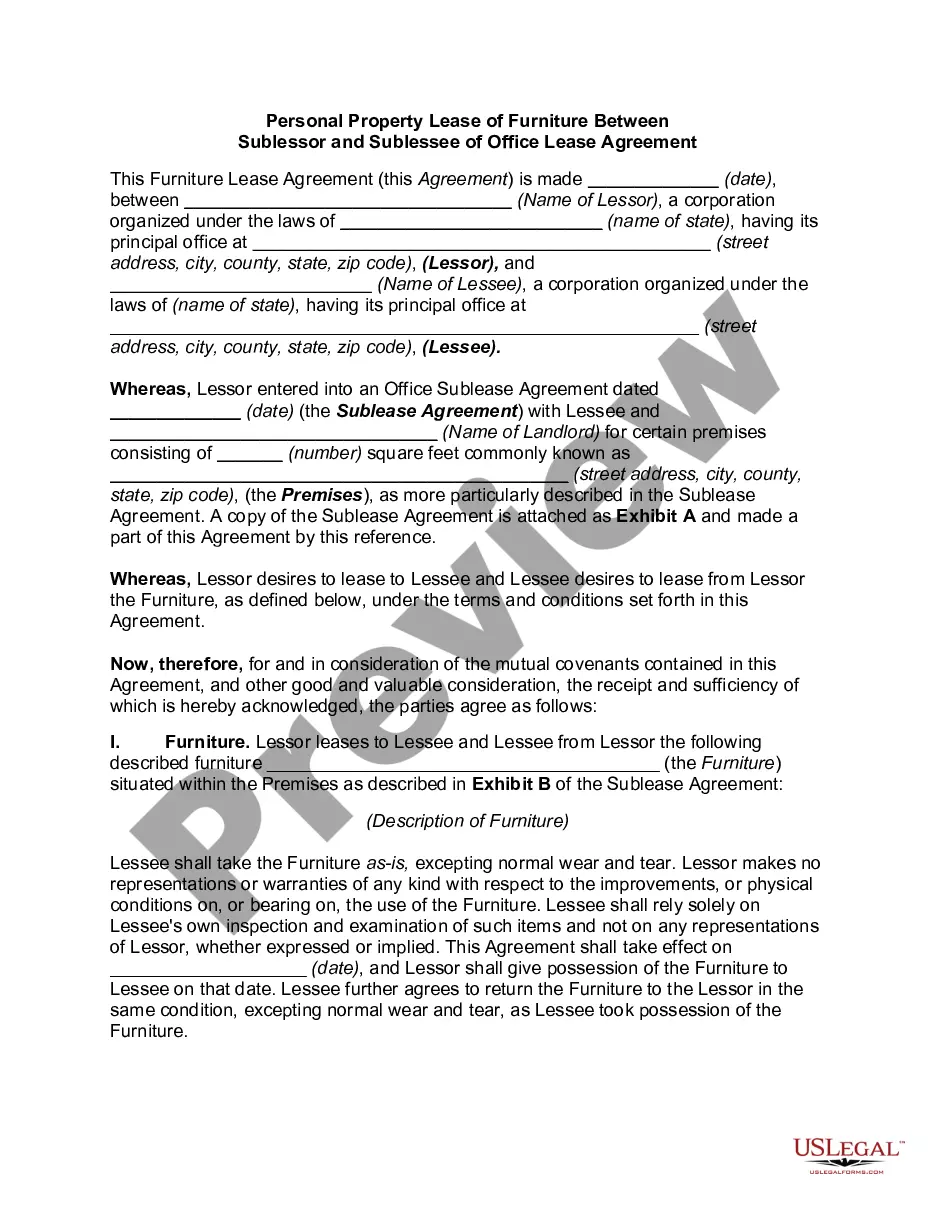

A Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements is a legal agreement that allows a farmer or individual to lease or rent a farm property in Massachusetts and have the right to make improvements on the land while receiving reimbursements for those improvements. This type of lease or rental agreement provides farmers with the opportunity to invest in and improve the farm property they are leasing, knowing that they will be compensated for their improvements. It encourages long-term commitment to the farm property by allowing the lessee to have a sense of ownership and the ability to make lasting changes to benefit their farming operations. Keywords: Massachusetts, farm lease, rental agreement, right to make improvements, receive reimbursements, farm property, farmer, investment, long-term commitment, lessee, ownership, farming operations. Different types of Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements may include: 1. Renewable Lease: This type of lease agreement allows for periodic renewals, providing the lessee with the option to continue leasing the farm property on an ongoing basis. It offers stability and security for farmers who wish to make long-term investments in improving the land. 2. Fixed-Term Lease: In contrast to a renewable lease, a fixed-term lease has a predetermined end date. This type of agreement may be suitable for farmers who want to try farming on a specific property for a set period before making a decision on long-term investment. 3. Crop-Share Agreement: Instead of paying a fixed rental amount, this type of agreement allows the farmer to share a portion of the crop harvest with the landowner as a form of rental payment. It incentivizes both parties to work collaboratively and share the risks and rewards of agriculture. 4. Improvements Reimbursement Agreement: This particular addendum to a farm lease or rental agreement specifies the terms and conditions under which the lessee will be reimbursed for any approved improvements made to the farm property. It ensures that the lessee receives fair compensation for their investments, creating a mutually beneficial arrangement. These different variations of the Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements provide flexibility, security, and incentives to farmers, creating a conducive environment for agricultural development and long-term sustainable farming practices in the state.

Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements

Description

How to fill out Massachusetts Farm Lease Or Rental With Right To Make Improvements And Receive Reimbursements?

Are you presently in a location where you require documents for either commercial or personal matters almost every day.

There is a multitude of legal document templates accessible online, but finding reliable ones isn't simple.

US Legal Forms offers a vast selection of form templates, including the Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, which can be generated to comply with state and federal regulations.

Once you find the right form, click on Buy now.

Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterwards, you can download the Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements template.

- If you do not yet have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is suitable for the appropriate city/county.

- Utilize the Review button to evaluate the form.

- Check the description to confirm you have selected the correct document.

- If the form isn't what you are looking for, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

In Massachusetts, a farm generally qualifies based on its primary use for agricultural production. This can include crop farming, livestock raising, or other agricultural-related activities on a certain scale. Understanding what qualifies as a farm can help when negotiating a Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, ensuring you comply with local regulations.

To achieve farm status in Massachusetts, you typically need to meet specific criteria regarding land use and the type of activities engaged in. This might involve submitting an application to the local tax assessor's office. Obtaining farm status can enhance your eligibility for a Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, giving you greater benefits.

An on-farm lease refers to an agreement where a landowner rents out their land for agricultural use directly to farmers. This type of lease often includes provisions for improvements and may allow for reimbursement for investments made during the lease period. For those interested, a Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements is a savvy way to set clear expectations for both parties.

There is no strict minimum number of acres required to farm in Massachusetts, but larger areas often yield better economic viability. Farmers can start with a small plot, depending on the type of farming. If you're looking to enter into a Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, consider how the land size impacts your farming goals.

The 'right to farm' in Massachusetts allows farmers to engage in agriculture without interference from neighbors or local ordinances. This protection encourages sustainable farming practices and promotes local agriculture. When considering a Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, it's crucial to understand your rights and responsibilities under this law.

A hobby farm typically does not offer the same tax benefits as a business farm, as the IRS has specific guidelines to distinguish the two. However, if you engage in a Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, you might be able to deduct certain expenses if you can show a clear intention to generate income. Keeping records will be crucial to justify your operations.

Form 4835 is used to report farm rental income and expenses if you receive this type of income as a landlord rather than operating the farm. If you have a Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, this form helps clarify the income you earn from leasing your property. Make sure to include any reimbursements for improvements which may directly affect your bottom line.

The IRS generally allows you to show a farm loss for up to three years consecutively while still being considered a legitimate business. If you are renting property under a Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, it is essential to maintain records of your efforts and expenses in case of scrutiny. Eventually, demonstrating profit can turn your farm into a sustainable venture.

While you may not earn any income this year, you can still deduct reasonable farm expenses related to your activities. If your farm is under a Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, ensuring proper documentation and keeping track of all expenses can provide future benefits when you eventually generate income. Consult a tax professional for tailored advice.

Yes, you may still be able to claim certain expenses even if you have no income from your farm. However, if you actively engage in farming under a Massachusetts Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, you may want to document your efforts to show that you are operating a legitimate business. This documentation may be helpful for tax purposes in future years.