A Massachusetts Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy Sell Provisions is a legally binding contract that outlines the rights and responsibilities of two shareholders in a closely held corporation based in Massachusetts. This agreement sets forth the terms and conditions that govern their relationship and addresses various aspects of the corporation's operations and shareholder rights. Key terms and provisions included in this type of agreement are: 1. Buy-Sell Provisions: These provisions detail the circumstances under which a shareholder can sell their shares and the process of transferring ownership. This can include situations such as death, disability, retirement, or voluntary transfer. By defining these provisions, the agreement ensures a smooth transition of ownership and protects the interests of both parties involved. 2. Price and Valuation: The agreement establishes a mechanism to determine the fair value of the shares when a buy-sell event occurs. It may include methods like appraisals or predetermined formulas considering factors such as financial statements, industry standards, or independent third-party valuations. This ensures a fair and transparent process for both shareholders. 3. Rights and Obligations: The agreement outlines the rights and obligations of each shareholder, including voting rights, decision-making authority, and responsibilities towards the corporation. It ensures that each shareholder has a clear understanding of their roles and responsibilities, avoiding conflicts and disputes in the future. 4. Non-Compete and Non-Disclosure: These provisions restrict shareholders from engaging in activities that may compete with the corporation or divulge sensitive information. They protect the corporation's trade secrets, goodwill, and prevent unfair competition among shareholders. 5. Dispute Resolution: The agreement may include provisions for dispute resolution, such as mediation, arbitration, or litigation, in case conflicts arise between the shareholders. These provisions outline the steps to resolve disputes in an efficient and cost-effective manner, minimizing disruptions to the corporation's operations. Other types of Massachusetts Shareholders' Agreements between Two Shareholders of Closely Held Corporation with Buy Sell Provisions may include: 1. Cross Purchase Agreement: This agreement allows one shareholder to buy the shares of the other shareholder, either entirely or proportionately, in the event of a buy-sell trigger. This is often used when there are only two shareholders and provides a straightforward method of transferring ownership. 2. Redemption Agreement: In this type of agreement, the corporation has the right or obligation to repurchase the shares of a shareholder following a buy-sell event. The corporation can then retire or redistribute the repurchased shares as per the agreement's terms. 3. Hybrid Agreement: This agreement combines elements of both the cross-purchase and redemption agreements. It allows either the shareholder or the corporation to buy the shares, providing flexibility depending on the specific circumstances that trigger a buy-sell event. In conclusion, a Massachusetts Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy Sell Provisions is a vital legal document that protects the rights and interests of shareholders in a closely held corporation. Its purpose is to establish clear guidelines concerning share transfers, valuation methods, rights, and obligations, ensuring a smooth operation and preventing disputes between shareholders.

Massachusetts Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions

Description

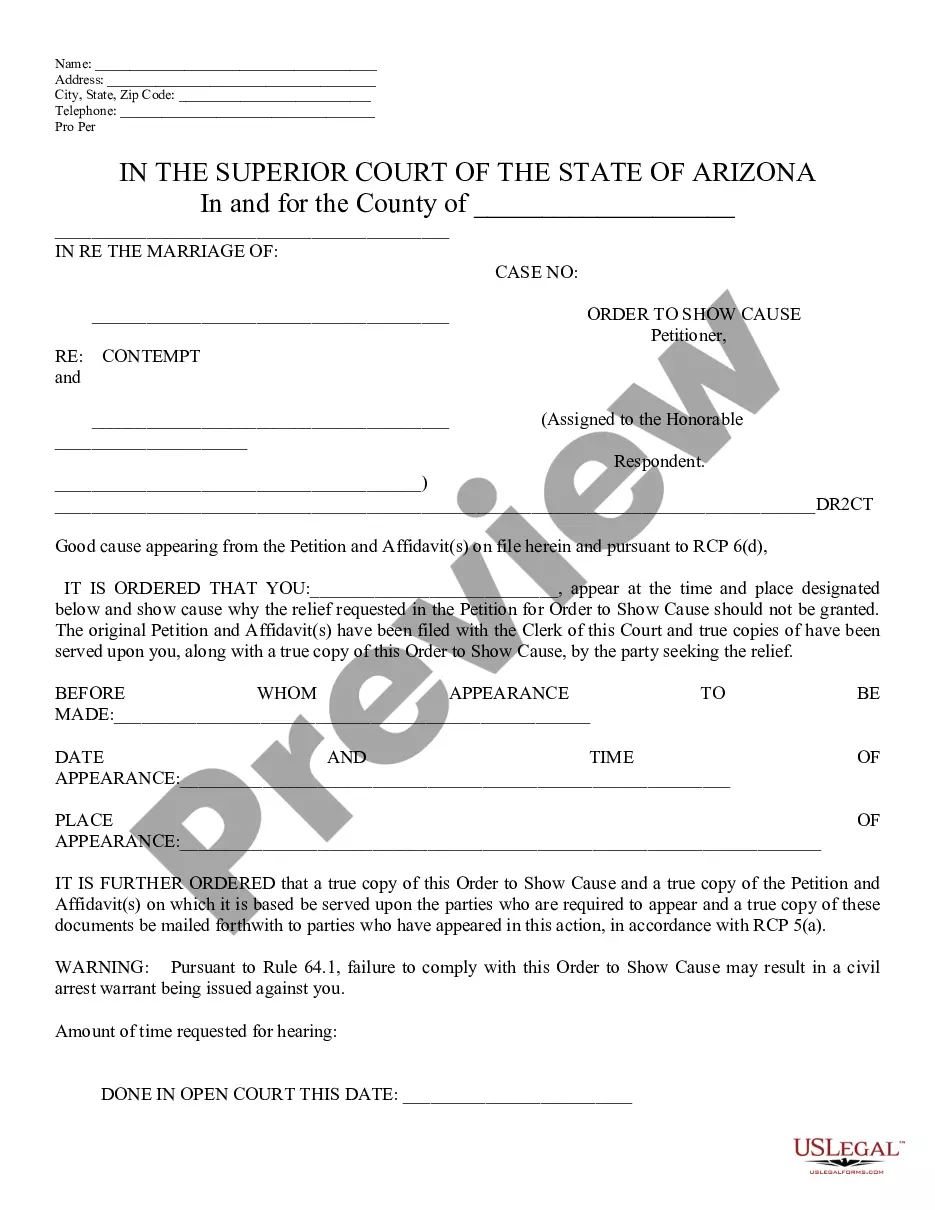

How to fill out Massachusetts Shareholders' Agreement Between Two Shareholders Of Closely Held Corporation With Buy Sell Provisions?

You may invest time online attempting to find the legitimate file design that fits the federal and state demands you need. US Legal Forms offers thousands of legitimate varieties which can be reviewed by experts. It is possible to download or print out the Massachusetts Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions from the assistance.

If you have a US Legal Forms bank account, you can log in and then click the Down load switch. After that, you can total, change, print out, or indication the Massachusetts Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions. Every legitimate file design you get is your own property for a long time. To have an additional copy of any purchased form, visit the My Forms tab and then click the related switch.

If you use the US Legal Forms internet site the first time, stick to the straightforward instructions beneath:

- Initial, ensure that you have selected the correct file design for the area/metropolis of your choosing. Browse the form information to make sure you have selected the correct form. If accessible, make use of the Preview switch to appear from the file design too.

- If you would like discover an additional model from the form, make use of the Research field to find the design that meets your requirements and demands.

- Once you have discovered the design you desire, simply click Acquire now to continue.

- Pick the rates prepare you desire, type in your qualifications, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You may use your credit card or PayPal bank account to purchase the legitimate form.

- Pick the file format from the file and download it in your device.

- Make adjustments in your file if possible. You may total, change and indication and print out Massachusetts Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions.

Down load and print out thousands of file layouts utilizing the US Legal Forms site, which provides the largest assortment of legitimate varieties. Use expert and express-particular layouts to take on your small business or person requires.