Massachusetts Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement

Description

How to fill out Stock Purchase Agreement Between Two Sellers And One Investor With Transfer Of Title Concurrent With Execution Of Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal templates you can download or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can access the latest versions of forms such as the Massachusetts Stock Purchase Agreement between Two Sellers and One Investor with Title Transfer Concurrent with Agreement Execution in just seconds.

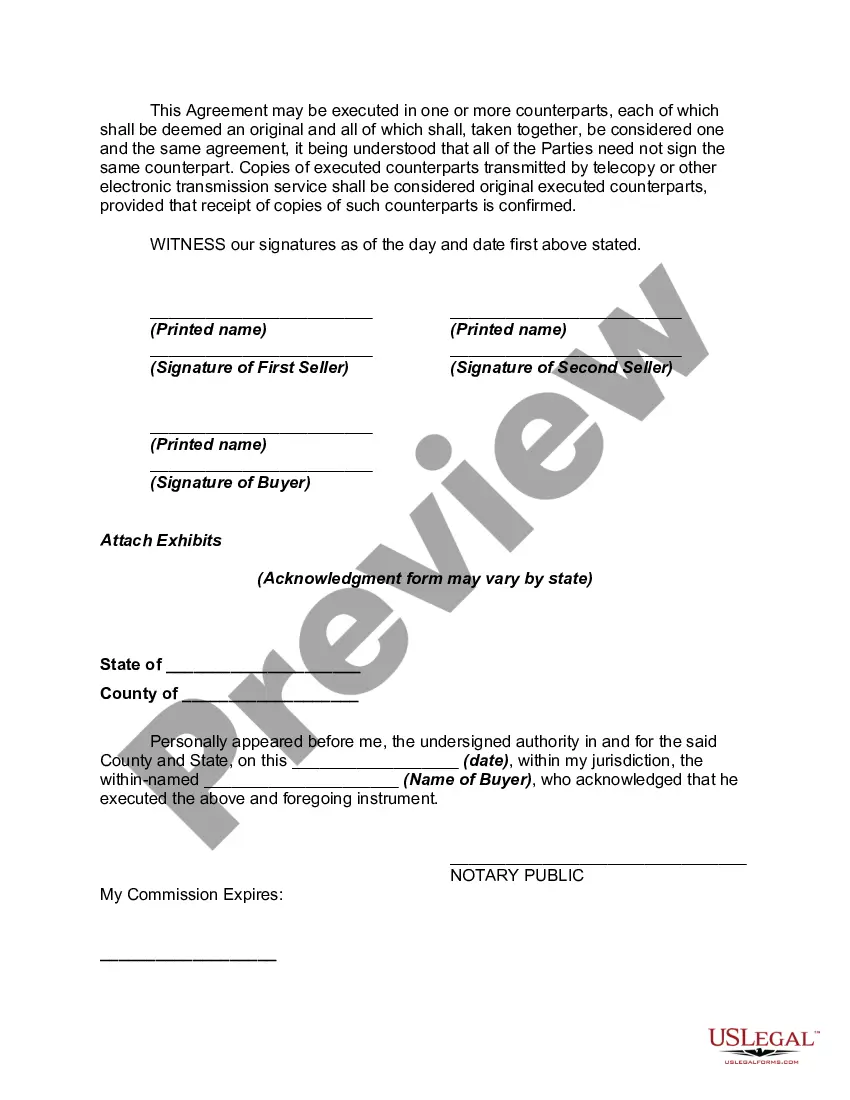

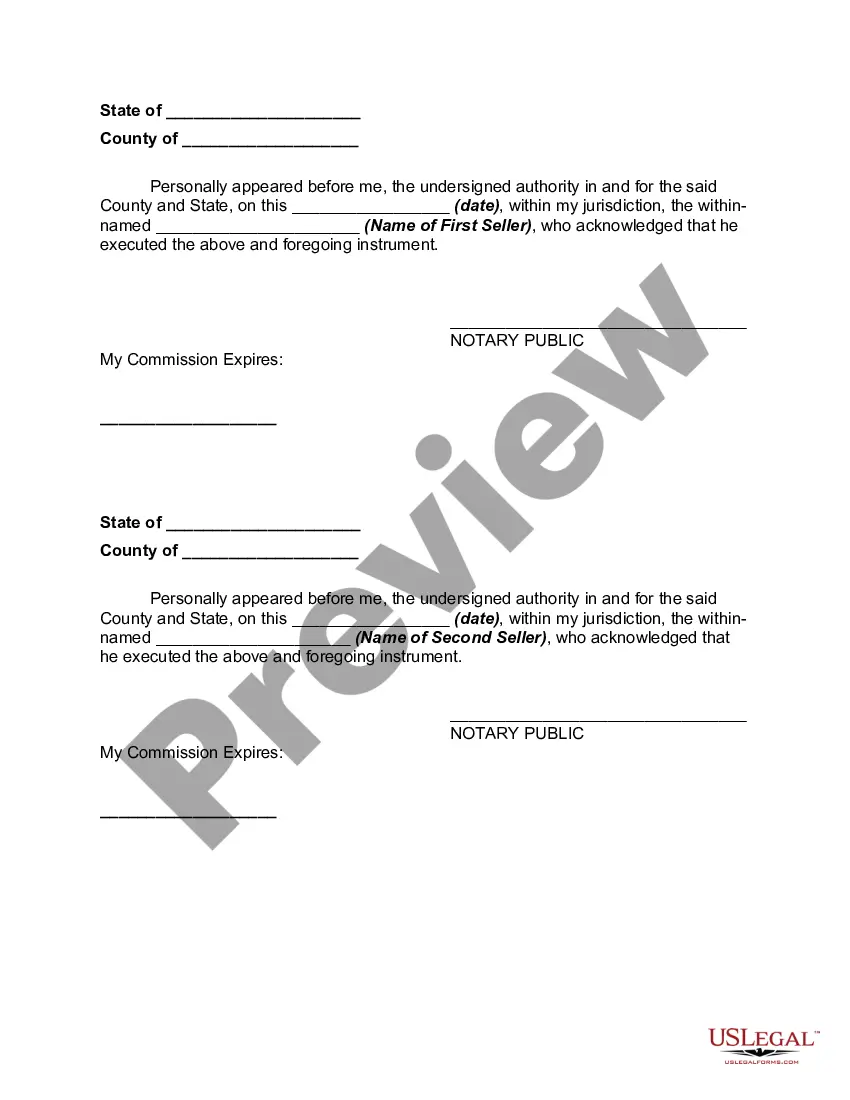

Click the Preview button to review the content of the form.

Review the form details to ensure that you have chosen the correct document.

- If you already possess a membership, Log In and download the Massachusetts Stock Purchase Agreement between Two Sellers and One Investor with Title Transfer Concurrent with Agreement Execution from the US Legal Forms library.

- The Download button will be available on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you are new to US Legal Forms, here are simple steps to get you started.

- Make sure you have selected the correct form for your city/county.

Form popularity

FAQ

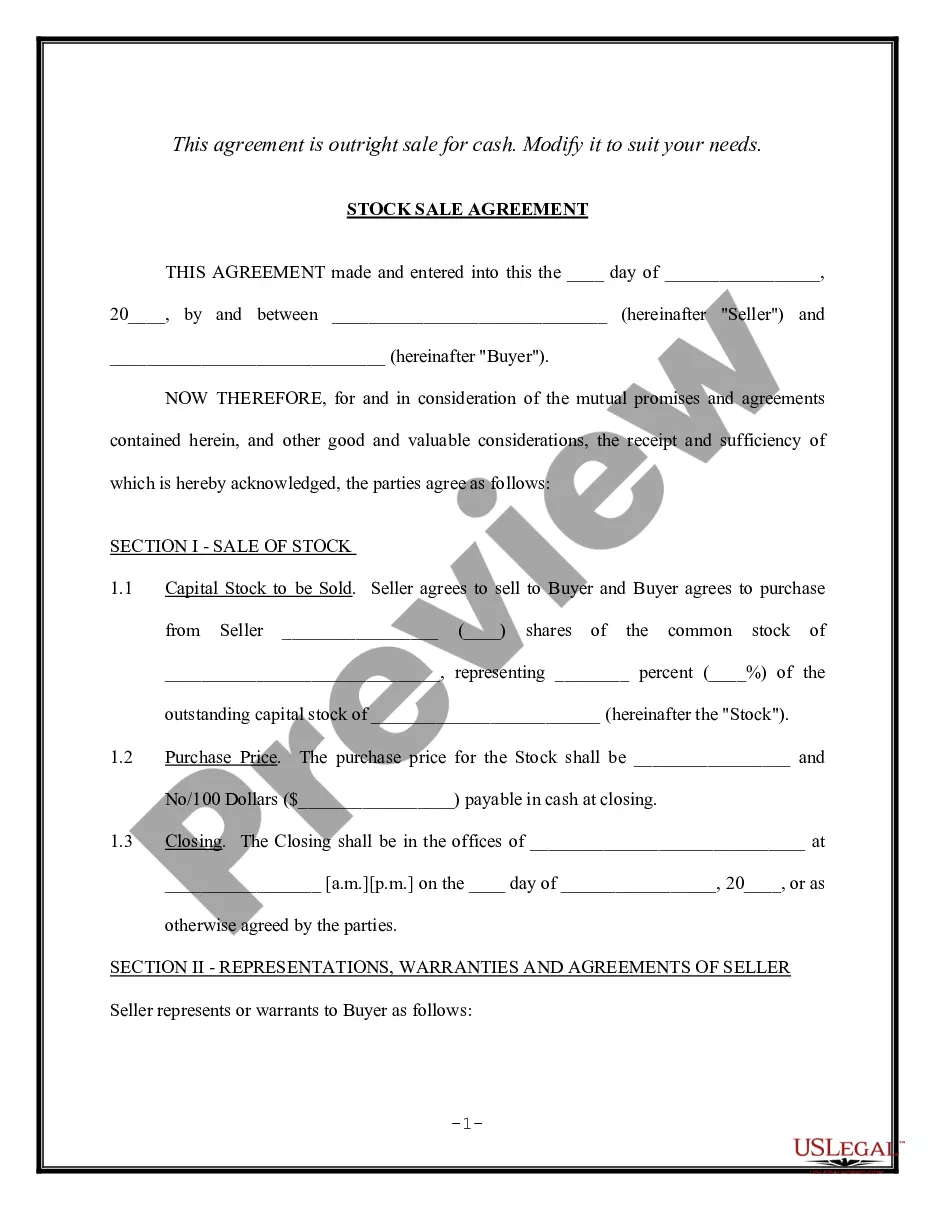

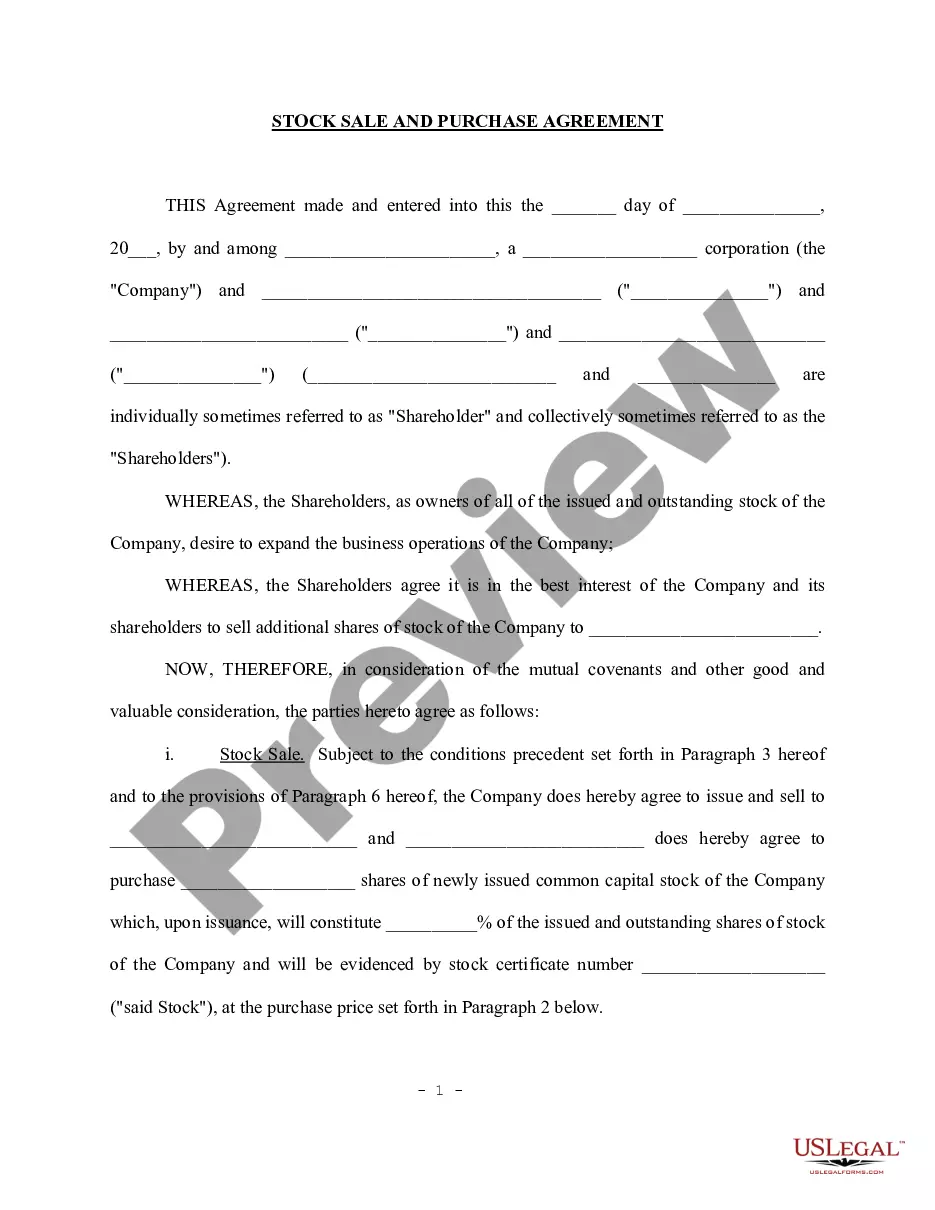

A Share Purchase Agreement is a document that transfers company shares (also called stocks) from one party to another. It contains the shares for sale, price, date of the transaction, and other terms and conditions.

A secondary stock transaction is when an investor buys shares in a company directly from an existing stockholder (typically a founder, employee or existing investor). The funds paid go to the seller, not to the company.

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

What is a "secondary sale"? A secondary sale is a sale by an existing stockholder to a third-party purchaser, the proceeds of which benefit the selling stockholder. This is in contrast to a "primary" issuance, in which the company is selling its stock to an investor and using the proceeds for corporate purposes.

A secondary sale is the sale by an existing stockholder of shares in a private company to a third party that does not occur in connection with an acquisition of the company. When a lot of secondary sales happen together as part of the same transaction, it is sometimes referred to as a liquidity round.

A secondary offering occurs when an investor sells their shares to the public on the secondary market after an initial public offering (IPO). Proceeds from an investor's secondary offering go directly into an investor's pockets rather than to the company.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

A Sale and Purchase Agreement (SPA) is a legally binding contract outlining the agreed upon conditions of the buyer and seller of a property (e.g., a corporation). It is the main legal document in any sale process.

A Share Purchase Agreement, also called a Stock Purchase Agreement, is used to transfer the ownership of shares (also called stock) in a company from a seller to a buyer. Shares (or stock) are units of ownership in a company that are divided among shareholders (also called stockholders).

In real estate, a purchase agreement is a binding contract between a buyer and seller that outlines the details of a home sale transaction. The buyer will propose the conditions of the contract, including their offer price, which the seller will then either agree to, reject or negotiate.