Title: Massachusetts Letter to Social Security Administration Notifying Them of Death — Explained Introduction: The Massachusetts Letter to Social Security Administration Notifying Them of Death is a formal document that informs the Social Security Administration (SSA) about the demise of an individual who was receiving benefits from the Social Security program. This comprehensive guide will provide you with a detailed understanding of this letter, its purpose, and how to draft one successfully. Read on to learn more about the different types of Massachusetts Letters to the Social Security Administration Notifying Them of Death. 1. Purpose of the Massachusetts Letter to Social Security Administration Notifying Them of Death: The primary purpose of this letter is to inform the SSA about a beneficiary's passing to ensure the cessation of any ongoing benefit payments and to facilitate the appropriate handling of the deceased's Social Security records. This letter also serves as a supporting document for reporting the death to other relevant agencies and organizations. 2. Required Information to Include: When drafting the Massachusetts Letter to Social Security Administration Notifying Them of Death, it is crucial to provide the following key information: — Full legal name and Social Security number of the deceased individual — Date and place of the deceased person's death — Your relationship to the deceased (e.g., spouse, child, relative, or legal representative) — Your contact information, including name, address, and phone number — Supporting documentation (e.g., death certificate, funeral home statement, or medical certification) 3. Different Types of Massachusetts Letters to Social Security Administration Notifying Them of Death: a. Surviving Spouse's Letter: This type of letter is sent by the surviving spouse of the deceased beneficiary to notify the SSA of their partner's passing, ensuring a halt in any spousal benefits being received. b. Estate Representative's Letter: If you are the legal representative of the deceased's estate, you'll need to send a letter to inform the SSA of the individual's death. This type of letter may include additional documentation, such as a copy of the representative's legal appointment. c. Family Member or Relative's Letter: In case the surviving spouse or legal representative is not available, a close family member or relative can write a letter to inform the SSA about the death. This letter should contain all the necessary details mentioned above. 4. Steps to Write the Massachusetts Letter to Social Security Administration Notifying Them of Death: a. Begin with a formal salutation, addressing the appropriate SSA representative or office. b. Clearly state the purpose of the letter, mentioning the deceased's full name, Social Security number, and date/place of death. c. Provide your relationship to the deceased and your contact information. d. Attach any supporting documents requested by the SSA. e. Express your willingness to cooperate further if required and appreciate the prompt attention given to the matter. f. End the letter with a courteous closing, followed by your printed or typed name, contact details, and signature. Conclusion: The Massachusetts Letter to Social Security Administration Notifying Them of Death is crucial for informing the SSA about the demise of a beneficiary and ensuring the smooth cessation of benefits. By furnishing the necessary information and following the steps mentioned above, you can craft a comprehensive letter that expedites the necessary administrative processes during this challenging time.

Massachusetts Letter to Social Security Administration Notifying Them of Death

Description

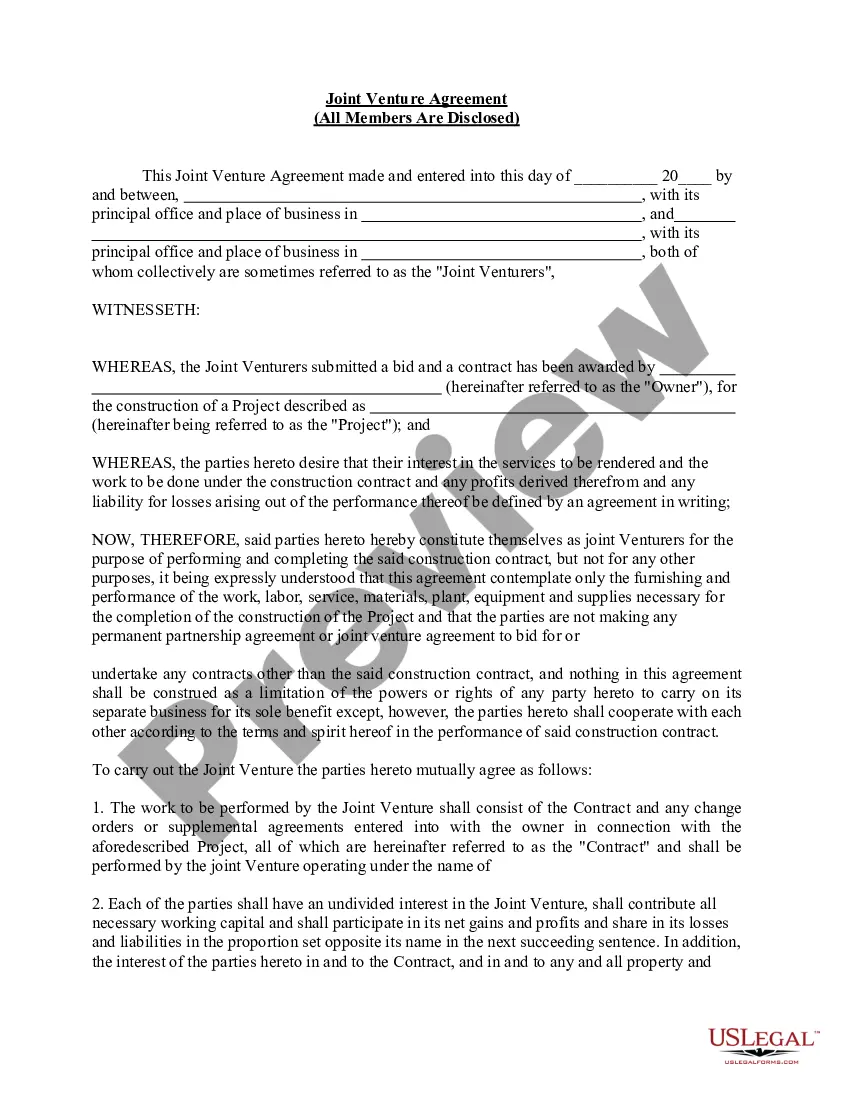

How to fill out Massachusetts Letter To Social Security Administration Notifying Them Of Death?

You are able to devote several hours on-line attempting to find the lawful papers format that meets the federal and state requirements you will need. US Legal Forms supplies a large number of lawful types that are evaluated by professionals. You can easily acquire or printing the Massachusetts Letter to Social Security Administration Notifying Them of Death from the support.

If you already have a US Legal Forms accounts, you can log in and click the Down load option. Following that, you can total, change, printing, or signal the Massachusetts Letter to Social Security Administration Notifying Them of Death. Each lawful papers format you acquire is your own eternally. To get yet another version for any bought develop, visit the My Forms tab and click the corresponding option.

If you use the US Legal Forms web site initially, adhere to the straightforward instructions beneath:

- Initial, ensure that you have chosen the proper papers format for your region/area that you pick. Browse the develop description to make sure you have picked the appropriate develop. If offered, make use of the Review option to search throughout the papers format as well.

- If you would like find yet another variation in the develop, make use of the Search field to discover the format that meets your needs and requirements.

- After you have discovered the format you desire, click on Purchase now to proceed.

- Choose the pricing plan you desire, type your references, and sign up for an account on US Legal Forms.

- Complete the purchase. You can utilize your charge card or PayPal accounts to cover the lawful develop.

- Choose the format in the papers and acquire it for your device.

- Make adjustments for your papers if possible. You are able to total, change and signal and printing Massachusetts Letter to Social Security Administration Notifying Them of Death.

Down load and printing a large number of papers web templates while using US Legal Forms web site, that offers the largest collection of lawful types. Use expert and state-distinct web templates to take on your company or personal needs.

Form popularity

FAQ

Upon your death, unsecured debts such as credit card debt, personal loans and medical debt are typically discharged or covered by the estate. They don't pass to surviving family members. Federal student loans and most Parent PLUS loans are also discharged upon the borrower's death.

Write a letter to one of the nationwide credit reporting agencies. Whichever agency you contact ? TransUnion, Equifax or Experian ? will then notify the other two on your behalf. Along with a copy of the death certificate, please also include the following for the deceased: Legal name.

If it comes to your attention that the SSA has mistakenly listed you as deceased, you'll need to correct that error at once, and you can do so by visiting your local Social Security office.

First, notify family and friends of the deceased. The executor should be notified immediately, if the deceased made a will. The executor is responsible for the funeral, burial or cremation. The death must be registered with the provincial government.

A death notice is a brief statement announcing someone's death. In just a few sentences, the notice explains need-to-know details about the death, along with information regarding memorial or funeral services to be held.

The spouse or executor of the estate may request the deceased person's credit report by mailing a request to each of the credit reporting companies. Send a letter along with the following information about the deceased: Legal name. Social Security Number.

Estate executors or court-appointed designees, however, are encouraged to contact at least one of the three nationwide credit bureaus so that the deceased's credit report can be flagged, appropriately.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.