fitting subscription plan. Make a payment to proceed (PayPal and credit card options are provided).

- Template download and further usage. Select the file format for your Massachusetts Lien Disclosure Form and click Download to save it on your device. Print it to finalize your paperwork manually, or utilize a multi-featured online editor to prepare an electronic version more quickly and efficiently.