A Massachusetts Earnest Money Promissory Note is a legally binding document that is used during a real estate transaction in the state of Massachusetts. It serves as evidence of the buyer's intention to purchase the property and demonstrates their commitment to completing the transaction. The Earnest Money Promissory Note is typically provided by the buyer to the seller as a form of security. It signifies that the buyer has submitted a certain amount of money, known as the earnest money deposit, to show their good faith and serious intent to purchase the property. The seller holds this deposit until the deal closes or if the buyer breaches the terms of the agreement. The note outlines the terms and conditions of the transaction, including the total amount of the earnest money deposit, the date on which it was submitted, and the deadline for the completion of the sale. It also specifies what will happen to the deposit in different scenarios, such as if the buyer fails to secure financing or if any contingencies specified in the purchase agreement are not met. In Massachusetts, there are no specific types or variations of an Earnest Money Promissory Note. However, the terms and conditions can vary depending on the individual purchase agreement and the preferences of the parties involved. The note can be customized to include additional clauses or provisions that are agreed upon between the buyer and seller. It is crucial for both the buyer and seller to carefully review and understand the Massachusetts Earnest Money Promissory Note before signing. They should make sure the document accurately reflects their intentions and protects their interests. In case of any disagreements or disputes, the note serves as a legal record that can be referred to for resolution. Overall, the Massachusetts Earnest Money Promissory Note is an essential document during a real estate transaction in the state. It provides a commitment from the buyer, offers security to the seller, and establishes the terms and conditions for the completion of the sale.

Massachusetts Earnest Money Promissory Note

Description

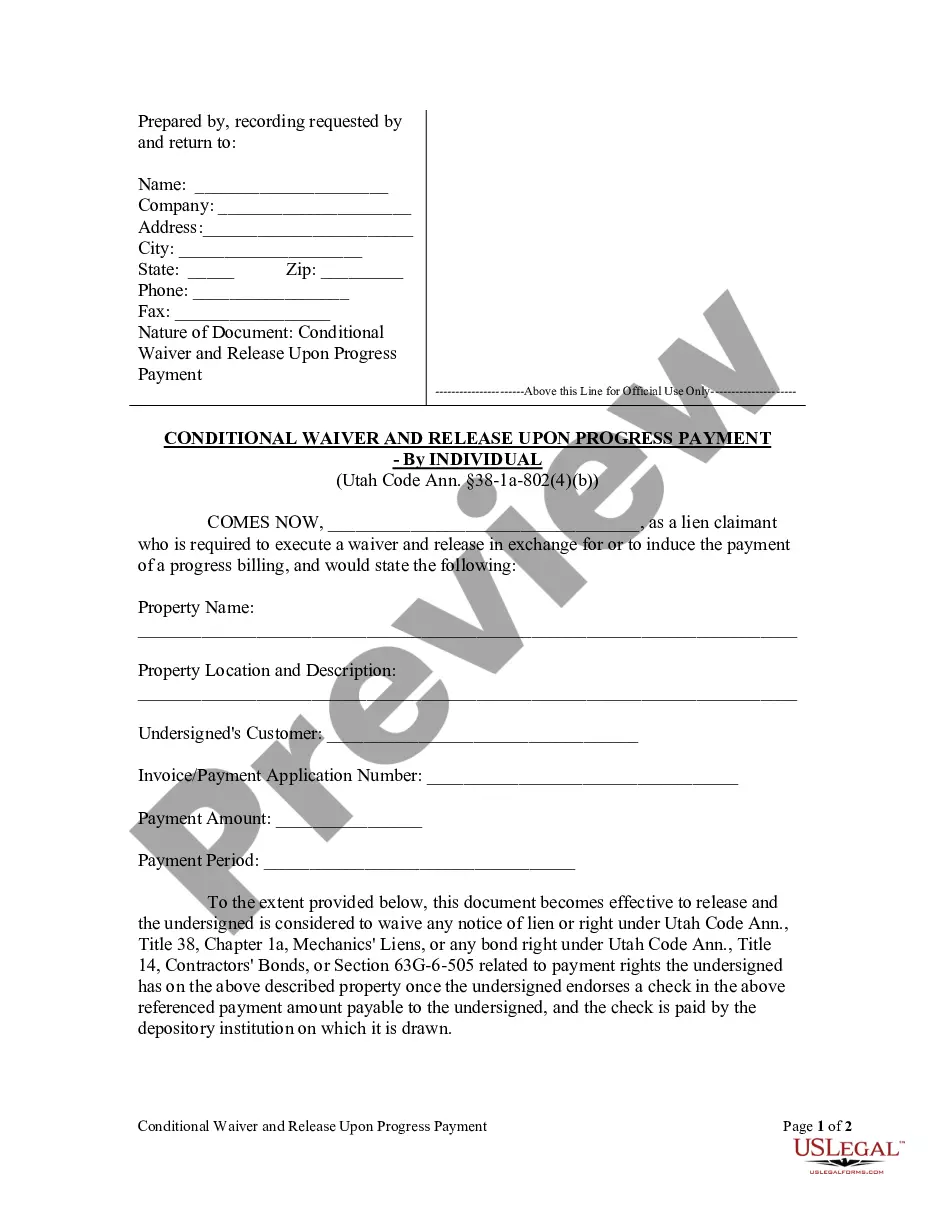

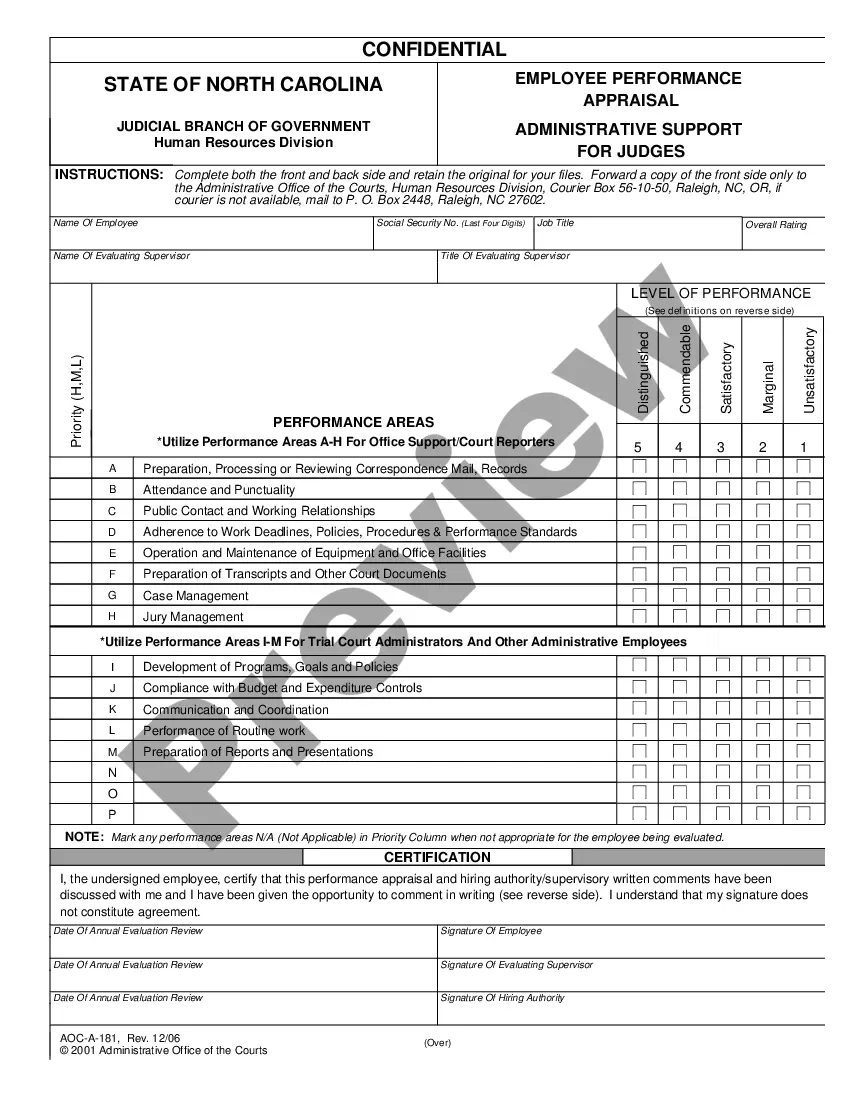

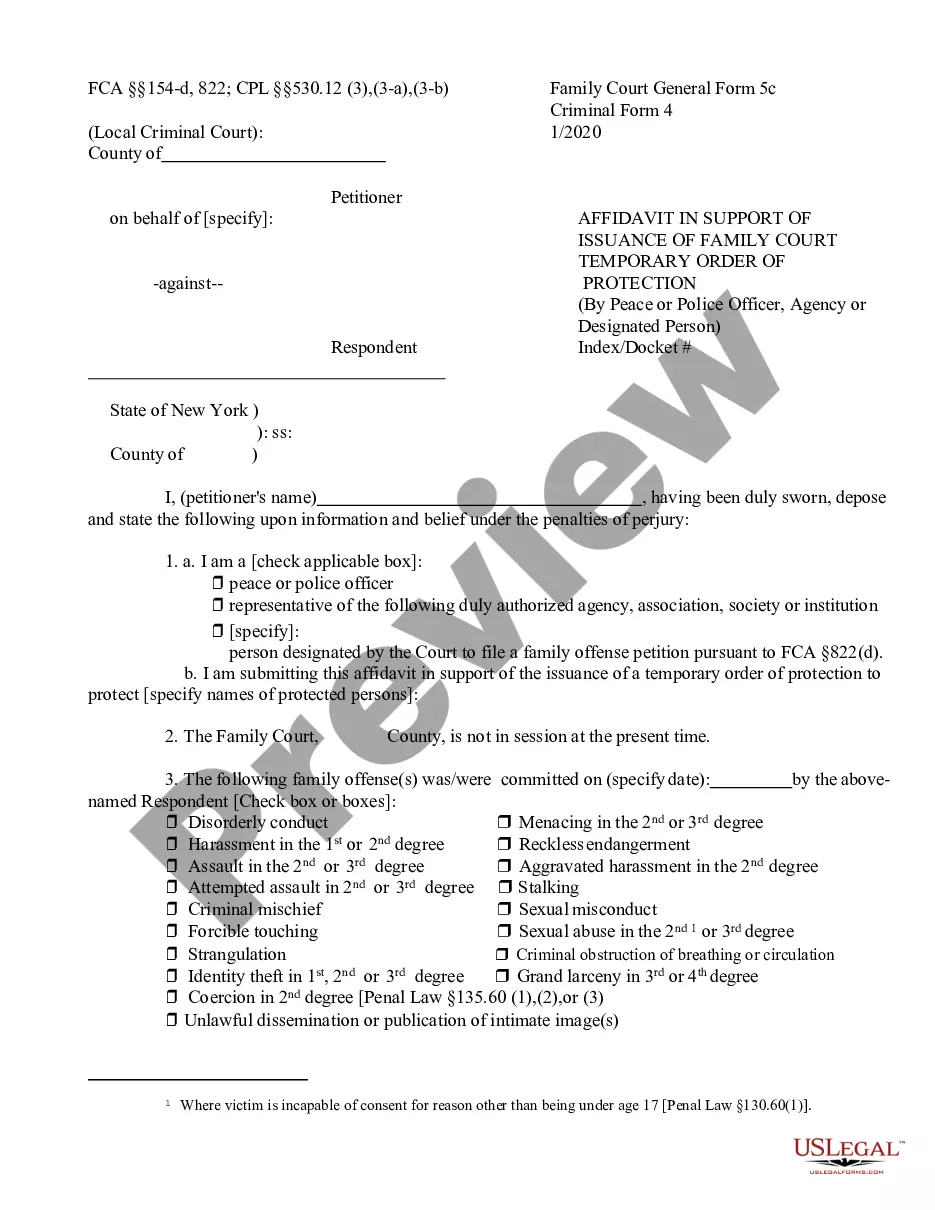

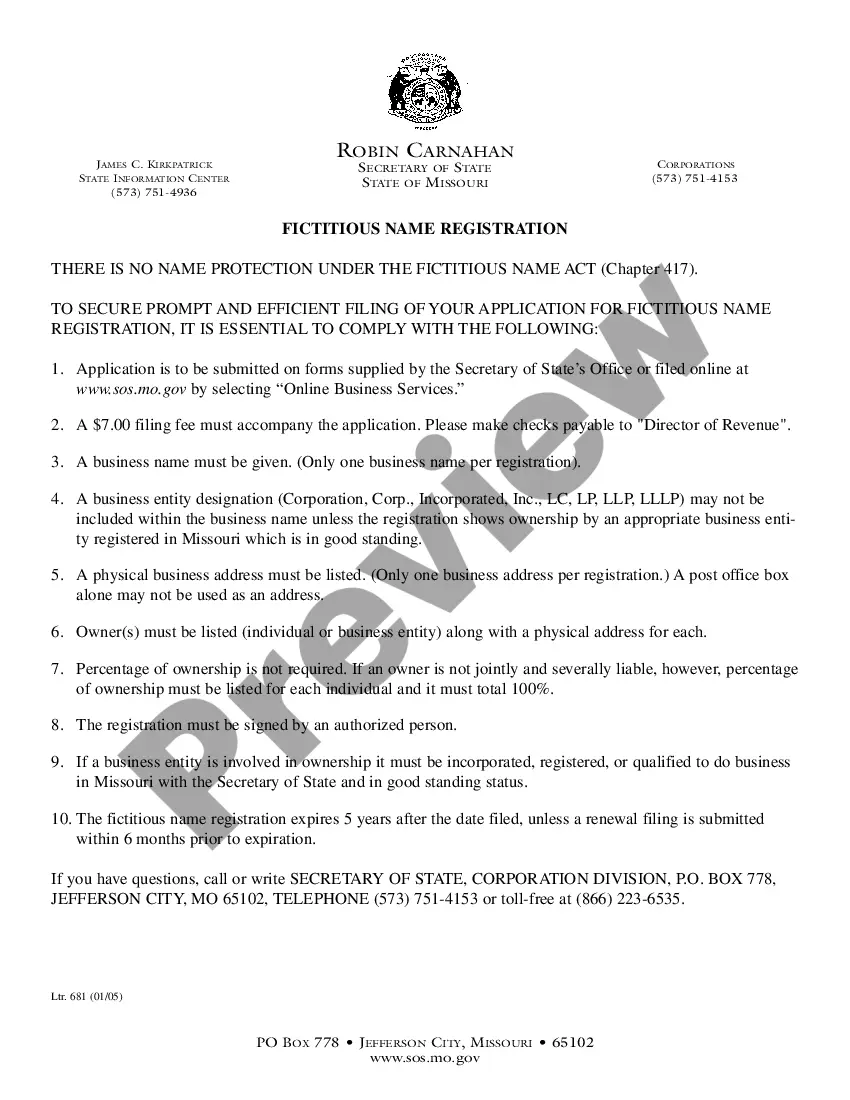

How to fill out Massachusetts Earnest Money Promissory Note?

US Legal Forms - one of the largest compilations of legal documents in the United States - offers a range of legal document templates that you can download or print.

Through the site, you can access thousands of documents for business and personal use, organized by categories, states, or keywords. You can find the latest versions of documents such as the Massachusetts Earnest Money Promissory Note within moments.

If you already possess an account, Log In and retrieve the Massachusetts Earnest Money Promissory Note from the US Legal Forms database. The Download button will appear on every document you view. You can access all previously downloaded documents in the My documents section of your account.

Complete the payment. Utilize your credit card or PayPal account to finalize the purchase.

Select the format and download the document to your device. Edit. Complete, modify, and print the downloaded Massachusetts Earnest Money Promissory Note.

Every template you've added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you require.

Access the Massachusetts Earnest Money Promissory Note with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your personal or business needs.

- Make sure you have selected the correct document for your city/state.

- Click on the Preview button to review the document's content.

- Read the document description to ensure you have selected the correct item.

- If the document does not suit your requirements, use the Search field at the top of the screen to find the one that does.

- Once satisfied with the document, confirm your choice by clicking the Purchase Now button.

- Then, choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

An earnest promissory note shows good faith commitment to purchase an asset and outlines the aspects of the purchase agreement between a buyer and seller.

For sophisticated or corporate investors, promissory notes can be a good investment. These instruments provide a reasonable reward for those who are willing to accept the risk. However, promissory notes that are marketed broadly to the general public often turn out to be scams.

If a homebuyer is taking advantage of a first-time homebuyer program that doesn't require as much cash on hand, the total deposit might be less than 5 percent. The deposits are held in escrow, usually by the listing agent's office or seller's attorney.

A promissory note is a written agreement between one party (you, the borrower) to pay back a loan given by another party (often a bank or other financial institution).

When to Use a Promissory Note? A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends. If you are lending a large amount of money to someone (or to a business), then you may want to create a promissory note from a promissory note template.

Deposit Promissory Note means a debt instrument issued by the Bank; upon maturity the Bank is obliged to pay to the Client the Amount Payable. Concurrently the Bank ensures the custody of such promissory note.

A promissory note is a legal and a financial instrument that is written between three financing parties: the maker, the lender, and the payee/the borrower.

For example, let's assume John wants to buy a home that is listed for $500,000. To show that he is serious and ready to close the deal quickly, he provides $10,000 in earnest money.

The owner must be aware that the earnest money deposit will be made in the form of a promissory note (i.e., not in cash) before it accepts the purchase offer. This fact must also be stated clearly in the purchase agreement itself.

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.

Interesting Questions

More info

Seller The seller is liable for an earnest money contract. The buyer is legally bound by the agreement. A buyer is not obliged to pay for an earnest money contract by the seller. What is an Elfin Express Money Deposit Contract? An earnest money deposit contract is one entered into by two parties with one or more of the following common characteristics: • it is open to the public (a seller may have as many as 20 buyers); • it is legally binding, meaning it is legally binding (the parties are legally bound to do something — in the case of an earnest money contract, this is to make sure they do not violate any of the agreements or rules in the contract); • it may be open to foreclosure if the seller defaults (this is very common in real estate.