Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a revocation of a trust by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee

Description

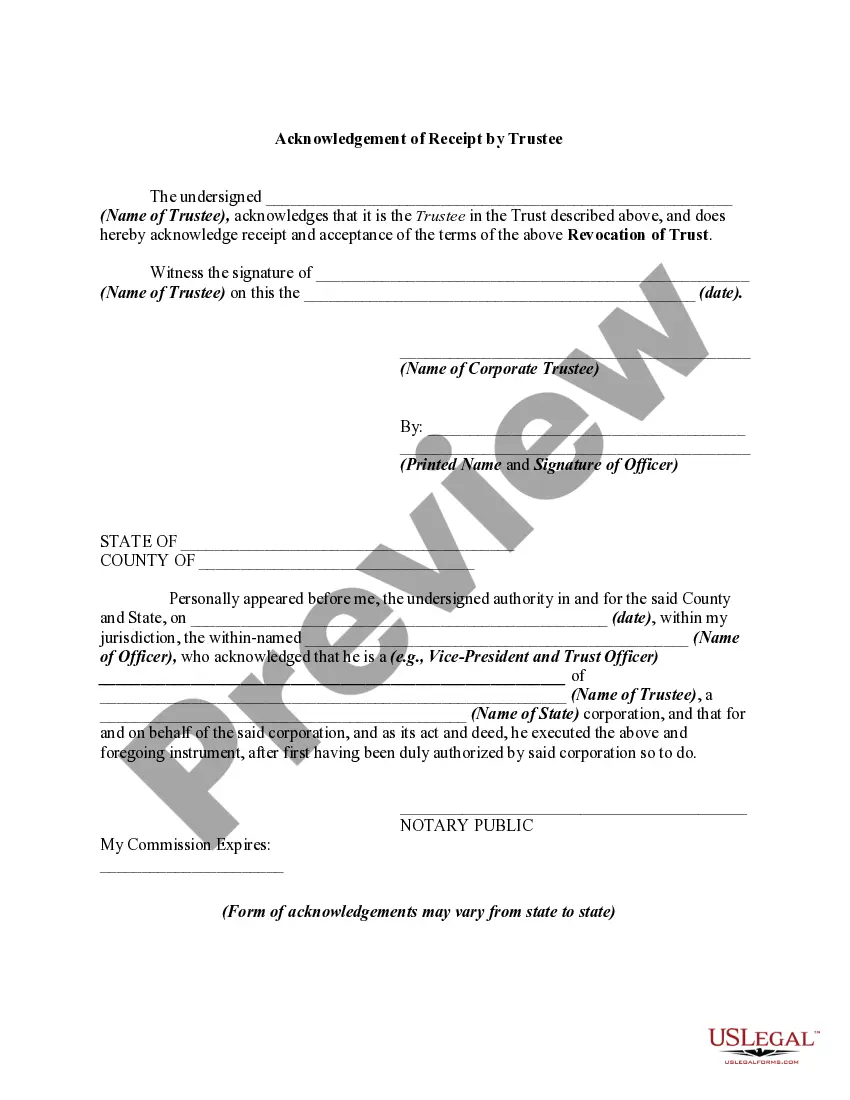

How to fill out Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Revocation By Trustee?

Are you presently in a circumstance where you frequently require documents for both commercial or personal purposes? There are many legitimate document templates available online, but locating reliable forms can be challenging.

US Legal Forms offers an extensive collection of document templates, including the Massachusetts Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee, designed to meet federal and state requirements.

If you are already registered on the US Legal Forms website and possess an account, simply Log In. Subsequently, you can download the Massachusetts Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee template.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Massachusetts Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee at any time. Simply select the desired form to download or print the document template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is suitable for your specific city/region.

- Utilize the Preview button to review the document.

- Check the description to confirm you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the document that meets your requirements.

- Once you find the right form, click Get now.

- Select the pricing plan you prefer, complete the necessary details to create your account, and make the purchase using PayPal or a credit card.

Form popularity

FAQ

A trust can be revoked through a written declaration by the trust maker, which should be done in accordance with Massachusetts law. This action formally cancels the trust, allowing for a smooth transfer of the assets back to the grantor. To ensure that you properly execute the Massachusetts Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee, consider using reliable platforms like US Legal Forms for templates and legal advice. This step can help prevent future disputes and ensure compliance with all legal requirements.

When a revocable trust is revoked, the assets held in the trust revert to the individual who created the trust, also known as the grantor. This transition typically happens without court intervention, simplifying asset management. Utilizing the Massachusetts Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee ensures that all legal notifications are properly documented. Opt for tools offered by US Legal Forms to help streamline the revocation process.

A trust can become null and void due to several factors, including lack of legal capacity, improper execution, or failing to meet legal requirements. In Massachusetts, if the trust does not adhere to state laws or is not properly funded, it may face revocation. Understanding the nuances of Massachusetts Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee can help clarify the steps to take once a trust is considered invalid. Consulting resources like US Legal Forms can provide the needed guidance to navigate these complexities.

While trustees in Massachusetts have discretion in managing trust assets, they are obligated to consider the input of beneficiaries. Beneficiaries can express concerns or preferences regarding trust matters, including a Massachusetts Revocation of Trust. Effective trustees will engage with beneficiaries, fostering a collaborative relationship that respects their voices. Resources available on uslegalforms can help clarify these responsibilities.

In Massachusetts, beneficiaries should expect to be notified of a person's death and any related trust information within a few weeks, as the executor or trustee has a legal duty to inform them promptly. This notification timeline may vary based on the complexity of the estate and any ongoing trust matters, such as a Massachusetts Revocation of Trust. Being proactive in these situations is vital, and platforms like uslegalforms can provide valuable resources.

A trustee in Massachusetts must notify beneficiaries within a reasonable timeframe, generally within 30 days of a Massachusetts Revocation of Trust. This notice includes informing them about the revocation and any implications it may have. Timely communication is crucial for maintaining trust and transparency with beneficiaries. Utilizing tools from uslegalforms can assist trustees in ensuring they meet their notification responsibilities effectively.

In Massachusetts, an executor is required to disclose all pertinent information regarding the estate to beneficiaries, including the will, asset inventory, and the total debts owed by the estate. The executor must also inform beneficiaries about any Massachusetts Revocation of Trust events that could impact their inheritance. Open communication is critical to ensuring that beneficiaries understand their rights. Consider using platforms like uslegalforms to access necessary forms and templates.

In Massachusetts, trust law protects the rights of beneficiaries, mandating that trustees must act in their best interests. This includes providing beneficiaries with important information regarding the trust's assets and actions taken by the trustee. Understanding Massachusetts Revocation of Trust is essential, as it allows beneficiaries to be informed about changes that might affect their inheritance. You can consult legal resources or platforms like uslegalforms for clear guidance.

An example of a Massachusetts Revocation of Trust is when a trustee decides to terminate the trust arrangement. This may happen if the grantor wishes to change their estate plan or if circumstances have changed significantly. The process involves formally notifying all relevant parties, ensuring they receive an Acknowledgment of Receipt of Notice of Revocation by Trustee. Using a reliable service like LegalForms can simplify this procedure.

One of the biggest mistakes parents make when setting up a trust fund is failing to update their trust as circumstances change. Many assume that one setup is enough, but life events like births, deaths, and marriages can affect the trust's effectiveness. To avoid complications, including when executing a Massachusetts Revocation of Trust and the Acknowledgment of Receipt of Notice of Revocation by Trustee, regularly reviewing and amending your trust is essential. Using the right resources, like uslegalforms, can simplify this process and help ensure your trust aligns with your family's current situation.