This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees

Description

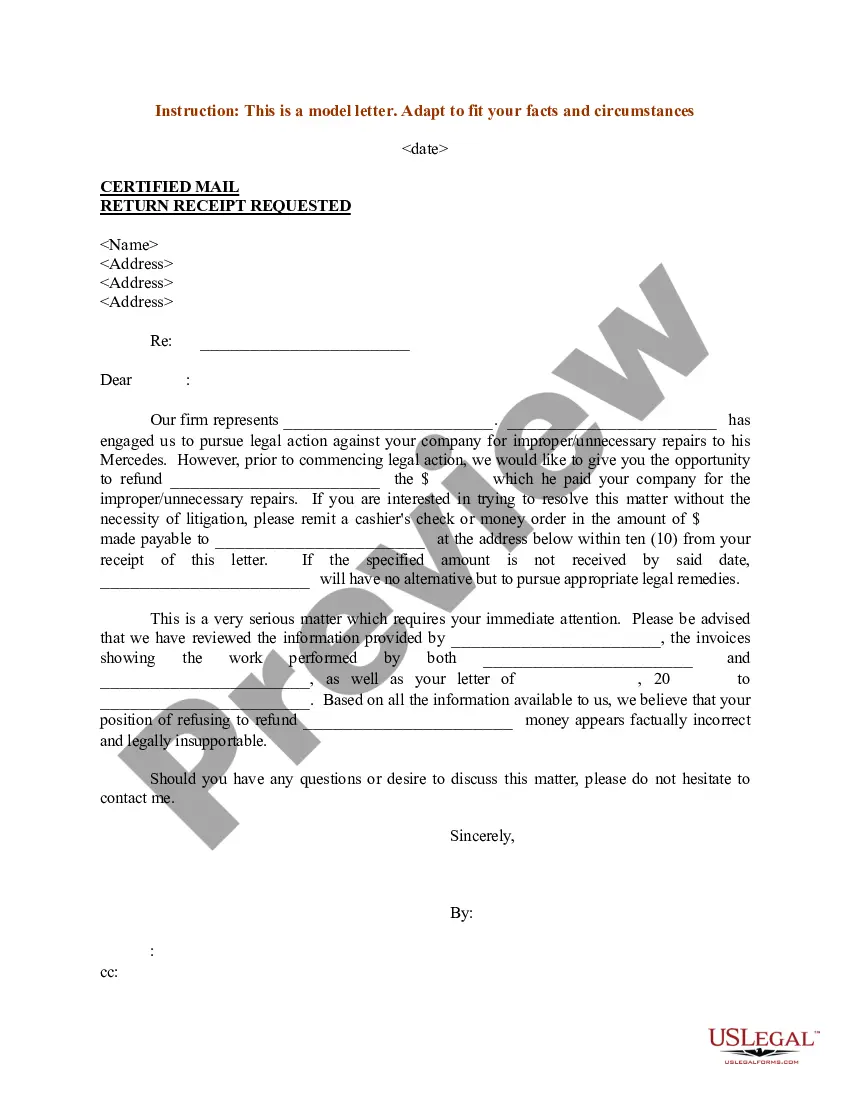

How to fill out Installment Promissory Note With Acceleration Clause And Collection Fees?

It is feasible to dedicate hours online trying to discover the legal document format that satisfies the federal and state regulations you need.

US Legal Forms offers thousands of legal templates that have been reviewed by professionals.

You can effortlessly obtain or generate the Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees from the service.

First, ensure you have selected the appropriate format for your region/city of choice. Review the form description to confirm that you have chosen the correct form. If available, make use of the Preview button to browse through the format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Afterward, you can complete, modify, generate, or sign the Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees.

- Every legal document you procure is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

When someone defaults on a promissory note, you should first review the terms outlined in the note, particularly regarding the acceleration clause and any potential collection fees. It's advisable to communicate with the borrower to discuss the situation and explore repayment options. If necessary, you can also seek legal counsel to enforce the terms of a Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees.

In Massachusetts, promissory notes do not typically need to be notarized to be valid. However, notarization can add an extra layer of credibility and protection for all parties involved. If your note includes significant financial terms, such as in a Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees, you might consider notarization for added security.

A valid promissory note must contain essential elements such as the borrower's identity, the lender's details, the pledge to repay, and the payment timeline. It should also address the interest rate and late payment penalties, particularly if it includes an acceleration clause. Complying with Massachusetts laws ensures the enforceability of a Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees.

Several factors can render a promissory note invalid, such as lack of essential details like the amount, terms, or signatures. If the terms are unclear or if one of the parties was not of sound mind when signing, the note may also be invalid. Additionally, a Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees must adhere to legal requirements; otherwise, it might not hold up in court.

A Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees requires clear terms for repayment, including the principal amount, interest rate, and payment schedule. Additionally, both parties must sign the document, demonstrating mutual agreement. It's also essential to specify the consequences of non-payment, which can include legal action and collection fees.

The acceleration clause in a Massachusetts Installment Promissory Note allows the lender to require full repayment of the outstanding balance if certain conditions are met. For example, if the borrower misses a payment or breaches any terms of the agreement, the lender has the right to demand immediate payment of the entire remaining amount. This clause protects the lender's interests and encourages timely payments from the borrower.

In a promissory note, such as a Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees, the acceleration clause specifies the conditions under which the lender can require full repayment. It often occurs when the borrower misses a payment or breaches other terms of the agreement. Understanding this clause is crucial, as it can impact your financial obligations and overall repayment strategy.

To accelerate a Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees, you must include a clause in the note itself that allows for this action upon default. When the borrower misses a payment, you can declare the full balance immediately due and payable. It's important that this process follows the agreed terms within the note to ensure legal enforceability.

To collect on a Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees, start by sending reminders to the borrower about missed payments. If those efforts fail, you may need to explore legal action, such as filing in small claims court or engaging a collection agency. Consider using US Legal Forms for templates and guidance on how to proceed.

To legally enforce a Massachusetts Installment Promissory Note with Acceleration Clause and Collection Fees, you must first document the borrower's failure to comply with the payment terms. Next, you may need to file a lawsuit in a local court, presenting your evidence and the note itself. Once the court issues a judgment, you can take legal steps to collect the owed amounts.