The Massachusetts Model Accredited Investor Exemption Uniform Notice of Transaction (MA-MAIE-UNT) is a document which allows an accredited investor to purchase securities in a private offering without having to register with the Massachusetts Securities Division. The MA-MAIE-UNT is a standardized form that includes information about the issuer, the securities being offered, and the terms and conditions of the offering. The form must be filled out and signed by both the issuer and the accredited investor and filed with the Massachusetts Securities Division. There are two types of MA-MAIE-UNT: a Notification of Transaction and a Notice of Exemption. The Notification of Transaction is used when an issuer wishes to offer securities to an accredited investor without making a public offering. The Notice of Exemption is used when an issuer has already made a public offering of the securities and wishes to offer additional securities to accredited investors.

Massachusetts Model Accredited Investor Exemption Uniform Notice of Transaction

Description

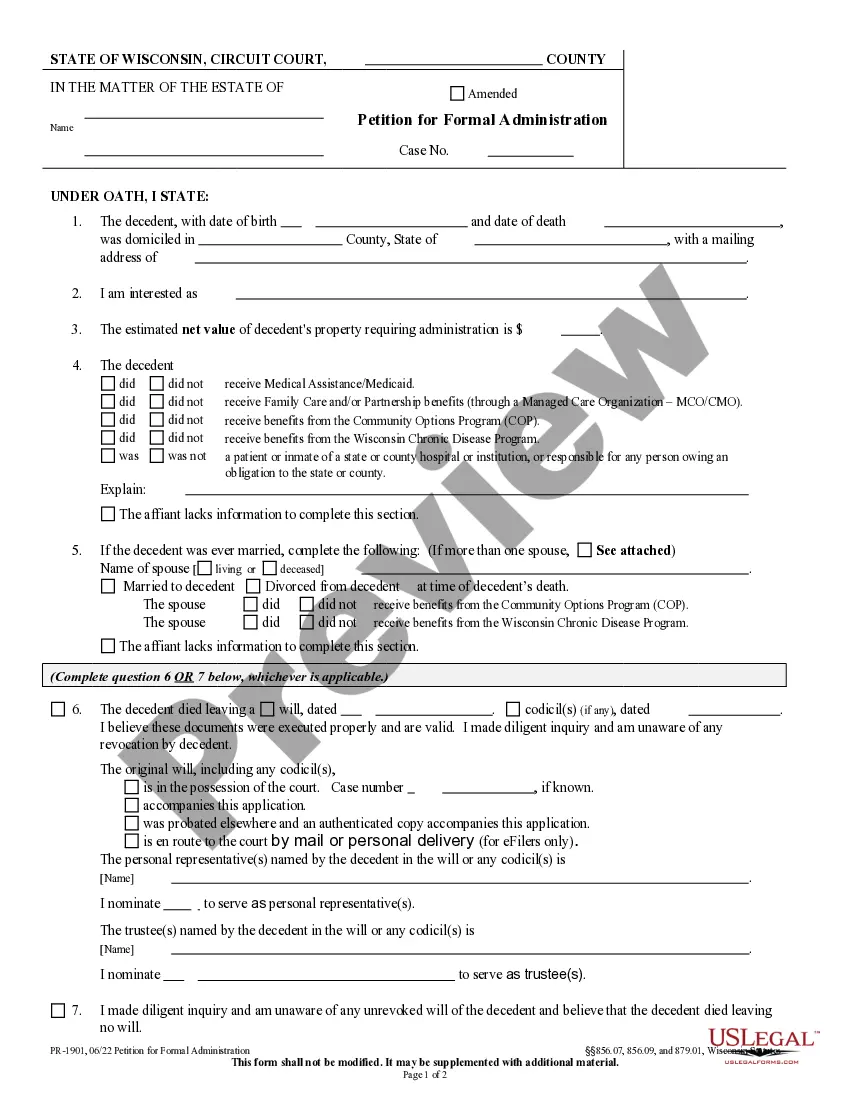

How to fill out Massachusetts Model Accredited Investor Exemption Uniform Notice Of Transaction?

If you’re looking for a way to properly complete the Massachusetts Model Accredited Investor Exemption Uniform Notice of Transaction without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business situation. Every piece of paperwork you find on our web service is drafted in accordance with federal and state laws, so you can be certain that your documents are in order.

Follow these simple instructions on how to acquire the ready-to-use Massachusetts Model Accredited Investor Exemption Uniform Notice of Transaction:

- Ensure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and select your state from the dropdown to find another template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Massachusetts Model Accredited Investor Exemption Uniform Notice of Transaction and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

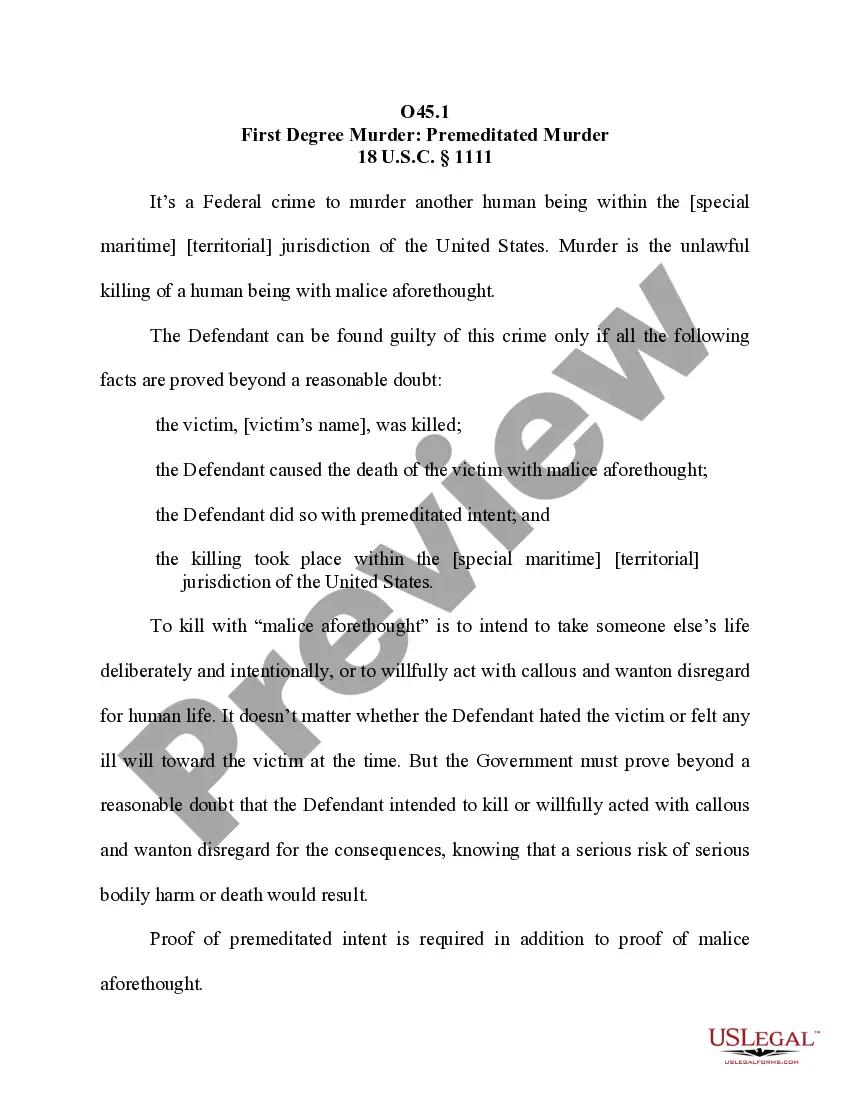

Rule 506(b) is part of Section 4(a)(2) in the Securities Act of 1933, which outlines rules companies or investors must follow to sell securities in a private offering. 506(b)'s defining feature: A GP can raise an unlimited amount of money as long as they do not publicly advertise or solicit investments for the fund.

Accredited Investor Exemption The Securities Act of 1933 allows unregistered sales to accredited investors if the total offering price is under $5 million. However, Regulation D does not address private offerings of securities under this provision.

Regulation D imposes reserve requirements on certain deposits and other liabilities of depository institutions2 solely for the purpose of implementing monetary policy. It specifies how depository insti- tutions must classify different types of deposit accounts for reserve requirements purposes.

It prohibits fraudulent or deceitful sales of securities and requires organizations that are issuing securities?such as bonds and stocks?to disclose helpful information about the investment when they register the security.

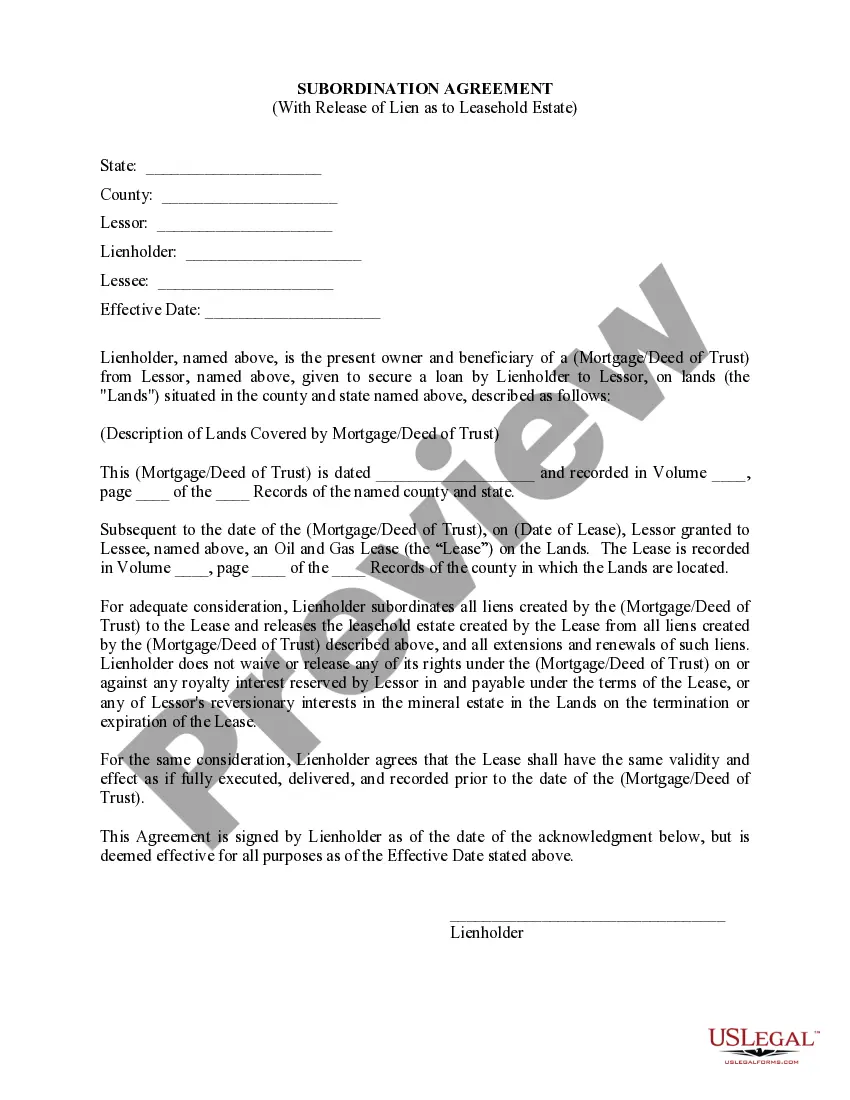

In the U.S., the term accredited investor is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings.

What is an Accredited Investor Under Regulation D? For most cases, an Accredited Investor is an individual whose income is over $200,000/year (for single persons) or $300,000/year (for married couples) or has a net worth over $1,000,000 not including equity in their principal residence.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

All non-accredited investors, either alone or with a purchaser representative, must be sophisticated?that is, they must have sufficient knowledge and experience in financial and business matters to make them capable of evaluating the merits and risks of the prospective investment.