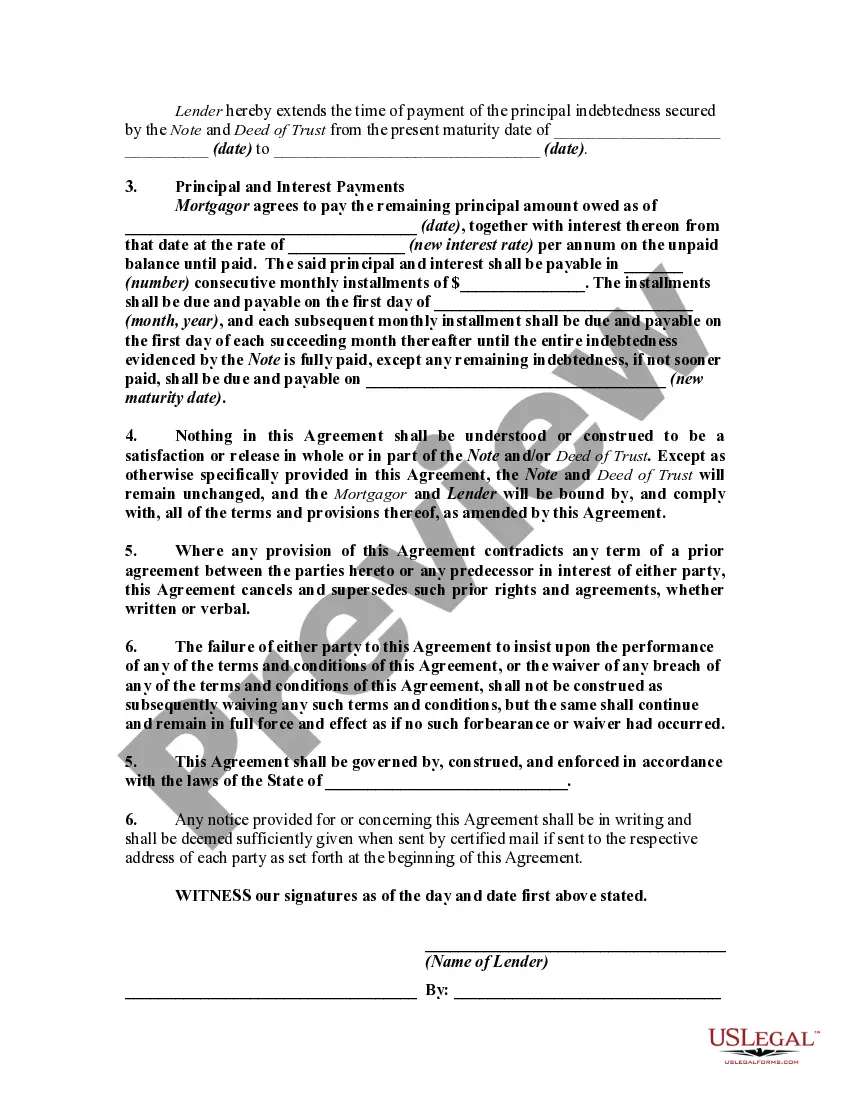

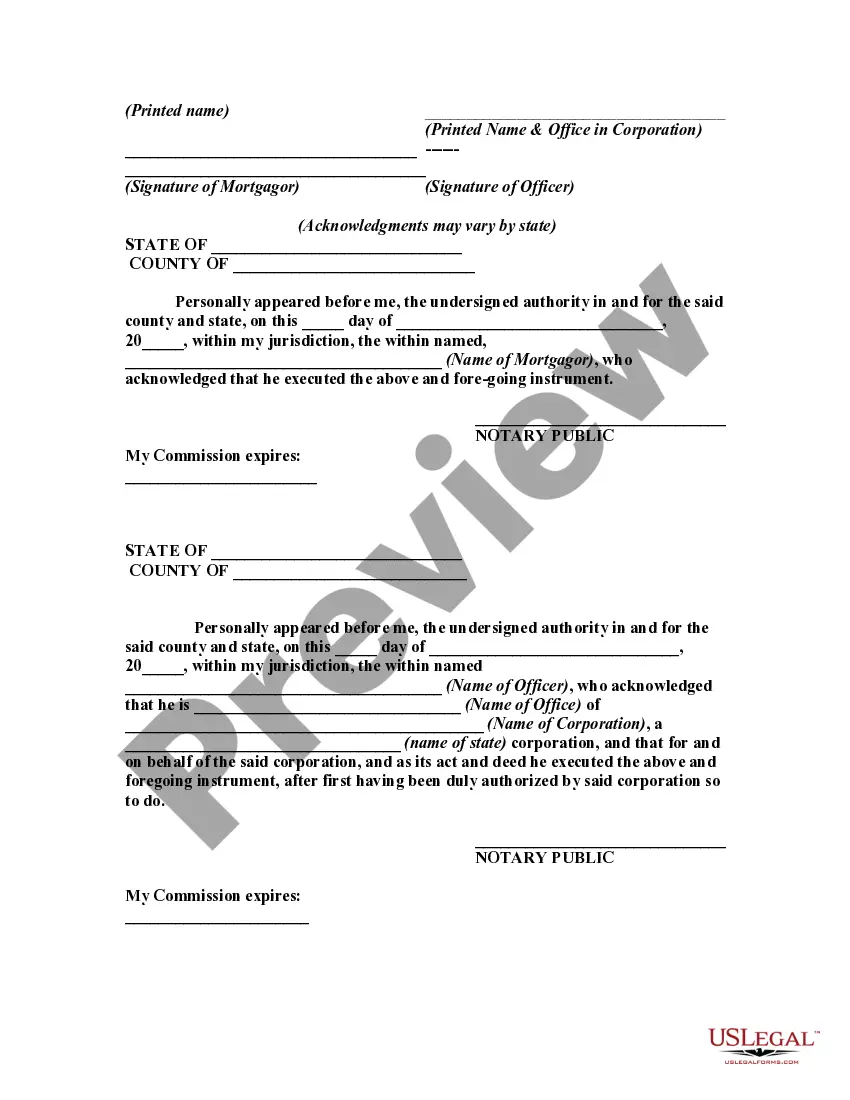

If you want to complete, down load, or print out authorized record web templates, use US Legal Forms, the largest assortment of authorized forms, that can be found on the Internet. Make use of the site`s simple and easy practical research to find the documents you want. A variety of web templates for organization and personal purposes are sorted by categories and suggests, or keywords. Use US Legal Forms to find the Massachusetts Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust within a couple of clicks.

Should you be already a US Legal Forms consumer, log in in your profile and click on the Down load key to find the Massachusetts Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust. You may also access forms you earlier delivered electronically from the My Forms tab of your profile.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form for the correct city/nation.

- Step 2. Use the Preview choice to look through the form`s content material. Do not overlook to see the description.

- Step 3. Should you be unhappy with all the kind, utilize the Search industry near the top of the screen to discover other versions in the authorized kind format.

- Step 4. Once you have identified the form you want, select the Purchase now key. Pick the prices program you like and add your accreditations to sign up on an profile.

- Step 5. Process the financial transaction. You may use your credit card or PayPal profile to finish the financial transaction.

- Step 6. Choose the structure in the authorized kind and down load it in your system.

- Step 7. Comprehensive, change and print out or indication the Massachusetts Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust.

Every single authorized record format you buy is your own for a long time. You might have acces to every single kind you delivered electronically within your acccount. Click on the My Forms segment and decide on a kind to print out or down load once more.

Compete and down load, and print out the Massachusetts Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust with US Legal Forms. There are many expert and state-certain forms you can utilize to your organization or personal needs.