Massachusetts Agreement for Sale of Goods, Equipment and Related Software

Description

How to fill out Agreement For Sale Of Goods, Equipment And Related Software?

You might spend hours online searching for the legal document template that meets the federal and state criteria you require.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can easily obtain or create the Massachusetts Agreement for Sale of Goods, Equipment and Related Software from our platform.

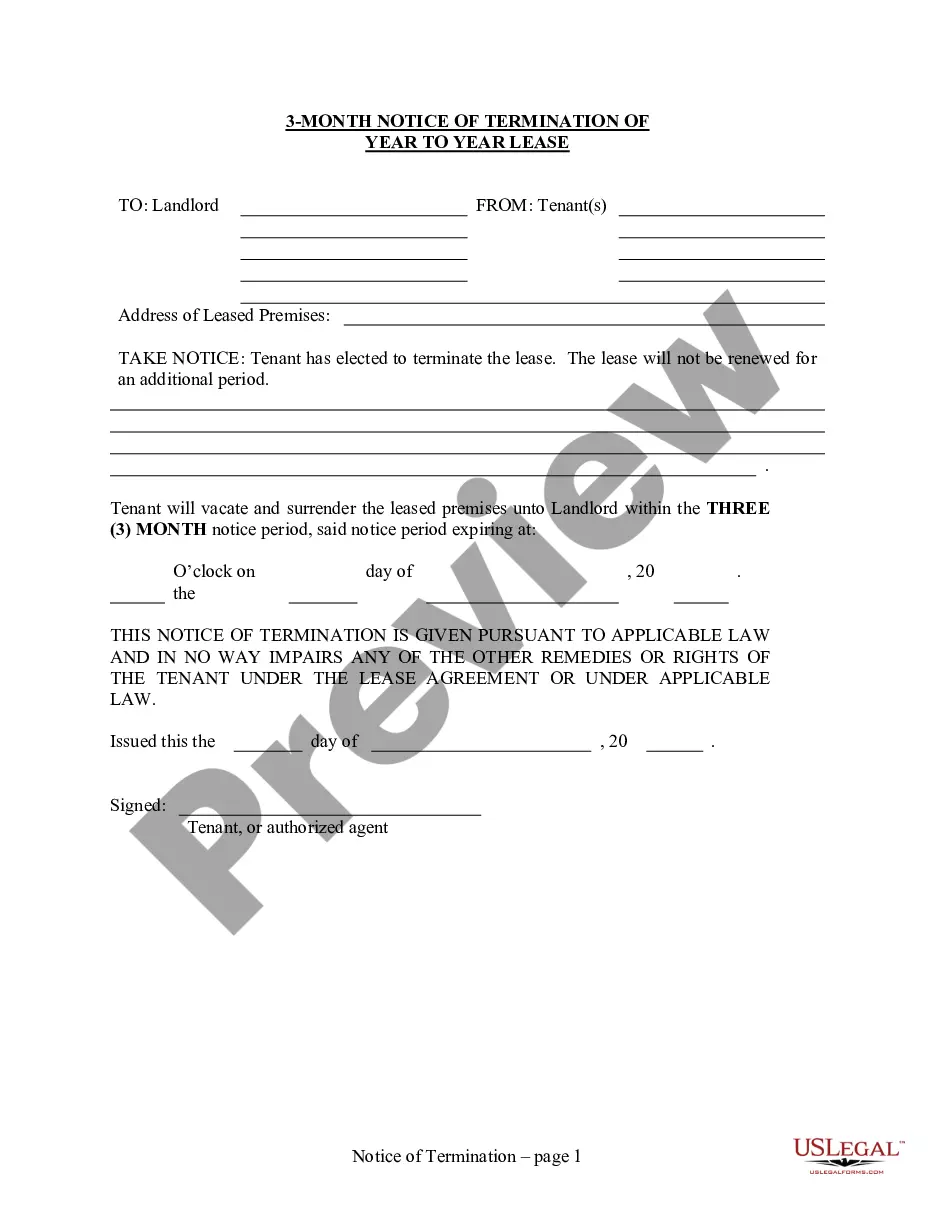

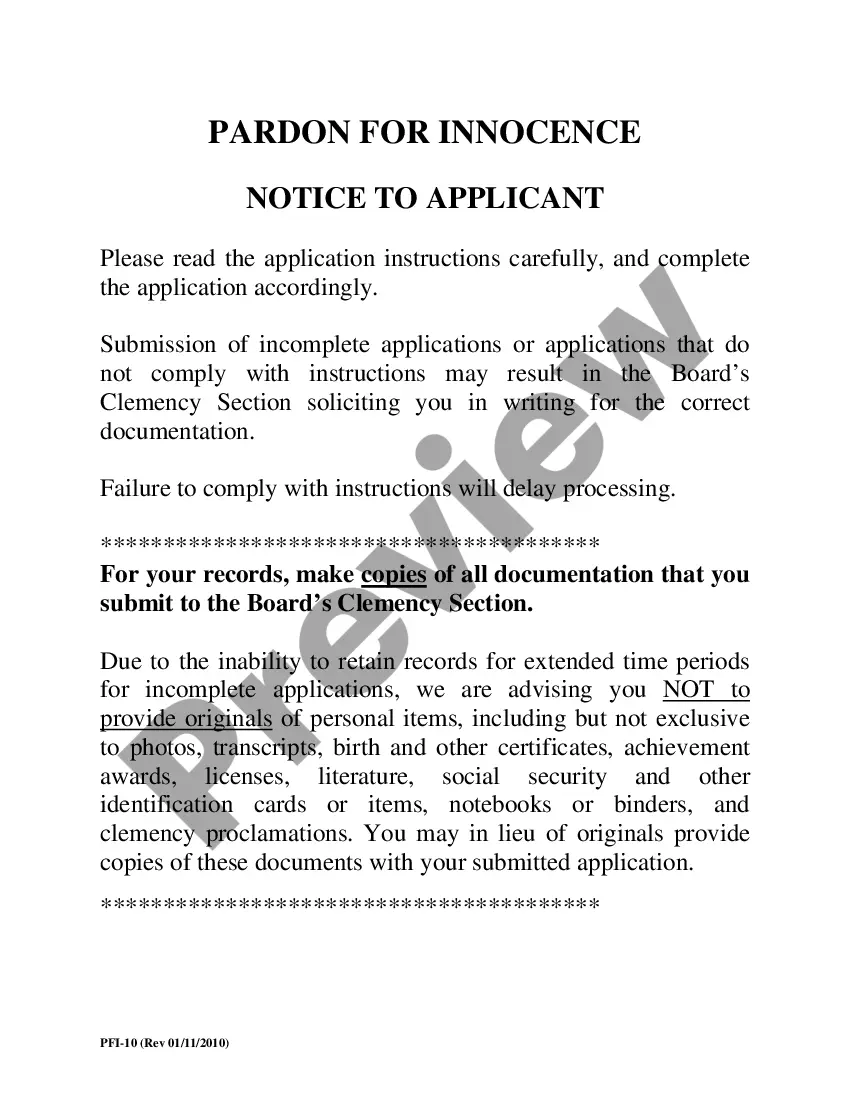

If available, use the Review button to view the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- Then, you are able to fill out, edit, create, or sign the Massachusetts Agreement for Sale of Goods, Equipment and Related Software.

- Every legal document template you receive is yours permanently.

- To get another copy of the downloaded document, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct document template for the state/region you have chosen.

- Check the document description to confirm you have selected the appropriate form.

Form popularity

FAQ

This type of legal agreement is often referred to as a trademark licensing agreement. It allows an entity to market and sell the products of a parent company under its established brand. Navigating this agreement is an essential part of crafting a Massachusetts Agreement for Sale of Goods, Equipment, and Related Software, as it ensures all branding and marketing practices are compliant with legal standards.

In Massachusetts, items subject to sales tax include tangible personal property, most services related to personal property, and certain admissions. This includes many types of software, unless specifically exempted. When preparing a Massachusetts Agreement for Sale of Goods, Equipment, and Related Software, consider which items fall under these regulations to ensure a smooth transaction.

Such a contract is typically referred to as a brand licensing agreement. It permits one party to use another party's brand name in exchange for specific terms, often involving compensation. Understanding this agreement is crucial when drafting a Massachusetts Agreement for Sale of Goods, Equipment, and Related Software to protect intellectual property rights.

This agreement is commonly called a licensing agreement. It allows a subsidiary or partner to utilize the parent company's name while selling its goods. A Massachusetts Agreement for Sale of Goods, Equipment, and Related Software often includes clauses addressing how this name can be used, ensuring that both parties benefit from the established brand.

Yes, Massachusetts imposes sales tax on certain types of software. Specifically, pre-written software is subject to sales tax, while custom software may not be. When engaging in a Massachusetts Agreement for Sale of Goods, Equipment, and Related Software, it's vital to understand these tax implications to ensure compliance and avoid unintentional liabilities.

In Massachusetts, certain items are exempt from sales tax, which can benefit your financial planning. For example, sales of machinery, certain food products, and specific types of equipment may fall under this exemption. When you engage in a Massachusetts Agreement for Sale of Goods, Equipment and Related Software, understanding these exemptions can significantly impact your overall costs. Utilizing platforms like US Legal Forms can help you navigate these regulations effectively, ensuring that your agreements align with state tax requirements.

The vendor customer ID is a unique identifier assigned to vendors within the Massachusetts procurement system. This ID helps streamline transactions and tracks vendor activity. It's important to use your vendor customer ID when engaging in contracts, including the Massachusetts Agreement for Sale of Goods, Equipment and Related Software.

In Massachusetts, software delivered in tangible form, such as CDs or DVDs, is subject to sales tax. Conversely, software delivered electronically may not be taxed. Understanding these tax implications is important when creating a Massachusetts Agreement for Sale of Goods, Equipment and Related Software.

Commbuys is the statewide e-procurement platform for Massachusetts, designed to streamline the procurement process for vendors and government entities. It allows vendors to access bid invitations, submit responses, and manage contracts. By using Commbuys, you can more effectively engage in the Massachusetts Agreement for Sale of Goods, Equipment and Related Software.

To become a state vendor in Massachusetts, you must register through the Commbuys platform. Registration involves providing business details, including your Federal Employer Identification Number (FEIN). Once registered, you can participate in opportunities related to the Massachusetts Agreement for Sale of Goods, Equipment and Related Software.