Massachusetts Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift is a legal document that confirms the receipt of a pledged gift by the organization. It serves as an acknowledgment to the donor for their generosity and allows the donor to claim tax deductions for their charitable contribution. This acknowledgment is specific to charitable or educational institutions in Massachusetts. The Massachusetts Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift typically includes the following details: 1. Institution Information: The name, address, and contact information of the organization issuing the acknowledgment are mentioned. This helps to identify the institution and provides credibility to the document. 2. Donor Information: The name, address, and contact details of the donor are specified. This ensures that the acknowledgment is personalized and acknowledges the donor's contribution. 3. Description of Gift: The pledged gift is described in detail, including its nature, value, and any specific terms or conditions associated with the donation. This ensures clarity regarding the pledged gift. 4. Acknowledgment Statement: This section generally contains a statement expressing appreciation to the donor for their pledged gift and confirms its receipt. It may also highlight the impact and importance of the donation to the organization's mission and activities. 5. Tax Reducibility Information: The acknowledgment includes a statement explaining whether the organization is a qualified tax-exempt entity and whether the donor can claim a tax deduction for their contribution. This information helps the donor in their tax planning. It should be noted that there may be different types of Massachusetts Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift, depending on various factors such as the type of organization (charitable or educational) and the specific requirements set by the Massachusetts state laws or regulations. These different types can be categorized based on the nature of the organization or any specific guidelines or provisions set by the state. Some potential different types of Massachusetts Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift may include: 1. Charitable Institution Acknowledgment: This type of acknowledgment is issued by nonprofit organizations recognized as charitable institutions under Massachusetts state laws. 2. Educational Institution Acknowledgment: Educational institutions, such as schools, colleges, and universities, may have their own specific acknowledgment format to comply with state requirements. 3. Pledged Gift Acknowledgment with Restrictions: In cases where the donated gift comes with specific restrictions or conditions, an acknowledgment that addresses these restrictions may be required. 4. Large Value Gift Acknowledgment: For pledged gifts of significant value, organizations may have additional requirements or guidelines for providing acknowledgments. These acknowledgments may involve more detailed financial information or formal procedures. It is important for Massachusetts charitable or educational institutions to ensure compliance with state laws and regulations while generating the Massachusetts Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift. Consulting with legal professionals or using standardized templates provided by state authorities can help institutions in generating accurate and appropriate acknowledgments.

Massachusetts Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Description

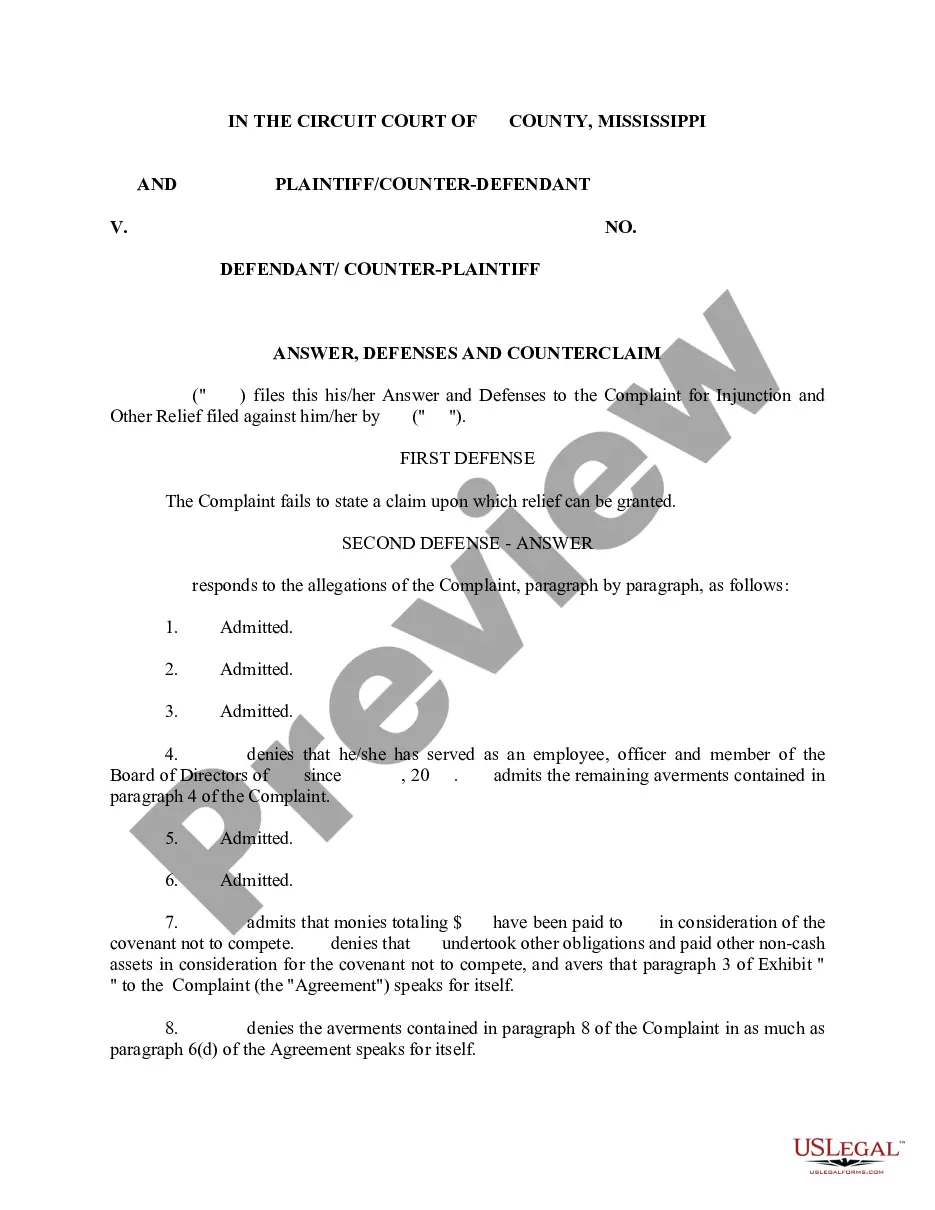

How to fill out Massachusetts Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

You are able to spend hours on-line attempting to find the legitimate record template that fits the state and federal requirements you will need. US Legal Forms gives thousands of legitimate types which are examined by professionals. It is possible to download or printing the Massachusetts Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift from our assistance.

If you already have a US Legal Forms account, you are able to log in and click the Download option. Afterward, you are able to total, modify, printing, or indication the Massachusetts Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift. Every single legitimate record template you buy is yours for a long time. To obtain an additional version of any purchased type, go to the My Forms tab and click the related option.

If you use the US Legal Forms site the first time, adhere to the basic directions below:

- Very first, be sure that you have chosen the right record template for that area/city of your choice. See the type information to make sure you have chosen the proper type. If readily available, utilize the Review option to check through the record template as well.

- If you would like discover an additional variation of the type, utilize the Research area to obtain the template that fits your needs and requirements.

- Upon having discovered the template you would like, click Buy now to move forward.

- Choose the pricing prepare you would like, type in your accreditations, and sign up for your account on US Legal Forms.

- Total the purchase. You should use your charge card or PayPal account to pay for the legitimate type.

- Choose the formatting of the record and download it to the product.

- Make changes to the record if possible. You are able to total, modify and indication and printing Massachusetts Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift.

Download and printing thousands of record web templates making use of the US Legal Forms web site, which offers the largest assortment of legitimate types. Use skilled and state-particular web templates to take on your small business or personal demands.

Form popularity

FAQ

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

15 Best Practices For Your Nonprofit Thank You Letter Use the donor's name. Nothing says, ?This is a form letter? more clearly than failing to include a donor's name. ... Send it promptly. ... Send it from a person. ... Show impact. ... Be warm and friendly. ... Use donor-centered language. ... Avoid empty jargon. ... Reference their history.

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

Sample Donor Acknowledgement Letter for Non-Cash Donation On [DATE], you donated [DESCRIPTION ? WITHOUT MONETARY VALUE]. This gift is greatly appreciated and will be used to support our mission. In exchange for this contribution, you received [GOODS OR SERVICES ? WITH ESTIMATE OF FAIR MARKET VALUE].

A donation acknowledgment letter (sometimes called a donation receipt or thank-you letter) is an email or paper that recognizes a charitable contribution. At a bare minimum, it's a confirmation receipt to your donors acknowledging you've received their donation.

Sample Acknowledgment for an In-Kind Gift ?Thank you for your generous gift of ________(Full Description)________ which we received on ____(Date)____. Your generous contribution will help to further the important work of our organization.

Example 2: Individual Acknowledgment Letter Hi [donor name], We're super grateful for your contribution of $250 to [nonprofit's name] on [date received]. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.