A Massachusetts Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a legal document used in the state of Massachusetts when selling a business or personal assets as part of an asset purchase transaction. This comprehensive document outlines the terms and conditions of the sale, protecting the rights and interests of both the buyer and the seller. Keywords: Massachusetts, Sale of Business, Bill of Sale, Personal Assets, Asset Purchase Transaction Different types of Massachusetts Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction may include: 1. Business Sale Agreement: This type of bill of sale specifically focuses on the transfer of ownership of an entire business, including its assets and liabilities. It outlines the terms of the sale, purchase price, assets included, and any warranties or representations made regarding the business. 2. Equipment Sale Agreement: This document is used when only specific equipment or machinery is being sold as part of a business or asset purchase transaction. It includes details about the equipment, its condition, purchase price, and any warranties provided by the seller. 3. Vehicle Sale Agreement: If a business involves the sale of vehicles such as cars, trucks, or vans, a separate bill of sale may be required. This agreement specifically addresses the transfer of ownership and associated details related to the vehicles, including VIN numbers, mileage, and warranties. 4. Intellectual Property Sale Agreement: In certain transactions, a business may be selling its intellectual property assets, such as patents, trademarks, or copyrights. This type of sale agreement outlines the transfer of these intangible assets, including any licensing terms or restrictions associated with their use. 5. Real Estate Sale Agreement: In cases where the sale of a business involves the transfer of real estate, a separate bill of sale may be necessary. This agreement would cover the details of the property being sold, including its legal description, purchase price, and any conditions or contingencies related to the sale. Regardless of the specific type of Massachusetts Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction, it is crucial to consult with a legal professional to ensure that all necessary provisions are included and that the document complies with Massachusetts state laws.

Massachusetts Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

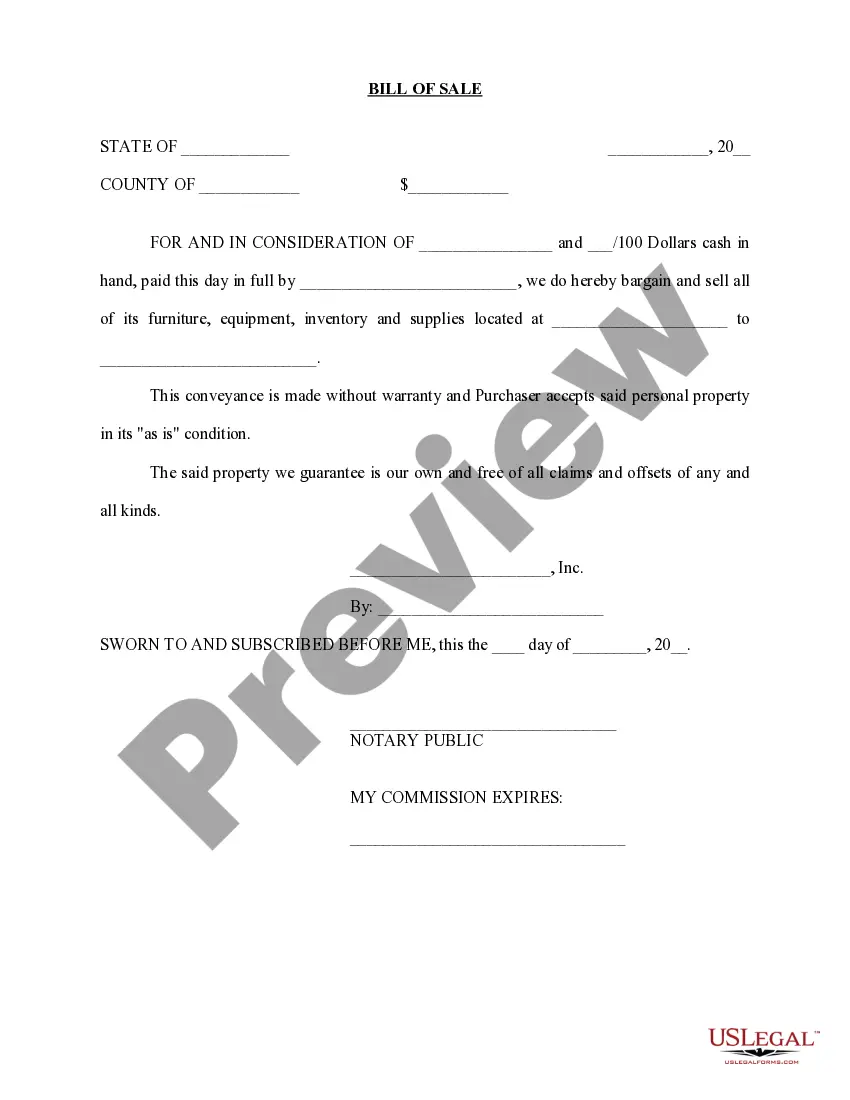

How to fill out Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

You are capable of spending time online searching for the valid document template that fulfills the state and federal standards you need.

US Legal Forms offers thousands of valid templates which can be reviewed by experts.

You can easily acquire or print the Massachusetts Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction with my assistance.

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Massachusetts Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction.

- Every valid document template you receive is yours permanently.

- To retrieve another copy of any purchased document, visit the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions provided below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the document description to confirm you have chosen the correct form.

Form popularity

FAQ

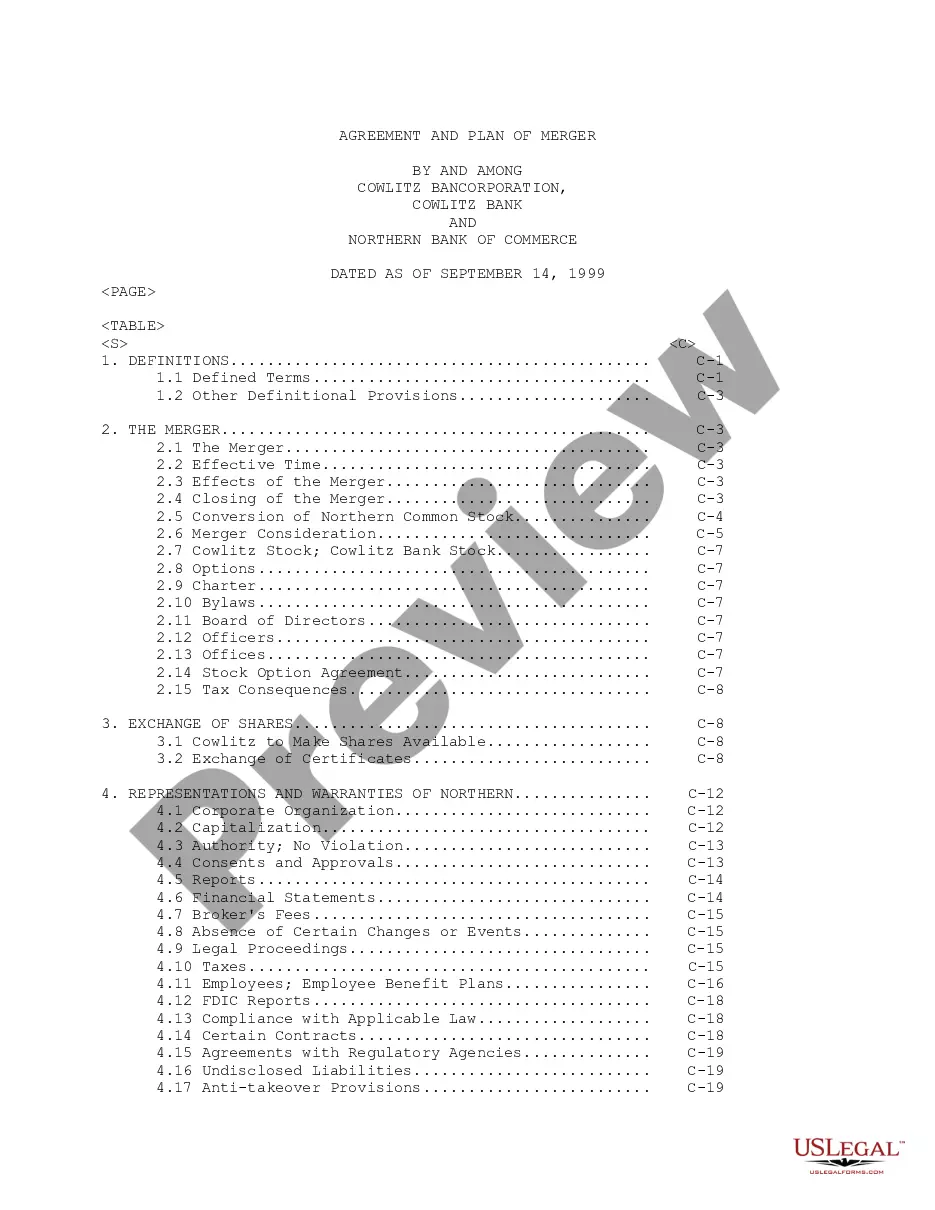

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.) along with the rights and obligations of the parties.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

A business usually has many assets. When sold, these assets must be classified as capital assets, depreciable property used in the business, real property used in the business, or property held for sale to customers, such as inventory or stock in trade. The gain or loss on each asset is figured separately.

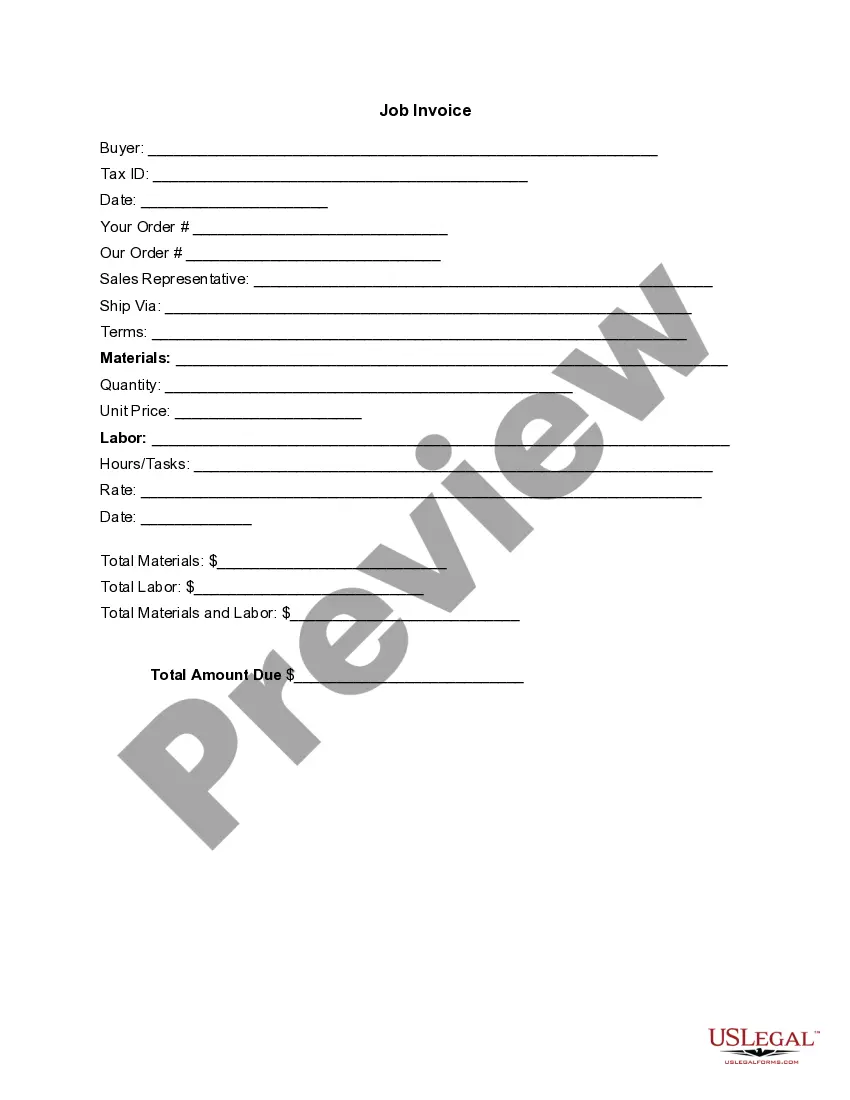

The key difference is that a purchase order is sent by buyers to vendors with the intention to track and control the purchasing process. On the other hand, an invoice is an official payment request sent by vendors to buyers once their order is fulfilled.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

An asset sale involves the purchase of some or all of the assets owned by a company. Examples of common assets which are sold include; plant and equipment, land, buildings, machinery, stock, goodwill, contracts, records and intellectual property (including domain names and trademarks).

Interesting Questions

More info

You would only need to make a small mistake on the inside of the vehicle, and it needs to be taken care. It must have good quality brakes, and the tires on it. For that you will need the best car tires, and there are plenty to choose from. There are plenty of different brands in the market, so the choice will be up to you. However, choosing the right tires will save you money and hassle, so this is something you must take care of. There are also many other important tips in making a good use out of your vehicle. If you are trying to buy a second hand car, you can always check out used cars. If you are buying a used car, then you should always see if it has warranty. If it does, it means that the vehicle is in good condition, and you should get the same for your own use. For the price of a second hand car, you can also have it tested by a professional. You can have a service done on your car yourself, but you can save quite some money by hiring someone to do it.