Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

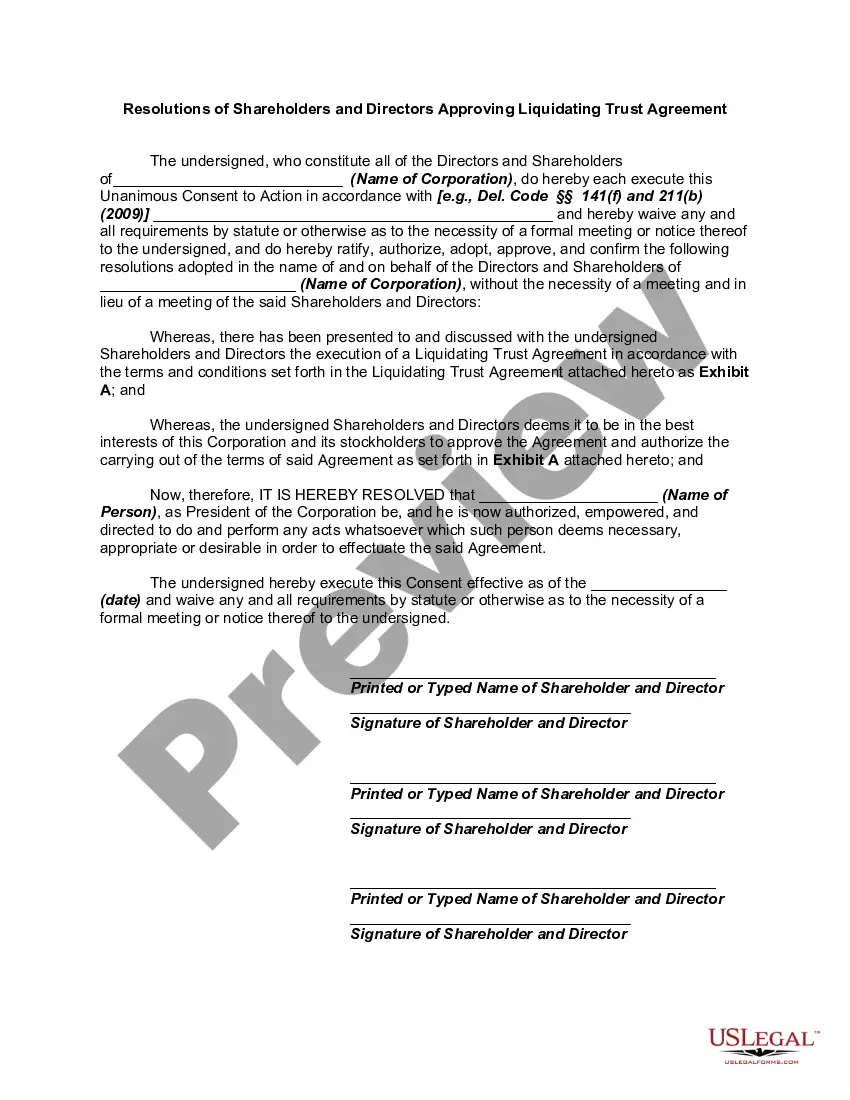

Massachusetts Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement are legal documents that outline the consent and approval of the shareholders and directors of a company in Massachusetts to establish a liquidating trust agreement. This agreement is formed when a corporation or business entity decides to wind up its affairs and distribute its assets among the shareholders. The purpose of these resolutions is to provide a clear and formal record of the decision-making process and the unanimous agreement of the directors and shareholders to proceed with the liquidation process. This is an essential step in ensuring that all stakeholders are informed and involved in the process. The Massachusetts Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement typically include specific information such as: 1. Name and identification of the corporation: The legal name, address, and any other necessary identification details of the corporation seeking dissolution. 2. Purpose of the resolution: Clearly stating the intention to dissolve the corporation and establish a liquidating trust agreement. 3. Authorization: The resolutions typically authorize the directors to enter into and execute the liquidating trust agreement on behalf of the corporation. 4. Approval of shareholders: Shareholders' approval is required to proceed with the liquidating trust agreement. Details regarding the consent and majority vote are included, ensuring compliance with corporate bylaws and regulations. 5. Effective date: The resolutions will specify the effective date of the liquidating trust agreement, usually after all necessary legal steps and formalities have been completed. Different types of Massachusetts Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement may vary based on the specific circumstances and requirements of the corporation. Some potential variations include: 1. Voluntary liquidation resolutions: Used when a corporation decides to voluntarily wind up its affairs and distribute assets among shareholders due to various reasons such as business closure, bankruptcy, or strategic restructuring. 2. Involuntary liquidation resolutions: These resolutions may be required when a corporation faces legal actions, insolvency, or court-mandated liquidation due to non-compliance or other compelling reasons. 3. Dissolution with the intent to reorganize resolutions: In some cases, a corporation may need to dissolve, establish a liquidating trust agreement, and subsequently reorganize its operations under new ownership or a different legal structure. Resolutions in this scenario would outline specific provisions for the transition. It is crucial to consult legal counsel or professionals experienced in corporate law and Massachusetts regulations when drafting and executing these resolutions. This ensures compliance with all legal requirements and protects the rights and interests of all stakeholders involved in the liquidation process.Massachusetts Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement are legal documents that outline the consent and approval of the shareholders and directors of a company in Massachusetts to establish a liquidating trust agreement. This agreement is formed when a corporation or business entity decides to wind up its affairs and distribute its assets among the shareholders. The purpose of these resolutions is to provide a clear and formal record of the decision-making process and the unanimous agreement of the directors and shareholders to proceed with the liquidation process. This is an essential step in ensuring that all stakeholders are informed and involved in the process. The Massachusetts Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement typically include specific information such as: 1. Name and identification of the corporation: The legal name, address, and any other necessary identification details of the corporation seeking dissolution. 2. Purpose of the resolution: Clearly stating the intention to dissolve the corporation and establish a liquidating trust agreement. 3. Authorization: The resolutions typically authorize the directors to enter into and execute the liquidating trust agreement on behalf of the corporation. 4. Approval of shareholders: Shareholders' approval is required to proceed with the liquidating trust agreement. Details regarding the consent and majority vote are included, ensuring compliance with corporate bylaws and regulations. 5. Effective date: The resolutions will specify the effective date of the liquidating trust agreement, usually after all necessary legal steps and formalities have been completed. Different types of Massachusetts Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement may vary based on the specific circumstances and requirements of the corporation. Some potential variations include: 1. Voluntary liquidation resolutions: Used when a corporation decides to voluntarily wind up its affairs and distribute assets among shareholders due to various reasons such as business closure, bankruptcy, or strategic restructuring. 2. Involuntary liquidation resolutions: These resolutions may be required when a corporation faces legal actions, insolvency, or court-mandated liquidation due to non-compliance or other compelling reasons. 3. Dissolution with the intent to reorganize resolutions: In some cases, a corporation may need to dissolve, establish a liquidating trust agreement, and subsequently reorganize its operations under new ownership or a different legal structure. Resolutions in this scenario would outline specific provisions for the transition. It is crucial to consult legal counsel or professionals experienced in corporate law and Massachusetts regulations when drafting and executing these resolutions. This ensures compliance with all legal requirements and protects the rights and interests of all stakeholders involved in the liquidation process.