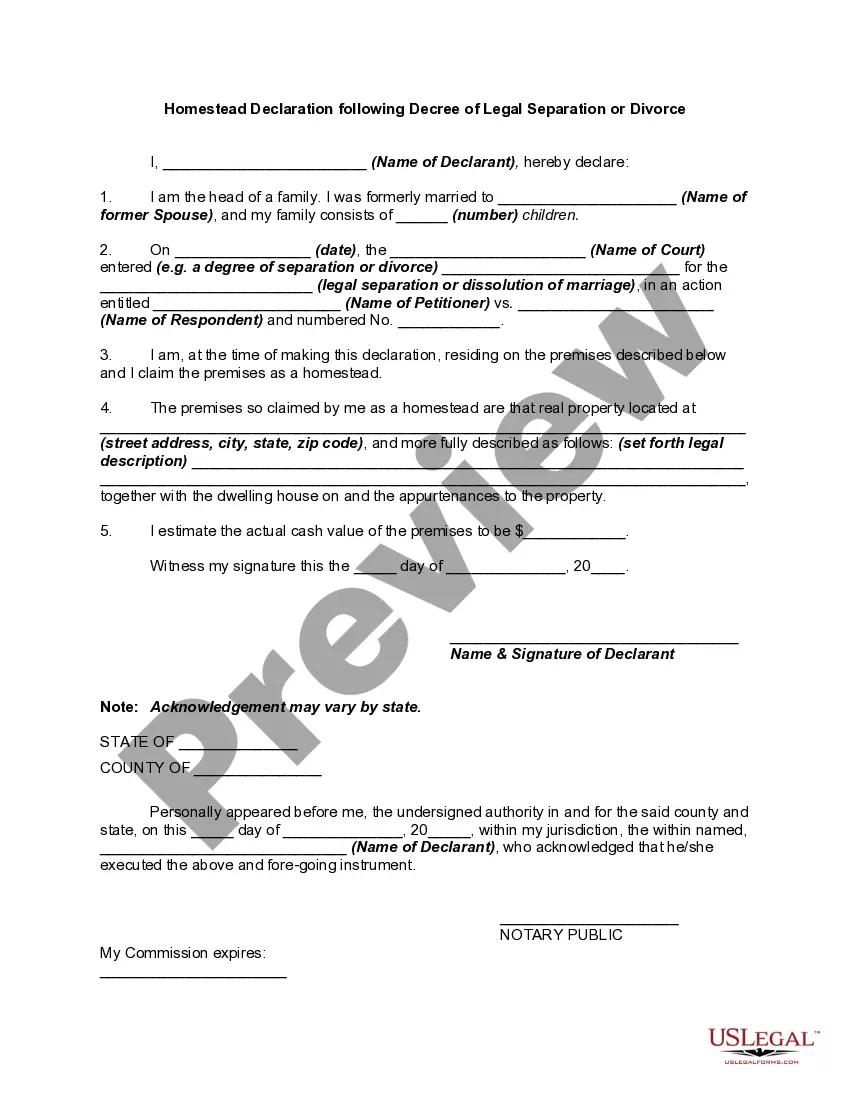

Ordinarily, the declaration must show that the claimant is the head of a family. In general, the claimant's right to select a homestead and to exempt it from forced sale must appear on the face of the declaration, and its omission cannot be supplied by extraneous evidence. Under some statutes, a declaration of homestead may be made by the owner or by his or her spouse.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Homestead Declaration following a Decree of Legal Separation or Divorce allows individuals to protect their primary residence from creditor claims after a divorce or legal separation. By filing a Homestead Declaration, the homeowner claims an exemption on their property, shielding it from certain unsecured debts incurred after the marital dissolution. The Massachusetts Homestead Declaration ensures that divorced individuals retain a safe haven, wherein they can continue living without concerns regarding potential liability arising from financial or legal complications. It establishes a legal protection that safeguards the property against most debts incurred after the divorce or legal separation. There are generally two types of Homestead Declarations following a Decree of Legal Separation or Divorce in Massachusetts: 1. Automatic Homestead Protection: Under Massachusetts law, homeowners are automatically granted a homestead exemption of $125,000 without needing to file a Homestead Declaration. This level of protection applies to all homeowners, including those who are divorced or legally separated. This automatic protection safeguards against certain unsecured debts, such as medical bills or credit card debts, but it does not provide a comprehensive shield against all liabilities. 2. Enhanced Homestead Protection: Homeowners who wish to secure additional protection for their primary residence can voluntarily file an Enhanced Homestead Declaration. This declaration increases the exemption amount available to $500,000 per residence, protecting against a broader range of debts, including those arising from lawsuits, bankruptcy proceedings, or other financial obligations. However, it is crucial to note that this enhanced protection requires filing the declaration with the Registry of Deeds. If not filed, the automatic homestead exemption of $125,000 remains in effect. It is essential to consult with an attorney experienced in Massachusetts divorce and real estate law to fully understand the implications and requirements of filing a Homestead Declaration following a Decree of Legal Separation or Divorce. They can guide individuals through the process and help determine the best course of action based on their specific circumstances. In conclusion, Massachusetts Homestead Declaration following a Decree of Legal Separation or Divorce offers divorced individuals the opportunity to protect their primary residence from creditor claims. By filing either an Automatic Homestead Protection or an Enhanced Homestead Declaration, homeowners can secure varying levels of exemption, safeguarding their property from specific unsecured debts. Seeking professional legal advice is advisable to ensure compliance with the necessary procedures and maximize the protection offered under the Homestead Declaration laws in Massachusetts.Massachusetts Homestead Declaration following a Decree of Legal Separation or Divorce allows individuals to protect their primary residence from creditor claims after a divorce or legal separation. By filing a Homestead Declaration, the homeowner claims an exemption on their property, shielding it from certain unsecured debts incurred after the marital dissolution. The Massachusetts Homestead Declaration ensures that divorced individuals retain a safe haven, wherein they can continue living without concerns regarding potential liability arising from financial or legal complications. It establishes a legal protection that safeguards the property against most debts incurred after the divorce or legal separation. There are generally two types of Homestead Declarations following a Decree of Legal Separation or Divorce in Massachusetts: 1. Automatic Homestead Protection: Under Massachusetts law, homeowners are automatically granted a homestead exemption of $125,000 without needing to file a Homestead Declaration. This level of protection applies to all homeowners, including those who are divorced or legally separated. This automatic protection safeguards against certain unsecured debts, such as medical bills or credit card debts, but it does not provide a comprehensive shield against all liabilities. 2. Enhanced Homestead Protection: Homeowners who wish to secure additional protection for their primary residence can voluntarily file an Enhanced Homestead Declaration. This declaration increases the exemption amount available to $500,000 per residence, protecting against a broader range of debts, including those arising from lawsuits, bankruptcy proceedings, or other financial obligations. However, it is crucial to note that this enhanced protection requires filing the declaration with the Registry of Deeds. If not filed, the automatic homestead exemption of $125,000 remains in effect. It is essential to consult with an attorney experienced in Massachusetts divorce and real estate law to fully understand the implications and requirements of filing a Homestead Declaration following a Decree of Legal Separation or Divorce. They can guide individuals through the process and help determine the best course of action based on their specific circumstances. In conclusion, Massachusetts Homestead Declaration following a Decree of Legal Separation or Divorce offers divorced individuals the opportunity to protect their primary residence from creditor claims. By filing either an Automatic Homestead Protection or an Enhanced Homestead Declaration, homeowners can secure varying levels of exemption, safeguarding their property from specific unsecured debts. Seeking professional legal advice is advisable to ensure compliance with the necessary procedures and maximize the protection offered under the Homestead Declaration laws in Massachusetts.