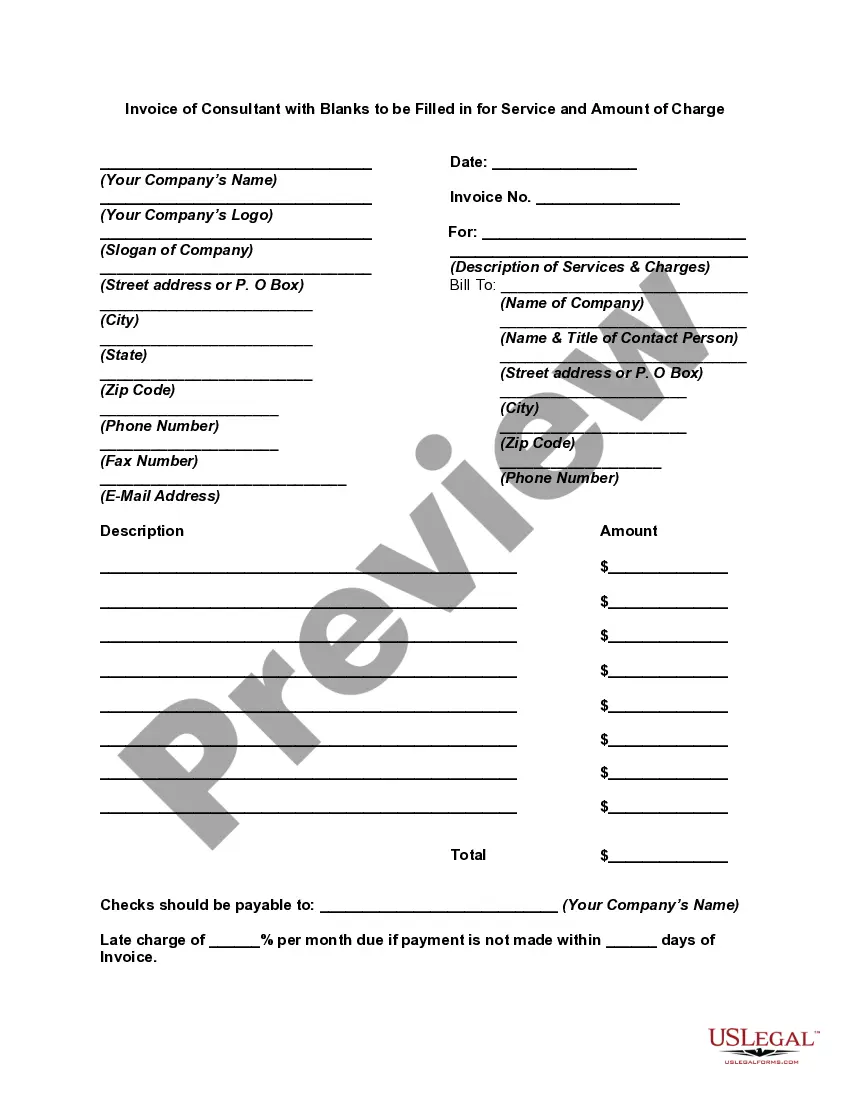

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge

Description

How to fill out Invoice Of Consultant With Blanks To Be Filled In For Service And Amount Of Charge?

It is feasible to spend several hours online attempting to locate the legal document template that complies with the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that are scrutinized by professionals.

You can easily download or print the Massachusetts Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge from our service.

If available, utilize the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Massachusetts Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge.

- Every legal document template you obtain is yours permanently.

- To access another copy of a purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form description to confirm that you have chosen the appropriate form.

Form popularity

FAQ

How to Set Up a Consulting Invoice TemplateInclude Your Company's Information in the Header.Keep Track of Your Hours.Include an Invoice Date.Add Contact Details for Each Client.List Your Services Clearly.Highlight the Payment Due Date.Number Each Invoice.State Clear Payment Terms.More items...?

Steps to create an invoice for consultantsAdd invoice number.Include invoice date.Track your hours.Include professional headers.Mention contact details of your clients.List your services.Mention the payment policies.Payment due date.More items...?

How to Invoice as a ContractorIdentify the Document as an Invoice.Include Your Business Information.Add the Client's Contact Details.Assign a Unique Invoice Number.Add the Invoice Date.Provide Details of Your Services.Include Your Payment Terms.List the Total Amount Due.More items...

To create an invoice for free, build your own invoice using Microsoft Word, Microsoft Excel or Google Docs. You can use a premade invoice template offered by the program you choose, or you can create your own invoice from scratch.

The Best Invoicing Software for 2022Best Overall: FreshBooks.Best for Payment Processing: Square.Best Free Option: Invoice Ninja.Best for Mobile Invoicing: Invoice Simple.Best Automation Solutions: Zoho Invoice.Best for Detailed Reporting: QuickBooks.

How to Invoice as a ConsultantTrack Your Hours. It's common in the consulting industry for businesses to charge clients by the hour.Include A Header.Add Your Client's Contact Details.Include The Invoice Date.Number Your Invoices.Clearly List Your Services.State Your Payment Terms.List the Payment Due Date.More items...

To calculate your hourly consulting rate:Determine what salary you'd like to make.Take that number and divide it by 52 (number of working weeks), then again by 40 (number of hours each week).Take that number and mark it up by 25% to 50%.

What should be included on an invoice for professional servicesThe name of your company.The name of your customer.The date the services were provided.Invoice number.A description of services rendered.Quantity of hours spent on services rendered.The price you're charging for the services or your hourly rate.More items...?

How to Invoice Clients for Consulting ServicesTrack the number of hours you work.Add your business details.Add your client's details.Make sure you include an invoice number.Clearly list your services and hourly rate.Outline your payment terms.Bill clients often.Send your invoices immediately.More items...

How to Invoice as a ContractorIdentify the Document as an Invoice.Include Your Business Information.Add the Client's Contact Details.Assign a Unique Invoice Number.Add the Invoice Date.Provide Details of Your Services.Include Your Payment Terms.List the Total Amount Due.More items...