Massachusetts Employment Application for Lawyer

Description

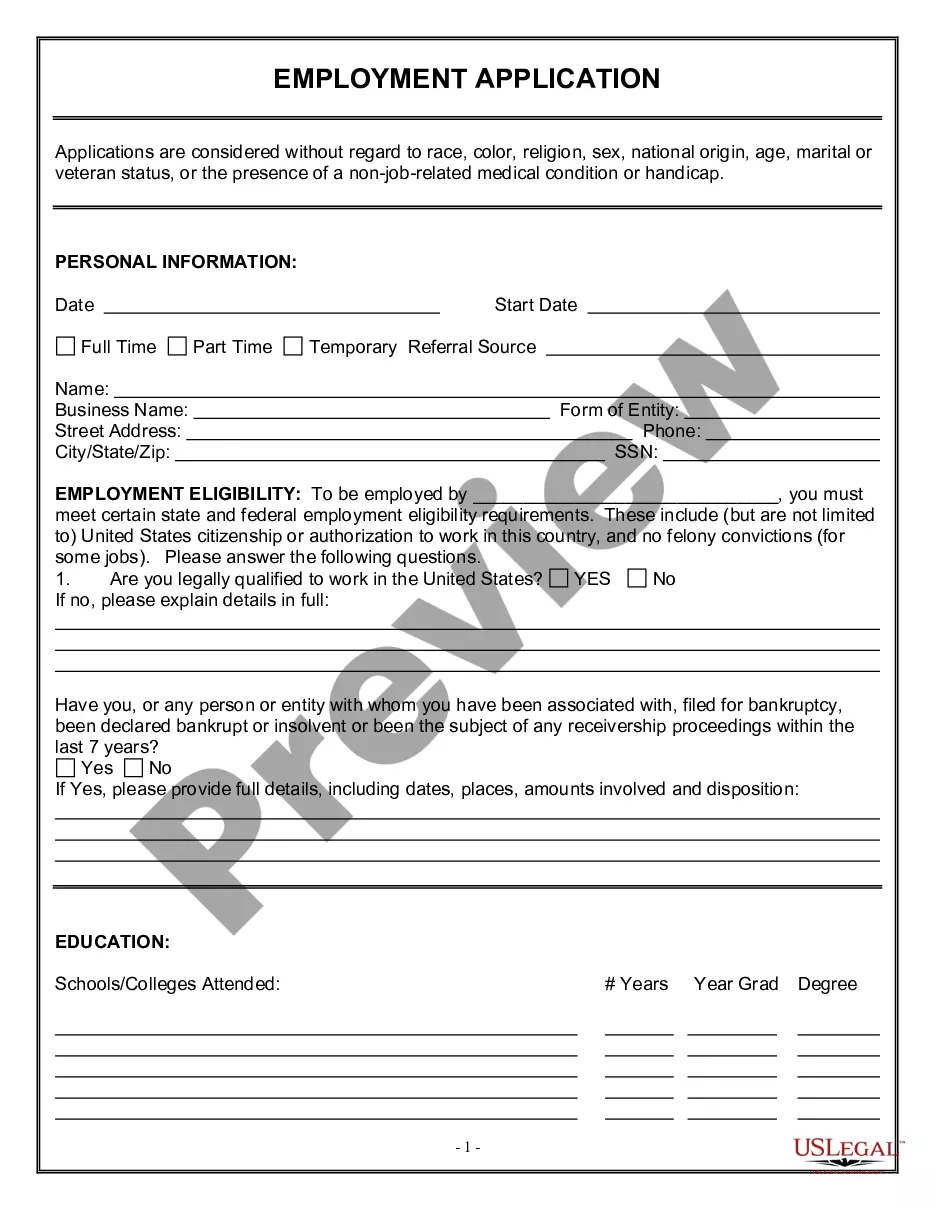

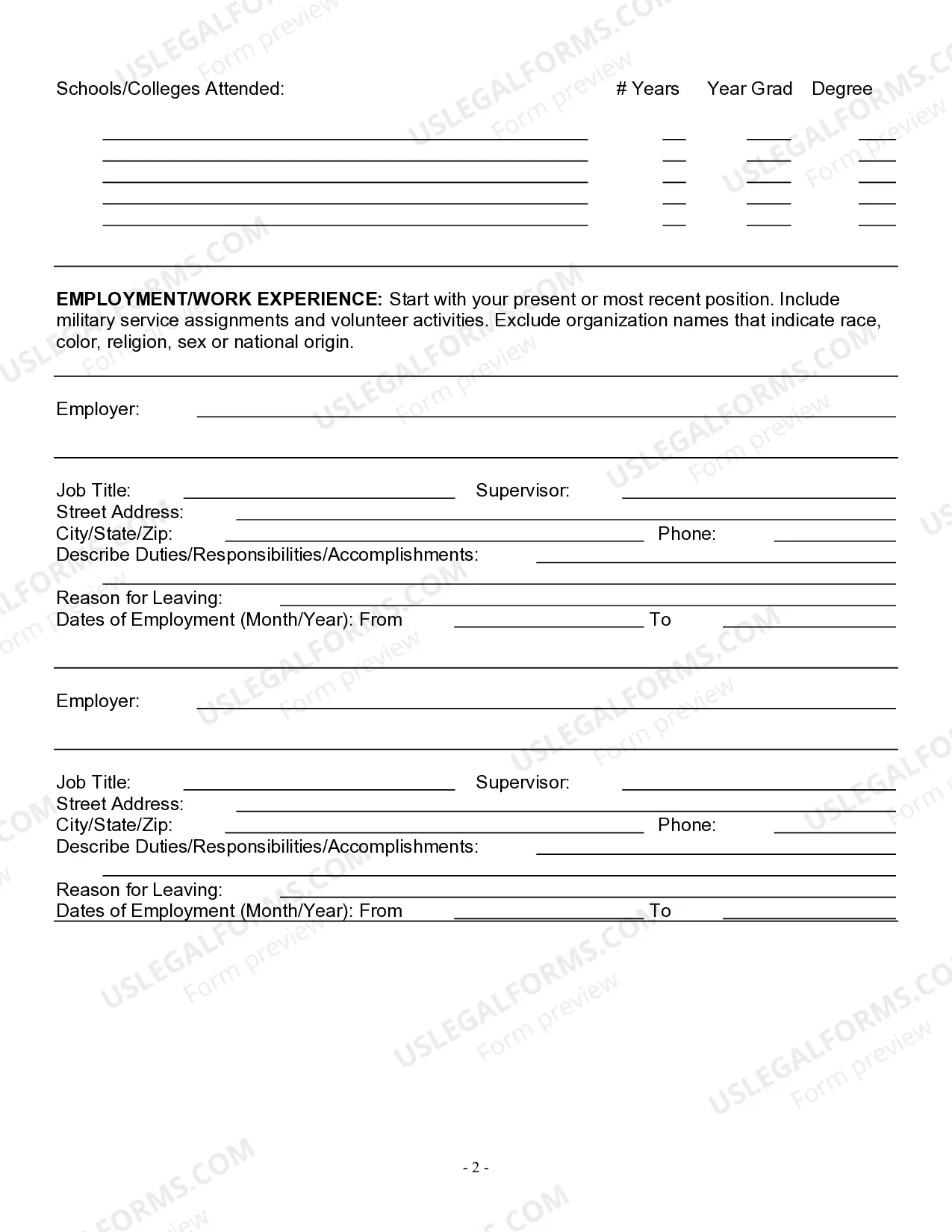

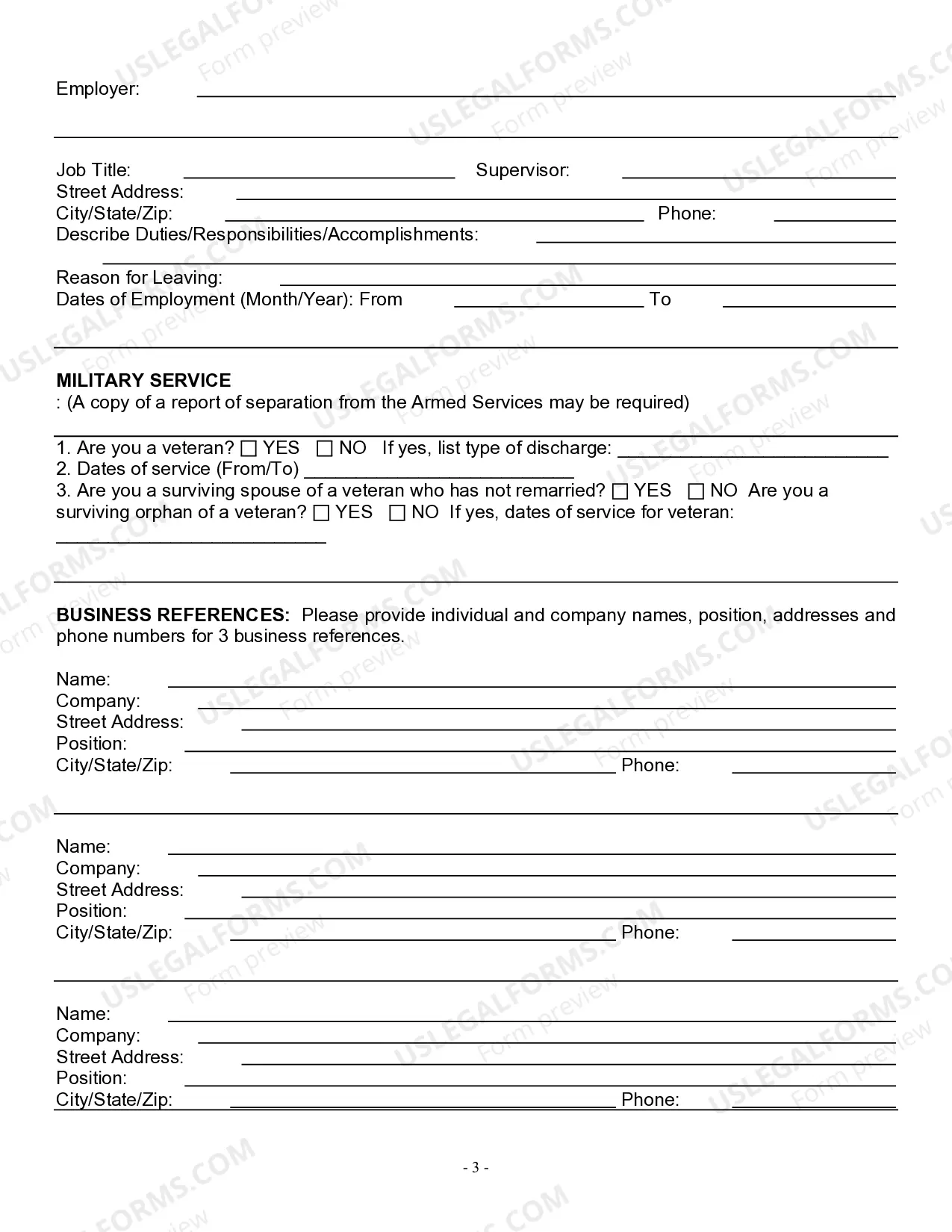

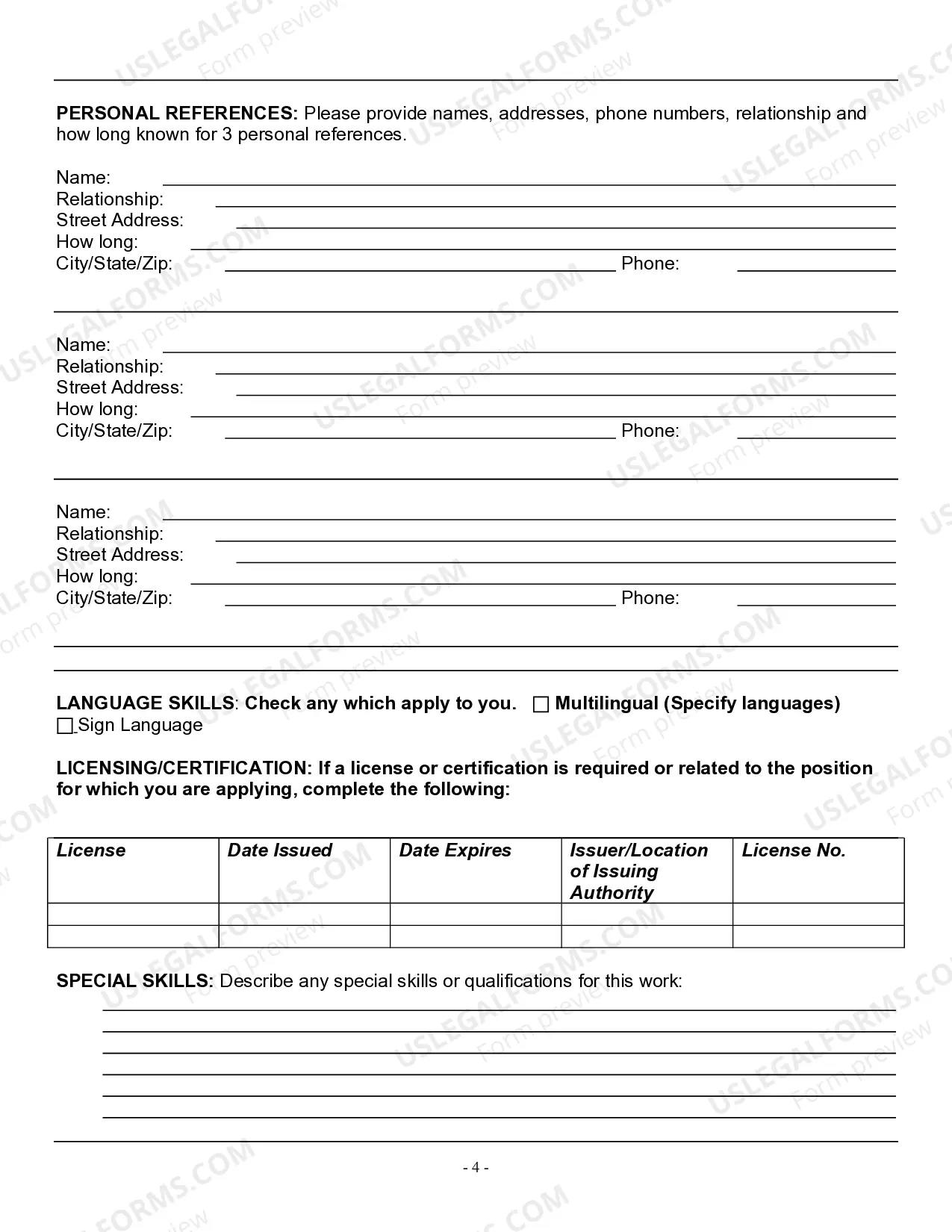

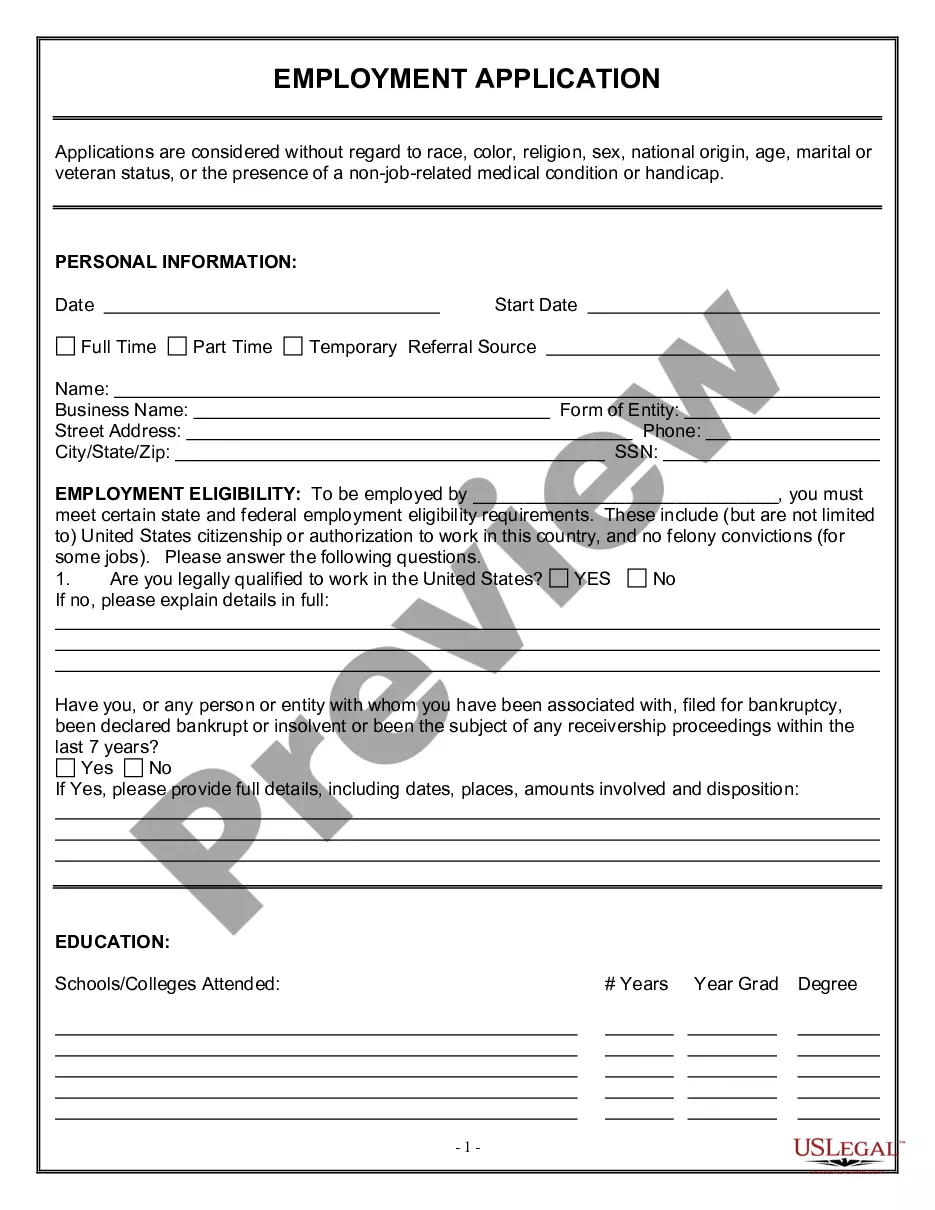

How to fill out Employment Application For Lawyer?

If you need to finalize, acquire, or print official document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the website's user-friendly and convenient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or by keywords.

Every legal document template you purchase is yours to keep indefinitely. You can access every form you acquired within your account.

Be proactive and obtain, and print the Massachusetts Employment Application for Attorney with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Massachusetts Employment Application for Attorney with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Massachusetts Employment Application for Attorney.

- Additionally, you can access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have selected the form for the correct city/state.

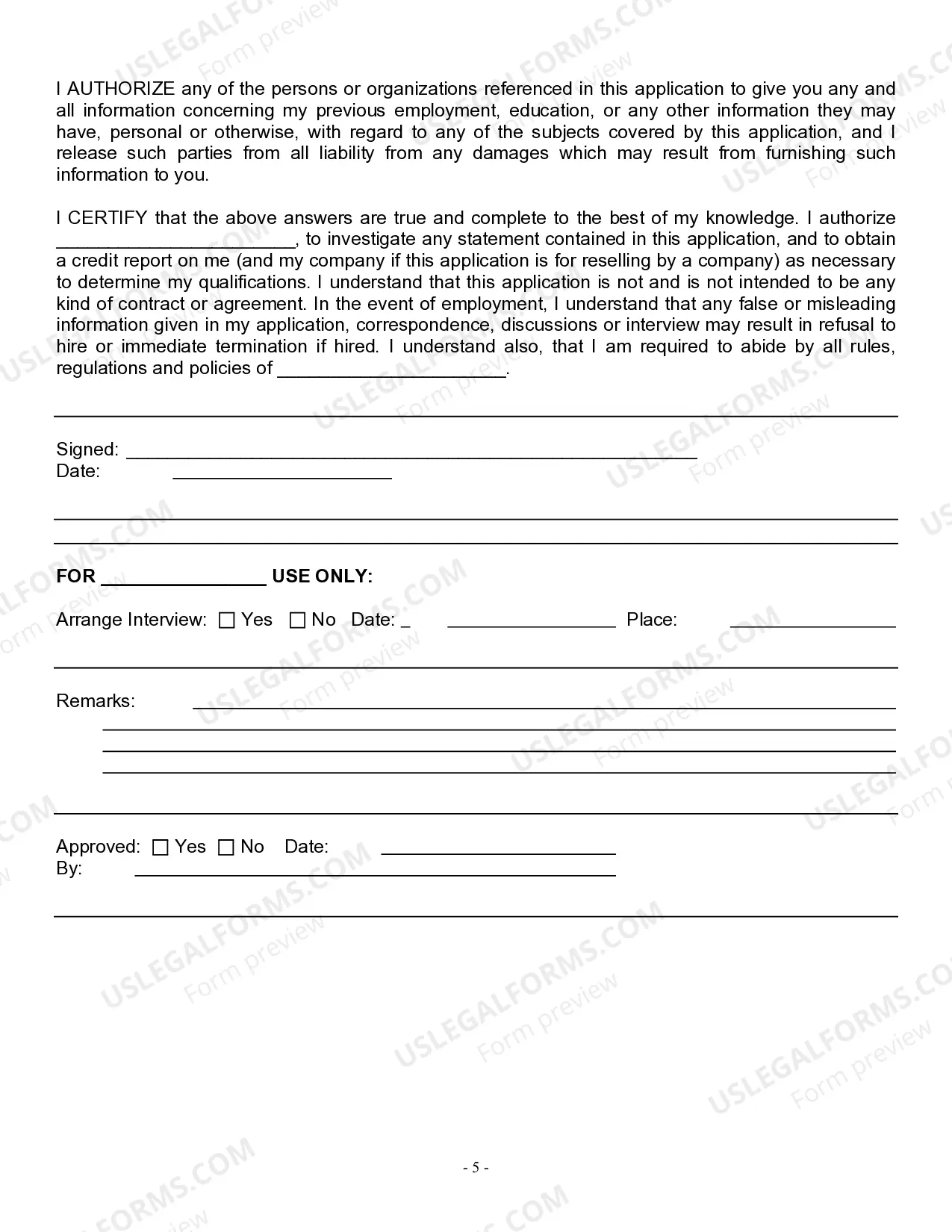

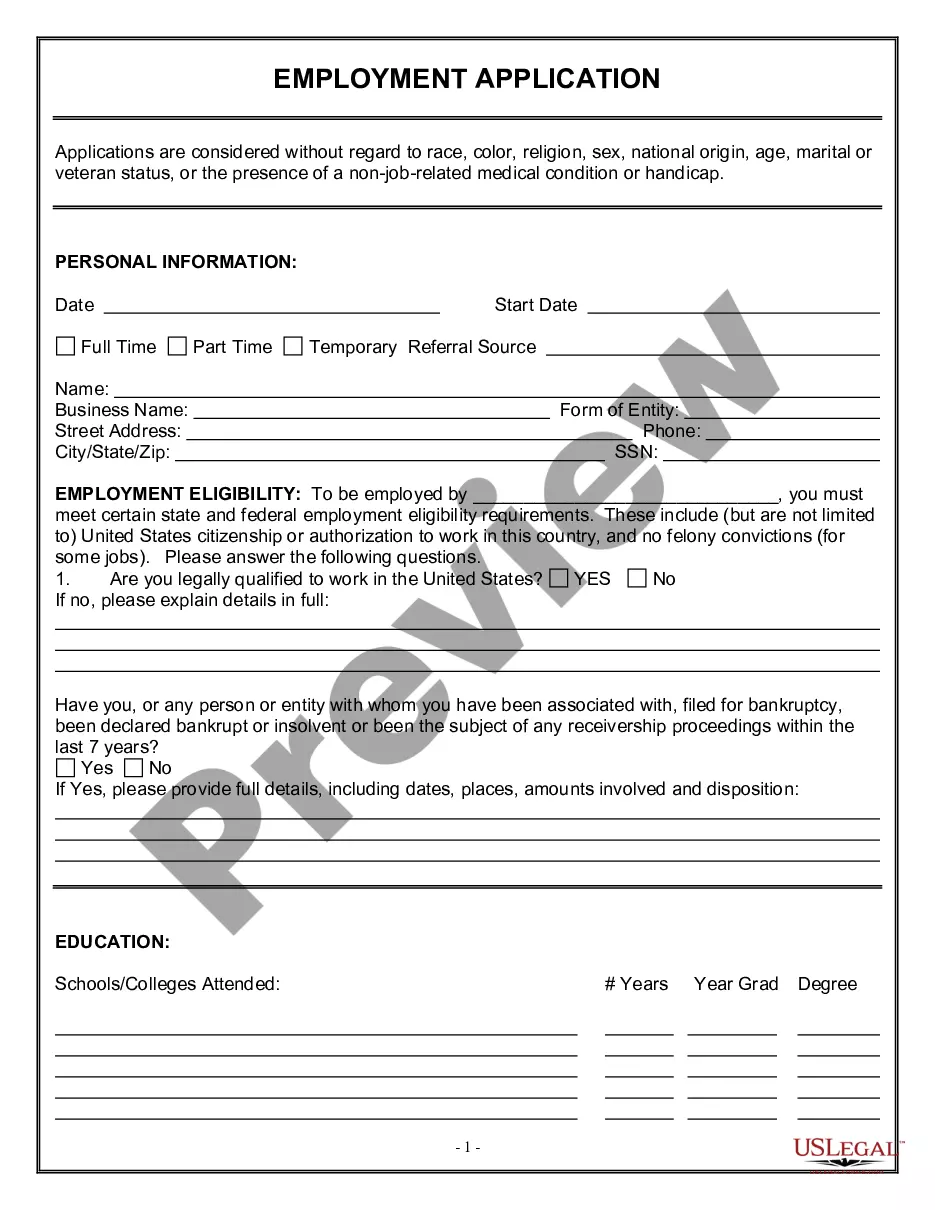

- Step 2. Utilize the Preview option to review the form's details. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you find the form you want, click the Get now button. Choose your preferred pricing plan and enter your information to create an account.

- Step 5. Complete the payment process. You can use your Visa, MasterCard, or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your system.

- Step 7. Fill out, edit, and print or sign the Massachusetts Employment Application for Attorney.

Form popularity

FAQ

Massachusetts is the first state to prohibit potential employers from asking about applicants' salary history before making a job offer. Employees are free to share their salaries with potential employers at any time if they so choose but they cannot be compelled to do so.

Forms and notices for newly-hired employeesForm I-9 Employment eligibility verification form, US Dept.Form M-4: Massachusetts employee's withholding exemption certificate, Mass.Form NHR: New hire and independent contractor reporting form, Mass.Form W2 Federal tax withholding, IRS.More items...?

Steps to Hiring your First Employee in MassachusettsStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Maine - E-Verify is voluntary for all employers. Maryland - E-Verify is voluntary for all employers. Massachusetts - Mandatory E-Verify for state agencies. Michigan - E-Verify is voluntary for most employers and mandatory for contractors and subcontractors of the transportation department.

Forms and notices for newly-hired employeesForm I-9 Employment eligibility verification form, US Dept.Form M-4: Massachusetts employee's withholding exemption certificate, Mass.Form NHR: New hire and independent contractor reporting form, Mass.Form W2 Federal tax withholding, IRS.More items...?

Before you can add a new hire to your payroll, you need to know how much money to withhold from their wages for federal and, if applicable, state income taxes. To find out, you need to collect two new hire tax forms: federal and state W-4 forms.

How to reportOnline. If you have 25 or more employees, you must file your new hire reports online through MassTaxConnect.By mail. If you have fewer than 25 employees, you can use the New Hire Reporting Form (Form NHR) to submit your new hire reports by mail.By fax.

Required Employment Forms and Paperwork in MassachusettsSigned Job Offer Letter. W2 Tax Form. I-9 Form and Supporting Documents. Direct Deposit Authorization Form (Template)

Hire and pay employeesGet an Employer Identification Number (EIN)Find out whether you need state or local tax IDs.Decide if you want an independent contractor or an employee.Ensure new employees return a completed W-4 form.Schedule pay periods to coordinate tax withholding for IRS.More items...