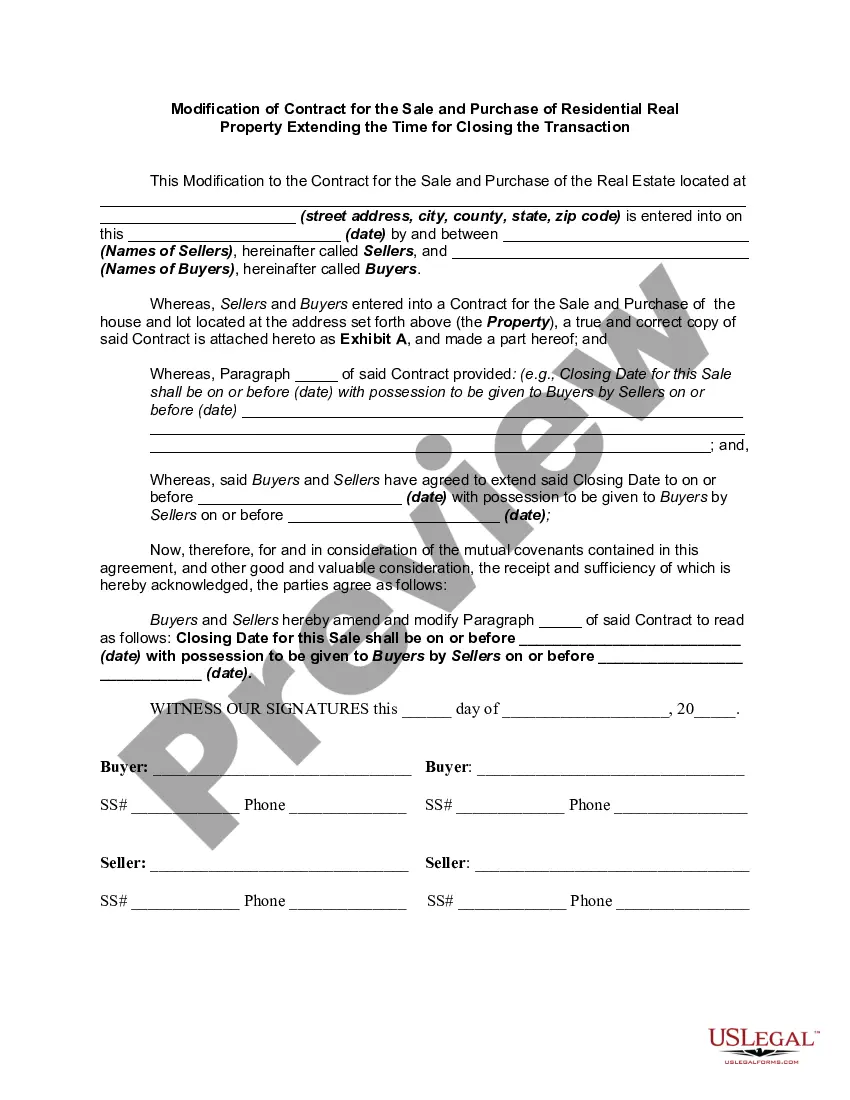

This form is a sample of an agreement to extend the time of a loan commitment in order to consummate a purchase of real property which will be security for the loan. In effect the loan applicant is asking for an extension of the date of closing set forth in the loan commitment or application.

Massachusetts Extension of Loan Closing Date

Description

How to fill out Extension Of Loan Closing Date?

Are you currently inside a situation in which you will need paperwork for either organization or personal functions almost every day time? There are plenty of legal record themes available on the Internet, but discovering types you can rely on isn`t straightforward. US Legal Forms gives thousands of form themes, like the Massachusetts Extension of Loan Closing Date, that are published to satisfy state and federal needs.

Should you be previously familiar with US Legal Forms internet site and also have a merchant account, just log in. Following that, you can down load the Massachusetts Extension of Loan Closing Date format.

Should you not offer an bank account and wish to begin to use US Legal Forms, follow these steps:

- Find the form you require and make sure it is for the right city/area.

- Utilize the Preview switch to examine the shape.

- Read the description to actually have selected the proper form.

- In the event the form isn`t what you are searching for, use the Look for area to obtain the form that meets your requirements and needs.

- When you obtain the right form, click on Purchase now.

- Pick the costs program you want, complete the required info to create your account, and buy the order making use of your PayPal or credit card.

- Pick a convenient file file format and down load your backup.

Locate each of the record themes you possess purchased in the My Forms food list. You can get a further backup of Massachusetts Extension of Loan Closing Date at any time, if possible. Just click the required form to down load or printing the record format.

Use US Legal Forms, probably the most extensive variety of legal varieties, to conserve time as well as prevent mistakes. The support gives skillfully manufactured legal record themes which you can use for a range of functions. Create a merchant account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

Whatever the reason for the delay, if the home doesn't close on time, the purchase contract will usually expire. However, this doesn't always mean the house purchase won't go ahead. The seller can agree to delay the closing date to give the buyer some extra time.

Negotiate a per diem penalty In the event that the buyer requests an extension, the seller can agree under the conditions of the buyer paying a per diem penalty until they close on the sale. A per diem penalty is a fee that the buyer pays to cover the inconvenience of pushing the closing date back.

There are various reasons why a buyer or seller might request an extension. One of the most popular extensions is a closing extension, but requesting to extend the inspection period or mortgage contingency period are also pretty common.

Accepting the Breach and Terminating the Agreement: If the purchaser is unable to close, and the seller is unwilling to grant an extension, the seller might elect to accept the breach and terminate the Agreement and claim the deposit as damages.

Negotiate a Per Diem Penalty In addition to compensating the seller for the extra mortgage, tax, and insurance payments the seller still has to make due to the delayed closing, a per diem penalty is charged to the buyer as compensation for the inconvenience of delaying the delayed closing.

There are a number of reasons why a seller might cause delays at closing. In some cases, a seller tries to renegotiate the purchase price or terms of the sale. In other cases, a seller may have difficulty with financing or may have second thoughts about selling the property.

It is quite common for the mortgage commitment date to be extended. Often, the lender simply needs more time to clear conditions on the loan. The burden is on the Buyer to request and receive from the Seller in writing any mortgage commitment date extension.

In most cases, if the home does not close on time, the purchase contract expires if the seller does not agree to delay closing to give the buyer some extra time. However, this only sometimes means the house purchase will not go ahead.