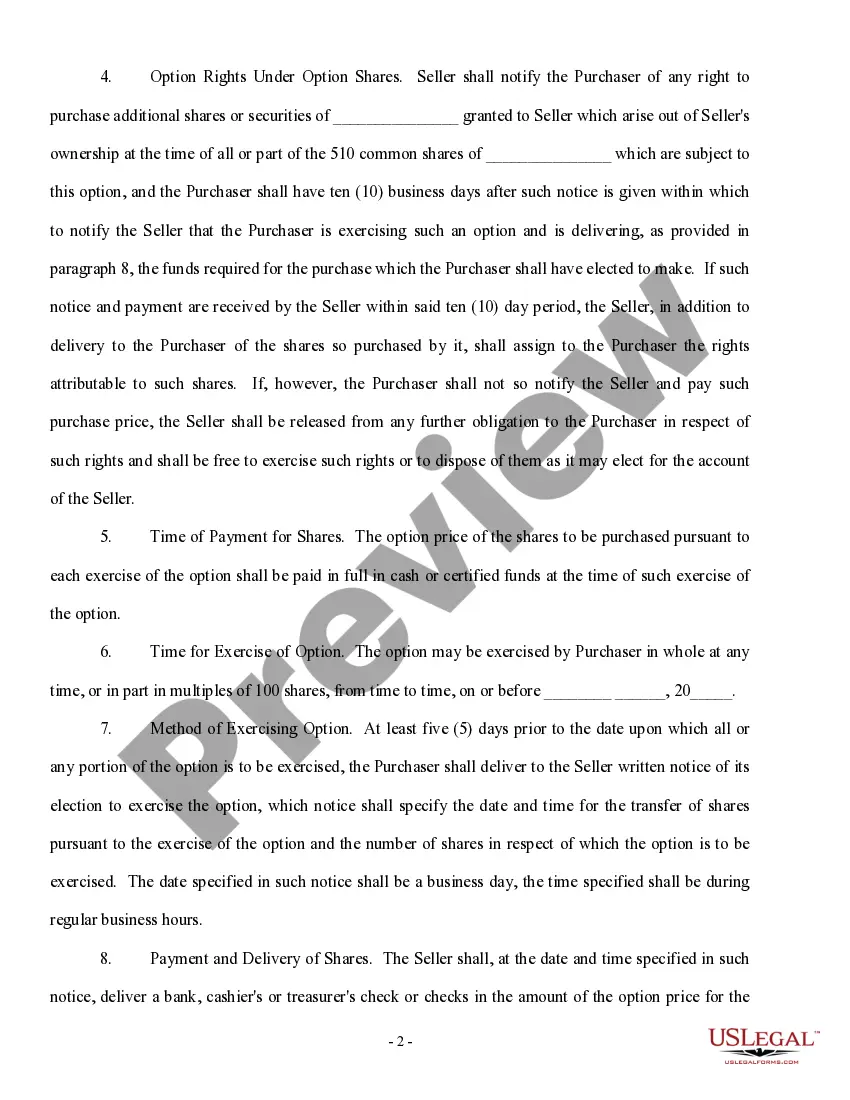

Massachusetts Option to Purchase Stock - Long Form

Description

How to fill out Option To Purchase Stock - Long Form?

If you want to finalize, obtain, or print legal document templates, utilize US Legal Forms, the premier selection of legal forms available online.

Take advantage of the site’s user-friendly search to locate the documents you require.

A wide array of templates for professional and personal applications are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Purchase now button. Choose the pricing plan you prefer and input your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to discover the Massachusetts Option to Purchase Stock - Long Form with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Massachusetts Option to Purchase Stock - Long Form.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Utilize the Preview option to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

Employees often prefer Incentive Stock Options (ISOs) because these options can provide favorable tax treatment. When you exercise ISOs and hold the stock for a specific period, you may qualify for long-term capital gains. This can lead to a lower tax rate. Additionally, ISOs can enhance employee retention by encouraging them to remain with the company to maximize their benefits.

RSU, ESOP, and ESPP are the benefits that an employee receives during his/her first job. Though these benefits are included in the CTC package, people often don't know much about the benefits and tax implications of these benefits. ESPP, ESOP and RSU are benefits granted to individuals during their first job.

Upon vesting, RSUs are assigned a fair market value. The Internal Revenue Service considers RSUs fully taxable upon vesting. After a portion of the stock shares is withheld to pay taxes, the employee receives the balance of the shares and may sell them at their discretion. An ESPP is an employee stock purchase plan.

An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

A stock option is the contractual right to purchase shares of a company's stock at a specified price during a specified period. An option is granted with a vesting schedule (typically 4 years) and an exercise price that is generally equal to the fair market value of the stock at the time of the grant.

Stock options are only valuable if the market value of the stock is higher than the grant price at some point in the vesting period. Otherwise, you're paying more for the shares than you could in theory sell them for. RSUs, meanwhile, are pure gain, as you don't have to pay for them.

Employee Stock Ownership Plan (ESOP)

Several international companies with employees in India also offer ESOPs. ESOP (Employee stock option plan) is an employee benefit plan offering employees the ownership interest in the organization. It is similar to a profit sharing plan.

Eligibility. Excluding directors and promoters of a company who have more than 10% equity in the company, every employee is eligible for ESOP.