This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Massachusetts Application for Certificate of Discharge of IRS Lien

Description

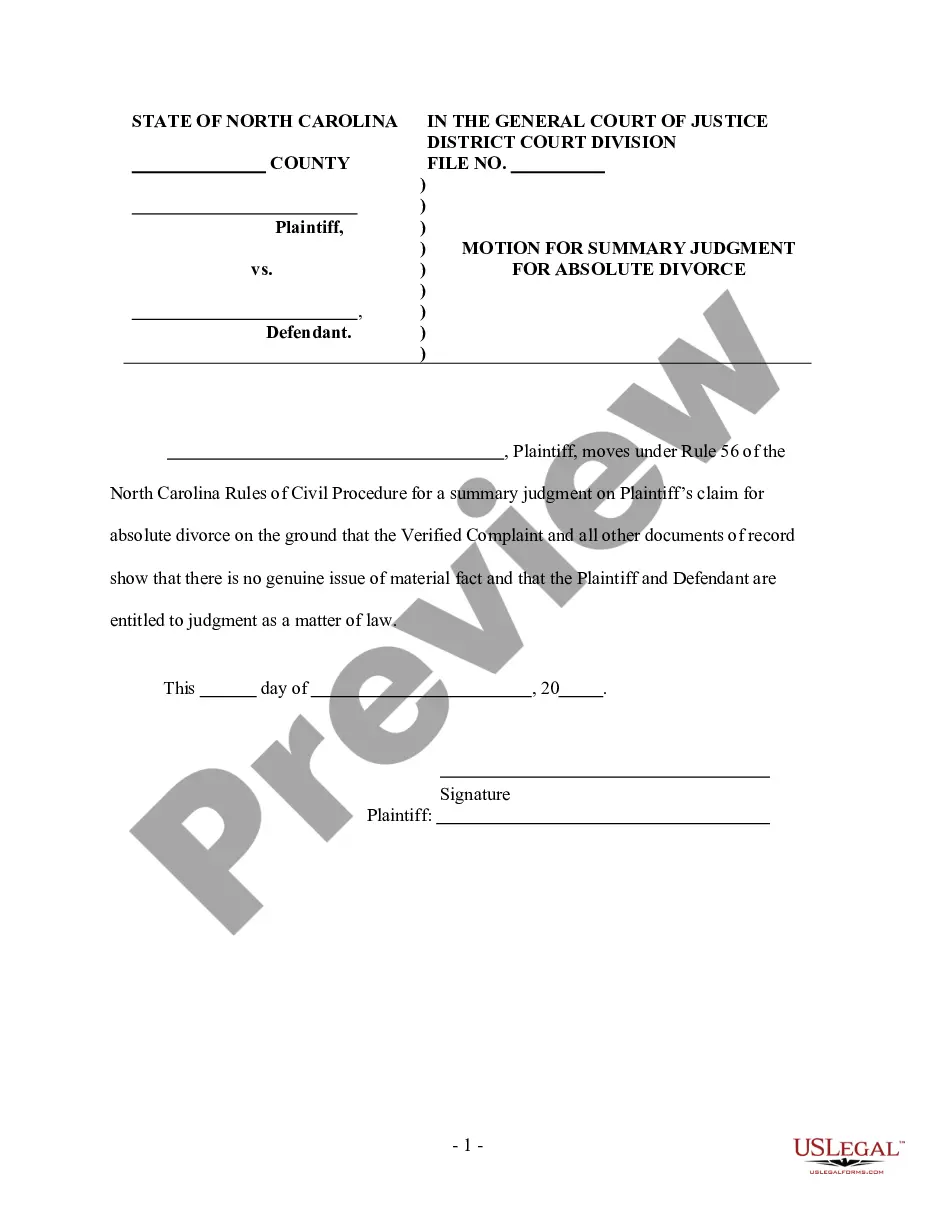

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Are you currently in the position that you need to have papers for sometimes company or personal reasons virtually every working day? There are tons of legitimate record web templates available online, but getting kinds you can depend on is not straightforward. US Legal Forms delivers thousands of type web templates, just like the Massachusetts Application for Certificate of Discharge of IRS Lien, that happen to be created to meet state and federal needs.

If you are already acquainted with US Legal Forms website and get an account, just log in. Next, it is possible to obtain the Massachusetts Application for Certificate of Discharge of IRS Lien format.

If you do not provide an bank account and wish to begin using US Legal Forms, abide by these steps:

- Discover the type you need and make sure it is for your proper metropolis/county.

- Take advantage of the Preview switch to examine the shape.

- Browse the description to ensure that you have selected the appropriate type.

- When the type is not what you`re seeking, use the Look for field to obtain the type that meets your needs and needs.

- Whenever you obtain the proper type, simply click Purchase now.

- Opt for the rates strategy you would like, complete the specified details to create your bank account, and pay for an order making use of your PayPal or bank card.

- Select a convenient document formatting and obtain your copy.

Find every one of the record web templates you may have purchased in the My Forms menus. You can obtain a additional copy of Massachusetts Application for Certificate of Discharge of IRS Lien anytime, if required. Just click the required type to obtain or produce the record format.

Use US Legal Forms, the most substantial selection of legitimate varieties, to save efforts and steer clear of blunders. The service delivers skillfully created legitimate record web templates which you can use for an array of reasons. Create an account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

These documents are usually requested by law offices in preparation of a refinance or sale of a property. Municipal Lien Requests can now be ordered online using the Invoice Cloud Store. Alternatively, a Municipal Lien Request Form (PDF) must be submitted to the Collector's Office.

A Municipal Lien Certificate (MLC) is a legal document that lists all taxes, assessments, sewer, trash water and electric charges owed on a property. These documents are usually requested by law offices in preparation of a refinance or sale of a property.

Tax Lien Certificates and Tax Deeds in Massachusetts MA. By law Massachusetts can have tax lien sales, but most municipalities conduct tax deed sales instead. 16%, but municipalities do not conduct tax lien sales. Following a tax deed sale there is no right of redemption.

The standard method of obtaining a release of estate tax lien is to file an estate tax return with the Massachusetts Department of Revenue (DOR) and obtain from the DOR a Release of Estate Tax Lien, known as an M-792 certificate. This is the required method when dealing with estates that are worth $1,000,000 or more.

Full Release of Lien. A taxpayer that wants to obtain a full release of a lien must pay the amount shown on the lien plus any additional interest and penalties accrued to the date of payment.

For a majority of estates, there is no estate tax actually due, but unless a release of estate tax lien form is filed with the Registry of Deeds, there is a claim against the title of property owned by the decedent for ten years following his or her death.