A nominee trust is a trust in which the trustee holds legal title to the trust property for the trust's beneficiaries, but the beneficiaries exercise the controlling powers, and the actions that the trustees may take on their own are very limited. Such trusts are a common device for holding title to real estate, and afford certain tax advantages. A nominee trust is not a trust in the strict classical sense, because of the trustee-beneficiary relationship. Despite a nominee trust's nontraditional relationship between trustee and beneficiary, such a trust must still adhere to the rule that no trust exists when the same individual is the sole settlor, sole trustee, and sole beneficiary. The trustees of a nominee trust act at the direction of the beneficiaries.

Massachusetts Nominee Trust

Description

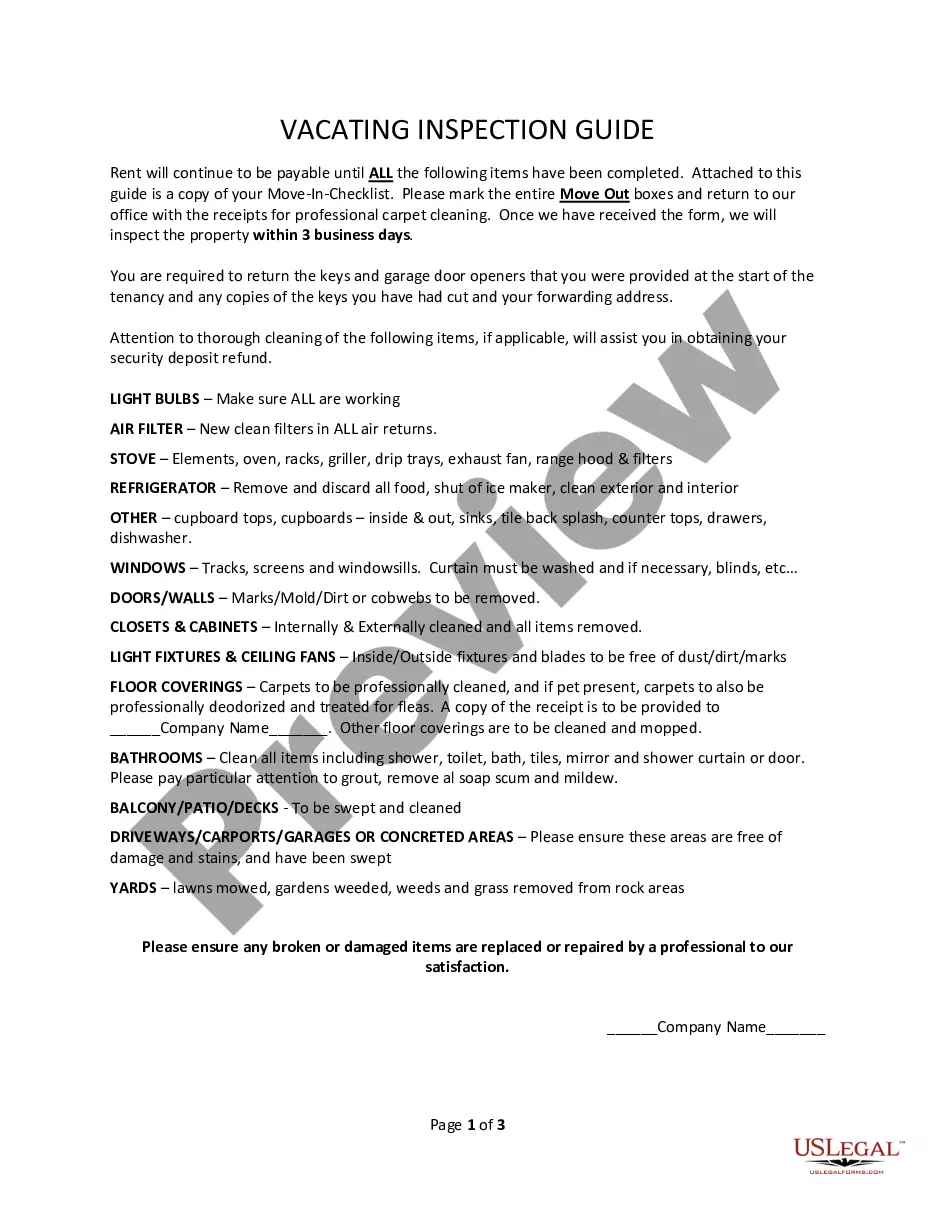

How to fill out Nominee Trust?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad array of legal form templates that you can download or print. By using the site, you can access thousands of forms for business and personal use, categorized by type, state, or keywords. You can find the latest templates like the Massachusetts Nominee Trust in just moments.

If you already have an account, Log In and download the Massachusetts Nominee Trust from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously acquired forms in the My documents section of your account.

If you're using US Legal Forms for the first time, here are simple instructions to get you started: Ensure you have chosen the correct form for your area/region. Click the Review button to verify the form's content. Read the form description to confirm that you have selected the right form. If the form doesn’t fit your requirements, utilize the Search field at the top of the screen to find one that does. Once you’re satisfied with the form, confirm your choice by clicking the Buy now button. Next, select your preferred payment plan and provide your details to register for an account. Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make changes. Fill out, edit, and print and sign the downloaded Massachusetts Nominee Trust.

With US Legal Forms, you have the capability to acquire essential legal documents quickly and efficiently.

Maximize your productivity and ensure your documents meet all necessary standards with our extensive library.

- Every template you add to your account has no expiration date and is yours indefinitely.

- So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the Massachusetts Nominee Trust with US Legal Forms, the largest collection of legal document templates.

- Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Get started today with ease and confidence.

Form popularity

FAQ

A nominee trust is an example of a bare trust: this is a simple type of trust where the trustee acts as the legal owner of some property but is under no obligation to manage the trust fund other than as directed by the beneficiary, and where there are no restrictions beneficiary's right to use the property.

In a Nominee Trust the beneficiaries direct the trustee and may even serve as the trustee. Also, unlike an irrevocable trust, the beneficiaries of an NT may terminate the trust at any time and take full ownership of the trust property as tenants in common.

An irrevocable trust offers your assets the most protection from creditors and lawsuits. Assets in an irrevocable trust aren't considered personal property. This means they're not included when the IRS values your estate to determine if taxes are owed.

Limitations of Nominee Trusts It will do absolutely no good regarding MassHealth /Medicaid Planning, because it is not really a transfer in their eyes. Also, you cannot take a Homestead declaration on it, so creditors can attach it in a lawsuit, assuming liability.

The trustees do not file income tax returns - the activities of the trust are shown on the tax returns of the beneficiaries.

Disadvantages of an Irrevocable Trust You will give up much more control over your financial affairs. Additional tax returns may need to be filed for the irrevocable trust, which can add cost and complexity. Irrevocable trusts may be more difficult to create and are nearly impossible to modify.

Unlike a real trust, where the power and duty to appropriately control the trust property lies with the trustee, in a nominee trust the beneficiaries actually retain all decision-making power. In fact, the trustee is really just an agent of the beneficiaries, who essentially act as the principal.

What Happens When the Grantor Dies? When the grantor of an irrevocable trusts dies, the person named successor trustee in the Declaration of Trust assumes control of the trust. The new trustee distributes the assets placed in the trust to the proper beneficiaries.