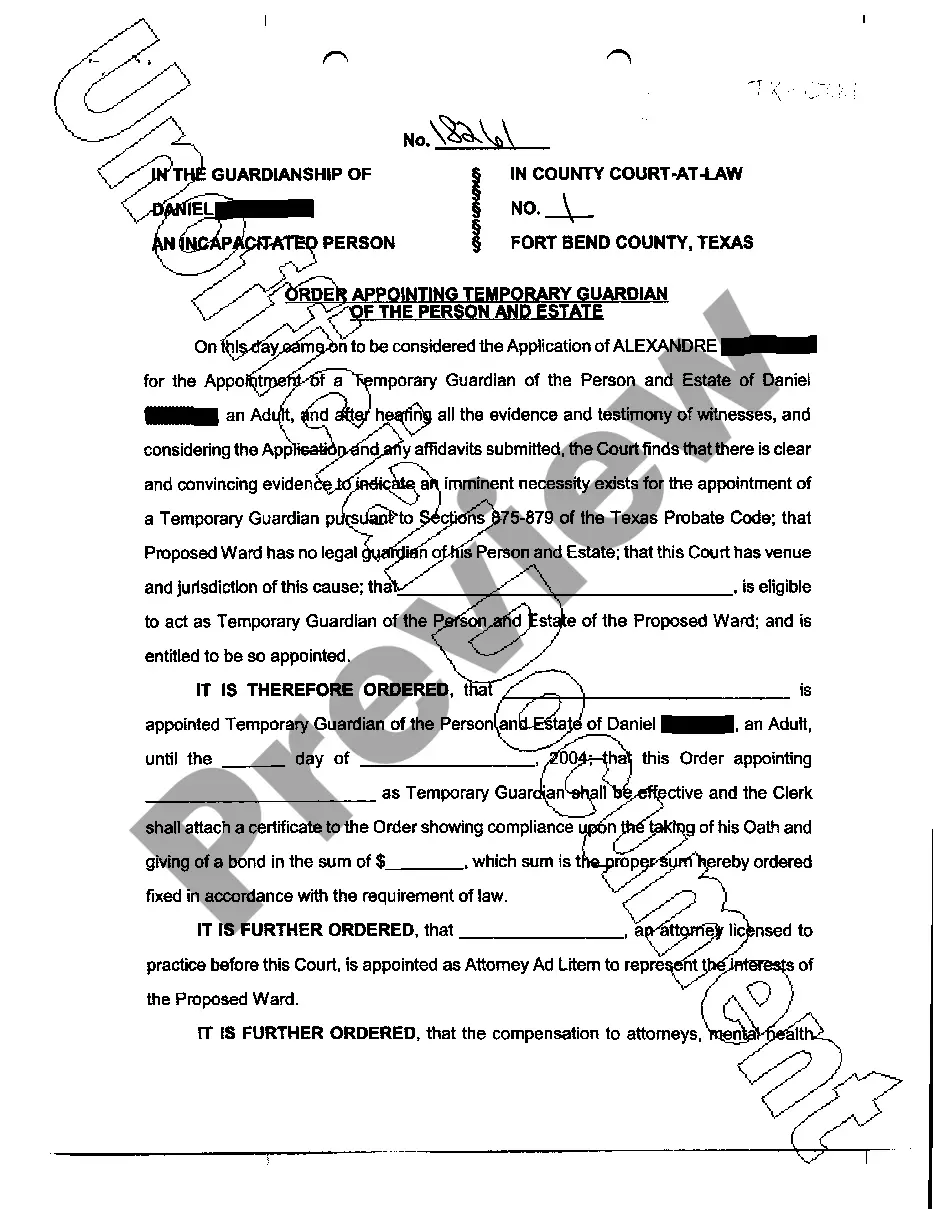

Massachusetts Prepayment Agreement

Description

How to fill out Massachusetts Prepayment Agreement?

Are you presently within a position the place you need papers for either enterprise or person purposes almost every day? There are a lot of lawful papers web templates available online, but discovering kinds you can trust isn`t simple. US Legal Forms offers 1000s of form web templates, like the Massachusetts Prepayment Agreement, that happen to be composed to meet state and federal specifications.

When you are previously acquainted with US Legal Forms internet site and also have a merchant account, just log in. Afterward, you can obtain the Massachusetts Prepayment Agreement format.

If you do not have an profile and wish to start using US Legal Forms, abide by these steps:

- Obtain the form you will need and make sure it is to the correct area/region.

- Make use of the Review button to examine the shape.

- See the description to actually have chosen the correct form.

- In the event the form isn`t what you are looking for, take advantage of the Lookup area to obtain the form that suits you and specifications.

- When you find the correct form, click Purchase now.

- Pick the prices strategy you desire, submit the necessary information to make your account, and buy your order utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free document structure and obtain your version.

Get all the papers web templates you possess purchased in the My Forms food list. You can aquire a more version of Massachusetts Prepayment Agreement at any time, if needed. Just click on the necessary form to obtain or printing the papers format.

Use US Legal Forms, one of the most substantial variety of lawful varieties, to conserve time as well as avoid blunders. The support offers appropriately produced lawful papers web templates that you can use for a selection of purposes. Generate a merchant account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

There are two ways you can set up a payment agreement. Online with MassTaxConnect (For payment agreements of $5,000 or less), When registered on MassTaxConnect select "More", and then choose "Request a Payment Plan" within the Collection Notices section.

The advance payment is based on either (1) the total tax liability from the 1st through the 21st of the monthly filing period or (2) at least 80% of the prior month's total liability.

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. If you qualify for a short-term payment plan you will not be liable for a user fee.

Go to the MassTaxConnect homepage. Select the Make a payment hyperlink in the Quick Links section. Select Individual payment hyperlink.

MA-DOR Monthly Payment Plan The MA-DOR will consider allowing you to pay back your taxes over 36 months. On rare occasion, they may consider a Payment Agreement longer than 36 months if your financial circumstances support it. Be prepared to provide financial information for longer terms.

Different states have enacted different laws related to prepayment penalties on residential first mortgages. In most cases, Massachusetts allows lenders to collect penalties for prepayment during the first three years of a loan.

Overview of MA Tax Payment Plans If you owe $5,000 or less, you must pay at least $25 per month, and you can take up to 36 months to pay off the total balance. Taxpayers who owe over $5,000 must pay at least $50 per month, and the length of their payment plan varies based on the situation.