A consultant is an individual who possesses special knowledge or skills and provides that expertise to a client for a fee. Consultants help all sorts of businesses find and implement solutions to a wide variety of problems, including those related to business start-up, marketing, manufacturing, strategy, organization structure, environmental compliance, health and safety, technology, and communications. Some consultants are self-employed, independent contractors who offer specialized skills in a certain field; other consultants work for large consulting firms.

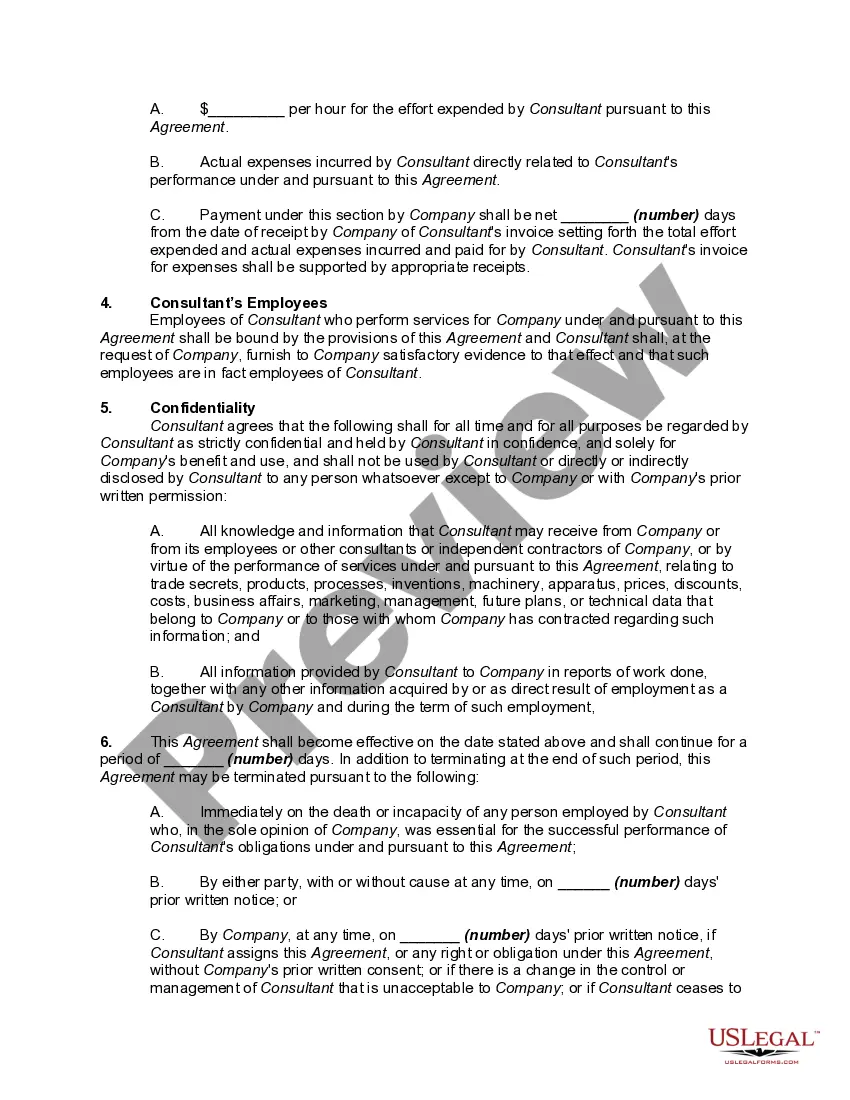

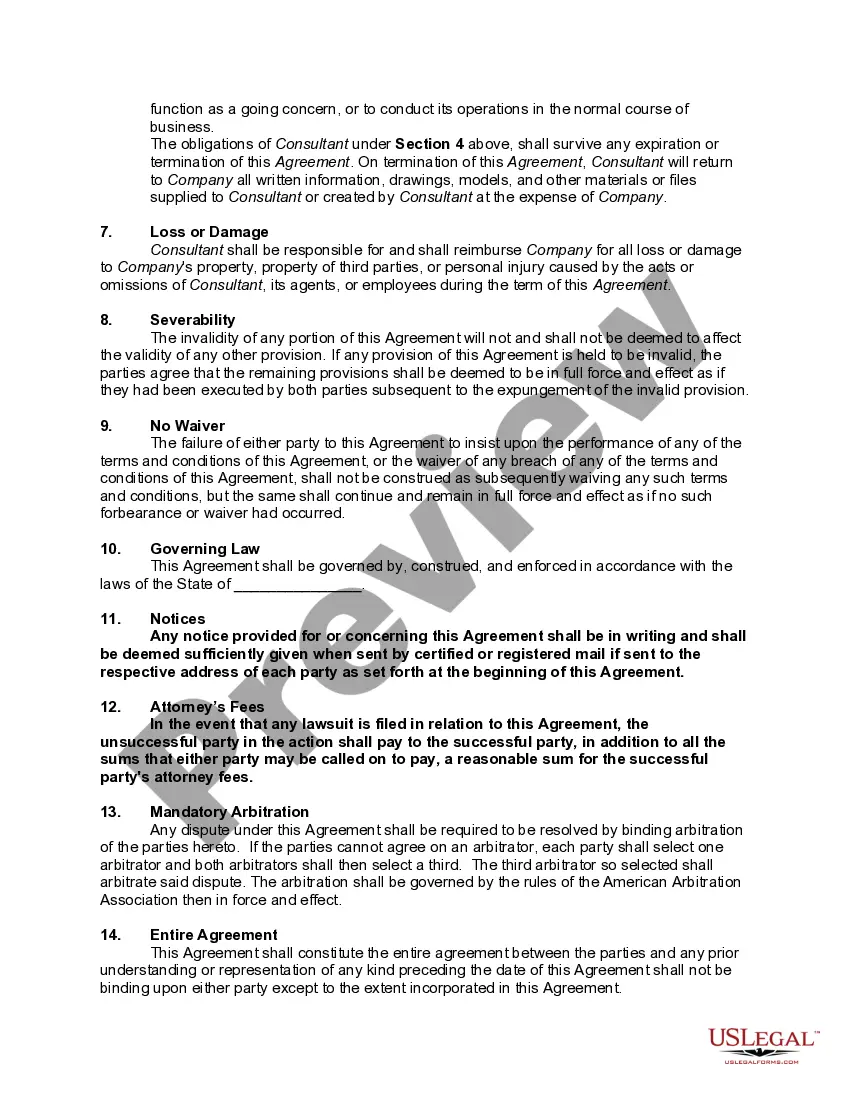

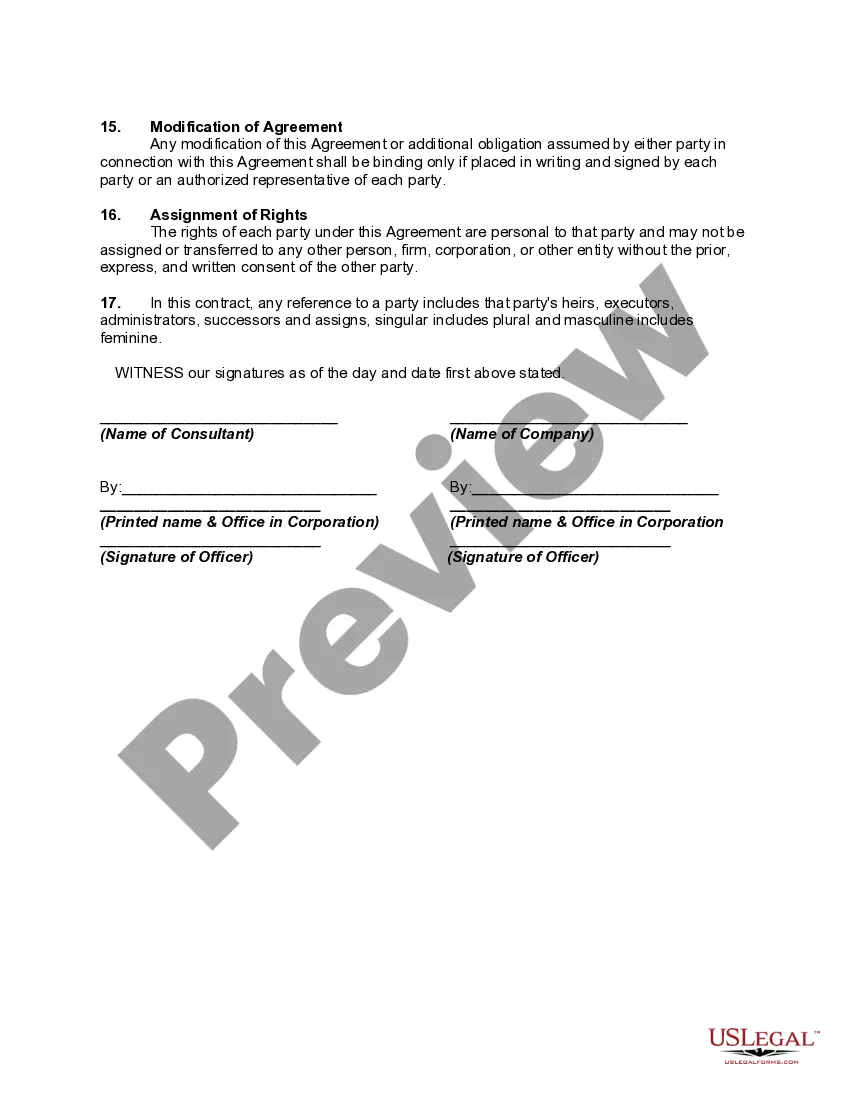

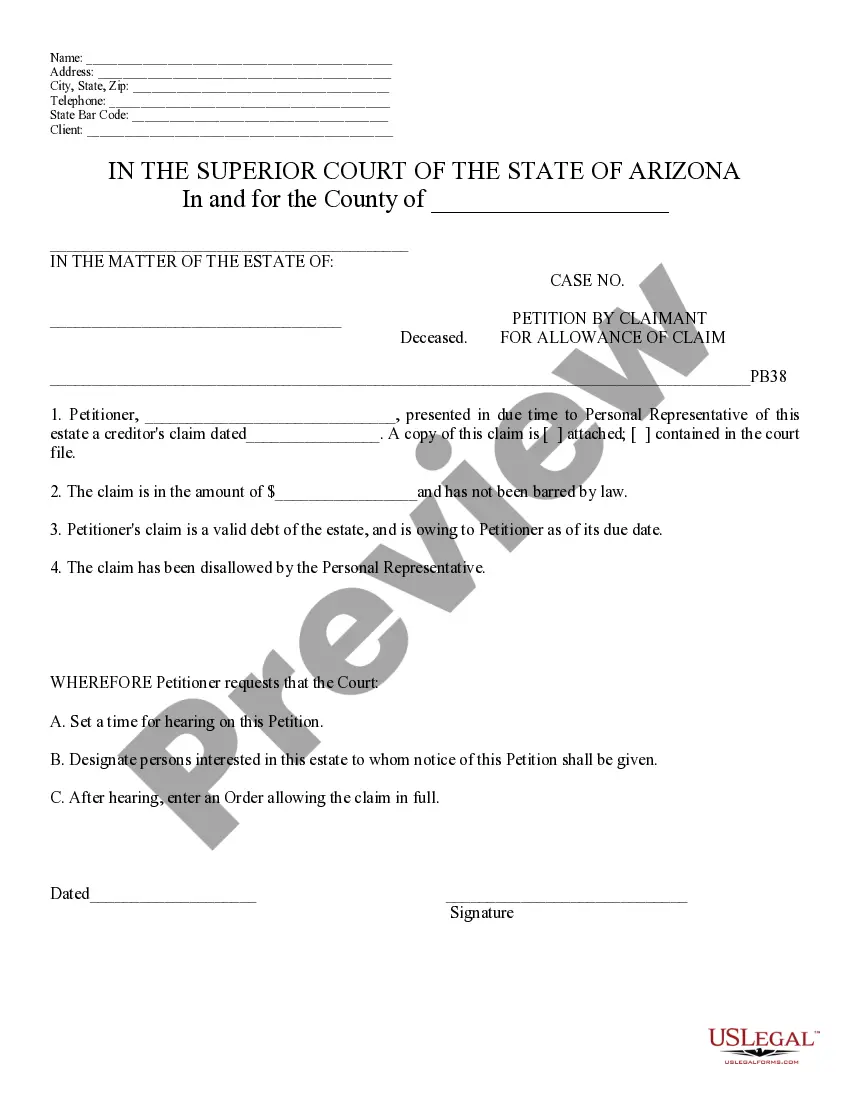

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.