Title: Massachusetts Letter to Lender for Produce the Note Request: A Comprehensive Guide Introduction: A Massachusetts Letter to Lender for Produce the Note Request is a formal document submitted to a lender by a borrower in the state of Massachusetts. This letter is widely used by borrowers seeking to validate the authenticity and ownership of their mortgage loan notes. By requesting the lender to produce the note, borrowers aim to ensure that the lender has legal rights to enforce the terms of the loan. This comprehensive guide will provide detailed information on the purpose, types, and key components of a Massachusetts Letter to Lender for Produce the Note Request. Keyword: Massachusetts Letter to Lender for Produce the Note Request Types of Massachusetts Letter to Lender for Produce the Note Request: 1. Verification and Authentication of the Note Request: This type of letter is commonly used by borrowers to verify and authenticate the existence of the original loan note. It seeks to confirm that the lender holds the legal right to enforce the loan agreement and foreclose on the property, if necessary. 2. Request for Clarification of Loan Ownership: When a borrower suspects a transfer of their loan to another entity, they may submit a request seeking clarification regarding the current loan owner. This letter aims to uncover any potential discrepancies or unknown parties involved in the loan transfer process. 3. Production of Note for Loan Modification or Approval: Borrowers applying for loan modifications or other loan-related approvals may use this letter to request the lender to produce the original note as part of the application process. By reviewing the original documentation, borrowers can ensure the accuracy of loan terms and their eligibility for specific programs. Keywords: Verification, Authentication, Clarification, Loan Ownership, Production, Loan Modification, Approval Components of a Massachusetts Letter to Lender for Produce the Note Request: 1. Introduction: The letter should begin with a clear and concise introduction, stating the purpose of the letter and the borrower's identification information, such as full name, property address, and loan account number. 2. Explanation of Request: Provide a detailed explanation of why the borrower is requesting the lender to produce the note. Emphasize the need to validate loan ownership, ensure legal compliance, or support a loan modification request. Include any relevant suspicion or concerns regarding the transfer or validity of the loan. 3. Supporting Documentation: Attach any supporting documents that strengthen the request. These may include copies of the loan agreement, mortgage deed, or previous correspondence with the lender. 4. Request for Response: Conclude the letter by requesting a response within a specific timeframe, typically 30 days. Mention that failure to provide the requested documentation may lead to legal actions or other appropriate measures. Keywords: Introduction, Explanation, Request, Supporting Documentation, Response Conclusion: A Massachusetts Letter to Lender for Produce the Note Request is an essential tool for borrowers seeking clarity, verification, and proof of loan ownership. By mandating lenders to produce the original note, borrowers can guard against potential fraud and ensure compliance with the legal framework. Understanding the different types and key components of this letter can empower borrowers to assert their rights in the complex field of mortgage loans. Keywords: Clarity, Verification, Proof, Loan Ownership, Fraud, Legal Framework.

Massachusetts Letter to Lender for Produce the Note Request

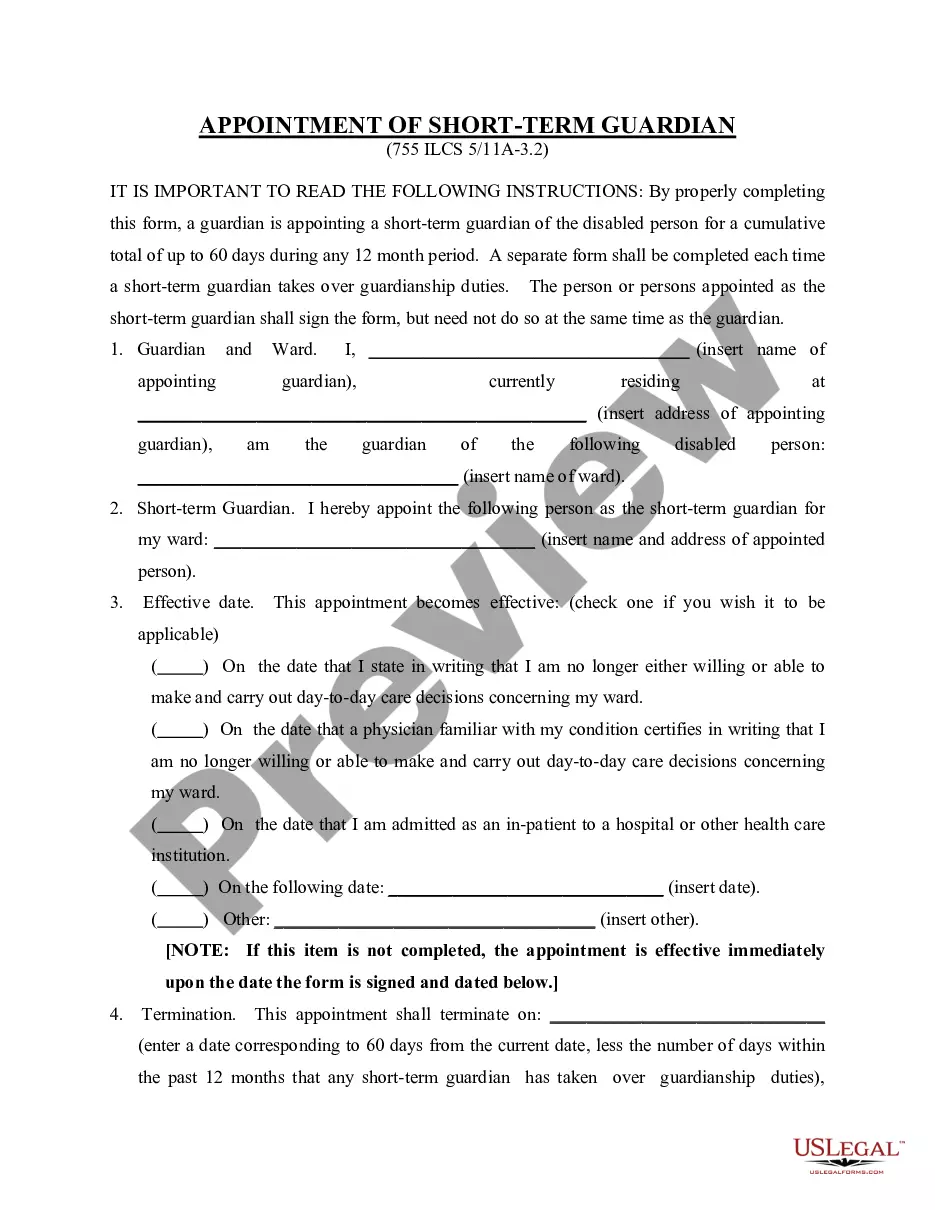

Description

How to fill out Massachusetts Letter To Lender For Produce The Note Request?

You are able to commit time on-line looking for the legitimate document template that fits the state and federal requirements you want. US Legal Forms provides thousands of legitimate varieties that are analyzed by pros. You can actually obtain or printing the Massachusetts Letter to Lender for Produce the Note Request from your service.

If you already have a US Legal Forms account, you may log in and click on the Acquire option. Afterward, you may comprehensive, modify, printing, or indicator the Massachusetts Letter to Lender for Produce the Note Request. Each and every legitimate document template you acquire is your own property for a long time. To obtain one more version of any purchased type, proceed to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms web site initially, follow the easy guidelines beneath:

- Initially, ensure that you have selected the best document template for that region/metropolis that you pick. Read the type explanation to ensure you have picked the proper type. If offered, use the Preview option to look throughout the document template as well.

- If you would like find one more edition of your type, use the Research field to get the template that meets your needs and requirements.

- Upon having identified the template you want, click on Purchase now to continue.

- Pick the prices prepare you want, key in your qualifications, and register for a merchant account on US Legal Forms.

- Full the purchase. You can utilize your credit card or PayPal account to fund the legitimate type.

- Pick the formatting of your document and obtain it to the system.

- Make alterations to the document if required. You are able to comprehensive, modify and indicator and printing Massachusetts Letter to Lender for Produce the Note Request.

Acquire and printing thousands of document web templates while using US Legal Forms site, which provides the largest selection of legitimate varieties. Use specialist and state-particular web templates to handle your organization or person requires.