Are you presently within a position that you will need documents for both company or personal functions virtually every working day? There are a lot of legal file layouts available on the net, but discovering versions you can trust isn`t effortless. US Legal Forms delivers 1000s of develop layouts, such as the Massachusetts Satisfaction of Mortgage by a Corporation, which are created to meet federal and state demands.

Should you be currently acquainted with US Legal Forms site and have your account, just log in. Following that, you can down load the Massachusetts Satisfaction of Mortgage by a Corporation format.

If you do not have an accounts and wish to start using US Legal Forms, follow these steps:

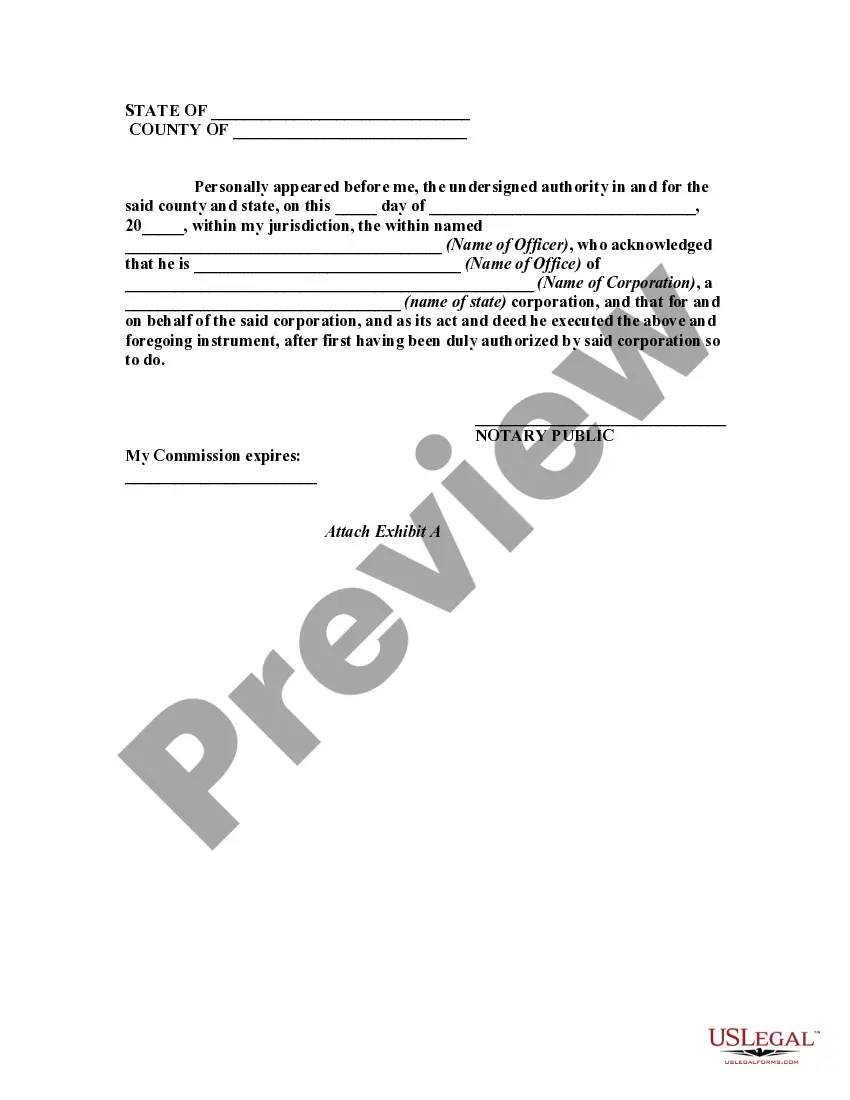

- Obtain the develop you will need and ensure it is for your right city/county.

- Use the Preview option to analyze the form.

- Read the explanation to actually have chosen the correct develop.

- When the develop isn`t what you`re searching for, make use of the Look for field to find the develop that meets your needs and demands.

- Once you find the right develop, just click Get now.

- Opt for the pricing strategy you need, submit the desired information to create your bank account, and pay money for the order utilizing your PayPal or charge card.

- Select a practical document format and down load your copy.

Find all of the file layouts you might have bought in the My Forms food selection. You can obtain a more copy of Massachusetts Satisfaction of Mortgage by a Corporation whenever, if required. Just click the necessary develop to down load or print out the file format.

Use US Legal Forms, probably the most extensive assortment of legal kinds, to conserve efforts and prevent faults. The support delivers professionally created legal file layouts that can be used for a variety of functions. Produce your account on US Legal Forms and initiate creating your lifestyle a little easier.