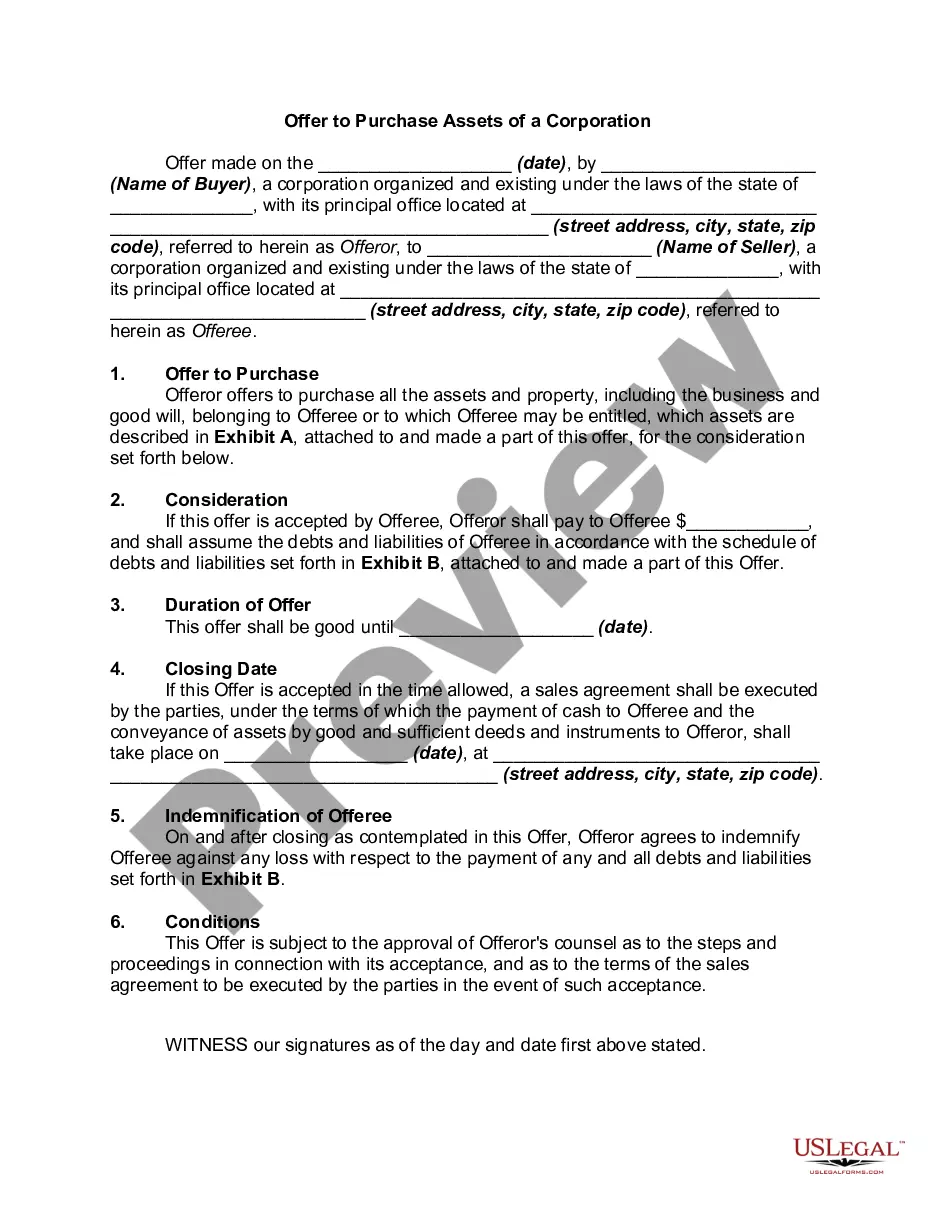

A Massachusetts Offer to Purchase Assets of a Corporation refers to a legally binding agreement between two parties where one party, typically a buyer, offers to acquire the assets of a corporation based in Massachusetts. This document outlines the terms and conditions of the transaction, including the price, payment terms, and various representations and warranties made by both parties. One type of Massachusetts Offer to Purchase Assets of a Corporation is an agreement for the purchase of tangible assets. This type of agreement includes the acquisition of physical assets such as real estate, machinery, equipment, inventory, and other tangible property owned by the corporation. It also encompasses any associated contracts, permits, and licenses linked to these assets. Another type of Offer to Purchase Assets involves the acquisition of intangible assets. This encompasses the purchase of intellectual property rights, trademarks, copyrights, patents, trade secrets, and other proprietary assets owned by the corporation. The agreement may also include provisions for the transfer of customer lists, goodwill, and non-compete agreements. In drafting a Massachusetts Offer to Purchase Assets of a Corporation, several key components should be included: 1. Identification of the parties: Clearly state the legal names and addresses of both the buyer and the corporation being acquired. 2. Description of the assets: Provide a detailed list and description of the assets to be acquired, including both tangible and intangible assets. 3. Purchase price: Specify the agreed-upon purchase price, any potential adjustments, and the payment terms, including the method and timeline of payment. 4. Representations and warranties: Outline the assurances made by both parties regarding the accuracy of information, ownership of assets, absence of undisclosed liabilities, and compliance with laws and regulations. 5. Closing conditions: Specify any conditions that need to be fulfilled for the transaction to close successfully, such as obtaining necessary approvals or third-party consents. 6. Allocation of purchase price: Detail how the purchase price will be allocated among the different assets for tax and accounting purposes. 7. Indemnification provisions: Include provisions that address indemnification for potential breaches of representations and warranties, specifying the duration and limits of the indemnification. It's important to note that a Massachusetts Offer to Purchase Assets of a Corporation should be drafted and reviewed by experienced legal professionals to ensure compliance with state laws and to protect the interests of both parties involved.

Massachusetts Offer to Purchase Assets of a Corporation

Description

How to fill out Massachusetts Offer To Purchase Assets Of A Corporation?

Discovering the right authorized record format can be quite a battle. Needless to say, there are a lot of layouts available on the Internet, but how can you get the authorized form you need? Utilize the US Legal Forms website. The assistance provides 1000s of layouts, like the Massachusetts Offer to Purchase Assets of a Corporation, which can be used for enterprise and personal demands. Every one of the types are inspected by professionals and meet state and federal demands.

Should you be presently listed, log in to the profile and click on the Down load key to get the Massachusetts Offer to Purchase Assets of a Corporation. Make use of your profile to check throughout the authorized types you possess acquired previously. Go to the My Forms tab of your own profile and get yet another backup in the record you need.

Should you be a new user of US Legal Forms, allow me to share simple directions that you should comply with:

- Very first, ensure you have chosen the correct form for the area/state. You are able to look through the form making use of the Review key and study the form information to guarantee it is the best for you.

- In the event the form does not meet your requirements, use the Seach area to get the proper form.

- When you are sure that the form is suitable, click on the Get now key to get the form.

- Opt for the costs prepare you want and enter in the necessary information. Make your profile and purchase an order making use of your PayPal profile or charge card.

- Opt for the submit formatting and obtain the authorized record format to the system.

- Complete, change and produce and indicator the received Massachusetts Offer to Purchase Assets of a Corporation.

US Legal Forms is definitely the most significant local library of authorized types that you will find a variety of record layouts. Utilize the company to obtain skillfully-produced documents that comply with status demands.