The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

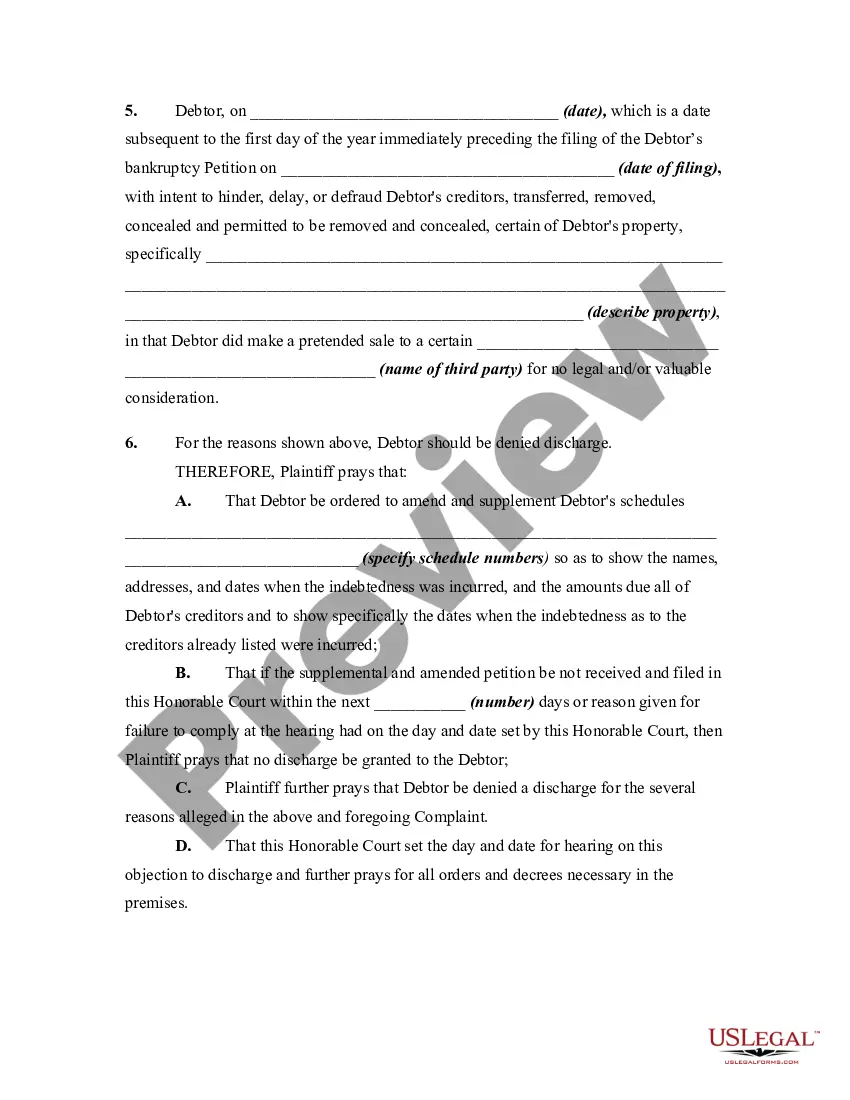

Massachusetts Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property Within One Year Preceding

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceeding For Transfer, Removal, Destruction, Or Concealment Of Property Within One Year Preceding?

US Legal Forms - one of the greatest libraries of legitimate types in America - provides a wide array of legitimate record templates it is possible to down load or print. Making use of the internet site, you may get a huge number of types for enterprise and individual functions, categorized by classes, suggests, or keywords and phrases.You can find the latest types of types like the Massachusetts Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property within minutes.

If you already possess a subscription, log in and down load Massachusetts Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property from the US Legal Forms local library. The Download key can look on each develop you perspective. You gain access to all formerly acquired types within the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, allow me to share straightforward directions to get you began:

- Be sure to have picked the best develop to your town/area. Select the Review key to examine the form`s information. Browse the develop information to actually have chosen the correct develop.

- When the develop doesn`t suit your specifications, use the Look for industry on top of the monitor to obtain the one which does.

- If you are satisfied with the form, validate your choice by clicking on the Get now key. Then, opt for the costs strategy you prefer and give your references to sign up for an accounts.

- Process the transaction. Make use of your Visa or Mastercard or PayPal accounts to perform the transaction.

- Find the formatting and down load the form in your system.

- Make changes. Fill out, edit and print and indication the acquired Massachusetts Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property.

Each and every template you included in your bank account does not have an expiration date and is also yours eternally. So, if you would like down load or print yet another backup, just proceed to the My Forms section and click around the develop you want.

Gain access to the Massachusetts Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property with US Legal Forms, by far the most considerable local library of legitimate record templates. Use a huge number of expert and status-distinct templates that fulfill your business or individual demands and specifications.

Form popularity

FAQ

An objection to claim may be filed to object to one claim or multiple claims subject to conditions in Federal Rule of Bankruptcy Procedure 3007(e). When an objection to claim objects to multiple claims, it is called an omnibus objection to claim. An omnibus objection to claim may cause the entry of multiple orders.

Objecting to a Discharge Generally This might be appropriate when the debtor lied to the bankruptcy judge or trustee, made false statements on the bankruptcy petition, fraudulently transferred title to property, destroyed property, or disregarded a court order.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

An objection to discharge is a notice lodged with the Official Receiver by a trustee to induce a bankrupt to comply with their obligations. An objection will extend the period of bankruptcy so automatic discharge will not occur three years and one day after the bankrupt filed a statement of affairs.

Under Federal Rules of Bankruptcy Procedure Rule 4004, a trustee or creditors have sixty (60) days after the first date set for the 341(a) Meeting of Creditors to file a complaint objecting to discharge.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...