This form is a sample letter in Word format covering the subject matter of the title of the form.

Massachusetts Sample Letter for Exemption - Relevant Information

Description

How to fill out Sample Letter For Exemption - Relevant Information?

Are you in a situation where you need documents for occasional business or personal purposes every time.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the Massachusetts Sample Letter for Exemption - Relevant Information, that are crafted to meet federal and state requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service provides properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Massachusetts Sample Letter for Exemption - Relevant Information template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to check the form.

- Read the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search section to find the form that meets your needs and criteria.

- Once you find the right form, click Acquire now.

- Select the payment plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Choose a suitable file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Massachusetts Sample Letter for Exemption - Relevant Information at any time, if needed. Just select the required form to download or print the document template.

Form popularity

FAQ

The MA personal exemption is a specific amount that reduces your taxable income in Massachusetts. It varies based on your filing status, age, and dependency claims. This exemption can lead to significant tax savings by lowering your overall tax liability. For detailed insights into personal exemptions and related letters, explore the Massachusetts Sample Letter for Exemption - Relevant Information.

The ST-5 form in Massachusetts is a Sales Tax Exempt Certificate used by organizations seeking exemption from sales tax. This form must be filled out and presented to vendors when purchasing goods or services that qualify for exemption. It is essential for non-profits, government agencies, and certain educational institutions. For a comprehensive understanding of tax exemption processes, consider the Massachusetts Sample Letter for Exemption - Relevant Information.

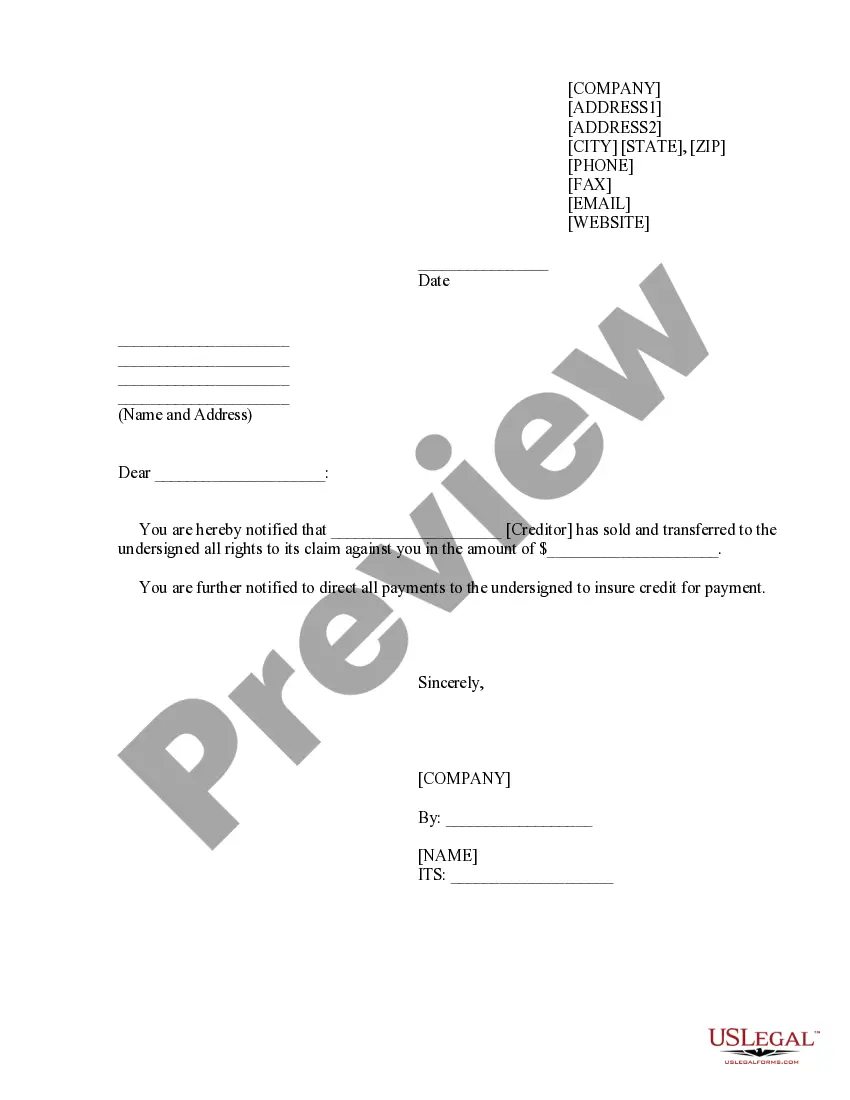

To write a request letter for tax exemption, start with a clear subject line that states your intention. Include your name, address, and contact information at the top, followed by the date. In the body, explain your situation and why you qualify for tax exemption, providing any relevant details. Lastly, express your gratitude for considering your request and include a signature. For more guidance, refer to the Massachusetts Sample Letter for Exemption - Relevant Information.

Claiming Spouse Exemption An individual can claim their spouse's exemption if using the filing status Head of Household or Married Filing Separately, and only when specific conditions are met. ... The spouse's social security number must be entered in order to see the Head of Household Information option.

Personal exemptions are a reduction in taxes due to a particular personal circumstance and qualifications set forth in the Massachusetts General Laws.

You should claim the total number of exemptions to which you are entitled to prevent excessive over-withholding, unless you have a significant amount of other income. If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or have additional amounts withheld.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: ? Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

If you file a Massachusetts tax return, you're entitled to a personal exemption regardless of whether you can claim a personal exemption on your federal return or not. The amount of personal exemptions you're allowed depends on the filing status you claimed.