A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

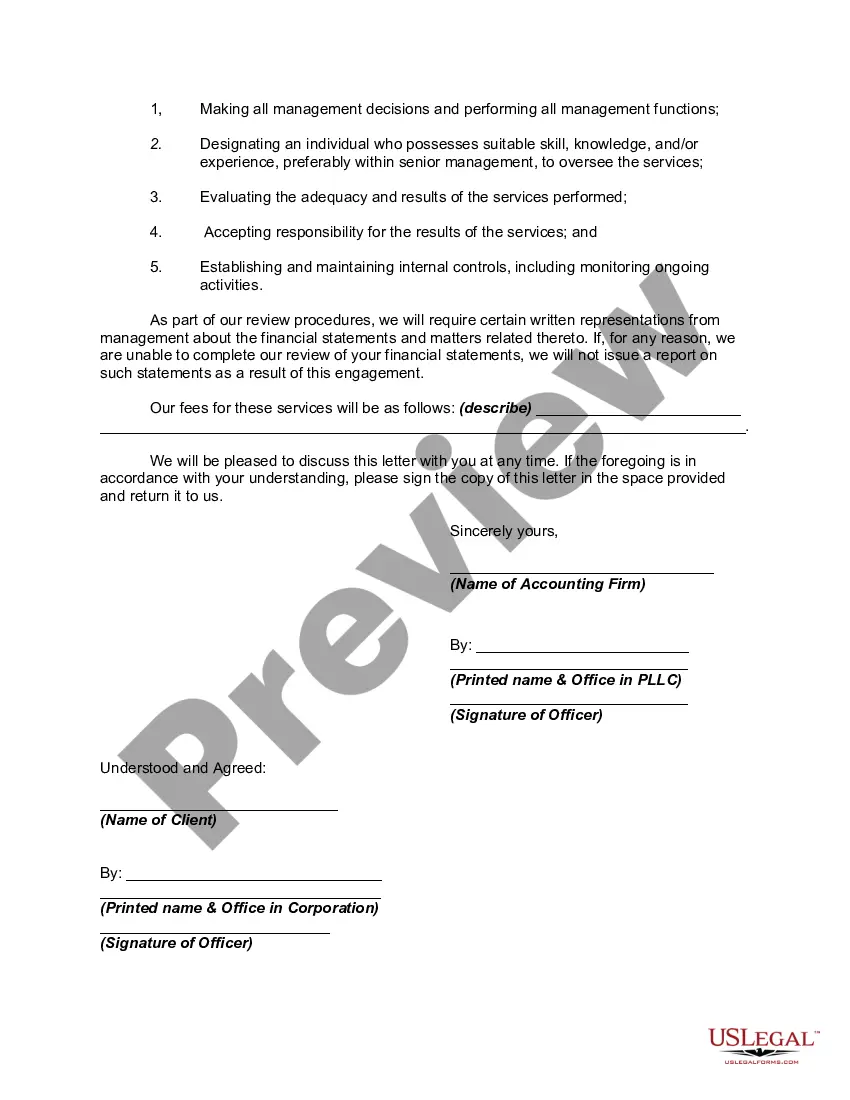

In Massachusetts, an Engagement Letter for Review of Financial Statements is an essential legal document established between a client and an accounting firm. This letter outlines the terms and conditions agreed upon by both parties before commencing a review engagement. A review engagement involves the accounting firm providing limited assurance that the financial statements are free from material misstatements, making this document of utmost importance. The Massachusetts Engagement Letter for Review of Financial Statements by an Accounting Firm typically includes the following key components: 1. Purpose: Clearly states that the engagement is for the review of financial statements and the objective to express limited assurance, rather than providing an audit opinion. 2. Responsibilities: Outlines the responsibilities of both the accounting firm and the client. This includes the client's obligation to provide complete and accurate financial statements, as well as access to supporting documents and explanations necessary for the review process. The accounting firm's responsibility is to conduct the review in accordance with Generally Accepted Review Standards (GARS) issued by the American Institute of Certified Public Accountants (AICPA). 3. Scope: Defines the scope of the review engagement, specifying the period covered by the financial statements and the level of detail to be reviewed. It also highlights that a review does not require the same level of testing and verification as an audit. 4. Independence: Affirms the independence of the accounting firm from the client and any potential conflicts of interest. It also mentions that the review engagement will be conducted objectively and without bias. 5. Limitations: Discloses that a review engagement may not detect all material misstatements or irregularities and that it provides less assurance than an audit engagement. 6. Communication: States that the accounting firm will issue a written report upon completion of the review, outlining the findings and conclusions. It specifies that this report will not constitute an audit opinion and may include suggestions for improving financial statement presentation or internal controls. Some different types of Massachusetts Engagement Letters for Review of Financial Statements by Accounting Firms may include: 1. Annual Engagement Letter: Established at the beginning of each fiscal year to cover the review of financial statements for that period. 2. Quarterly Engagement Letter: Created for engagements that involve the review of financial statements on a quarterly basis, often required by specific regulations or requested by clients who want more frequent reviews. 3. Special Engagement Letter: Used when a review engagement needs to be conducted for a specific purpose or interim period outside the regular annual or quarterly reviews. For instance, it may be required during the sale or acquisition of a business, change in ownership, or when obtaining financing. 4. Change of Accountants Engagement Letter: Utilized when there is a change in accounting firms, ensuring a smooth transition and clearly stating the responsibilities of the new firm. Overall, an Engagement Letter for Review of Financial Statements in Massachusetts ensures that both the accounting firm and client have a clear understanding of the expectations, responsibilities, and limitations associated with the review engagement, fostering transparency and mutual trust.In Massachusetts, an Engagement Letter for Review of Financial Statements is an essential legal document established between a client and an accounting firm. This letter outlines the terms and conditions agreed upon by both parties before commencing a review engagement. A review engagement involves the accounting firm providing limited assurance that the financial statements are free from material misstatements, making this document of utmost importance. The Massachusetts Engagement Letter for Review of Financial Statements by an Accounting Firm typically includes the following key components: 1. Purpose: Clearly states that the engagement is for the review of financial statements and the objective to express limited assurance, rather than providing an audit opinion. 2. Responsibilities: Outlines the responsibilities of both the accounting firm and the client. This includes the client's obligation to provide complete and accurate financial statements, as well as access to supporting documents and explanations necessary for the review process. The accounting firm's responsibility is to conduct the review in accordance with Generally Accepted Review Standards (GARS) issued by the American Institute of Certified Public Accountants (AICPA). 3. Scope: Defines the scope of the review engagement, specifying the period covered by the financial statements and the level of detail to be reviewed. It also highlights that a review does not require the same level of testing and verification as an audit. 4. Independence: Affirms the independence of the accounting firm from the client and any potential conflicts of interest. It also mentions that the review engagement will be conducted objectively and without bias. 5. Limitations: Discloses that a review engagement may not detect all material misstatements or irregularities and that it provides less assurance than an audit engagement. 6. Communication: States that the accounting firm will issue a written report upon completion of the review, outlining the findings and conclusions. It specifies that this report will not constitute an audit opinion and may include suggestions for improving financial statement presentation or internal controls. Some different types of Massachusetts Engagement Letters for Review of Financial Statements by Accounting Firms may include: 1. Annual Engagement Letter: Established at the beginning of each fiscal year to cover the review of financial statements for that period. 2. Quarterly Engagement Letter: Created for engagements that involve the review of financial statements on a quarterly basis, often required by specific regulations or requested by clients who want more frequent reviews. 3. Special Engagement Letter: Used when a review engagement needs to be conducted for a specific purpose or interim period outside the regular annual or quarterly reviews. For instance, it may be required during the sale or acquisition of a business, change in ownership, or when obtaining financing. 4. Change of Accountants Engagement Letter: Utilized when there is a change in accounting firms, ensuring a smooth transition and clearly stating the responsibilities of the new firm. Overall, an Engagement Letter for Review of Financial Statements in Massachusetts ensures that both the accounting firm and client have a clear understanding of the expectations, responsibilities, and limitations associated with the review engagement, fostering transparency and mutual trust.