The Massachusetts Direct Deposit Form for Social Security is a crucial document that allows recipients of Social Security benefits in the state to authorize the direct deposit of their payments into their bank accounts. This form streamlines the payment process, eliminating the need for paper checks and ensuring that beneficiaries receive their funds in a timely, secure, and convenient manner. This Direct Deposit Form for Social Security is specifically designed for residents of Massachusetts and is unique to the state's regulations and requirements. It is an essential tool for individuals receiving Social Security benefits, including retirement, disability, survivor, or Supplemental Security Income (SSI). By completing and submitting this form, beneficiaries can establish a direct link between the Social Security Administration (SSA) and their preferred financial institution for the electronic transfer of funds. The Massachusetts Direct Deposit Form for Social Security typically requests the recipient's personal information, such as their full name, Social Security number, address, and contact details. Additionally, it requires banking information, including the name of the bank or credit union, the type of account (checking or savings), the routing number, and the account number. This data ensures that the Social Security payments are accurately directed to the correct account and beneficiary. It is important to note that there may be different versions or variations of the Massachusetts Direct Deposit Form for Social Security based on the specific type of Social Security benefits being received. These variations may include forms tailored for retirement benefits, disability benefits, survivor benefits, or SSI payments. While the overall purpose of the form remains the same, the specific sections or fields to be completed may vary based on the type of benefit. Completing the Massachusetts Direct Deposit Form for Social Security is a simple process -- beneficiaries must accurately fill out all required fields, review the information for accuracy, sign the form, and submit it to the appropriate Social Security office. Alternatively, individuals can also submit the form online through the official SSA website or via phone, depending on the available options. Overall, the Massachusetts Direct Deposit Form for Social Security is a critical document for beneficiaries in the state, ensuring a seamless and efficient transfer of Social Security payments to their chosen bank account. By utilizing this form, recipients can enjoy the convenience and security that comes with direct deposit, avoiding the hassle of cashing checks and providing a reliable means of receiving their entitled benefits.

Massachusetts Direct Deposit Form for Social Security

Description

How to fill out Massachusetts Direct Deposit Form For Social Security?

If you need to sum up, obtain, or print legal documents topics, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's straightforward and easy navigation to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Massachusetts Direct Deposit Form for Social Security. Every legal document template you purchase is yours forever. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again. Compete and download, and print the Massachusetts Direct Deposit Form for Social Security with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to access the Massachusetts Direct Deposit Form for Social Security in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to retrieve the Massachusetts Direct Deposit Form for Social Security.

- You can also access forms you previously saved from the My documents section of your account.

- If you're using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your appropriate area/region.

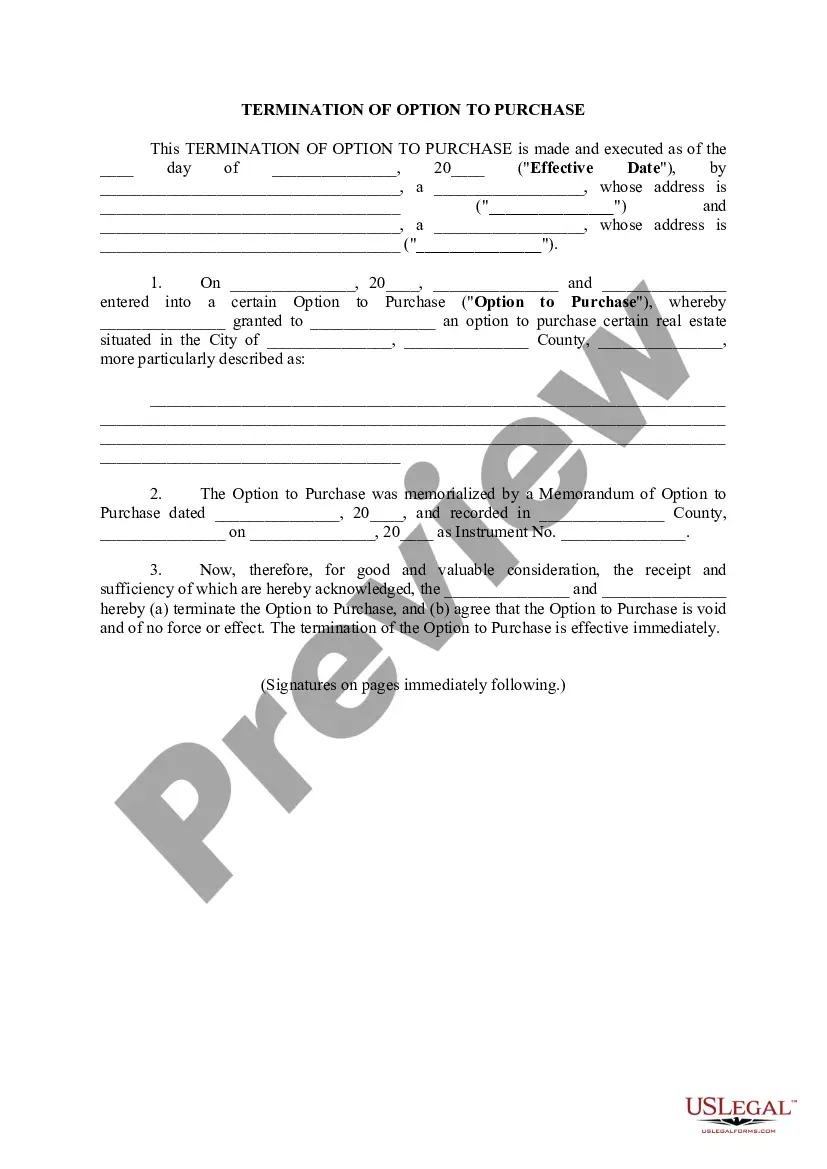

- Step 2. Utilize the Preview option to review the form's details. Be sure to read the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The Social Security Direct Deposit Form, sometimes referred to as Form 1199A, is a method to deliver the information required by the Social Security Administration for beneficiaries wishing to receive their payments as electronic transfers.

How can I change or sign up for direct deposit for my Social Security or Supplemental Security Income (SSI) payments?Contacting your bank, credit union, or savings and loan association.Calling us at 1-800-772-1213 (TTY 1-800-325-0778).

How Long Does It Take to Change to Direct Deposit with Social Security? Once you sign up (regardless of the method), it takes 30 to 60 days for any direct deposit changes or new accounts to take effect. Make sure you don't close or switch your bank account before you see that first successful deposit.

Quick It's easy to receive your benefit by Direct Deposit. You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. Then, just relax. Your benefit will go automatically into your account every month.

How to Set Up Direct DepositGet a direct deposit form from your employer.Fill in account information.Confirm the deposit amount.Attach a voided check or deposit slip, if required.Submit the form.

You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. Then, just relax.

Log in to your account.Sign in and Select the blue Benefits & Payment Details link on the right side of the screen.Scroll down and select the Update Direct Deposit button, and choose if you are the owner or co-owner of the bank account.Enter your bank account information and select Next.More items...

Setting Up Direct Deposit to Receive PaymentsBank account number.Routing number.Type of account (typically a checking account)Bank name and addressyou can use any branch of the bank or credit union you use.Name(s) of account holders listed on the account.

Log in to your account.Sign in and Select the blue Benefits & Payment Details link on the right side of the screen.Scroll down and select the Update Direct Deposit button, and choose if you are the owner or co-owner of the bank account.Enter your bank account information and select Next.More items...

Interesting Questions

More info

Direct Express Mastercard is a Federal Direct Prepaid Debit MasterCard. Federal law requires your Social Security Benefits to be deposited electronically. As the nation's leading online banking service, directexpressmastercard provides an easy-to-use and convenient way to receive and transfer your Social Security payments directly into an existing bank account. Direct Express Mastercard is a federal direct prepaid debit card with a cardholder's name, Social Security Number, account number, routing address, routing telephone number (SSN), expiration date, PIN and the last four digits of the credit card's debit card number, on a cardholder verified card. The credit card must be a Discover or Visa. Direct Express Mastercard can be used with a variety of bank accounts including: Direct Express Prepaid debit cards — This card offers online banking with no minimum balance requirements. This card can be used to access your Social Security Benefit by entering the correct amount.