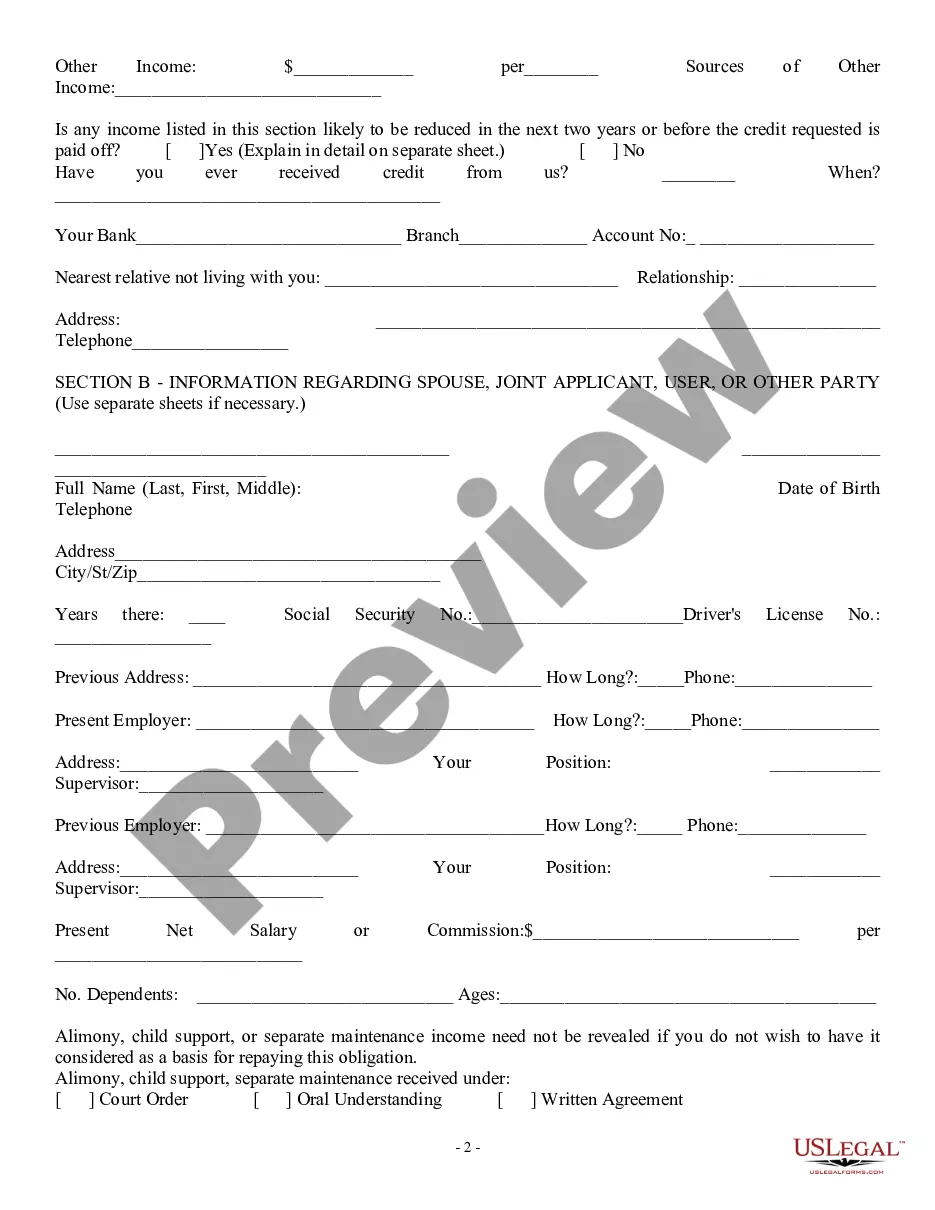

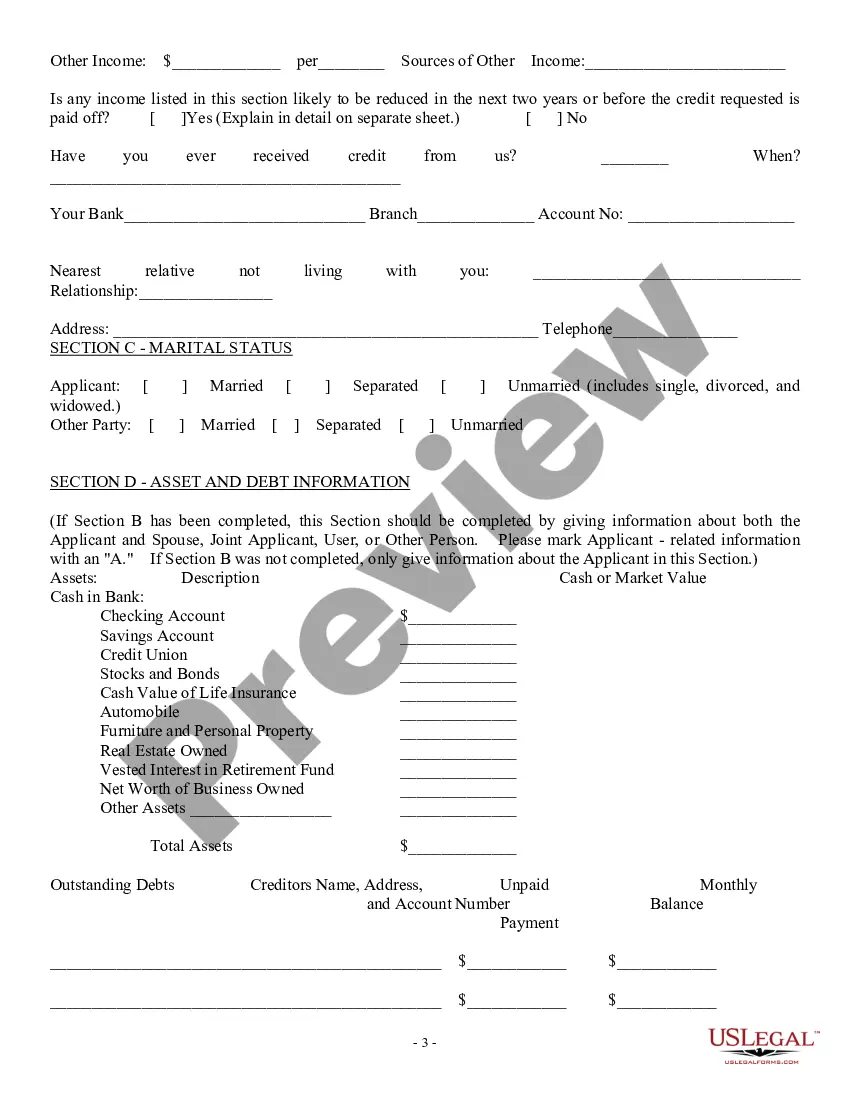

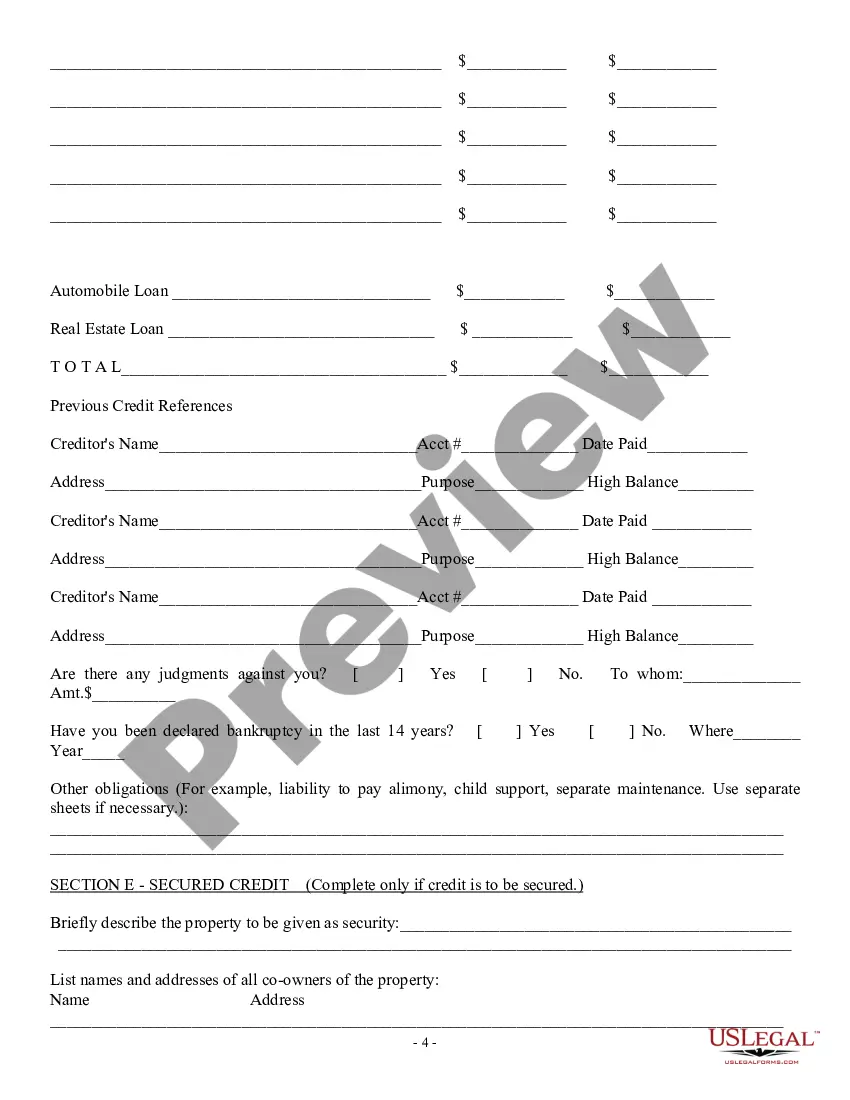

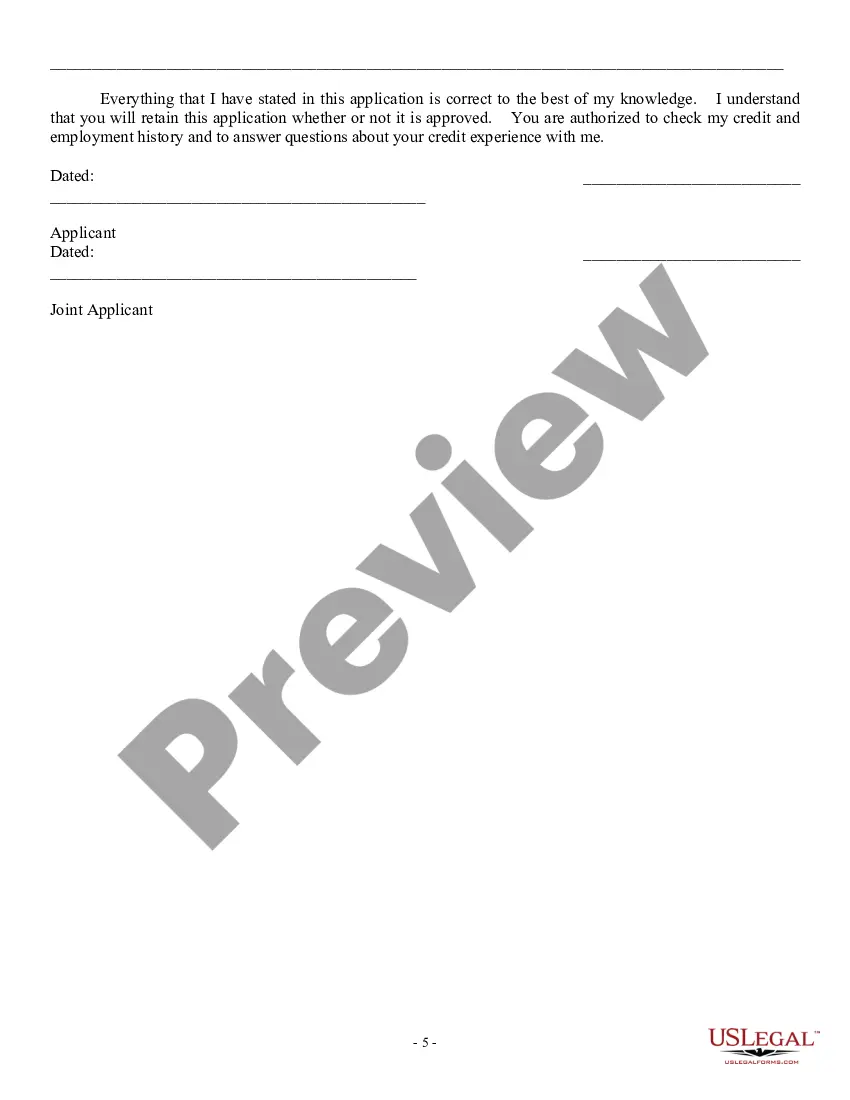

Title: Massachusetts Consumer Loan Application — Personal Loan Agreement: Understanding its Necessity and Types Introduction: The Massachusetts Consumer Loan Application — Personal Loan Agreement is a crucial set of documents that borrowers must comprehend when applying for personal loans in the state. This comprehensive agreement outlines the terms and conditions between the lender and the borrower, ensuring transparency and protection for both parties involved. In Massachusetts, there are several types of loan agreements that fall under this category. Keywords: Massachusetts, Consumer Loan Application, Personal Loan Agreement, types 1. Understanding the Massachusetts Consumer Loan Application: — The Massachusetts Consumer Loan Application is a standardized form that borrowers must fill out when seeking a personal loan from a licensed lender in the state. — It serves as an official request outlining the borrower's personal information, financial situation, and loan requirements. — The application helps lenders assess the borrower's eligibility and determine the loan amount, interest rates, and other terms specific to the individual's circumstances. Keywords: Massachusetts, Consumer Loan Application, personal loan, standardized form, borrower, lender, eligibility, interest rates, terms 2. Personal Loan Agreement within Massachusetts: — A Personal Loan Agreement is a legally binding contract between the lender and borrower that specifies the terms and conditions of the loan. — In Massachusetts, this agreement must comply with the state's laws and regulations to ensure fairness and protect the rights of all parties involved. — It covers essential aspects such as loan amount, interest rates, repayment schedule, fees, penalties, and any additional terms mutually agreed upon by the lender and borrower. Keywords: Personal Loan Agreement, Massachusetts, legally binding contract, terms and conditions, laws and regulations, fairness, borrower, lender, loan amount, interest rates, repayment schedule, fees, penalties 3. Types of Massachusetts Personal Loan Agreements: a. Secured Personal Loan Agreement: — A secured personal loan agreement requires collateral (e.g., property, vehicle, savings account) that the lender can seize if the borrower defaults on the loan. — This type of loan generally offers lower interest rates as the collateral mitigates the lender's risk. b. Unsecured Personal Loan Agreement: — In an unsecured personal loan agreement, no collateral is required. The loan is solely based on the borrower's creditworthiness and income. — Due to the absence of collateral, these loans usually have higher interest rates compared to secured loans. c. Fixed-Rate Personal Loan Agreement: — A fixed-rate personal loan agreement entails a fixed interest rate throughout the loan term, offering predictable monthly payments. — Borrowers prefer this type of loan as they can budget and plan accordingly without worrying about fluctuating interest rates. d. Variable-Rate Personal Loan Agreement: — A variable-rate personal loan agreement involves an interest rate that can fluctuate over time, usually based on a reference index. — Borrowers opting for this type of loan must be prepared for potential changes in their monthly payments due to interest rate variations. Keywords: Massachusetts, Personal Loan Agreements, types, secured, unsecured, fixed-rate, variable-rate, collateral, creditworthiness, interest rates, monthly payments, default Conclusion: Understanding the Massachusetts Consumer Loan Application — Personal Loan Agreement is vital for individuals seeking personal loans in the state. It ensures clarity and protection for both borrowers and lenders, outlining all terms and conditions. The types of personal loan agreements within Massachusetts include secured, unsecured, fixed-rate, and variable-rate, offering borrowers different options based on their needs and preferences.

Massachusetts Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Massachusetts Consumer Loan Application - Personal Loan Agreement?

Are you currently in a placement the place you need to have papers for sometimes company or specific functions just about every day time? There are plenty of legitimate record web templates available online, but discovering types you can rely on isn`t simple. US Legal Forms gives thousands of develop web templates, such as the Massachusetts Consumer Loan Application - Personal Loan Agreement, that are published to meet state and federal needs.

When you are presently familiar with US Legal Forms site and also have a merchant account, basically log in. Afterward, you are able to down load the Massachusetts Consumer Loan Application - Personal Loan Agreement format.

If you do not come with an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the develop you want and ensure it is for your correct town/state.

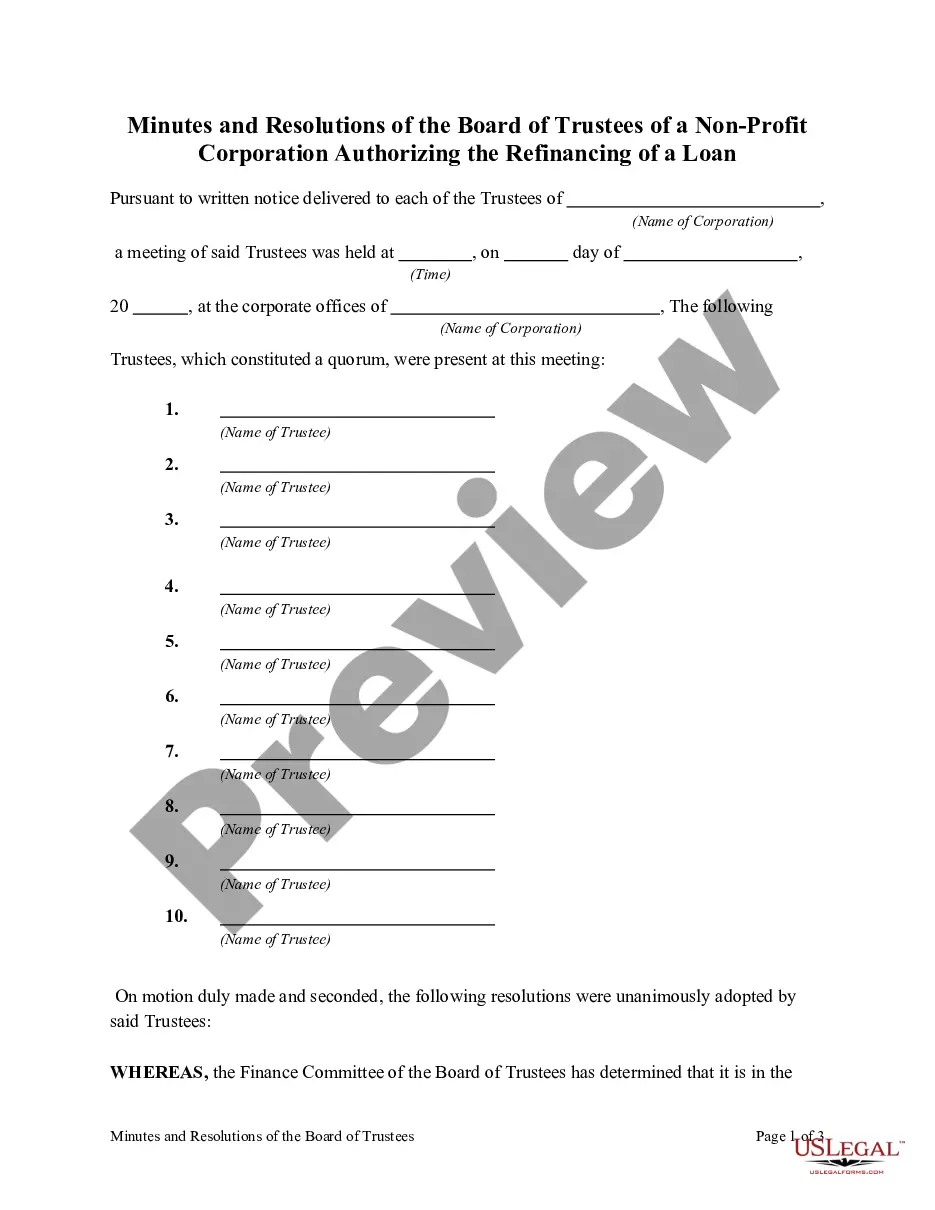

- Use the Review key to examine the form.

- Look at the outline to actually have chosen the correct develop.

- When the develop isn`t what you`re looking for, take advantage of the Research discipline to find the develop that meets your requirements and needs.

- Whenever you get the correct develop, just click Purchase now.

- Select the rates prepare you desire, fill in the specified details to generate your bank account, and pay money for your order making use of your PayPal or bank card.

- Select a hassle-free file file format and down load your copy.

Discover all of the record web templates you might have purchased in the My Forms food selection. You can obtain a further copy of Massachusetts Consumer Loan Application - Personal Loan Agreement at any time, if needed. Just click the needed develop to down load or printing the record format.

Use US Legal Forms, the most extensive variety of legitimate varieties, to save lots of efforts and stay away from faults. The support gives skillfully created legitimate record web templates which can be used for an array of functions. Create a merchant account on US Legal Forms and start creating your lifestyle easier.