A Massachusetts Buy Sell or Stock Purchase Agreement Covering Common Stock in a Closely Held Corporation with Option to Fund Purchase through Life Insurance is a legal document that outlines the terms and conditions for the sale and purchase of common stock in a closely held corporation in the state of Massachusetts. This agreement provides an option for the purchaser to fund the stock purchase through a life insurance policy. The agreement typically begins with a preamble that identifies the parties involved, including the corporation, the selling shareholders, and the purchasing shareholder(s). It also includes the date of the agreement and a recital of the corporation's status as a closely held corporation. The agreement contains various provisions that define the rights and obligations of the parties involved. These provisions cover important aspects such as the purchase price of the stock, the payment terms, the method of valuation, and the allocation of rights and responsibilities between the parties. One key component of this type of agreement is the provision related to the use of life insurance to fund the stock purchase. This provision outlines the requirement for the purchasing shareholder(s) to obtain and maintain life insurance policies on the lives of the selling shareholder(s). The face value of these policies is typically equal to the agreed-upon purchase price of the stock. In the event of the death of a selling shareholder, the proceeds from the life insurance policy can be used to fund the stock purchase from the deceased shareholder's estate. In addition to the standard provisions, there may be variations of this agreement. Some possible variations include: 1. Cross-Purchase Agreement: This type of agreement allows each shareholder to individually purchase the stock of a deceased shareholder. Each shareholder maintains a life insurance policy on the life of every other shareholder. In the event of a shareholder's death, the surviving shareholders use the life insurance proceeds to purchase the deceased shareholder's stock. 2. Stock Redemption Agreement: In this agreement, the corporation is responsible for purchasing the stock of a deceased shareholder. The corporation maintains life insurance policies on the lives of the shareholders, and in the event of a shareholder's death, the corporation uses the life insurance proceeds to repurchase the deceased shareholder's stock. 3. Hybrid Agreement: This type of agreement combines elements of both the cross-purchase and stock redemption agreements. Depending on the circumstances, the purchasing shareholder(s) and the corporation can both be involved in the purchase of the stock. These variations provide flexibility in structuring the agreement based on the specific needs and preferences of the shareholders and the corporation. Overall, a Massachusetts Buy Sell or Stock Purchase Agreement Covering Common Stock in a Closely Held Corporation with Option to Fund Purchase through Life Insurance is a comprehensive legal document that helps protect the interests of the shareholders and ensure the smooth transfer of ownership in a closely held corporation.

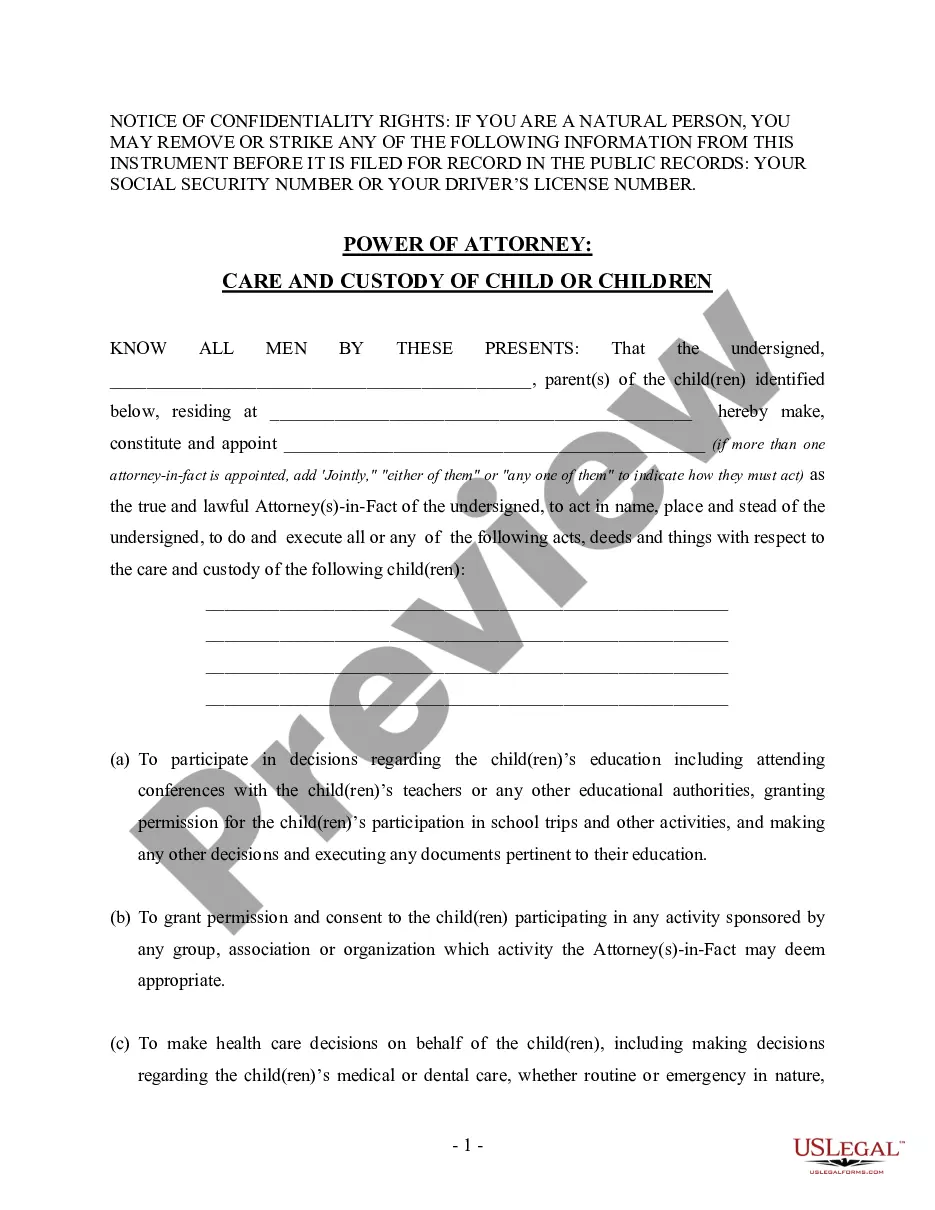

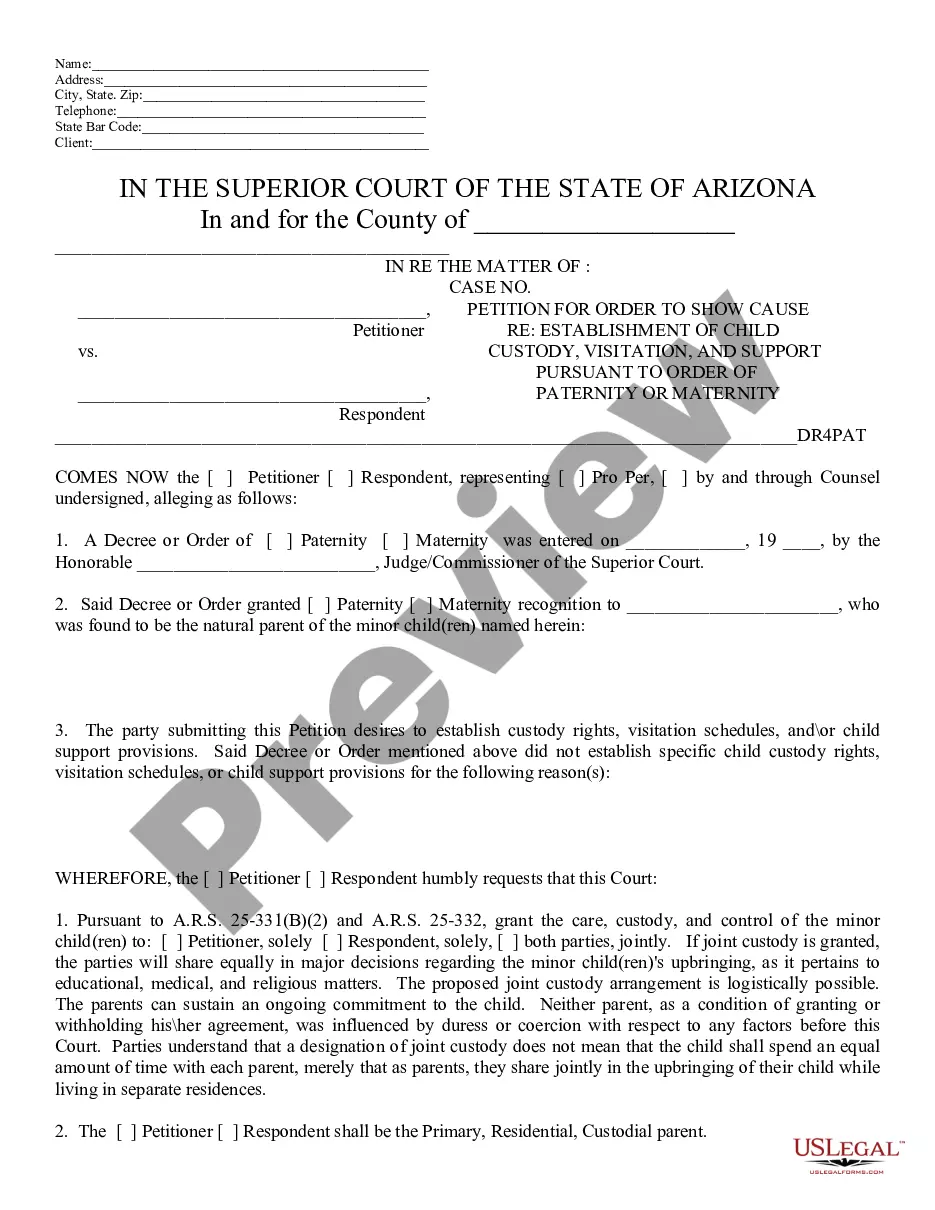

Massachusetts Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

How to fill out Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

You can spend hours online attempting to locate the sanctioned document template that meets the federal and state requirements you necessitate.

US Legal Forms provides thousands of legal forms that can be reviewed by professionals.

It is easy to acquire or print the Massachusetts Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance from our service.

If available, use the Review button to preview the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Massachusetts Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance.

- Every legal document template you obtain is yours indefinitely.

- To have another copy of any purchased form, navigate to the My documents section and click on the relevant button.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, confirm that you have selected the appropriate document template for your county/region of choice.

- Review the form details to ensure you have selected the correct one.

Form popularity

FAQ

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

The purpose of a buy-and-sell agreement is to provide the surviving co-owners with cash to purchase the interest of a deceased co-owner. According to the agreement, each co-owner takes out life cover on the other co-owners' lives.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

There are four common buyout structures:Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business.Entity redemption plan.One-way buy sell plan.Wait-and-see buy sell plan.

Stock purchase agreements are legal documents that lay out the terms and conditions for a sale of company stocks. They are legally binding contracts that create obligations and rights for all the parties involved.

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

Common Stock Agreement means an agreement between the Company and a Grantee evidencing the terms and conditions of an individual Common Stock grant. The Stock Grant agreement is subject to the terms and conditions of the Plan.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

Interesting Questions

More info

Lego, a native from Guayaquil, Colombia who has been a member of the University of Illinois for more than 20 years, is pleased to announce that she is making her first visit as a visiting scholar to the Imanuels-Nelson family farm. Amanda and Imanuels-Nelson are a two-year-old family owned, three family operated, four hectare farm, about 200 kilometers north of Quito, Ecuador. The Niles-Nelson Farm is the second largest dairy operation run by the Nile's family in the United States, and also the largest private property on the Imanuels-Nelson farm, with 4,500 square feet of indoor and outdoor living space. In addition to the farm's dairy operations, Amanda noted that there is no less than 100 sheep, some of their children, some goats, and chickens on the 200 hectare farm. This farm is known for the variety and quality of its produce, being the world's foremost dairy exporter due in part to the Niles-Nelson family's close cooperation with the farm's partners at U-Va.