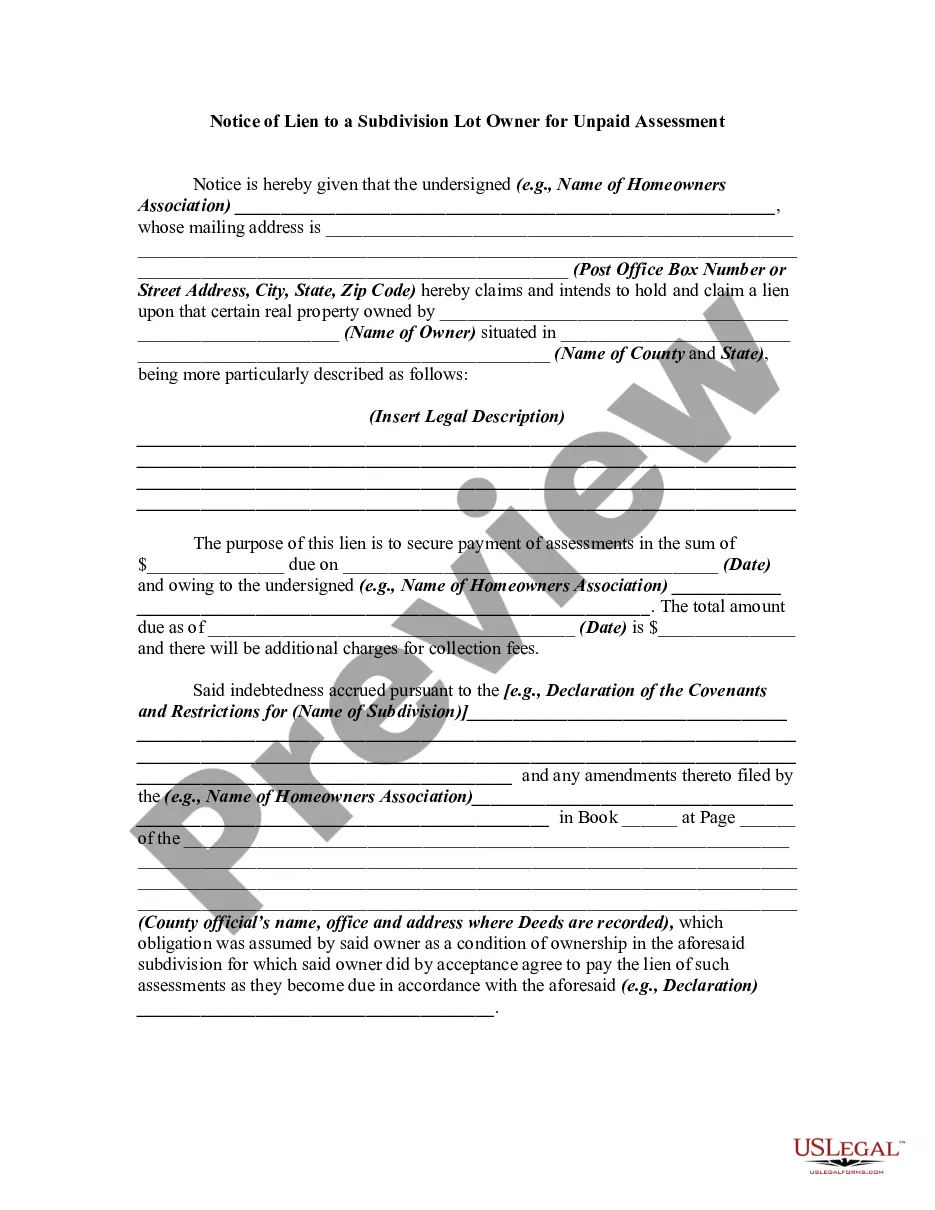

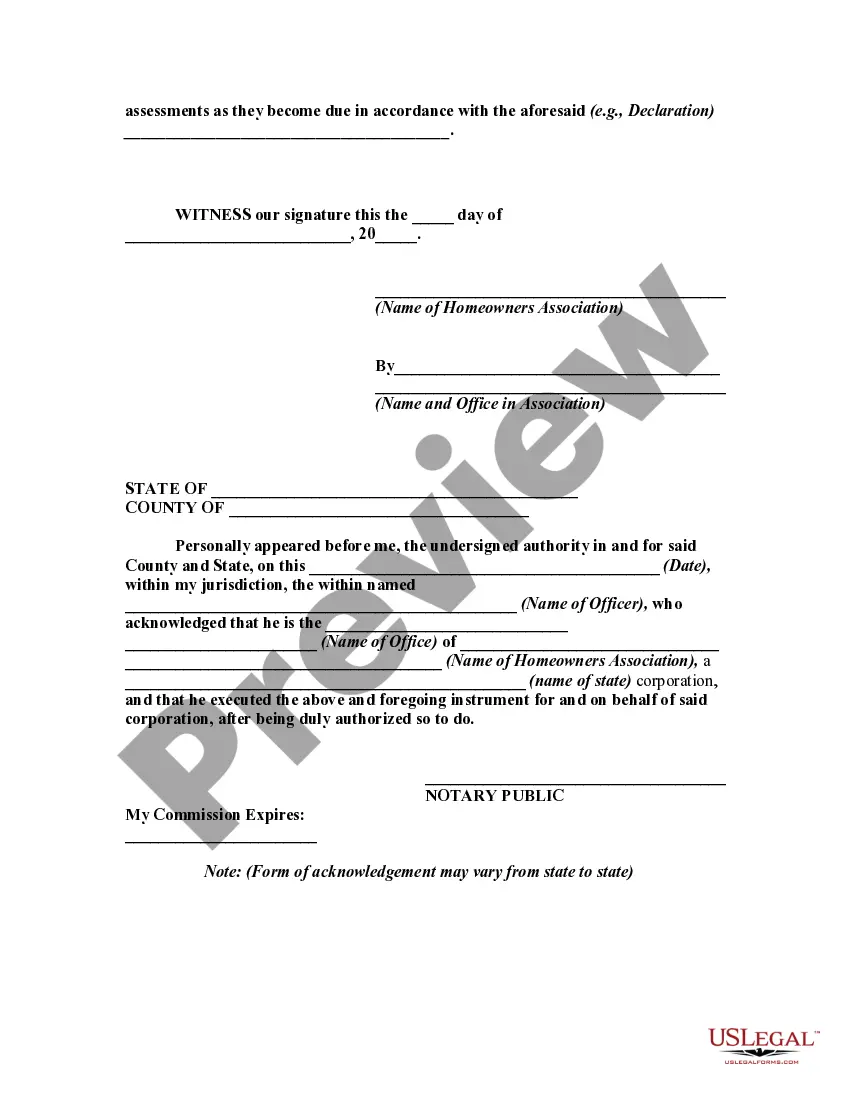

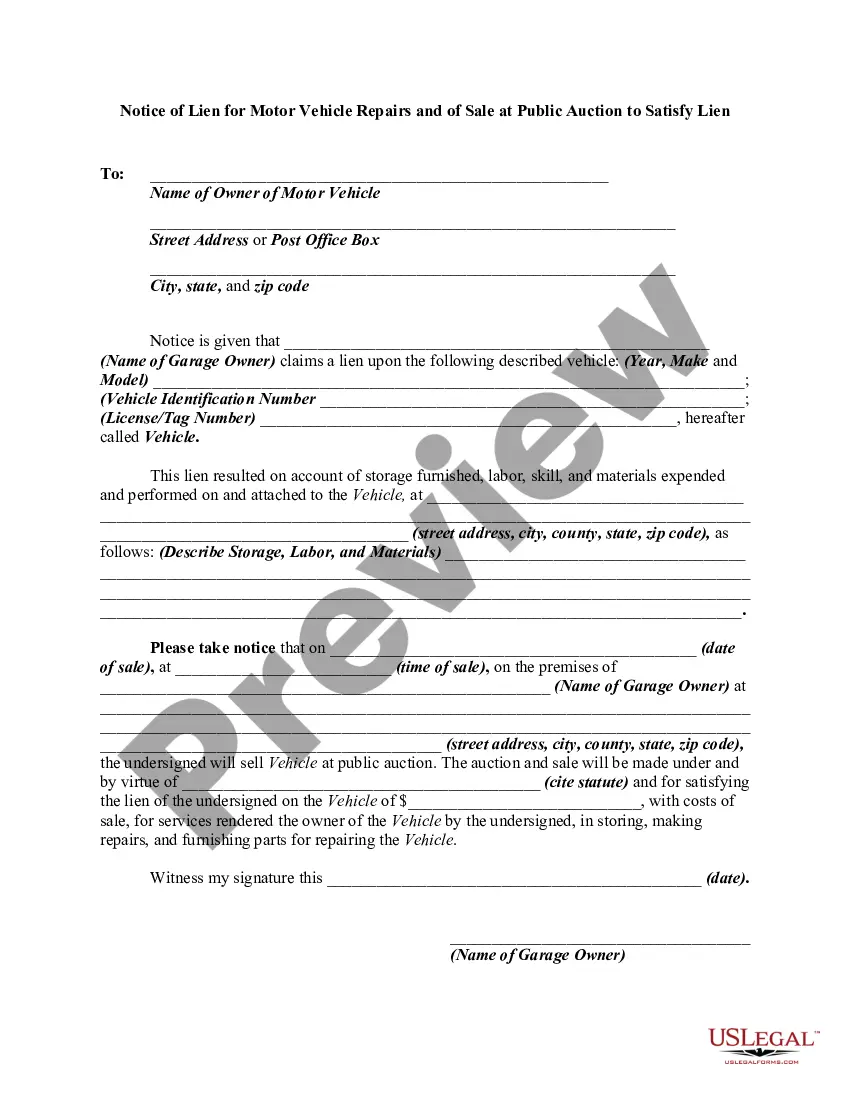

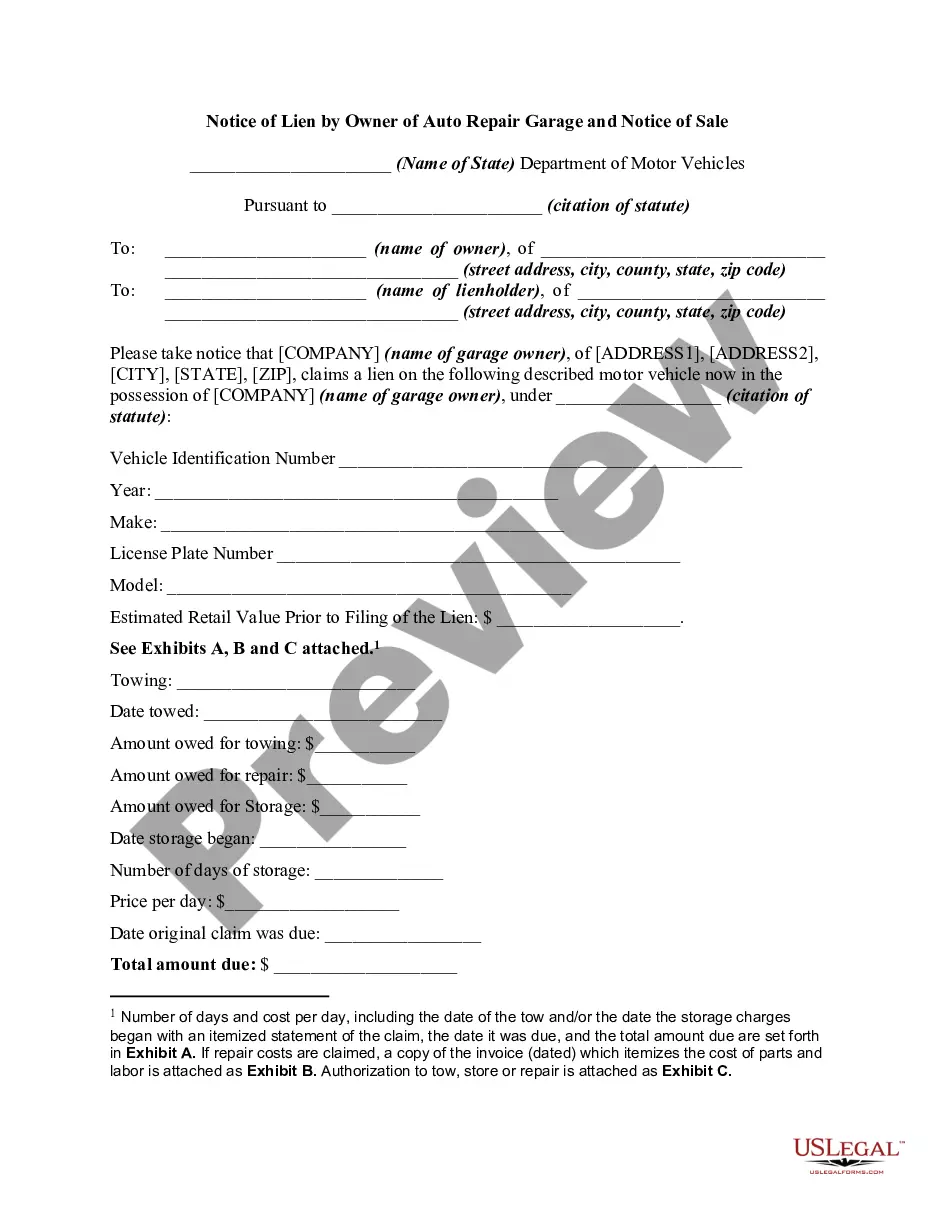

If you want to total, acquire, or printing lawful file templates, use US Legal Forms, the largest selection of lawful varieties, which can be found on the Internet. Use the site`s easy and handy research to find the papers you will need. Numerous templates for organization and personal reasons are sorted by groups and says, or search phrases. Use US Legal Forms to find the Massachusetts Notice of Lien to a Subdivision Lot Owner For Unpaid Assessment with a few clicks.

Should you be presently a US Legal Forms client, log in in your bank account and then click the Acquire button to have the Massachusetts Notice of Lien to a Subdivision Lot Owner For Unpaid Assessment. You may also entry varieties you previously saved in the My Forms tab of your own bank account.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for that appropriate town/nation.

- Step 2. Utilize the Review option to examine the form`s information. Do not forget to read through the information.

- Step 3. Should you be not happy together with the develop, utilize the Research discipline near the top of the monitor to discover other variations in the lawful develop template.

- Step 4. When you have identified the shape you will need, click the Buy now button. Pick the costs prepare you prefer and add your references to register for the bank account.

- Step 5. Process the deal. You can use your credit card or PayPal bank account to accomplish the deal.

- Step 6. Choose the file format in the lawful develop and acquire it on the system.

- Step 7. Full, revise and printing or sign the Massachusetts Notice of Lien to a Subdivision Lot Owner For Unpaid Assessment.

Each and every lawful file template you acquire is yours permanently. You have acces to every single develop you saved within your acccount. Click the My Forms area and decide on a develop to printing or acquire again.

Compete and acquire, and printing the Massachusetts Notice of Lien to a Subdivision Lot Owner For Unpaid Assessment with US Legal Forms. There are millions of professional and condition-certain varieties you can utilize for your personal organization or personal needs.