Massachusetts Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act

Description

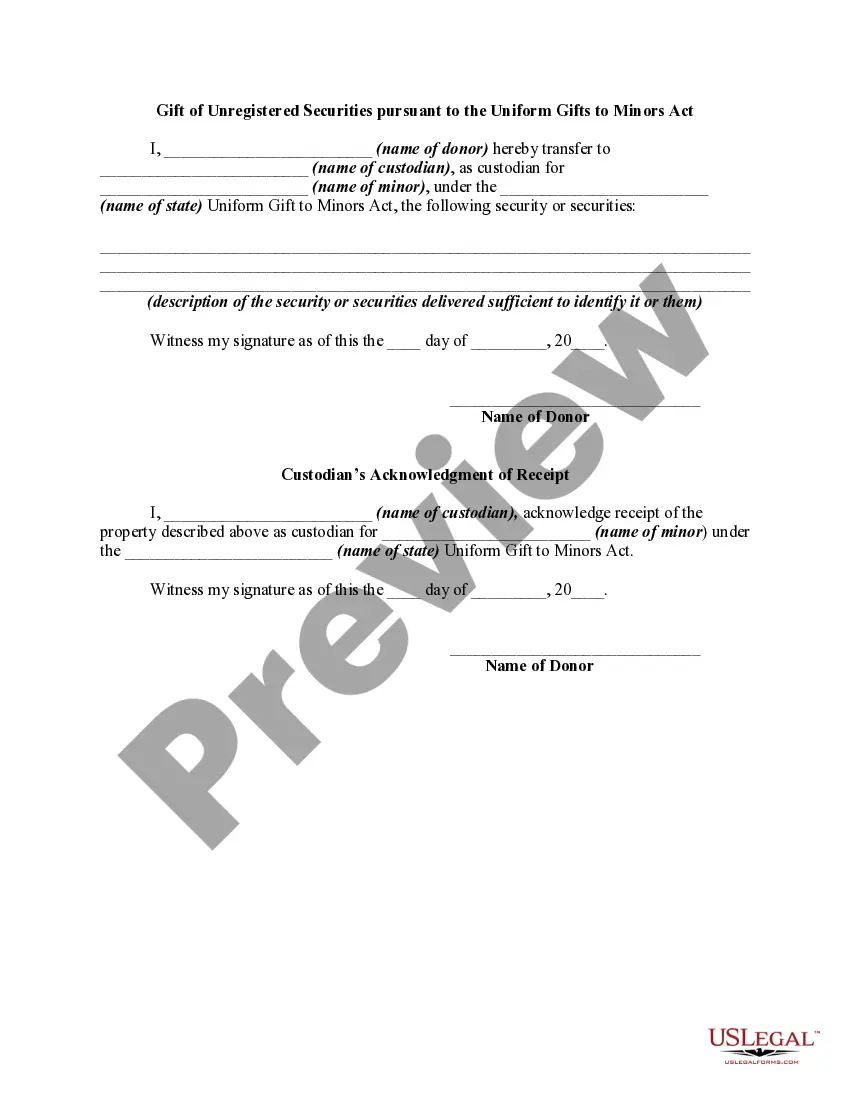

How to fill out Gift Of Unregistered Securities Pursuant To The Uniform Gifts To Minors Act?

US Legal Forms - one of the biggest libraries of lawful varieties in the States - provides an array of lawful file web templates you can acquire or produce. While using site, you can find thousands of varieties for business and individual uses, sorted by classes, claims, or keywords and phrases.You can find the newest models of varieties much like the Massachusetts Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act within minutes.

If you currently have a subscription, log in and acquire Massachusetts Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act through the US Legal Forms collection. The Obtain button will appear on every single form you look at. You have accessibility to all previously acquired varieties from the My Forms tab of your account.

If you want to use US Legal Forms the very first time, allow me to share basic directions to get you started out:

- Ensure you have picked out the proper form to your area/region. Click the Review button to review the form`s content. Browse the form description to ensure that you have chosen the correct form.

- In case the form doesn`t match your needs, use the Research industry near the top of the display screen to discover the one which does.

- If you are pleased with the shape, validate your option by visiting the Purchase now button. Then, select the costs plan you prefer and supply your qualifications to sign up on an account.

- Approach the transaction. Make use of charge card or PayPal account to complete the transaction.

- Select the structure and acquire the shape in your gadget.

- Make alterations. Load, modify and produce and signal the acquired Massachusetts Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act.

Every web template you included in your money does not have an expiry particular date and it is your own property forever. So, in order to acquire or produce another copy, just proceed to the My Forms portion and click on the form you require.

Get access to the Massachusetts Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act with US Legal Forms, by far the most comprehensive collection of lawful file web templates. Use thousands of expert and state-certain web templates that meet up with your small business or individual requires and needs.

Form popularity

FAQ

Transfers made to a UGMA or UTMA account are irrevocable and belong to the child in whose name the account is registered; however, the account is controlled by the custodian until the child reaches a certain age, which varies by state (usually 18 or 21).

The UTMA allows the donor to name a custodian, who has the fiduciary duty to manage and invest the property on behalf of the minor until that minor becomes of legal age. The property belongs to the minor from the time the property is gifted.

A Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account is an account into which property is set aside for a minor's benefit. Whether a UGMA or UTMA account is used depends on the law of the state in which the account is established.

Typically, transfers made to a UGMA or UTMA account are irrevocable and belong to the child in whose name the account is registered; however, the account is controlled by the custodian until the child reaches a certain age, which varies by state (usually 18 or 21).

Generally, when UTMA or UGMA accounts (UTMA/UGMA Accounts) are established, the beneficiary (a minor) becomes the owner of the property at the time of the gift; however, the custodian manages and invests the property on the beneficiary's behalf until the beneficiary reaches the age of majority, at which point the ...

All states in Region IX have repealed the UGMA and adopted the UTMA: Arizona effective 09/30/88, California effective 01/01/85, Hawaii effective 07/01/85, and Nevada effective 07/01/85.

What Is the Uniform Gifts to Minors Act (UGMA)? The Uniform Gifts to Minors Act (UGMA) allows individuals to give or transfer assets to underage beneficiaries. The act, which was developed in 1956 and revised in 1966, is commonly used to transfer assets from parents to their children.

The main advantage of using a UTMA account is that the money contributed to the account is exempted from paying a gift tax of up to a maximum of $16,000 per year for 2022 ($17,000 for 2023). 2 Any income earned on the contributed funds is taxed at the tax rate of the minor who is being gifted the funds.