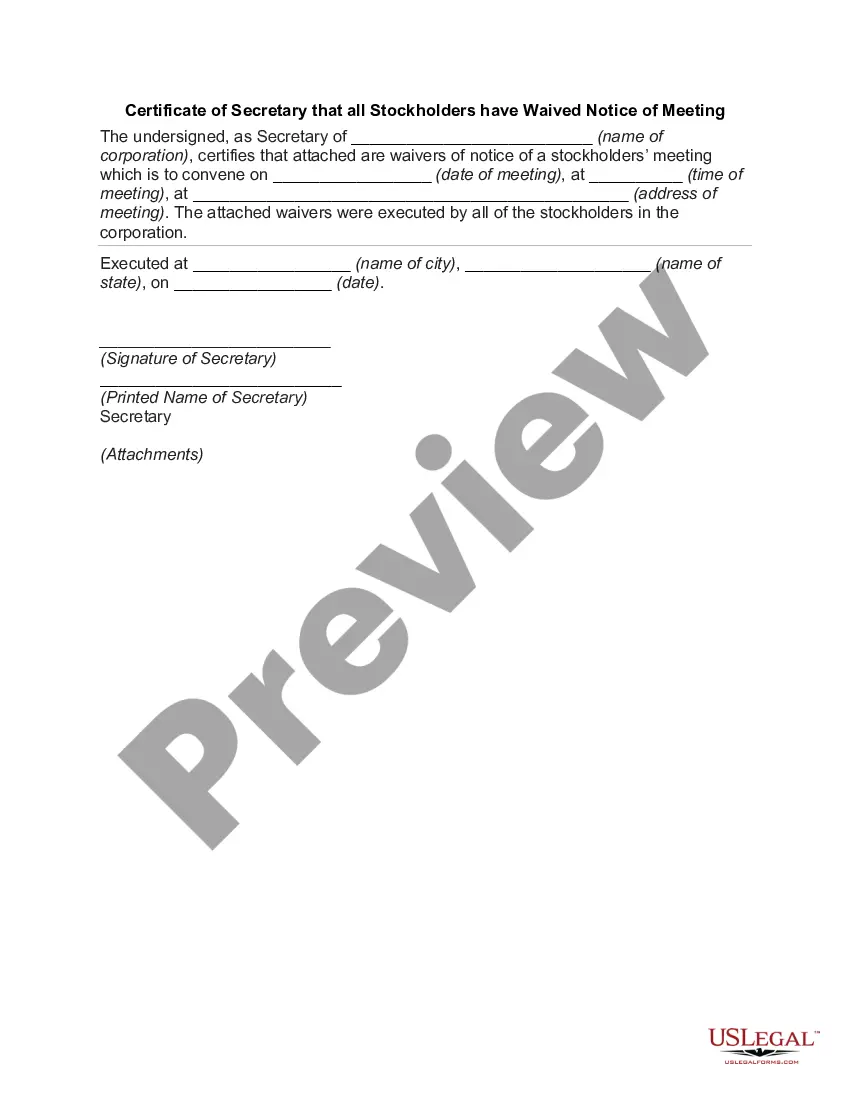

The Massachusetts General Form of Receipt is a legal document used to acknowledge the receipt of payment or goods in the state of Massachusetts. It serves as evidence of a transaction and is typically used in various industries, including retail, services, and rentals. This comprehensive receipt form ensures compliance with Massachusetts-specific regulations and provides a standardized template for clear documentation. The Massachusetts General Form of Receipt contains essential information such as the date of receipt, the recipient's details (name, address, contact information), and the payer's details. It also includes a detailed description of the goods or services received, including quantity and price. Additionally, this form may provide space for additional notes or terms and conditions specific to the transaction. In Massachusetts, there are several variants of the General Form of Receipt, tailored for specific industries and purposes. These include: 1. Retail Sales Receipt: This type of receipt is primarily used in retail establishments to document the sale of goods to consumers. It includes information about the purchased items, prices, taxes, and any applicable discounts. 2. Service Receipt: Service-based businesses issue this receipt to acknowledge payment for rendered services. It outlines the nature of the services provided, the duration, hourly rates, and any additional fees. 3. Rental Receipt: Landlords or property managers use this receipt when tenants pay rent or provide a partial payment. It specifies the rental period, the amount paid, any outstanding balance, and may include details of other fees, such as utilities or late charges. 4. Contractor Receipt: Contractors or construction-related businesses use this receipt to confirm payment for provided services, such as repairs, installations, or renovations. It outlines the scope of work, materials used, hourly rates (if applicable), and any subcontractor expenses. It is important to note that while these variants exist, the information included in the Massachusetts General Form of Receipt remains largely consistent. This uniformity ensures clarity, transparency, and legal compliance for both parties involved in a transaction.

Massachusetts General Form of Receipt

Description

How to fill out General Form Of Receipt?

Finding the appropriate legal document template can be challenging.

There are numerous templates available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Massachusetts General Form of Receipt, suitable for both business and personal use.

If the form does not meet your specifications, utilize the Search field to find the appropriate form.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already a member, Log In to your account and click the Download button to obtain the Massachusetts General Form of Receipt.

- Use your account to view the legal forms you have previously purchased.

- Navigate to the My documents section of your account to grab another copy of the document you need.

- For new users of US Legal Forms, here are simple steps to follow.

- First, ensure you have chosen the correct form for your city/state. Use the Review button to check the form and read the description to confirm it's suitable for your needs.

Form popularity

FAQ

Whether you need to file a Massachusetts state tax return depends on your income level and residency status. Generally, if you earn above a certain amount within the state, filing is required. Using the Massachusetts General Form of Receipt can help you organize your documents, making it easier to file accurately and on time.

You can pick up Massachusetts tax forms at various locations, including public libraries and local government offices. Additionally, many tax preparation services offer these forms to their clients. Online access is also available, with the Massachusetts Department of Revenue providing downloadable versions, including the Massachusetts General Form of Receipt.

In Massachusetts, the primary state tax form is known as Form 1 for residents and Form 1-NR for non-residents. These forms gather essential information about your income, deductions, and credits. The Massachusetts General Form of Receipt is valuable for documenting your financial transactions while filling out these forms.

The Massachusetts non-resident tax form is typically known as Form 1-NR. Non-residents use it to report income earned in Massachusetts while living elsewhere. Incorporating the Massachusetts General Form of Receipt can aid in supporting your claims, making it easier to track income and expenses for tax purposes.

To get a ST 1 form in Massachusetts, you can download it directly from the Massachusetts Department of Revenue's website. This form is used for sales tax registration, and having the Massachusetts General Form of Receipt helps ensure that you properly document your sales. Always confirm that you have the most current version of the form.

You can obtain Massachusetts tax forms online through the Massachusetts Department of Revenue's website. They offer a comprehensive collection of all necessary forms, including the Massachusetts General Form of Receipt. Additionally, many local libraries and government offices may have printed forms available for your convenience.

The ST 9 form in Massachusetts is a Sales Tax Resale Certificate. This document allows purchasers to buy items without paying sales tax, provided they will resell the items in the regular course of business. It's essential for businesses to maintain proper documentation, and the Massachusetts General Form of Receipt may play a role in record-keeping for such transactions.

The rule 401 financial statement in Massachusetts is a guideline used to report financial information in divorce or family law cases. It requires detailed disclosure of assets, liabilities, and income. Completing this statement properly can be streamlined by referring to documentation such as the Massachusetts General Form of Receipt, ensuring all necessary financial information is correctly reported.

Massachusetts sales tax payments refer to the amounts collected by businesses on taxable sales made within the state. Businesses must remit these payments to the Massachusetts Department of Revenue on a regular basis, based on their tax filing frequency. Utilizing the Massachusetts General Form of Receipt can help businesses maintain accurate records of sales and ensure timely payments.

In Massachusetts, sales tax is generally not charged on most services. However, some specific services, like telecommunications and certain labor services connected to tangible personal property, may incur sales tax. It's crucial to use the Massachusetts General Form of Receipt to accurately track taxable services and ensure compliance during tax filing.