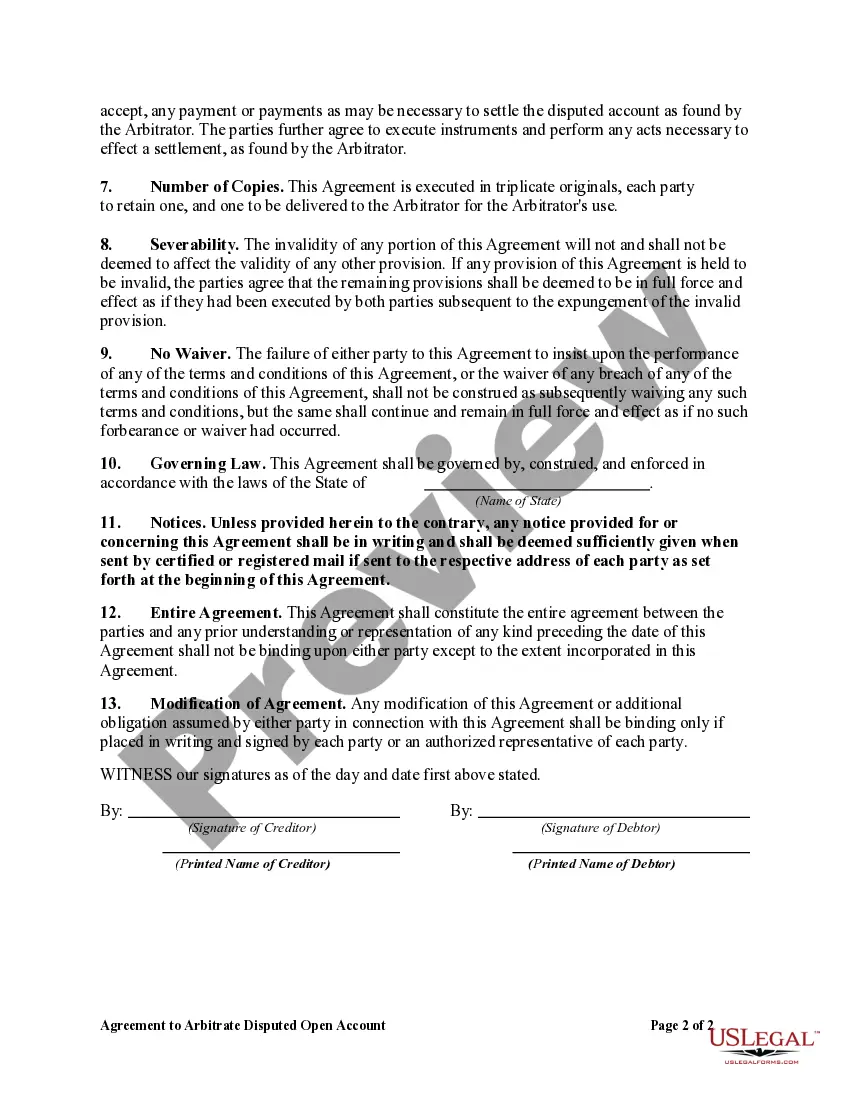

Massachusetts Agreement to Arbitrate Disputed Open Account

Description

How to fill out Agreement To Arbitrate Disputed Open Account?

Selecting the most suitable legal document template can pose a challenge.

Certainly, there are numerous templates accessible online, but how can you identify the legal template you require? Utilize the US Legal Forms website.

This service provides thousands of templates, including the Massachusetts Agreement to Arbitrate Disputed Open Account, which you can utilize for business and personal needs.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to locate the Massachusetts Agreement to Arbitrate Disputed Open Account.

- Use your account to search for the legal forms you have previously purchased.

- Visit the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have chosen the correct form for your city/region. You can view the form using the Preview button and read the form description to confirm it is the right one for you.

Form popularity

FAQ

Writing an effective arbitration agreement involves clarity and specificity, particularly in a Massachusetts Agreement to Arbitrate Disputed Open Account. You should include clear definitions, the scope of disputes, and the process for arbitration. It's advisable to consult a legal professional to ensure compliance with Massachusetts laws and to create a document that protects your interests adequately.

Deciding whether to agree to an arbitration agreement, like the Massachusetts Agreement to Arbitrate Disputed Open Account, requires thoughtful consideration of your legal needs. While arbitration often offers efficiency and lower costs, it also limits certain rights. Evaluate your personal circumstances and the implications of the agreement. Seek advice from a legal expert to align your decision with your best interests.

While arbitration can be a quick resolution method, some individuals prefer to avoid it due to its limited appeal options and potential costs. A Massachusetts Agreement to Arbitrate Disputed Open Account may restrict your ability to pursue certain claims. Carefully consider what you might be giving up by agreeing to arbitration. Discussing these concerns with a legal professional might help you weigh your options.

Opting out of an arbitration agreement depends on your specific situation. If you feel uncomfortable with the terms of a Massachusetts Agreement to Arbitrate Disputed Open Account, it might be beneficial to look for options to opt-out. However, consider the implications of seeking traditional litigation, which may take more time and resources. A lawyer can guide you through this important decision.

Yes, arbitration agreements are generally enforceable in Massachusetts, provided they meet certain legal standards. This enforceability stems from both state laws and federal regulations. If your contract includes a Massachusetts Agreement to Arbitrate Disputed Open Account, it is likely binding. However, exceptions may apply, so reviewing it with a legal professional is wise.

If you don't agree with arbitration in the context of a Massachusetts Agreement to Arbitrate Disputed Open Account, you may need to pursue litigation instead. This can lead to a longer, more expensive process in court. It's essential to understand your rights and options fully before making a decision. Consulting with a legal expert can provide clarity.

To invoke a Massachusetts Agreement to Arbitrate Disputed Open Account, you typically need to provide written notice to the other party. This notice should detail your intent to engage in arbitration and outline the issues at dispute. Following the terms set forth in the agreement, you may then select an arbitrator or an arbitration forum. Ensure that you understand the process thoroughly and comply with any specified timelines.

Signing a Massachusetts Agreement to Arbitrate Disputed Open Account generally means you waive your right to sue in court. However, this does not eliminate your legal rights entirely; you must follow the arbitration process outlined in the agreement. If the arbitration fails to resolve the issue, you may have grounds for further legal action. Always seek legal advice to understand your specific situation.

While it is possible to challenge an arbitration agreement, doing so can be complex. If you signed a Massachusetts Agreement to Arbitrate Disputed Open Account, you're typically bound by its terms. Circumstances such as fraud or unconscionability may allow you to contest the agreement. It's essential to consult with a legal professional to understand your options.

To arbitrate a dispute, you start by preparing your case documents and filing a notice of arbitration in accordance with your Massachusetts Agreement to Arbitrate Disputed Open Account. Next, both parties exchange information and may select an arbitrator, who will oversee the process. You will then present your evidence and arguments, leading to a decision that is typically final and binding. This streamlined process allows for a quicker resolution compared to the court system.