This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

Massachusetts Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand

Description

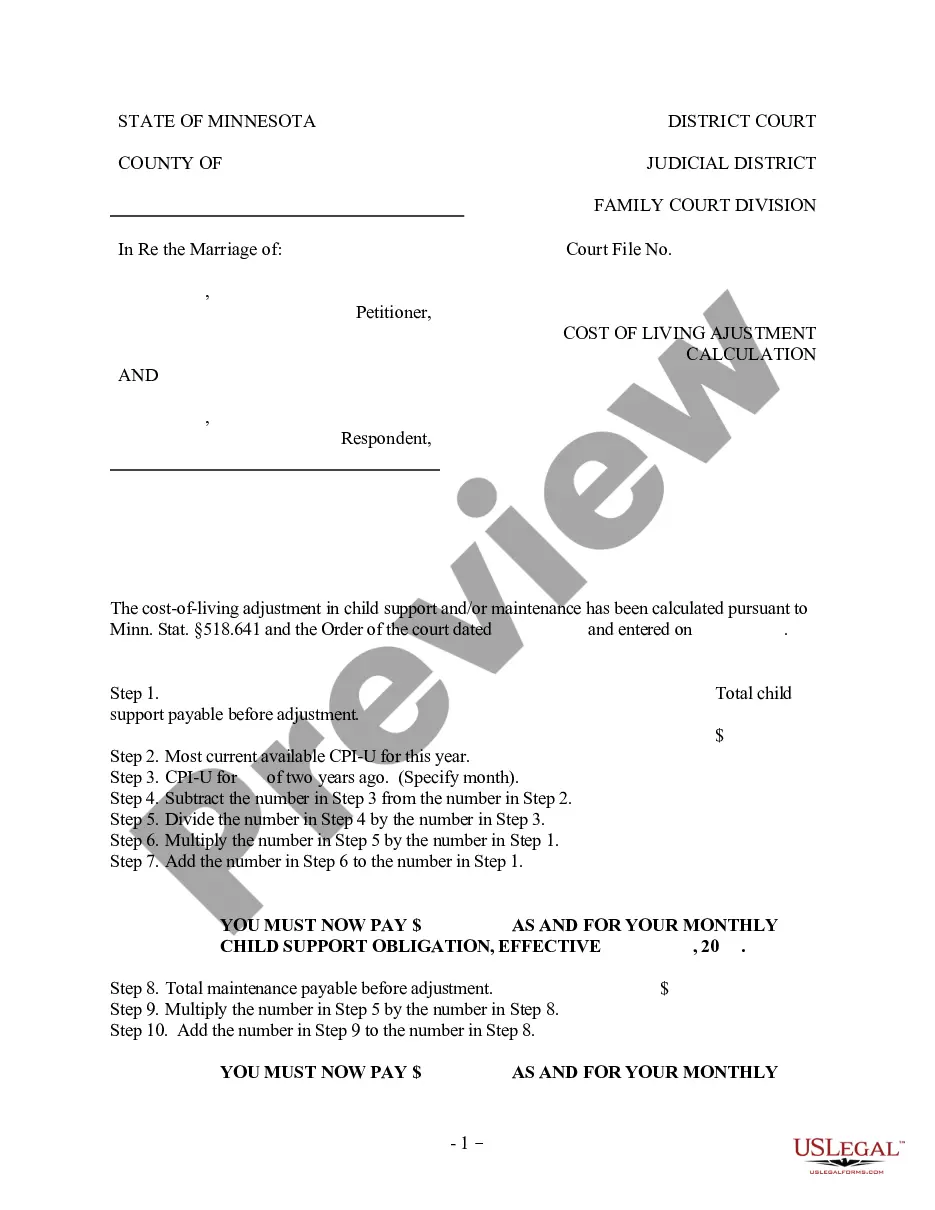

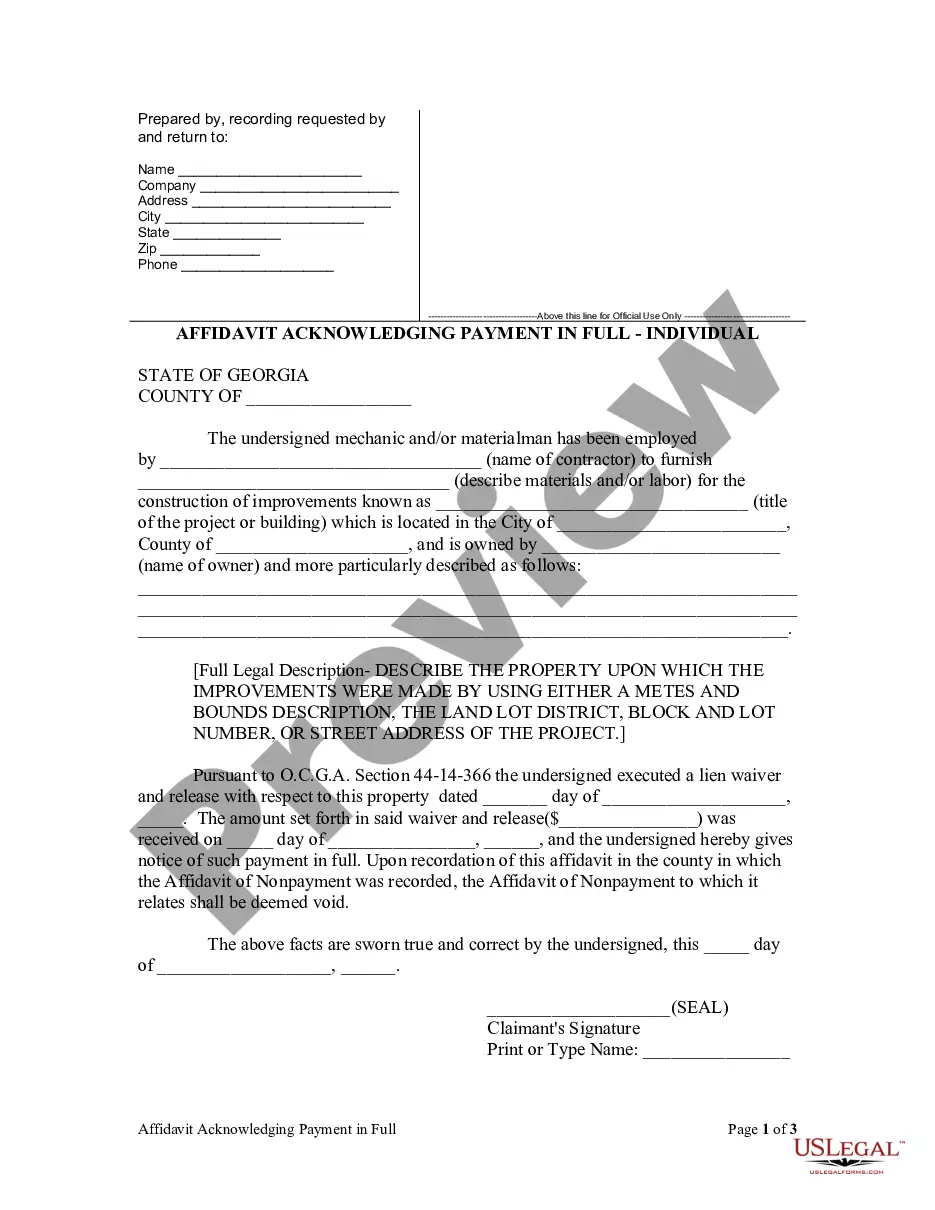

How to fill out Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand?

Selecting the appropriate legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how can you acquire the legal form you need? Utilize the US Legal Forms website. This service offers a vast array of templates, including the Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand, which can be utilized for both professional and personal purposes. All forms are reviewed by experts and comply with state and federal standards.

If you are already registered, Log In to your account and click the Download button to retrieve the Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand. Use your account to view the legal forms you have purchased previously. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow: First, ensure you have selected the correct form for your region/area. You can review the form using the Review button and read the form details to confirm it is suitable for you. If the form does not meet your needs, use the Search section to find the appropriate document. Once you are confident that the form is right, click the Purchase now button to obtain the form. Choose the payment plan you desire and enter the required information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document template onto your device. Complete, edit, print, and sign the received Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand.

Make use of US Legal Forms to simplify your legal documentation needs with reliable templates.

- US Legal Forms is the largest collection of legal documents where you can find numerous record templates.

- Utilize the service to obtain professionally crafted papers that comply with state regulations.

- The templates available are designed for various uses, whether for business or personal.

- Experts ensure that all forms meet the necessary legal standards.

- Easy access to your previously purchased documents through your account.

- Helpful resources are available for new users to guide them through the process.

Form popularity

FAQ

If an insurer fails to investigate a claim properly, it can result in wrongful denial of benefits. This lack of due diligence can lead to legal repercussions, including a Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand. It is essential to document every step and communicate with the insurer to ensure they fulfill their obligations. If they do not, you may need to seek legal assistance to protect your rights.

An insurer can be liable for bad faith in several ways. First, it may deny a legitimate claim without justification. Second, it might delay payments unreasonably, causing unnecessary stress and hardship. Lastly, if the insurer fails to communicate or investigate a claim properly, it can lead to a Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand, highlighting the need for accountability.

To prove that an insurance company acted in bad faith, you need to demonstrate that it denied your claim without a valid reason. Documentation is crucial; gather all communications, policy details, and any evidence supporting your claim. If you can show that the insurer failed to conduct a thorough investigation or ignored relevant facts, it strengthens your case for a Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand.

When pursuing a bad faith claim, you may be entitled to various types of damages, including compensatory damages, punitive damages, and consequential damages. These damages aim to compensate you for losses incurred due to the insurer's conduct. If you are preparing a Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand, understanding the available damages can significantly impact the outcome of your case.

While various insurance companies receive complaints, it is essential to research current statistics to find the most accurate information. Consumer feedback and state records can provide insights into companies with high complaint rates. If you are considering a Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand, reviewing this information can guide you in choosing the right legal path.

The two types of bad faith include first-party bad faith and third-party bad faith. First-party bad faith occurs when an insurer fails to fulfill its duty to its policyholder, while third-party bad faith involves the insurer's failure to defend or settle claims made by others against the policyholder. Understanding these types can help you identify your situation when considering a Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand.

To file a complaint in court against a company in Massachusetts, you need to prepare the necessary documents, including a complaint form that outlines your claims. Once you have completed the forms, you can file them at the appropriate court. If you are dealing with a Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand, consider seeking assistance from platforms like uslegalforms to ensure that your complaint is drafted correctly and efficiently.

The elements of bad faith in insurance include the insurer's unreasonable denial of a claim, failure to investigate claims properly, and lack of reasonable justification for delaying payment. When you face a situation involving a Massachusetts Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand, these elements become crucial in demonstrating the insurer's failure to uphold their obligations. Understanding these elements can help you build a strong case.