Massachusetts Sample Letter for Tax Deeds

Description

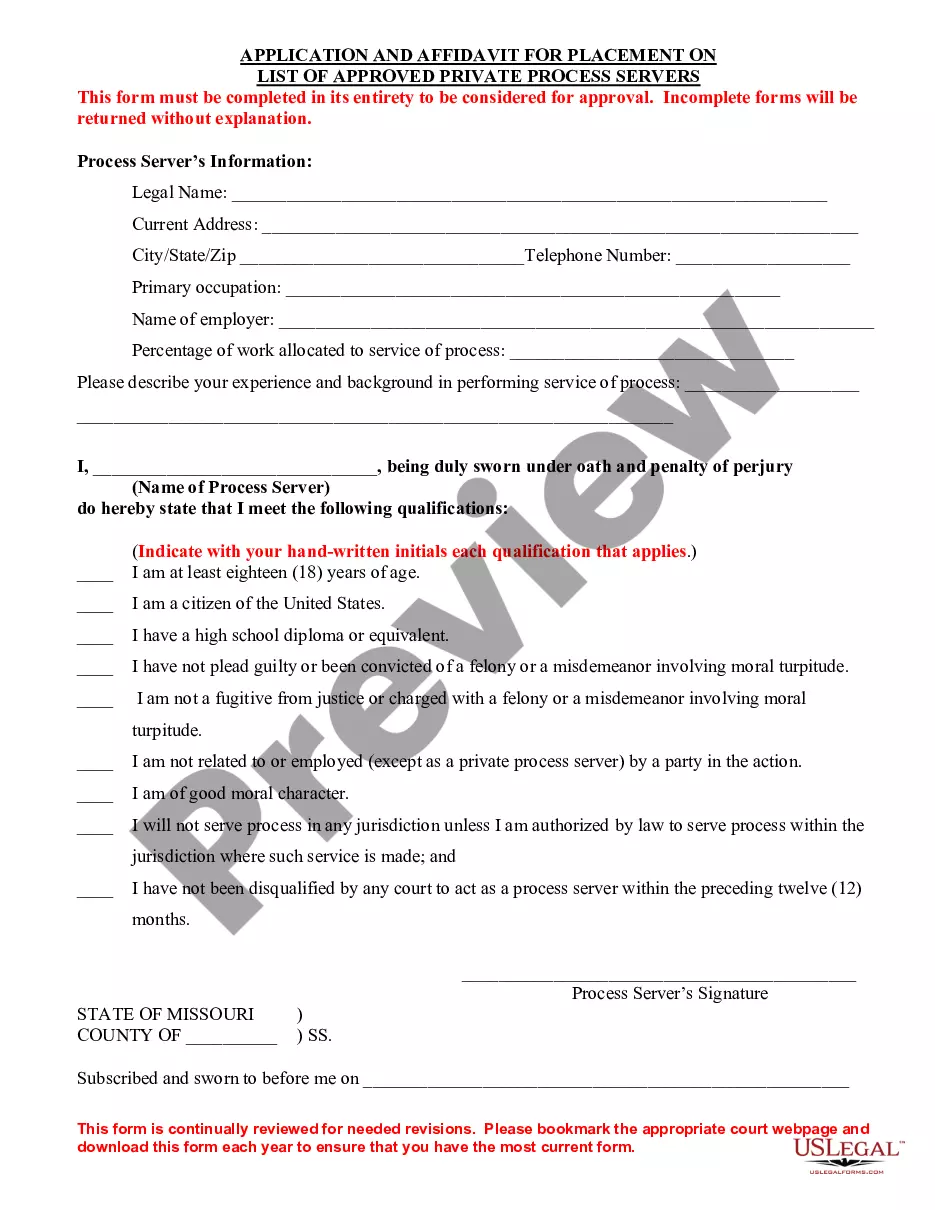

How to fill out Sample Letter For Tax Deeds?

It is feasible to spend hours online searching for the legal document template that meets the state and national requirements you desire.

US Legal Forms provides a vast array of legal forms that are vetted by professionals. You can easily download or print the Massachusetts Sample Letter for Tax Deeds from my services.

If you already possess a US Legal Forms account, you can sign in and then click the Acquire button. After that, you can complete, modify, print, or sign the Massachusetts Sample Letter for Tax Deeds. Each legal document template you receive is yours permanently. To obtain an additional copy of a purchased form, go to the My documents section and click the corresponding button.

Choose the format of the document and download it to your device. Make changes to your document if necessary. You can complete, modify, sign, and print the Massachusetts Sample Letter for Tax Deeds. Obtain and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow these simple instructions below.

- First, ensure that you have selected the correct document template for the county/area of your choice. Review the form description to confirm you have chosen the right one.

- If available, use the Review button to preview the document template as well.

- If you wish to find another version of the form, utilize the Search field to locate the template that suits your needs and specifications.

- Once you have found the template you want, click Get now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your Visa, Mastercard, or PayPal account to pay for the legal form.

Form popularity

FAQ

Massachusetts Collection Notices Notice of Assessment ? This notice explains your tax due plus penalties and interest. It also outlines your taxpayer rights and appeal options. If you don't appeal or make payment arrangements within 30 days, the MA DOR will continue collection actions on your account.

How long does a judgment lien last in Massachusetts? A judgment lien in Massachusetts will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or 30 days (for liens on personal property).

However, a tax taking by itself does not give the city or town full ownership of your property ? it is still possible at this point for you to reclaim ownership of your property by paying what you owe.

A tax lien foreclosure is a process through which you can lose ownership of your property if you do not pay your real estate taxes or water/sewer bill. This foreclosure can result in you losing your property entirely, even if the amount you owe is much less than your property's value.

By law Massachusetts can have tax lien sales, but most municipalities conduct tax deed sales instead. 16%, but municipalities do not conduct tax lien sales. Following a tax deed sale there is no right of redemption. Municipalities handle the sales, and rules can vary.

If the tax is not paid within six months, a Petition to Foreclose is filed in Massachusetts Land Court. The interest rate on a Tax Title account is 16% as established by M.G.L.

Tax Lien. To protect the Commonwealth's interests, the collector will file a "Notice of Massachusetts Tax Lien." The tax lien is a public record and attaches to all of the taxpayer's real and personal property and may prevent the sale or transfer of the property attached.

You must be 70 or older. For Clauses 41C and 41C½, the eligible age may be reduced to 65 or older, by vote of the legislative body of your city or town. You must own and occupy the property as your domicile.