A license authorizes the holder to do something that he or she would not be entitled to do without the license. Licensing may be directed toward revenue raising purposes, or toward regulation of the licensed activity, or both. Statutes frequently require that a person obtain a license before practicing certain professions such as law or medicine, or before carrying on a particular business such as that of a real estate broker or stock broker. If the license is required to protect the public from unqualified persons, an assignment of that license to secure a loan would probably not be enforceable.

Massachusetts Assignment of Business License as Security for a Loan

Description

How to fill out Assignment Of Business License As Security For A Loan?

Are you inside a situation where you need paperwork for either enterprise or individual reasons just about every day time? There are tons of authorized document templates available online, but locating ones you can rely isn`t effortless. US Legal Forms gives 1000s of type templates, just like the Massachusetts Assignment of Business License as Security for a Loan, which are published to meet federal and state requirements.

When you are presently informed about US Legal Forms site and get a merchant account, basically log in. After that, you can acquire the Massachusetts Assignment of Business License as Security for a Loan web template.

Should you not come with an account and need to begin using US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for your right area/region.

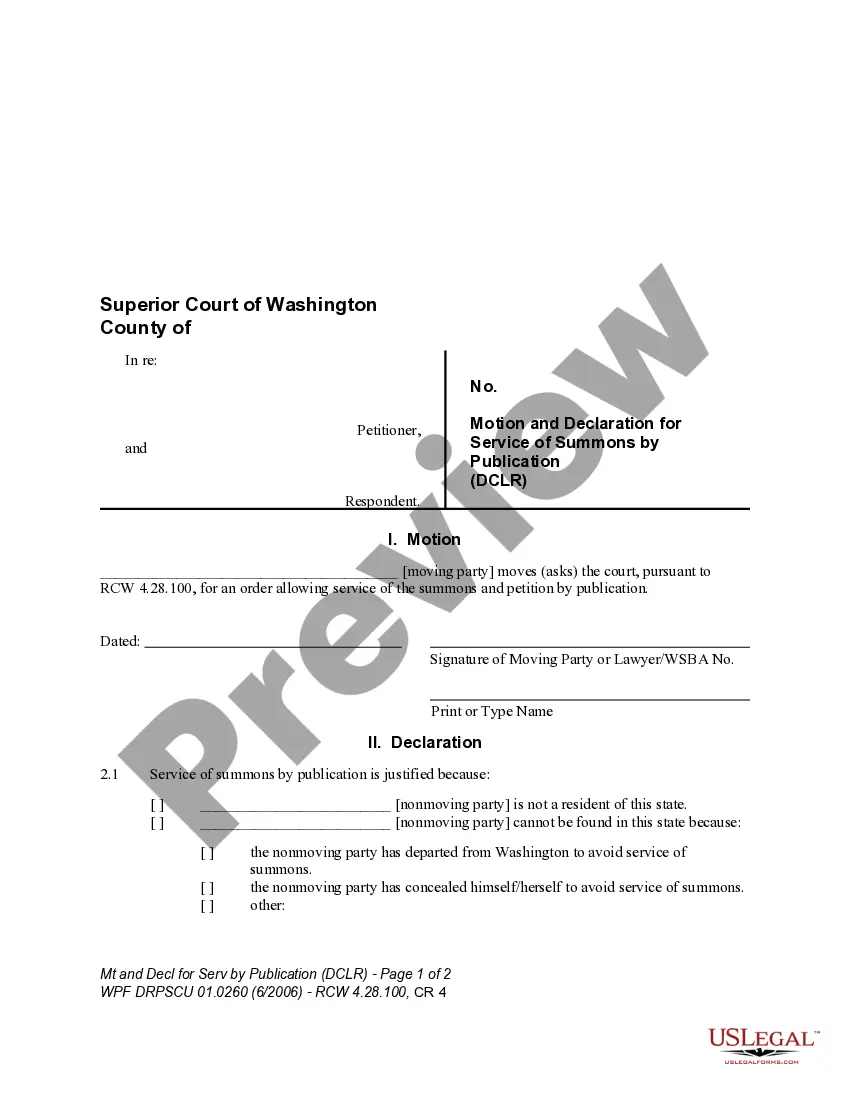

- Take advantage of the Review button to check the shape.

- Read the outline to actually have chosen the proper type.

- If the type isn`t what you are seeking, use the Look for industry to discover the type that meets your requirements and requirements.

- If you obtain the right type, click on Buy now.

- Pick the pricing program you want, fill in the specified details to make your account, and buy the transaction utilizing your PayPal or credit card.

- Pick a hassle-free paper formatting and acquire your duplicate.

Locate all the document templates you may have purchased in the My Forms menu. You can get a extra duplicate of Massachusetts Assignment of Business License as Security for a Loan any time, if required. Just select the essential type to acquire or print out the document web template.

Use US Legal Forms, the most considerable selection of authorized forms, to save efforts and avoid blunders. The assistance gives expertly manufactured authorized document templates which you can use for an array of reasons. Make a merchant account on US Legal Forms and commence producing your daily life a little easier.