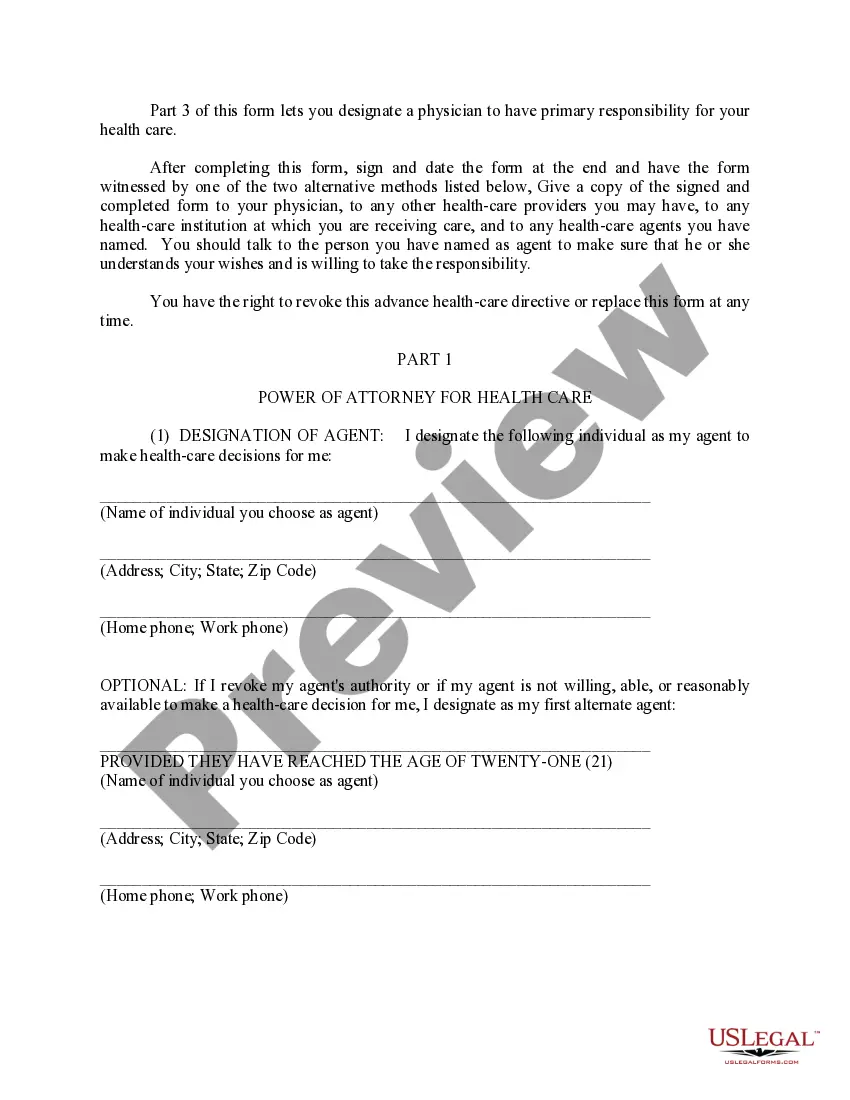

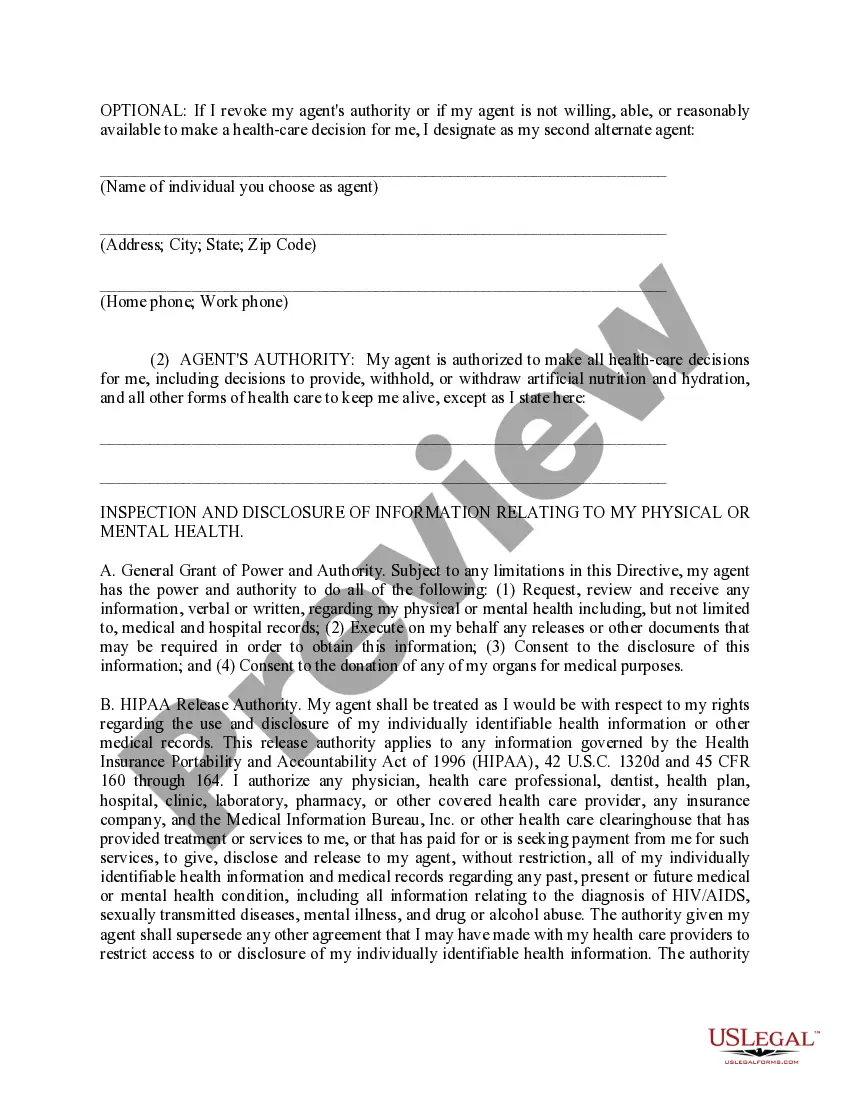

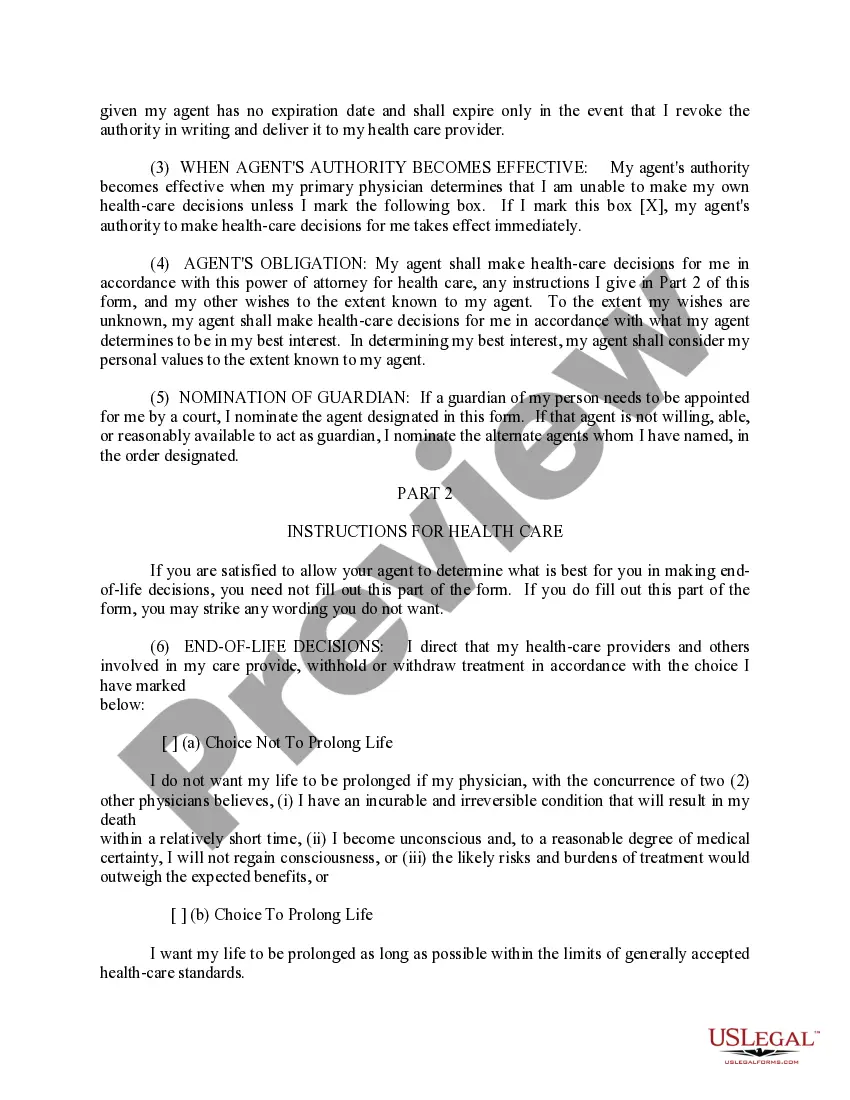

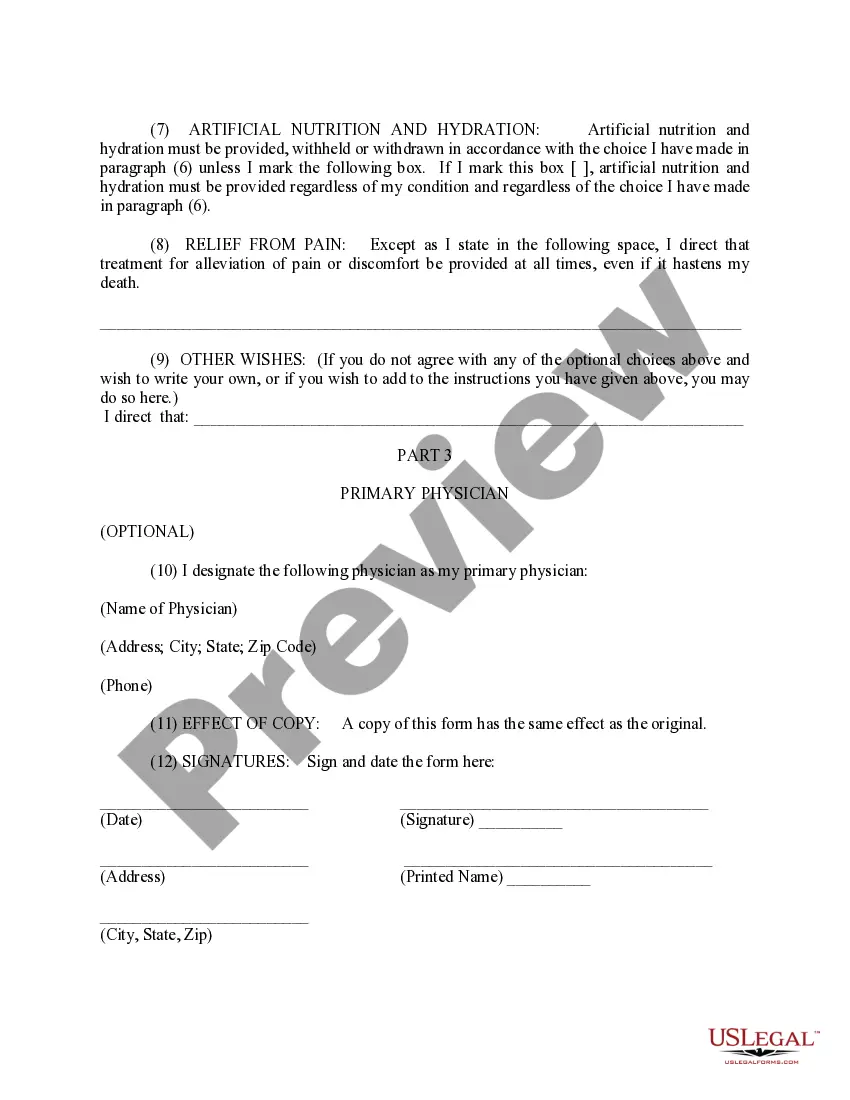

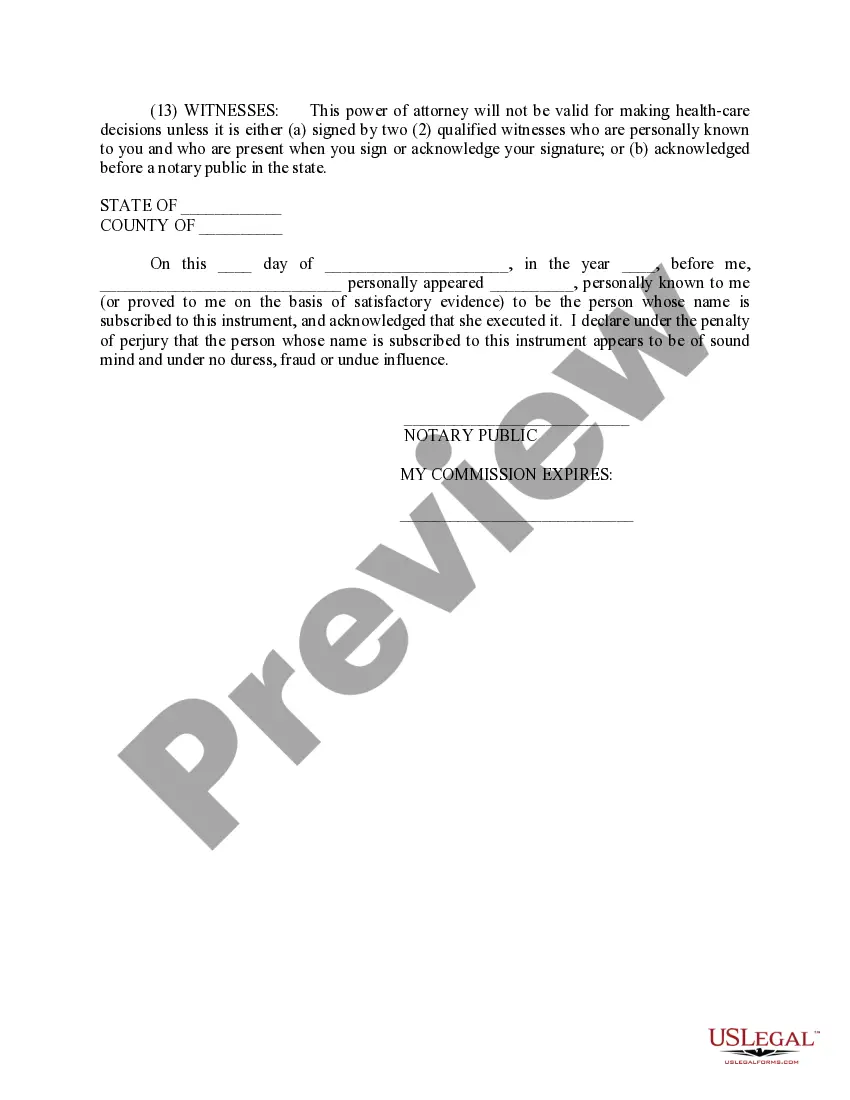

Massachusetts Uniform Healthcare Act Form

Description

How to fill out Uniform Healthcare Act Form?

If you wish to finalize, acquire, or produce legitimate document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have identified the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your system. Step 7. Complete, modify, and print or sign the Massachusetts Uniform Healthcare Act Form. Each legal document template you purchase is yours forever. You will have access to every form you acquired within your account. Select the My documents section and choose a form to print or download again. Compete and acquire, and print the Massachusetts Uniform Healthcare Act Form with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to find the Massachusetts Uniform Healthcare Act Form in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to access the Massachusetts Uniform Healthcare Act Form.

- You can also find forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other types of the legal form template.

Form popularity

FAQ

How to find your 1095-A online. Note: Your 1095-A may be available in your HealthCare.gov account as early as mid-January, or as late as February 1. Log in to your HealthCare.gov account. Under "Your Existing Applications," select your 2022 application ? not your 2023 application.

Those who were enrolled in a Health Connector or ConnectorCare Plan all or part of 2022 should receive their IRS Form 1095-A on or around January 31, 2023. Need a copy of or corrected Form 1095-A? New this year: You can now sign into your account and go to the Payment Center to download a copy of your tax forms.

Should I attach Form 1095-A, 1095-B or 1095-C to my tax return? No. Although you may use the information on the forms to help complete your tax return, these forms should not be attached to your return or sent to the IRS. The issuers of the forms are required to send the information to the IRS separately.

Q: What should I do if I don't receive a Form 1095-A? If you purchased coverage through the Marketplace and you have not received your Form 1095-A, you should contact the Marketplace from which you received coverage. You should wait to receive your Form 1095-A before filing your taxes.

Important: If you would like to request a duplicate Form 1095-B, you may visit our self-service site at .masshealthtaxform.com or contact the MassHealth Customer Service Center at (866) 682-6745; TDD/TTY: 711. You will need your MassHealth member ID, last name, and date of birth to request your Form 1095-B.

Full-year residents and certain part-year residents must complete and enclose Schedule HC with return.

This form is provided by your health insurance carrier and not the GIC. To download an electronic copy of your Form 1099-HC, you may sign into your medical insurance carrier's online account, or contact their member services at the number on your ID card for more information.

Click the ?Make a Payment? button OR scroll down to the ?Health Connector Billing and Notices? section and click the ?Go? button to open the member portal. Click on ?Tax Forms? in the member portal menu to find your Form 1095-A available for download.