An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Massachusetts Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian

Description

How to fill out Demand For Accounting From A Fiduciary Such As An Executor, Conservator, Trustee Or Legal Guardian?

Selecting the most suitable authentic document template can be challenging.

Clearly, numerous templates are accessible online, but how can you locate the genuine form you require? Utilize the US Legal Forms website.

The service offers a wide array of templates, including the Massachusetts Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian, which you can utilize for both business and personal purposes.

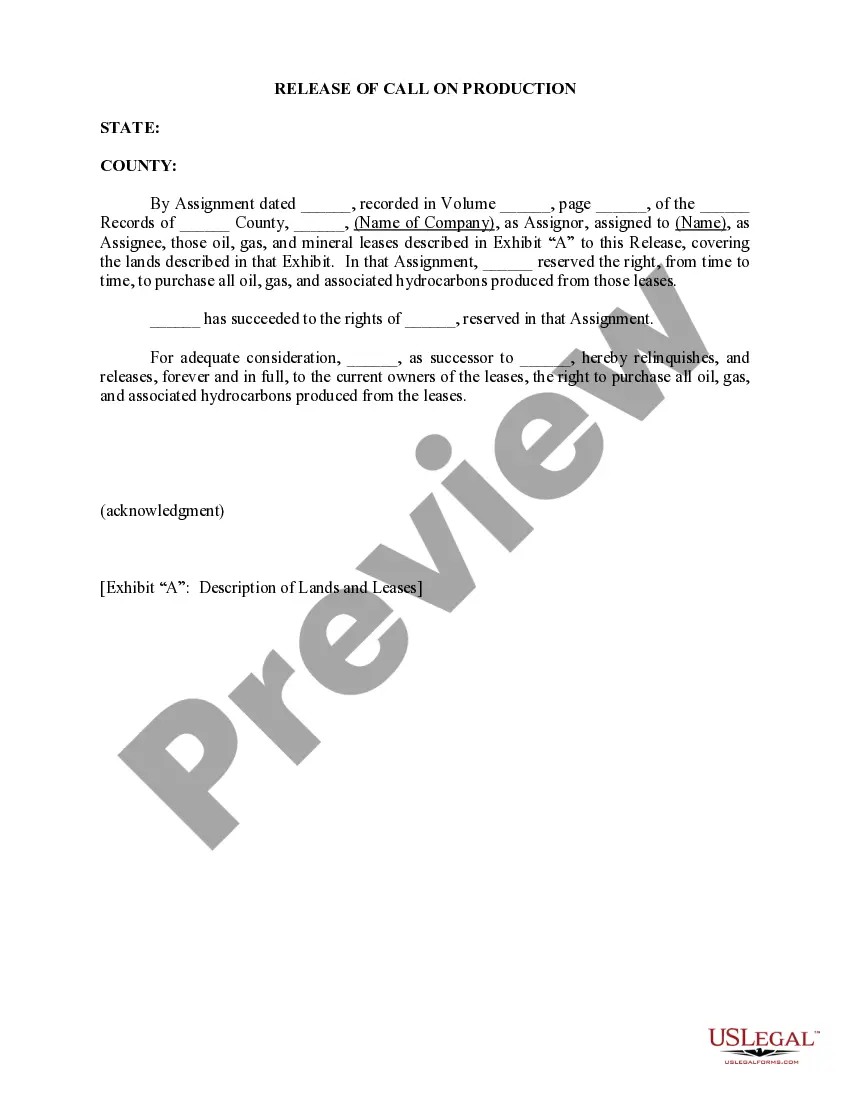

First, ensure you have selected the correct form for your city/county. You can view the document using the Preview button and read the document information to confirm it is suitable for you.

- All of the forms are verified by experts and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Massachusetts Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian.

- Use your account to search through the legitimate forms you may have previously purchased.

- Proceed to the My documents tab of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

Form popularity

FAQ

In Massachusetts, an executor typically has one year to settle an estate. This timeframe can vary depending on the complexity of the estate and the actions required to fulfill the estate's obligations. The Massachusetts Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian may come into play if beneficiaries seek clarity on the progress of the estate settlement. For further guidance, consulting US Legal Forms can help you navigate the process smoothly.

Yes, a beneficiary can request an accounting from a fiduciary such as an executor, conservator, trustee, or legal guardian. This request is part of the Massachusetts Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian. Beneficiaries have the right to ensure that the assets are managed properly and that funds are distributed appropriately. If you need assistance with the accounting process, consider using the resources available on the US Legal Forms platform.

An executor cannot simply discard the personal belongings of the deceased without informing the beneficiaries. Executors have a legal duty to manage the estate's assets responsibly, which includes communicating with all interested parties. If you feel that an executor is not honoring their obligations, you can issue a Massachusetts Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian. This formal request can help ensure that all properties are handled according to the law and the wishes of the deceased.

If a trustee fails to provide accounting, beneficiaries may feel uncertain about the management of their assets. This lack of transparency can lead to disputes and, in some cases, legal action. In Massachusetts, beneficiaries have the right to issue a Massachusetts Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian, ensuring they receive the necessary information. Taking timely action helps protect your interests and clarifies the fiduciary's responsibilities.

The fiduciary law in Massachusetts mandates that fiduciaries act in the best interests of those they serve, including beneficiaries of estates and trusts. This law establishes the responsibilities of fiduciaries such as executors, conservators, trustees, and legal guardians. By understanding fiduciary obligations and the Massachusetts Demand for Accounting from a Fiduciary, individuals can better navigate the complexities of estate management.

Yes, an executor is required to show accounting to beneficiaries in Massachusetts. This requirement reinforces the need for transparency and accountability throughout the estate settlement process. Beneficiaries can invoke the Massachusetts Demand for Accounting from a Fiduciary, ensuring that executors provide a complete financial picture.

In Massachusetts, a trustee can be an individual or a corporate entity, such as a bank or trust company. The person or organization must have the ability to manage trust assets responsibly. When establishing a trust, it's vital to consider the importance of the trustee's role, as they will be subject to the Massachusetts Demand for Accounting from a Fiduciary, assuring proper handling of the trust.

Section 813 of the Massachusetts Uniform Trust Code outlines the duties of trustees, including the obligation to keep beneficiaries informed. It establishes the right of beneficiaries to request details about trust administration. Understanding this section is important as it relates to the Massachusetts Demand for Accounting from a Fiduciary, ensuring beneficiaries receive necessary disclosures in a timely manner.

Yes, the executor must provide bank statements as part of the accounting process. This level of transparency helps beneficiaries understand the financial activities involving the estate. It's essential for maintaining trust and complying with the Massachusetts Demand for Accounting from a Fiduciary guideline, allowing beneficiaries to review all relevant transactions.

An executor is held accountable through the fiduciary duty to manage the estate honestly and efficiently. If beneficiaries demand an accounting, the executor must provide a detailed financial report as part of their responsibility. This is a crucial aspect of the Massachusetts Demand for Accounting from a Fiduciary role, ensuring that the executor remains answerable for their actions.